Börsipäev 20. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Täna avaldavad kvartalitulemused teiste seas Halliburton (HAL), Hasbro (HAS) ning õhtul peale turgude sulgemist Texas Instruments (TXN).

-

James Altucher kirjutab, miks temale internetifirmad enam investeeringuna ei sümpatiseeri, ja pakub hoopis välja mõned infrastruktuuriettevõtted, mis võiksid kasu lõigata majanduse ergutuspakettidest. Link.

Check out LNN, Lindsay Corporation, that does boring stuff like highway repair (they make those orange cones) and helps upgrade water infrastructure. With half of all hospital beds in the world filled by people with dirty water-related illnesses, this one is a good bet.

Or little known Colfax Corporation, CFX. At nine times forward earnings, this company is in the "fluid handling" business. Boring. But in a resource-starved world we need them to get oil quickly through the pipelines and into the refineries. And we can't forget about ASTE, Astec Industries, which is like the "Amazon of Asphalt" and is a major player in highway repair (think stimulus again).

The exciting plays right now are the companies that are rebuilding the country along with the economy. Save the Internet for your iTunes downloads.

-

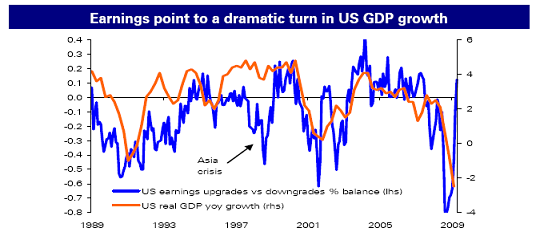

Viimaste kuudega on analüütikud aktiivselt aktsiate soovitusi tõstnud, mis ajaloo põhjal viitab USA SKP võimsale taastumisele järgnevatel kuudel:

Allikas: Deutsche Bank

-

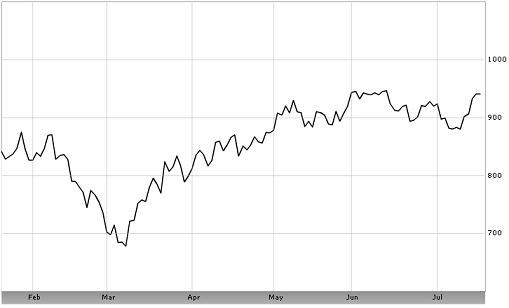

S&P500 on tõusnud oodatust paremate kvartalitulemuste peale (indeksi ettevõtetest on 76% siiani positiivselt üllatanud) 940 punkti juurde (futuurid hetkel 0.4% plussis). Karude poolt oodatud head&shoulders ei realiseerunud ja heade tulemuste peale soovitatakse üha rohkem uute tippude juurest aktsiaid soetada (või võlakirju müüa). Alates maist on S&P olnud volatiilses vahemikus & see nädal palju olulisi 2Q09 tulemusi (nt Texas Instruments, Morgan Stanley, Microsoft, Catapillar), mis näitavad, kas pullid suudavad volatiilsest vahemikust välja murda.

S&P500

Allikas: Bloomberg

-

Goldman Sachs on täna vastupidiselt mu hüpoteesile tõstmas Harley-Davidson'i (HOG) prognoose ja hinnasihti. Aktsia uueks reitinguks on "Neutraalne" hinnasihiga $20 (varasemalt vastavalt "Underweight" ja $11) ja ühtlasi eemaldatakse HOG Americas Sell List'ist, milles oleku ajal aktsia tõusis 56% võrra. Soovituse tõstmise olulisimad põhjused on järgnevad:

We are upgrading shares of HOG to Neutral from Sell. The change reflects:

1) our view that that post very weak 2Q09 results and dramatically lowered

guidance, expectations have been set very low (as evidenced by the

stock’s 8% rise on the result), and 2) with refi risk significantly diminished

we believe investors are taking a longer-term view of the shares. Our new

price target of $20 based on normalized earnings suggests shares are fully

valued even looking longer-term. -

More Upside

By Rev Shark

RealMoney.com Contributor

7/20/2009 8:56 AM EDT

Acceptance is not submission. It is acknowledgement of the facts of a situation, then deciding what you're going to do about it.

-- Kathleen Casey Theisen

The market underwent a dramatic change in character last week as it celebrated strong earnings from Goldman Sachs (GS) , Intel (INTC) and IBM (IBM) . The upbeat mood is continuing as we kick off a new week -- CIT (CIT) has cut a deal to save itself from bankruptcy; Goldman raises its target for the S&P 500 for the end of the year to 1060 from 940; the dollar is weak, causing oil to rally; China reports strong housing demand; and analysts upgrade Cisco (CSCO) , Caterpillar (CAT) and Texas Instruments (TXN) .

The quickness and intensity of last week's reversal caught a lot of folks by surprise. We were on the brink of cracking key support when the Meredith Whitney upgrade hit last Monday, and we haven't looked back since then. What was particularly notable about the action last week was how limited the pullbacks were. On Wednesday and Thursday in particular, we barely pulled back for longer than a minute or two. A lot of folks were obviously caught unprepared for the sudden and sustained strength and were so anxious to add long exposure that they didn't let the market come in at all.

The great difficulty now is that so many stocks made such strong moves for three, four or five days that they are quite extended and do not offer favorable entry points unless you are willing to chase things that are quite technically overbought.

Nonetheless, a lot of folks are obviously feeling left out, and that means we should have some very strong underlying support. They may have missed the move last week, but the psychology now is that they won't miss the next dip.

In addition we have another flood of earnings reports coming this week, and the market has been quite pleased with what it has seen so far. Many key reports are already out, but both Apple (AAPL) and Microsoft (MSFT) report this week and will likely keep the bears on the sidelines -- especially those who were burned by Intel last week.

You always have to be a bit distrustful of strong moves on Monday morning, especially when we are already a bit extended, but there is a lot of positive news on the wires this morning and we should see some strong underlying support. Many charts badly need to consolidate some gains, but with anxious buyers under the surface, they may not do so for long.

The key this morning will be to see how quickly buyers jump on the first dip in the first hour or so of trading. I suspect they will stay aggressive and will not let this market fall too much. That means our challenge will be to find stocks that offer entry points without being too extended already, and that doesn't leave a whole lot.

---------------------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CHINA +11.1% (light volume), PETS +5.9%, JCI +4.2% (light volume), HAS +3.4%, HAL +2.5%, ETN +2.5%... Select financial names seeing early strength: CIT +76.1% (Bondholders plan CIT rescue - WSJ), LYG +7.3%, IBN +6.4%, HBC +3.7%, CS +2.9%, DB +2.8%, ABB +2.2% (mentioned positively in International Trader - Barron's), MS +1.8%... Select metals/mining names trading higher: HL +5.1%, AEG +4.3%, BBL +4.1%, SLW +3.8%, AUY +3.7%, AEM +3.7%, GOLD +3.4% (Randgold Resources says 'more to come from pipeline'), MT +3.3%, RTP +2.2% (Industry pushes new iron-ore pricing plan - WSJ), GG +2.2%, VALE +1.7%, GLD +1.6%... Select drug/biotech names trading higher: HGSI +203.6% (Human Genome Sciences and GlaxoSmithKline announce positive Ph. 3 study results for BENLYSTA in systemic lupus erythematosus; also upgraded to Buy from Hold at Citigroup and upgraded to Hold at Lazard Capital Mkts), OREX +23.0% (schedules July 20, 2009 teleconference and webcast discussion of Contrave Ph. 3 results), CYTR +20.0% (announced treatment with its cancer drug candidate INNO-206 resulted in a statistically significant reduction in the average primary tumor size in an animal model), IMMU +9.8%, SPPI +8.1% (announces that the FDA has accepted for filing and review the resubmission to its supplement to the biologics license application for ZEVALIN in the first line consolidation setting on July 8, 2009), ARNA +7.5%, GSK +4.1% (Human Genome Sciences and GlaxoSmithKline announce positive Ph. 3 study results for BENLYSTA in systemic lupus erythematosus), NVS +3.1%, SNY +2.3%, AZN +1.7%... Select oil/gas related names showing strength: BP +3.0%, RDS.A +2.9%, E +2.6%, PBR +1.9%, TOT +1.7%, XOM +1.2%, CVX +1.2 (Chevron expects to fight Ecuador lawsuit in US - WSJ)... Select shippers showing modest strength: SBLK +6.5%, DRYS +1.9%, EGLE +1.8%... Other news: EXTR +10.0% (light volume; Extreme Networks and McAfee form strategic alliance to promote secure and reliable networking), RHT +8.3% (will replace CIT Group in the S&P 500), SAY +8.2% (announced that the Company Law Board has given permission to the central government to withdraw FOUR of the SIX directors appointed by it to the Board of Directors of Satyam Computer Services Limited), LVS +3.6% (said to plan HK IPO in August - Business Times), YHOO +2.1% (Microsoft deal talk, optimism overshadow results - Reuters)... Analyst comments: CAT +4.4% (upgraded to Buy at BofA/Merrill), BTU +3.7% (upgraded to Outperform at FBR Capital), ELN +3.1% (upgraded to Buy at UBS), CSCO +2.7% (upgraded to Outperform at Credit Suisse), DIS +2.4% (upgraded to Overweight at Morgan Stanley), HOG +2.0% (upgraded to Neutral at Goldman; removed from Americas Sell list- Reuters), TXN +1.7% (upgraded to Hold at Jefferies),

Allapoole avanevad:

In reaction to disappointing earnings/guidance: WFT -8.1%, NGA -4.2% (light volume)... Other news: MSB -14.0% (determined to not distribute any royalty income for the three months ended July 31, 2009), EWBC -9.9% (announces it has commenced an 11 mln share common stock offering), RT -9.3% (announces a 10 mln share common stock offering pursuant to an effective registration), RDN -8.0% (filed for a $1 bln mixed shelf offering)... Analyst comments: INFN -13.8% (downgraded to Underperform at Jefferies), AUXL -4.0% (initiated with a Sell at Caris & Company), BJS -2.9% (downgraded to Underperform at Wells Fargo), TSN -2.7% (downgraded to Hold at Deutsche), BIDU -1.1% (downgraded to Underperform at Credit Suisse). -

Notable Calls vahendab, et Credit Suisse langetas Baidu (BIDU) neutraalse soovituse underweight peale. CS’i hinnasiht on $250 dollarit ja eelturul on Baidu aktsia protsendi võrra miinuses ja kaupleb $318 dollari juures.

-

Goldman Sachs’i USA strateegid ootavad samuti ralli jätkumist aasta teises pooles ja S&P500 aastalõpu prognoos tõsteti 1060 punkti peale (varasem prognoos oli 940 punkti).

-

BBT (BB&T Corp) downgraded to Strong Sell at Miller Tabak; tgt cut to $17.03

-

Homme tuleb Tallinna börsil ilmselt väga suur tõus. Praegu tunduvad kõik näitajad kinnitavat vaid üht, nimelt et kriis sai täna läbi ning nüüd algab pidev tõus kuni 2015 aastani. Seda väidavad nii Bloomberg, Eesti Päevaleht kui ka LHV foorum.

Mul on kahju vaid Kalle Muulist, kes alles eile saates Olukorrast Riigis arvas, et tõepoolest oluliselt mõistlikum on eesti inimestel hoida praegu raha pangas kontol, kui see aktsiaturule investeerida. Üheainsa päeva saigi ainult tema mõte lennata, sic transit gloria mundi! -

no neid Muuli taolisi vendi on täna ikka tuhandete viisi. Kroonihoiust nad nagunii ei julge kasutada ja siis istuvad rõõmsalt mõtetu intressiga eurihoiuses. Aga varsti on neil kõigil üks ühine küsimus: what the hell?

-

Texas Instruments Earnings Preview

Texas Instruments (TXN) is scheduled to report 2Q09 earnings after the close tonight, typically around 4:30 ET, with a conference call following at 5:30 ET. Consensus is for EPS of $0.18 on revenues of $2.41 bln, in-line with the company's raised guidance of $0.14-0.22/$2.3-2.5 bln issued on the mid-quarter update (06/08). The company historically guides revenue and EPS for the following quarter. Consensus for Q3 EPS is at $0.27 on revenues of $2.5 bln. -

Texas Instruments prelim $0.20 vs $0.18 First Call consensus; revs $2.46 bln vs $2.41 bln First Call consensus

Texas Instruments sees Q3 EPS of $0.29-0.39 vs $0.27 First Call consensus; sees revs $2.5-2.8 bln vs $2.52 bln First Call consensus -

TXN tulemused korralikud, esimese hooga müüdi kergelt punasesse, kuid nüüd kauplemas $23.70 tasemel. Oluline kuidas homme käitutakse. Hetkeseisuga tänase päeva kohta käive väga korralik ~34mio RTH ja ~2 mio

järelturul. Arvestades +12% tõusu enne tulemusi, siis pigem ootaks homme "sell the news" reaktsiooni. -

Nojah, kui aasta tagusega võrrelda, siis ei pane nagu keegi tähele, et kukuti 56%. Aktsia hind ka peaaegu samal tasemel, kui eelmine aasta. Tore ju.