Börsipäev 25. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Paari nädalane puhkus maa all ja maa peal on mul selleks korraks selja taga ning saame uue hooga edasi minna. Eilsed kestvuskaupade tellimusnumbrid olid oodatust paremad (viimasest neljast kuust on kestvuskaupade tellimusnumbrite muutus olnud positiivne kolmel) ja see aitas hommikul turge kõrgemale viia, kuid õhtuks anti võit siiski käest ära. Täna tuleb tund aega enne turu algust esmaste töötu abiraha taotlejate number (konsensus 600 000 vs eelmise nädala näit 608 000) ning fikseeritakse ära ka lõplik USA 1. kvartali majanduslangus (ootus -5.7%).

-

Oppenheimer tõstab Microsofti (MSFT) hinnasihi $25 pealt $29 peale uskudes, et juuli keskel avalikustatavad EPSi ja müügitulude konsensusnumbrid (vastavalt $0.38 ja $14.7 mld) on praegu turul liialt tagasihoidlikud ning et ärimudel pakub nõudluse taastudes väga head võimendusefekti kasumireal.

-

FED-i kommentaarid andsid turuosalistele vähe vihjeid selle kohta, kui kauaks võiks keskpank intressimäärad nõnda madalale jätta. Kui USA-s näis see valmistavat kerget pettumust siis Aasias on Oracle oodatust paremate majandustulemuste ja Joeli välja toodud makro peale meeleolu märksa rõõmsam. Nikkei, Hang Seng ja Kospi on hetkel 2.1% kõrgemal.

-

BP tegevjuht Peter Sutherland lahkub oma ametipostilt ning teda asub asendama Carl-Henric Svanberg ehk Ericsson AB tegevjuht. Osalisele tööle saabub uus tegevjuht juba 1. septembril, kuid Ericssoniga toimub hüvastijätt alles aasta lõpus.

-

Hiljuti teatati uudisest, et Nigeeria Emancipation of the Niger Delta (MEND) ründas Royal Dutch Shelli naftajuhet. Ettevõtte aktsiahind on Londoni aktsiaturul odavnenud 0.19%.

-

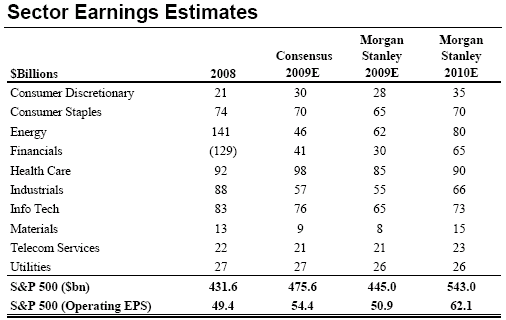

Panen siia veel Morgan Stanley eelmisel nädalal avaldatud nägemuse sellest, kuidas S&P500 indeksisse kuuluvad 500 suurimat ettevõtet peaksid loodetavasti ca $450 miljardit kasumit 2009. aastal ja $540 miljardit 2010. aastal omavahel sektorite lõikes siis ära jagama:

Morgan Stanley prognooside järgi kaupleb USA aktsiaturg täna 900 punkti peal 17.5 korda 2009. aasta ja 14.5 korda 2010. aasta kasumit.

-

Barclays Capital langetas täna nii Morgan Stanley (MS) kui ka Goldman Sachs (GS) hinnasihte. Barclays Capital prognoosib, et Morgan Stanley teenib $0.40 kasumi asemel hoopis $0.70 kahjumit. Hinnasihiks määras analüüsimaja $32. Goldman Sachs kasumiprognoosi langetati $5.20 pealt $3.55 peale. GS hinnasihiks anti $165.

-

Pühade ajal on OECD esimest korda viimase kahe aasta jooksul tõstnud majanduskasvu prognoose. Kokku kahanevad OECD majandused 2009. aastal 4.1% ja 2010. aastal kasvavad 0.7% (veel märtsis prognoositi järgmiseks aastaks 0.1% langust). Erinevate riikide prognoose saab näha interaktiivselt kaardilt (prognooside järgi kahaneb Eesti SKP 2009. aastal -13.9%).

-

Enne USA aktsiaturgude avanemist pisut negatiivse alatooniga sõnumeid. U.S. exhanges ja Bloombergi koostööl registreeritakse S&P 500 indeksaktsiasse kuuluvate ettevõtete aktsiatega tehtud lühikeseks müügid. Näitaja kerkis 15. juunil w-o-w baasil 1%. Tervishoiusektori lühikeseks müügi tehingute arv kasvas koguni 7%. Kõige rohkem müüdi lühikeseks Merck & Co. ja Cardinal Health Inc. aktsiaid.

-

Kui võtta Joeli poole enne toodud MS'i 2009. a EPS'i prognoos ($54,4) ja korrutada see S&P 500 ajaloo keskmise P/E'ga (15,3), siis võiks indeksi õiglane väärtus olla kusagil 832 punkti juures.

-

DB aktsiaturgude strateeg J. Reid leiab ajaloo keskmisi näitajaid analüüsides, et suure tõenäosusega siseneti 2000. aastal pikaajalisele karuturule, mis on võib kesta 17-20 aastat & lõppeda ühekohalise P/E suhtarvuga. Reidi hinnangul on viimase sajandi jooksul aktsia hindade reaalkasv olnud 1.6% aastas ja sellele on lisandunud 4.4% dividenditootlust. Hetkel on S&P500 dividenditootlus 2.9%, mis on ajaloo keskmisest märgatavalt madalam.

-

Q1 GDP Q/Q Final -5.5% vs -5.7% consensus, prelim -5.7%

Q1 Core PCE Q/Q Final +1.6% vs +1.5% consensus, prelim +1.5%

Initial Claims 627K vs 600K consensus, prior revised to 612K from 608K; Continuing Claims rises to 6.71 mln from 6.69 mln

Q1 Personal Consumption- Final +1.4% vs +1.5% consensus, prelim +1.5%

-

Esmaste töötu abiraha taotlejate oodatust koledam number on nüüd turgu kenasti ehmatanud ning USA indeksid pool protsenti punases.

-

S&P500 futuurid eelturul -0.65% @ 892 punkti ning Nasdaq100 -0.6% @ 1439 punkti. Nafta +0.7% @ $69.2 barrelist.

Euroopa turud:

Saksamaa DAX -2.16%

Prantsusmaa CAC 40 -2.02%

Inglismaa FTSE 100 -1.27%

Hispaania IBEX 35 -1.25%

Venemaa MICEX -2.46%

Poola WIG -1.03%Aasia turud:

Jaapani Nikkei 225 +2.15%

Hong Kongi Hang Seng +2.14%

Hiina Shanghai A (kodumaine) +0.09%

Hiina Shanghai B (välismaine) -0.03%

Lõuna-Korea Kosdaq +1.82%

Tai Set 50 +1.75%

India Sensex 30 -0.53% -

Bulls Don't Want to Be Tardy to the Dance

By Rev Shark

RealMoney.com Contributor

6/25/2009 8:42 AM EDT

A horse never runs so fast as when he has other horses to catch up and outpace.

-- Ovid

Market action is becoming increasingly muddled as technical conditions slowly deteriorate, but hopes of an end-of-quarter window-dressing bounce keeps the bulls ready for action. Yesterday the pending FOMC interest rate decision helped to boost the market out of the gate, but the actual news, which contained nothing surprising, wasn't enough to keep the buyers interested.

Although there were some pretty good bounces in select momentum stocks yesterday such as Netease.com (NTES) , Shanda (SNDA) , Green Mountain Coffee Roasters (GMCR) and Baidu (BIDU) , other key stocks like Apple (AAPL) , Research In Motion (RIMM) and Visa (V) are looking quite troubled. There is very little good momentum in this market, but there is a lot of money looking for some bounces into the end of the month, and they are always going to be attracted to some of the key high-beta names. Nothing drives money managers more than trying to catch up with other money managers.

So we have a market that is looking troubled but we also have conditions that could easily drive some upside over the next four days of trading. One of the big problems with this scenario is that everyone is waiting for the quarter-end mark-ups. When everyone is looking for the same thing to occur it can become self-fulfilling, but it also can be extremely unstable as everyone tries to stay a step ahead of one another. When everyone is looking for an end-of-the-quarter move, they will rush to be in first and then rush to take gains first. The more they try to jump in front of each other, the more likely the move does not develop well.

At this point we have some very weak technical support in the indices, most notably at 900 on the S&P 500. If we can continue to hold in this area we should have some forays on the upside in hopes of catching a quarter-end move. I suspect dip-buyers will even lend us some support should we begin to stumble, but the key is to not be too trusting of the upside here.

Keep in mind that everyone is looking for that end-of-the-quarter bouncem but they aren't investing -- they are trading, and they'll be happy to take some quick gains if they can catch them. I'm looking for the market to hold up fairly well while the quarter winds down, but it is just a matter of time before we crack S&P 500 support around 878 or so and see another leg down.

So let's see if we can catch some trades in the end-of-quarter circus, but let's make sure we keep in mind that the technical conditions are looking increasingly precarious and we'll need to be ready to move quickly to avoid being caught in some downside. We have a rather flat open shaping up with gold and oil showing a little strength. Europe was weak and Asia strong.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: HTZ +12.7%, BBBY +5.9% (also upgraded to Neutral from Underperform at Cowen), LEN +5.5%, CKR +3.4% (also reports period five same-store sales of -5.2%), JEF +3.3% (also filed for a mixed shelf offering for an indeterminate amount), STX +1.8% (also upgraded to Hold at Deutsche)... M&A news: AVGN +29.8% (MediciNova intends to acquire Avigen), TWB +21.2% and DBRN +4.2% (Tween Brands to be acquired by DBRN in all stock deal; TWB shareholders to receive equivalent of $6.22 per share based on 6/24 closing price)... Select shippers ticking higher: NM +5.1%, EGLE +2.3%, EXM +2.1%... Other news: JAZZ +34.5% (Jazz Pharma and UCB announce second Phase III study of sodium oxybate in patients with fibromyalgia meets primary endpoints), CAEI +32.8% (announces new contract to build resort near Shanghai; project value to exceed $500 mln), AGEN +15.8% (has expanded its Phase 2 clinical trial of Oncophage), IMAX +12.0% (underwriter has exercised in full its option to purchase an additional 1,470,000 common shares), DTG +6.2% (up in sympathy with HTZ), ARM +5.6% (divests ownership stakes in two light vehicle systems chassis businesses), OGXI +4.5% (continued strength from yesterday's ~10% pop), QGEN +4.0% (still checking), MDRX +3.6% (estimates that new order intake for its clinical solutions during Q3, was ~$103 mln vs $82 mln), HCBK +2.8% (Cramer makes positive comments on MadMoney)... Analyst comments: SLM +5.0% (upgraded to Overweight at JPMorgan), ADI +4.7% (upgraded to Buy from Underperform at BofA/Merrill), BIG +2.6% (upgraded to Outperform from Neutral at Cowen), PT +1.9% (raised to Buy from Neutral by Goldman Sachs- DJ), DE +1.4% (upgraded to Neutral from Sell at Goldman- DJ), RIG +1.4% (raised to Buy from Neutral at Goldman- Reuters), AA +1.2% (initiated with a Buy at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SVU -10.8%, DRI -2.1%... Select European drug names showing weakness: NVS -2.2%, SNY -2.0%... Other news: LYG -13.8% (trading ex dividend), AGP -10.4% (discloses Q1 update; outpatient medical costs appear to be higher than previously estimated), PQ -10.2% (announces a 10 mln share common stock offering), RT -9.1% (still checking), OSIR -6.7% (reports interim data for COPD stem cell study; The trial met its primary goal of demonstrating the safety of Prochymal in patients), ROY -3.2% (to raise C$50 mln in bought deal financing), SWY -2.0% (trading down in sympathy with SVU)... Analyst comments: WFR -2.9% (downgraded to Underweight at JPMorgan), BA -1.3% (downgraded to Equal Weight from Overweight at Morgan Stanley and downgraded to Underperform at Oppenheimer). -

Uudiseid UBSist:

"Economic Times reports the co is considering outsourcing about 5,000 jobs over the next two years a majority of which may come to India, according to people familiar with bank's plans. This signifies an opportunity to win new business for Indian IT vendors such as Wipro (WIT) and Infosys Technologies (INFY) that already work with the Swiss bank. UBS recently appointed consulting co McKinsey to advise it on the outsourcing process. The decision to outsource thousands of jobs is in line with the ailing bank's cost-cutting strategy. The bank is an important client for both Wipro and Infosys. While Wipro, India's third largest software-services firm by revenues, gets over $50 million in annual revenues from UBS, second-ranked Infosys derives about $40-50 million. Apart from these os, other vendors for UBS include TCS, Polaris, Cognizant and Headstrong. "

-

Natural gas inventory showed a build of 94 bcf, analysts were expecting a build of 101 bcf, ranging from a build of 92 bcf to a build of 105 bcf.

-

IMAXi tänane suur pluss tuleneb asjaolust, et aktsiate müük ettevõtte poolt hinnaga $7.15 tükist on bilansilehe parandamise eesmärgil osutunud igati edukaks. Aktsiate pakkumisest kaasatakse ca $80 miljonit.

-

Rahavoogude kohta aktsiaturgudele ka üks graafik - eelmine nädal jätkus raha sissevool mutual fundidesse, kuigi summad sedapuhku väiksemad. 17. juuniga lõppenud nädalal lisandus fondidesse $3.4 miljardit (allolev joonis on korrigeeritud varade väärtuste muutustega, mis tähendab, et see kajastab adekvaatselt netoraha liikumist fondides).

-

S&P 500 jõudnud üle küllaltki olulise 920 taseme ja hetkel püsimas antud tasemel. Ei tahaks uskuda, et nii sirge jalaga üles mindud päeval ei ole kellelgi müügihuvi.

-

Fitch downgrades State of California GOs to 'A-'; Rating Watch Negative

-

SINGER MICHAEL JACKSON RUSHED TO UCLA MEDICAL CENTER- LOS ANGELES TIMES

JACKSON NOT BREATHING WHEN PARAMEDICS ARRIVED AT HIS HOME TO TAKE HIM TO HOSPITAL, SINGER GIVEN CPR - LOS ANGELES TIMES -

ja futuurid 0,08% miinuses... :)

-

Õpetlik lugu. Vaat kuhu viib liigne pesuvalgendiga mängimine.

Kehv on asja juures see, et nüüd ei saa oma paar nädalat raadiot lahti teha, või tuleb ainult Elmarit ja Klassikaraadiot vaheldumisi kuulata. Tegelikult ei saa vist ka nende kanalite peale kindel olla... -

Imelik et ÄP ei kirjuta juba miljardärmeelelahutaja äkksurmast ega pane seda uudist esikohale....

-

Ilmselt uus D-jutt tulemas

-

Elmar räägib tihedalt Jacksonist, varahommikul mängis isegi ühe tema loo

-

Pärast kiirabi lahkumist Jacksoni maja juurest nägi Jacksoni kokk salapärast autot, kuhu hiilis maskiga mees. Auto oli roosa Cadillac ja juht sarnanes aedniku sõnul Elvis Presleyle :)