Börsipäev 14. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Eilne turu ralli oli mitme teise viimase vaikse suvepäeva kõrval väga tervitatud vahelduseks. Täna kell 15.30 Eesti aja järgi teatatakse USA juunikuu tootjahinnaindeks (ootuseks 1.0% vs maikuu 0.2%) ning ka juunikuu jaemüügi muutus (ootus 0.4% vs maikuu 0.5%). Ärivarude maikuu muutus teatatakse Eesti aja järgi kell 17.00 ning seal peaksime nägema varude kiire kokkukuivamise jätkuvat trendi (ootus -1.0%).

Tuletan meelde, et käimas on tulemuste hooaeg ja kõige mugavam on tulemusi jälgida tulemuste tabelist siit. Täna enne turgu tuleb oma numbritega Goldman Sachs (GS) ja Johnson & Johnson (JNJ) ning pärast turgu Intel (INTC) ja YUM! Brands (YUM).

-

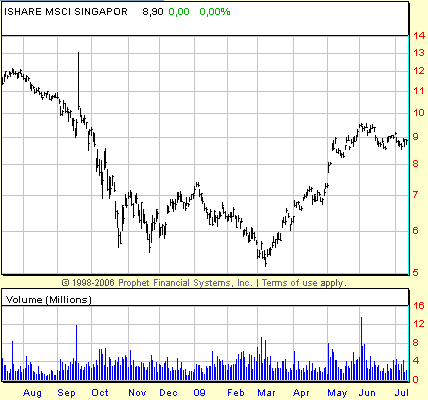

Maailmast tuleb ka paremaid uudiseid. Singapuri valitsus tõstis äsja terve aasta SKP prognoosi vahemikku -4% kuni -6% varasema prognoositud -9% pealt. Q2 09 vs Q1 09 näidati annualiseeritult isegi ca +20%list kasvu. Jah, kasvu. Bloomberg on sellest ka artikli kirjutanud, mida saab lugeda siit.

Singapuri aktsiatest koosneva börsil kaubeldava fondi sümbol USA aktsiaturul on EWS.

-

Saksamaalt on viimastel nädalatel tulnud positiivselt üllatavaid häid makronumbreid (tööstustoodang, tellimused) ning viimasel ajal on riigis kiiresti kerkinud ka investorite enesekindlus eesootavate paremate aegade suhtes. Investor Confidence on Saksamaal tõusmas 3 aasta tippude juurde.

Täna on Merrill Lynch/Bank of America väljas ka 35-leheküljelise kommentaariga, mis kuulutab majanduslanguse lõppu ja on pealkirjastatud niimoodi "The Recession is Over...". MER/BofA soovitab vähendada portfellides raha osakaalu ning maailma aktsiate osas ollakse optimistlikud. Kõige rohkem tõstab analüüsimaja oma SKP prognoose Hiina ja USA majandustel. USAlt oodatakse 2009. aasta teiselt poolelt kasvu 2.7% ning 2010. aastalt tervikuna 2.6%. See on tänasest turu-konsensusest rohkem. Hiina 2010. aasta SKP kasvuprognoos tõstetakse 9.6% peale. 2010. aasta globaalse SKP kasvuprognoos tõstetakse 3.7% peale, kusjuures arenevatelt turgudelt oodatakse 5.5%list kasvu ning arenenud turgudelt 2.2%list kasvu.

-

Morgan Stanley on energiasektoris viimasel ajal toimunud langust ära kasutamas ning alustab mitme integreeritud naftaettevõtte katmist ostusoovitusega:

Morgan Stanley initiates coverage of the integrated oils industry with an Attractive view. Firm says while they see downside risk to the group into the near term, they recommend increasing exposure on weakness with a longer-term bullish outlook, driven primarily by their supply-and-demand model. The firm initiates ConocoPhillips (COP) tgt $51, Exxon Mobil (XOM) tgt $85, Hess (HES ) tgt $65, and Murphy Oil (MUR) tgt $72 with Equal Weights. The firm also initiates Chevron (CVX) with an Overweight and an $89 tgt, and Marathon Oil (MRO) with an Underweight and a $34 tgt.

-

Uudiseid enne Goldman Sachsi tulemusi:

"FT reports executives at GS sold almost $700 mln worth of stock following the collapse of Lehman Brothers last September, according to filings with the SEC. Most of the sales occurred during the period in which the investment bank enjoyed the support of $10 bln from the troubled asset relief program. The surge in selling among Goldman partners, at a time when the US government had thrown a lifeline to Wall Street, is likely to draw criticism from lawmakers on Capitol Hill. For the eight-month period for which figures are available, Goldman partners sold more than $691 mln in company stock, even as the co expanded its public float from 395 mln to 503 mln shares in several capital raises. For the comparable period between September 2007 and April 2008, when the average share price was substantially higher, Goldman partners sold about $438 mln in stock. A spokesman declined to comment on the sales, other than to note that Goldman partners receive a big share of annual bonuses in stock, and that for many, stock sales are an effort to diversify their holdings. Some of the sales could have been motivated by margin calls, which are said to have afflicted a number of Goldman executives who used company stock as collateral for loans."

-

Johnson & Johnson prelim $1.15 vs $1.11 First Call consensus; revs $15.2 bln vs $15.02 bln First Call consensus.

Johnson & Johnson confirms FY09 $4.45-4.55 vs $4.51 First Call consensus. -

Goldman Sachs prelim $4.93 vs $3.54 First Call consensus.

Goldman Sachs reports revs of $13.8 bln vs $10.66 bln First Call consensus. -

Whitney eilne EPSi kergitamine tugevalt üle konsensuse ($4.65) läks asja ette.

-

Kõrgetest ootustest räägib esimese hooga miinusesse vajunud aktsia.

-

GSist pikemalt briefing.com vahendusel:

"Goldman Sachs beats by $1.39, beats on revs (149.44)Reports Q2 (Jun) earnings of $4.93 per share, $1.39 better than the First Call consensus of $3.54; revenues rose 46.0% year/year to $13.76 bln vs the $10.66 bln consensus. Annualized return on average common shareholders' equity (ROE) was 23.0% for the second quarter of 2009 and 18.3% for the first half of 2009. Excluding a one-time preferred dividend of $426 million related to the repurchase of the firm's TARP preferred stock, diluted earnings per common share were $5.71 for the second quarter of 2009 and annualized ROE was 23.8% for the second quarter of 2009 and 19.2% (2) for the first half of 2009... Fixed Income, Currency and Commodities (FICC) generated record quarterly net revenues of $6.80 billion, reflecting strength across most businesses, including record results in credit products. Net revenues in Trading and Principal Investments were $10.78 billion, 93% higher than the second quarter of 2008 and 51% higher than the first quarter of 2009... Book value per common share increased approximately 8% during the quarter to $106.41 and tangible book value per common share increased approximately 10% during the quarter to $96.94. As of June 26, 2009, total capital was $254.05 billion, consisting of $62.81 billion in total shareholders' equity (common shareholders' equity of $55.86 billion and preferred stock of $6.96 billion) and $191.24 billion in unsecured long-term borrowings. The Board of Directors of Group Inc. (the Board) declared a dividend of $0.35 per common share to be paid on September 24, 2009 to common shareholders of record on August 25, 2009... "While markets remain fragile and we recognize the challenges the broader economy faces, our second quarter results reflected the combination of improving financial market conditions and a deep and diverse client franchise... Our role as an intermediary focused on making markets for buyers and sellers helped drive our performance. We were also active as an underwriter of many significant debt and equity offerings for clients."

-

June Advance Retail Sales +0.6% vs +0.4% consensus.

June Retail Sales ex-auto +0.3% vs +0.5% consensus, prior revised to +0.4% from +0.5%.

June PPI M/M +1.8% vs +0.9% consensus, prior +0.2%. -

GSi kauplemistulud olid prognoositult tugevad, equity trading tõusis aastaga 72% ja võrreldes eelmise kvartaliga 110%.

Hetkel kaubeldakse 1,4 booki ja 1,5 tangible booki. Book value tõusis kvartali jooksul 8%, aktsia aga natuke alla 50%. Ootused tuleviku osas on kõrged. -

USA futuurid indikeerivad päeva avanemist finantssektori jaoks väikeses plussis ja tehnoloogiasektori jaoks eilsete sulgumistasemete ligidalt. Energia on eelturul aga olnud tugev ning nafta on +2.5% @ $62 barrelist, maagaas kerkinud üle 3%.

Euroopa turud:

Saksamaa DAX +0.86%

Prantsusmaa CAC 40 +0.65%

Inglismaa FTSE 100 +0.34%

Hispaania IBEX 35 +0.34%

Venemaa MICEX +3.27%

Poola WIG +3.33%Aasia turud:

Jaapani Nikkei 225 +2.34%

Hong Kongi Hang Seng +3.66%

Hiina Shanghai A (kodumaine) +2.10%

Hiina Shanghai B (välismaine) +1.61%

Lõuna-Korea Kosdaq +0.04%

Tai Set 50 +3.10%

India Sensex 30 +3.38% -

Earnings in the Fore

By Rev Shark

RealMoney.com Contributor

7/14/2009 8:32 AM EDT

Hope is a good breakfast, but it's a bad supper.

-- Francis Bacon

On Monday the market enjoyed the "Meredith Whitney Increased Expectations" rally. Many were expecting a relatively quiet day on Monday while we awaited the onslaught of earnings news, but long-term bank bear Meredith Whitney appeared on CNBC and made very optimistic comments about upcoming earnings reports from Goldman Sachs (GS) and several others. That was all it took to ignite the buyers, who tend to be optimistic in front of big earnings reports anyway.

The folks on CNBC were congratulating themselves for driving the market on Monday, but now this morning we will get to see if they simply led the lambs to the slaughter or helped to identify some great values that we would have missed if we didn't buy in front of the news.

For the more thoughtful investor, the action on Monday presented a classic dilemma. Do you jump in and embrace the sudden optimism over the likelihood of good earnings, or do you avoid the risk of betting on earnings reports, particularly when expectations and the chances of disappointment are increasing? It is even more difficult when the volume isn't very heavy and technical conditions have not improved.

Despite the surge on Monday, the major indices remain in the downtrend that began in mid-June, and we haven't managed to negate the well-observed head-and-shoulders pattern. The bulls obviously seized the advantage on Monday and may have some further momentum, especially if earnings come in OK, but the technicals, at this point, don't suggest that we embrace the market for long.

Novellus (NVLS) , the first big technology company to report, was out last night and isn't generating much of a response so far. Dell (DELL) has some slightly negative comments that may be affecting the mood for technology just a bit, but the big report from Intel (INTC) is due tonight and will take center stage very quickly.

Navigating the market during earnings season is always extremely tricky. The technical patterns are often rendered unreliable and the mood can shift from euphoric optimism to disappointment in the matter of minutes. A lot of folks like to bet on these earnings reports, but it really is a roll of the dice, and there is no way to have any real edge.

Goldman Sachs should have its report soon, and I suspect it will create some very fast volatility. We can have a little more objectivity after things calm down, but for now there isn't much to do but to see where the roller coaster ride goes.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ININ +14.0%, OZRK +2.5%, CSX +1.6%, JNJ +1.4%... M&A news: NOVN +22.4% (Hisamitsu to buy Noven Pharma for $16.50/share in cash; announces positive Ph. 2 top-line results)... Select financial names showing continued strength: CIT +25.9% (U.S. in talks to rescue CIT - WSJ), AIB +10.3%, AIG +4.5%, C +4.0%, FNFG +3.6%, FITB +3.4%, ING +3.2%, GNW +3.2%, LYG +2.8%, DB +2.6%, HBC +2.4%, BAC +2.2%, BCS +1.8%, ZION +1.6%... Select metals/mining names trading higher: HMY +2.7%, BHP +2.4%, BBL +2.4%, GOLD +2.4%, MT +1.7%, FCX +1.7%, RTP +1.3%.... Select oil/gas names showing strength: PBR +2.1%, PTR +1.7%, OXY +1.6%, STO +1.2%, RDS.A +1.0%... Other news: SQNM +12.2% (University of Michigan Study Shows SEQUENOM's MassARRAY technology identifies HPV infections missed by standard hybridization test), ADY +4.4% (modestly rebounding following yesterday's 15 point drop), GRA +3.6% (Cramer makes positive comments on MadMoney), UNH +2.4% (announces that its UnitedHealth Military & Veterans Services has been awarded the Department of Defense's TRICARE Managed Care Support South Region contract), AET +2.3% (wins department of Defense Tricare Contract)... Analyst comments: IMMU +8.2% (assumed with a Buy at Brean Murray; tgt $8), FCS +4.6% (initiated with Buy at Merriman), PRU +1.7% (upgraded to Overweight at JPMorgan), UL +1.4% (upgraded to Overweight at JPMorgan), BK +0.8% (upgraded to Buy at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: COBZ -20.4% (also discloses it commenced an offering of ~$45 mln of its common stock), CPF -19.3% (also commences public offering of its common stock to raise gross proceeds of up to $100.0 mln), TTWO -9.8%, DELL -3.5%, MLM -3.0%, NVLS -1.1%, GS -0.6%... Other news: HNT -21.1% (not to be selected by TRICARE Management Activity for the Managed Care Support Contractor in the TRICARE North Region), HUM -8.3% (Humana's wholly-owned subsidiary, Humana Military Healthcare Services was not awarded the third generation TRICARE program contract for the South Region), AGNC -4.3% (hearing weakness attributed to pricing of secondary offering), TOT -1.4% (still checking for anything specific)... Analyst comments: MAS -3.7% (downgraded to Underweight at JPMorgan), VOD -2.0% (downgraded to Neutral at UBS), RGNC -1.7% (downgraded to Neutral from Buy at BofA/Merrill). -

Ja ärivarud muudkui kahanevad:

May Business Inventories -1.0% vs -0.8% consensus, prior revised to -1.3% from -1.1% -

Huvitav lõik Rosenbergilt:

"We thought that the ability of one person to move the market went out three decades ago with Henry Kaufmann over at Salomon Bros., but Meredith Whitney did manage to do the same — in a bullish fashion, though — with her CNBC remarks on Goldman yesterday morning. (Although, it was interesting that Dell’s reduced guidance for the current quarter garnered little attention.) What was interesting was how she stressed that this was not an industry-wide comment but rather specific to the firm and yet this was the tide that lifted all boats across the financials and the entire stock market for that matter. What this tells us is that even after 12 years of no appreciation in equities, and after brutal bear markets seven years apart, the public’s resolve in the stock market has not been shaken. The fact that the equity market could rally this much based on one analyst’s commentary is testament to the view of how badly investors want to believe that the recession and credit crunch are behind us and that unbridled prosperity lies ahead. As WTO Director-General Pascal Lamy said yesterday, “I would caution against excessive optimism.”

-

Turg on esialgu üsna igav, tiirutatakse nulli ümber. GS on küll kerges plussis, kuid selget suunda pole võtnud.

-

GS on peale konverentsikõne lõppu uuesti kergesse 0.5% langusesse vajunud:

Goldman Sachs: Conference call summary

On co's earnings conference call, GS mgmt says the competitive environment remained fragmented in Q2. Notes the strong performance in Fixed Income, Currencies, and Commodity (FICC) was driven by higher contribution of credit and currencies. Co also had strong revs in equity underwriting and trading... Notes that M&A advisory remains challenging, along with securities services... Downward price pressure in commercial real estate led to $700 mln in fair value losses. Says commercial real estate is the only real writedowns, with marks in the low 50's... Believes commodities will continue to be a strong business despite the regulation efforts being made, but says devil is in the details... The co continued to benefit from having no exposure to retail consumer businesses... Mgmt is happy with the business mix it has right now... Notes it is too early to comment on Q3 as it is only two weeks old and one of the weeks was a holiday week... Notes there are a lot of companies around the world that still need to fix balance sheets, so equity issuance should remain strong as long as the markets remain receptive (buyers willing to be involved)... When asked about excess capital, co says they think there will be opportunities but the world is still a tough place and there are new capital regulations coming, so they're being conservative with capital... Co would expect money to begin flowing back to hedge funds, as redemptions cycle appears to be over... With regard to CIT, co says they are well secured and are in talks with the Treasury on warrants.

-

The Department of Justice has opened an investigation into the credit derivatives market, with letters sent to over a dozen dealers asking for several years’ worth of detailed information about trading and pricing.

The move comes as the regulatory spotlight continues to shine on the credit default swaps (CDS) market, a sector of the privately-traded derivatives universe that grew dramatically in the last decade and generated huge profits for Wall Street. -

Kellel uudis kahe silmavahele jäänud, siis lisan siia:

Personal computer giant Dell (DELL) said last evening that it expects revenue to make a slight increase sequentially, but its gross margins are expected to decline.

DELL 7.45% languses $12.05 tasemel. -

Intel sees Q3 revs $8.1-8.9 bln vs $7.81 bln First Call consensus

INTC Intel prelim $0.18, ex items vs $0.08 First Call consensus; revs $8 bln vs $7.28 bln First Call consensus.

5 INTC INTC reports Q2 gross margin of 50.8% vs guidance of "mid-40s" and consensus of 46.4%.

INTC sees Q3 gross margin of 51-55% vs 49.76% consensus. -

YUM! Brands prelim $0.50 ex-items vs $0.43 First Call consensus; revs $2.48 bln vs $2.50 bln First Call consensus

-

Tulemuste hooaeg on saanud igaljuhul väga ilusa alguse. Tehnoloogiasektor üle 2% plussis.