Börsipäev 5. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Ka täna tõotab tulla huvitav börsipäev. Tund aega enne USA turgude avanemist teatatakse USA maikuu tööjõuraport, millelt oodatakse 520 000 töökoha kadumist ning tööpuuduse määra kerkimist 8.9% pealt 9.2% peale. Tegu on küll väga suure numbriga, kuid ometi oleks see enam kui viimase poole aasta parim näitaja, kui see nii ka läheks. Eelmine kuu kadus 539 000 töökohta. Turgude viimase aja optimismi taustal (ja kombineerituna tarbijausalduse kiire hüppega) võib eeldada, et reaalsed ootused raporteeritava numbri osas on tegelikult kõrgemad ehk loodetakse näha alla poole miljoni töökoha kadumist.

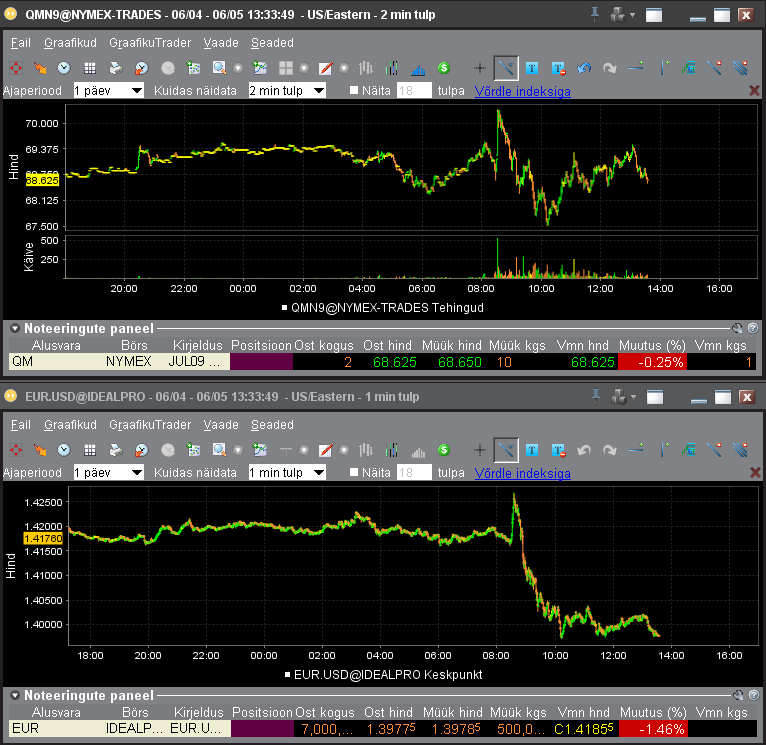

Energia hinnad on jätkanud oma tormilist jooksu ülespoole ning nafta barreli eest tuleb välja käia $69.5. -

Nagu näha, siis kauplemisaktiivsus Balti turgudel on taastumas - LHV enimkaubeldud aktsiate TOP 10 tuleb kõik Baltikumist.

-

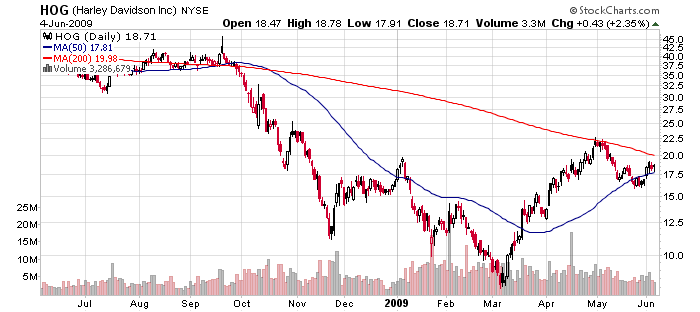

Citi alandab Harley-Davidson'i (HOG) reitingu Sell'ile hinnasihiga $16 ja ühtlasi lisab Top Picks Live nimekirja. Ma arvan, et aktsia võiks täna müügihuvi näha, sest Citi hoiatab oluliselt nõrgema Q2 eest, kui hetkel turg ootab:

U.S. Retail Sales Could Be Weak — We see sluggish US retail sales growth of down over 20% in April and May. We believe the street is currently expecting 2Q US retail sales to decline in 10% range similar to 1Q trends. We think 2Q US retail could be in the down high-teen range given an easy comparison in June (we estimate a low 20% decline). With liquidity issues largely behind HOG, we think investors will focus on retail sales, and lower than expected retail sales trends should drive downside risk to the stock.

Potential Downside to Shares — Since 3/2, HOG shares have increased 106% vs. 34% for the S&P 500. At 13x forward ests vs. its 2 yr median of 11.7x and with potential downward earnings revisions, we think there is potential downside on HOG shares. We are therefore adding HOG to Top Picks Live, as a Sell.

-

Yield on 10-year treasuries jumps to fresh 6-month high of 3.771% as bonds sell off at the open

Kas võlakirjaturg ootab 'oodatust' paremat tööjõuraportit? -

Millised numbrid !

May Nonfarm Payrolls -345K vs -520K consensus, prior revised to -504K from -539K

May Unemployment Rate 9.4% vs 9.2% consensus -

ja järgmine kuu on prior revised to -540K from -345K ? :D

-

USA turud on oodatust paremate tööjõuraporti numbrite peale avanemas ca 1% jagu kõrgemal.

Saksamaa DAX +1.59%

Prantsusmaa CAC 40 +2.11%

Inglismaa FTSE 100 +2.17%

Hispaania IBEX 35 +1.76%

Venemaa MICEX +3.86%

Poola WIG +1.42%

Aasia turud:

Jaapani Nikkei 225 +1.02%

Hong Kongi Hang Seng +0.96%

Hiina Shanghai A (kodumaine) -0.49%

Hiina Shanghai B (välismaine) +0.40%

Lõuna-Korea Kosdaq +0.21%

Tai Set 50 +2.00%

India Sensex 30 +0.63%

-

How Long Can This Party Last?

By Rev Shark

RealMoney.com Contributor

6/5/2009 8:38 AM EDT

"Great bodies of people are never responsible for what they do."

-- Virginia Woolf

For the individual investor, the big question regarding the market is, How long do you run with the crowd before you start to worry that they have gone too far? It isn't an easy thing to determine because you are dealing with mob mentality, and what might feel rational to a normal individual investor doesn't apply when emotions are at the forefront.

Because the market is dominated by crowd thinking, the action tends to be streaky. It continues to go in one direction for a while rather than randomly switching back and forth. It is why momentum investing can work so well if you jump in and catch a trend. The crowd has a tendency to just keep on going far further and longer than you think is reasonable.

Inevitably, the party comes to an abrupt end and people start to wonder, "What was I thinking?" Unfortunately, crowds don't tend to reverse course in an orderly fashion. They do it suddenly and in a panic. They realized that they may have overindulged, and they just want to hit the exits and get out of there.

Right now, the market is still enjoying the party and is giving few indications that it's ready to quit. There are a few warning signs such as the very high level of speculation in very low-priced and junk small caps. Many have seen prices double and triple for no reason other than that they are on the radar screens of aggressive traders looking for action in a market that has had consistently strong underlying support.

One thing I've written about market trends is that they will often last longer than you think they will. We just can't impose our subjective feelings about what is reasonable in a market that doesn't care about practicality.

Because of this tendency toward extremes, it is usually better to just stick with the trend until there is some clear evidence that it is reversing. The problem is that you are going to suffer some losses if are still pressing too hard, but quite often, you still end up further ahead than if you had tried to guess when the top would occur.

A lot of folks are trying to guess if we are close to a top right now. The reversal on Wednesday, when we broke back through the S&P 500 breakout point of 930, had some thinking that a false breakout would signal a top, but the market regained its form and acted very well again yesterday.

This morning, we have news that Steve Jobs is returning to Apple (AAPL) and the monthly jobs report. A bounce in energy and commodities led the recovery yesterday, and indications are that they are up again.

The crowd is still running, and they are having a good time. Just keep in mind that, at some point, the party will end rather suddenly, and when it does, there will be some scrambling to protect profits. So keep pushing for those gains, but think about protecting them, too.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: LSCC +20.8% CHP +10.5% (light volume), RTP +7.2% (also announces fully underwritten rights issue to raise gross proceeds of approx $15.2 bln; previously announced Chinalco transaction terminated), ABM +6.2% COO +5.8% GES +4.7% ULTA +4.2% (also reaches a preliminary settlement in its class action lawsuit)... Select financial names showing strength: AIB +7.3%, IRE +4.4%, KEY +3.6%, ING +3.5%, DB +2.1% (upgraded to Hold from Sell at ING Group), CS +1.7%, BAC +1.5%, COF +1.4%, BCS +1.2%, AXA +1.2%... Select solar names trading higher: SOL +7.6%, SOLF +5.2% , LDK +4.5%, JASO +4.1%, YGE +2.2% (announces that its PV modules will be installed in a 13 MW plant in the Czech Republic to be constructed by S.A.G. Solarstrom AG), CSIQ +2.1%... Select metals/mining names showing strength boosted by RTP qtr results and news: BHP +5.6%, BBL +4.5%, VALE +2.8%, MT +1.6%... Other news: RSOL +35.3% (to install $30 mln solar power program for Fremont Union High School District), SOMX +28.0% (resubmits new drug application for Silenor (Doxepin) for the treatment of insomnia), JTX +26.7% (appoints Harry Buckley Chief Executive Officer and Member of Board; also upgraded to Outperform from Perform and sets a $7.50 tgt at Oppenheimer), HEB +18.4% (continued momentum following this week's 100%+surge higher), FLIR +5.7% (still checking), PWR +5.6% (will replace Ingersoll-Rand Company in the S&P 500), BEAV +4.5% and AA +2.4% (Cramer makes positive comments on MadMoney), AAPL +2.1% (Jobs ready to return to Apple helm - WSJ), ELN +2.0% (still checking for anything specific), NOK +1.7% (Mobile TeleSystems and Nokia enter strategic partnership), BA +1.4% (Cramer makes positive comments on MadMoney)... Analyst comments: SPR +6.4% (upgraded to Buy at BofA/Merrill), DNDN +5.1% (initiated with a Buy at Deutsche Bank), SYT +3.8% (upgraded to Buy at BofA/Merrill), STO +2.4% (upgraded to Buy from Neutral at Goldman - Reuters and upgraded to Overweight from Underweight at Morgan Stanley), PHM +2.1% (upgraded to Neutral from Underperform at Credit Suisse).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CAE -10.2%, ALOG -6.4%, XIDE -5.3% (also downgraded to Neutral at Merriman)... Select gold related names showing weakness: KGC -4.6%, NG -4.0%, AUY -3.5%, ABX -2.8%, GG -2.5%, AU -2.5%, AEM -2.2%, GOLD -1.8%, GLD -1.8%... Other news: MWE -11.1% (announces public offering of 2.9 mln common units), FCBC -6.9% (prices a 4.6 mln share common stock offering at $12.50/share), UDRL -6.4% (prices 3.0 mln common share offering at $8.25/share), NVAX -5.5% (still checking), PICO -4.6% (prices a ~3.05 mln share common stock offering at $27/share), XCO -4.5% (still checking), BXP -3.8% (announces commencement of 10.5 mln share common stock offering), XOMA -2.5% (announces $12 mln financing), UAUA -2.3% (USA Today reports UAUA is poised to place a huge order that could approach $30 bln in face value; also downgraded to Underweight from Neutral at JP Morgan), DVR -2.2% (announces its secondary offering of 20 mln shares of Cal Dive Intl was priced at $8.50/share), WNR -2.1% (prices 20.0 mln common share offering at $9.00/share; increases size of convertible senior notes offering), HBC -1.2% (faces round two of subprime punishment - WSJ), ESRX -0.8% (prices a 23 mln share common stock offering at $61/share)... Analyst comments: HGSI -4.1% (downgraded to Source of Funds at ThinkEquity), LRCX -3.4% (downgraded to Hold at Citigroup), TER -2.4% (downgraded to Hold at Citigroup), ORN -2.2% (downgraded to Hold at BB&T), HOG -1.6% (downgraded to Sell from Hold at Citigroup), AMAT -1.6% (downgraded to Hold at Citigroup), DD -1.3% (downgraded to Underperform at BofA/Merrill). -

USD tõusus ja naftabarrel samuti tõusu roninud, uskumatud ajad.

-

Tõepoolest. Väga närvilised on liikumised valuutaturul, kus üle 1%lised liikumised on saanud uueks normiks.

-

5 kauplemispäevaga Boeing (BA) +18% ja EADS (EAD.PA) +2%. Üks lennukompanii (Boeing) on teisele (Airbus) suure puuga ära tegemas.

-

Kes mu lugu ja detailsemat ülevaadet maikuu tööjõuraporti oodatust parematest numbritest ei näinud, siis saab seda teha siit.

-

USA töötusmäär on praegu 9.4% - 2009. aasta äärmusliku stsenaariumi töötuse prognoosid on juba suurelt ületatud, baasstsenaariumitest ei tasu rääkidagi. Maikuu tööjõuraport annab küll lootust, et tööpuuduse kasv on aeglustumas, kuid kui olukord peaks juunis pöörduma, tasub kriteeriumite täitmise osas murelikumaks muutuda.

Tuletan meelde, et stresstesti eelduste järgi oli baasstsenaariumi korral 2009. aasta töötusmääraks 8.4% (SKP kasvuks -2.0%) ning 2010. aasta töötusmääraks 8.8% (SKP kasvuks +2.1%). Äärmusliku stsenaariumi korral oli töötusmääraks 2009. aastal 8.9% (SKP kasvuks -3.3%) ja 2010. aastal 10.3% (SKP kasvuks +0.5%). -

Aasta algusest on SPX tõusnud +4.5% ja NDX +17.5%. See vahe ei saa enam väga palju suuremaks paisuda ning seetõttu lähen QQQQdes lühikeseks ja riskide katmiseks ostan 2.5:1 suhtega SPY aktsiaid. Kui SPX kukub, siis usutavasti oluliselt vähem, kui seni tulikuum olnud tehnoloogia, kus kasumivõtt võiks olla suurem. Ning kui turu tõus jätkub, siis võiks samuti hakata tehnoloogiast raha välja voolama SPXi.

Horisont ca 1 kuu

-

EUR on USD vastu ühe päevaga kaotanud 1.8% (!). Hirmutavad liikumised.

-

Ja nafta ka tagasi punasesse lõpuks vajunud, kuigi ainult 0.6%.

-

Ja veel dollari tugevnemise põhjustest, Föderaalreservi intressimääradest ja muust:

The fed funds market is pricing in a nearly one-third possibiity of a 50-basis-point interest rate hike by September, a 40%-plus chance of a September hike (of a similar amount) and a 100% possibility by December.

-

Spread Nasdaqi ja S&P 500 2009. aasta liikumise vahel püsib endiselt rekordiliselt lai. Nasdaq on aasta algusest tõusnud üle 17%, S&P 500 vaid 4%. Tehnoloogiasektori headusest oleme ka varem kirjutanud, peamiseks märksõnaks on rahast pungil bilansid. Kuigi ilmselt ainult sellest ei piisa, et spreadi vähenemist ära hoida.