Börsipäev 27. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Ajal, mil pidu kestab ning maailma börsid tänu ettevõtete ootusi ületavatele kasumitele tõususeeriat juba 11-ndale päevale venitavad, tasuks lugeda ZeroHedgi ja David Rosenbergi koostöös valminud analüüsi "The End of The End of The Recession". ZeroHedge on üks paljudest blogidest, mis pidanud CNBC saatejuhtidega majanduslanguse lõppemise teemal maha mitmeid sõnasõdasid, üritades selgeks teha, et antud kanali vahendusel massidesse jõudev roosiline optimism pole põhjendatud.

-

aga kas parem oleks siis massidele meediast musta masendust peale ajada?

nagu Eestis seda tehakse. Selle tulemusena usub 76% eestimaalastest, et hullem on alles ees (eelmise nädala uudis). -

Kui allokatsiooniotsused õieti teha, siis on sügavalt ebaoluline, milline on retoorikapilt meedias.

Pole enne kuulnud et keegi sootsiumi kollektiivse vaimse stabiilsuse pärast niisama muretseks. -

Momentum,

masside ootused on üks majanduse aluseid. Suurem osa inimesi loob oma maailmapildi meedia abil.

ülaltoodud zerohedge analüüsis on kohe esimesena toodud välja, et US consumer=70% GDP.

Kui massid nüüd ei julge tarbida (nagu see on olnud alates eelmisest sügisest), siis on see selgelt tuntav GDPs->firmade käibed->kasumid->aktsiahind (muude varaklasside hinnad).

iga ameeriklane säästab hetkel ca 100 taala kuus (imikust hällini). see on 30 miljardit säästetakse halbadeks aegadeks. See on ca 10% kogu USA jaekaubanduse käibest. -

a) CNBC on meelelahutuskanal. Kas kellelegi tuleb see üllatusena?

b) Kas Eestis ei ole hullem alles ees? Mina kuulun 76% hulka ja arvan ka, et on. Reservid on sisuliselt läinud, tööturg feilab edasi ja isegi kui peamistel ekspordipartneritel peaks hakkama hirmus hästi minema, kulub meil kaks-kolm kvartalit ennem, kui me omal nahal seda positiivset efekti tunnetama hakkame.

c) Meedia ei adu enam oma vastutust. Käib "meele lahutamine" ja suvaline laksimine a la Anne Oja shedöövrid. -

Pigem on teemaks konkreetsed subjektiivusega pealesuruvad CNBC reporterid (nt Dennis Kneale), kes oma "eile-lõppes-majanduslangus" argumentides on välja noppinud vaid kõige punasemad kirsid ning teooriale vasturääkivatele aspektidele ei pöörata üldse tähelepanu. Sestap tekib mingil hetkel küsimus, kui palju sellest on finantsuudised ja kui palju puhas show, et vaatajate numbreid tõsta.

-

Bloomberg TV-s vastupidi ei ole veel päris ära unustatud, misasi on ajakirjandus ning misasi on analüüs.

-

Makromajanduse poole pealt kostitatakse täna kell 17.00 USA uute majade juunikuu müüginumbriga ning konsensus ootab tugevat põrget (352 000 ehk +2.9% võrreldes maiga). Maikuu näitaja osutus mäletatavasti oodatust kehvemaks, kui 360 000 asemel müüdi hoopis 342 000 maja, vähendes aprilliga võrreldes -0.6%.

-

Nouriel Roubini kirjutab NY Times'is, miks tema arvates Föderaalreservi esimees Ben Bernanke väärib omal kohal jätkamist. Nimelt lõppeb Bernanke ametiaeg järgmise aasta jaanuaris ja seetõttu on ilmselt lähiajal oodata veelgi tema tööd analüüsivaid arvamusartikleid.

-

Futuurid viitavad hetkel USA börside avanemisele kerges plussis (S&P500 +0.02%, Dow ja Nasdaq +0.1%), kui käesoleval nädalal jätkub kvartalitearuannete avaldamine (kokku 146 S&P 500 ettevõtet) ning reedel saame teise kvartali SKT näitaja näol täpsemat aimu Ühendriikide majandusseisust. Ebameeldiva üllatuse jõudis juba valmistada Suurbritannia eelmisel nädalal, registreerides kogutoodangu teise kvartali QoQ languseks oodatud -0.3% asemel -0.8%.

-

karumõmm: Eestis on sisulises mõttes hullem (s.t. suhteline ebaadekvaatsus oma reaalsete võimaluste hindamise suhtes) kindlasti möödas. Millal see majandus siin kasvama hakkab, ei omagi väga suurt tähtsust. Tähtsam on tõepoolest see, mis selle põhjustab. Loodetavasti on see "sucking sound", mida taastuv nõudlus eksportturgudel tekitab. Kui Eestis asuv tootja on tarneahelas kusagil algfaasis, siis arvestades selle varude tsükli loogikat peaks uue lõpptoodanguni jõudmiseks tekkima nõudlus sisendi järgi pigem varem, kui hiljem. Nii et tervikpildis see "paar-kolm kvartalit hiljem" mingi ülearu kindel väide ei tundu.

-

Nomura hinnangul on globaalsetel aktsiaturgudel veel 13% tõusuruumi selle aasta teises pooles. Nomura strateegide positiivse nägemuse põhjused:

- 2Q09 tulemuste positiivsed üllatused ületavad negatiivseid 3.1x (kasumid on keskmiselt 10.8% kõrgemad)

- 1Q tulemuste hooajal tõusid USA aktsiad 13%, kuid seekord on ralli tõus 10.7%

- 12. kuu ettevaatav P/E on 17% madalam viimase 20. aasta keskmisest

- USA kinnisvaraturul paraneb olukord (olemasolevate majade müük on tõusnud jaanuari põhjadest 9%)

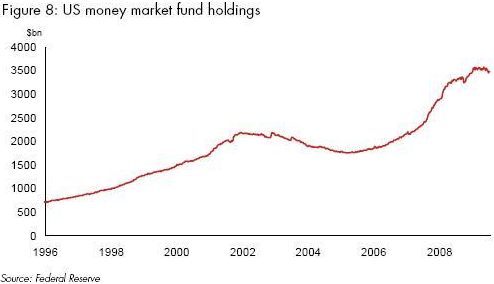

- Investorid on endiselt riskikartlikud:

Kokkuvõte:

All in all, our outlook for the second half of 2009 remains a bullish one for stocks. While the naysayers will point to the continued absence of top-line growth, we think it is clear that earnings numbers had been cut too far, and with multiples apparently discounting further downgrades, the reality of better-than-expected earnings figures, coupled with high cash balances, has the potential to have an exaggerated effect on stock prices. (allikas: FT)

Nomura nägemus kajastab uut konsensust. Goldman Sachs'i S&P500 aastalõpu prognoos on 1060 punkti, kuna 2Q09 tulemused (eriti finantssektoris) ületavad ootusi. Credit Suisse prognoosib 1050 punkti, sest tulemused on oodatust paremad ja bilansilehed paranevad. HSBC sihib S&P’le aastalõpuks 1020 punkti, kuna analüüsimajande downgrade'i tsükkel on lõppenud (pikemalt Bloombergis).

-

Extended, but So What?

By Rev Shark

RealMoney.com Contributor

7/27/2009 8:28 AM EDT

Our dilemma is that we hate change and love it at the same time; what we really want is for things to remain the same but get better.

-- Sydney J. Harris

A market as strong as this one has been over the last two weeks presents a difficult dilemma. By almost every technical measure, we are extended and/or overbought. It is reported that the "stocks only" McClellan Oscillator is at the most overbought level ever recorded. A number of other readings like this are out there, but it doesn't take any complicated indicators to know that this market went up a whole lot very fast.

The challenge for investors is that extended markets don't necessarily reverse and go straight back down. An old adage says that overbought markets can become even more overbought. There is no way to accurate predict when momentum will slow.

To complicate matters further, an extended market can work off its excesses simply by sitting there and doing nothing. We don't have to fall suddenly and sharply for the market to become less extended. We just need to tread water for a little while.

On Friday we saw a particularly good example of how a strong, extended market can stay sticky to the upside. This market has been so surprisingly strong that it has left a large contingent of folks underinvested and poorly positioned. They are frustrated and want to add long exposure, but they aren't inclined to chase things in to the stratosphere. However, they would be happy to buy a pullback, and it doesn't take more than a few downticks to make them jump in.

So that is where we stand as we kick off the final week of July. The market has extremely strong momentum and lots of underlying support, but is very extended and in need of a rest.

So how do we deal with this? If you tried to aggressively short into this action, you had your head handed to you. As I stated, we have no reason to think that we will suddenly reverse downward. If you are loading up on the short side, the danger of a further squeeze and more frustration remain quite high.

On the other hand, if you are looking to add some long exposure you aren't going to find much that is set up well technically. A tremendous number of stocks have been up many days in a row and aren't offering easy entry points. The smart move recently has been to chase strength, but for those with a disciplined trading methodology, that is not easy to do -- especially after running straight up for 10 days or so.

My inclination at this point is to continue to give the benefit of doubt to the bulls until there is good reason not to. Being extended isn't a sufficient reason to be aggressively short, and there are still some long buys to be found. It isn't easy to find things that are still within a base, but they are out there, and I'm going to focus on those.

I suspect this market will work off its overbought conditions by churning and maybe with some mild pullbacks. I don't expect to see a major collapse unless there is some really surprising economic news. Even then, the dip-buyers will be swarming about for a while and won't be discouraged until they suffer some disappointments.

It isn't an easy market situation, but if it were easy, it wouldn't be so potentially lucrative.

-----------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: COT +10.0%, NTY +7.2%, CYOU +4.4%, SOHU +2.9% (light volume)... Select oil/gas related names ticking higher: BP +1.4%, E +1.4%, RDS.A +1.2%... Select solar names showing continued strength: TAN +5.4%, YGE +3.5% (Cramer makes positive comments on MadMoney), JASO +3.4%, STP +2.0% (Cramer makes positive comments on MadMoney), CSIQ +1.9%, LDK +1.7%... Select drug and infectious disease related names trading higher: ACAD +22.6% (continued strength from Friday's 40%+surge higher), NVAX +10.9%, ONCY +10.4% (light volume, successfully completes 100-Litre cGMP Production of REOLYSIN), VICL +9.7%, INCY +6.0%, BCRX +4.8%, SVM +4.2%... Select metals/mining names showing modest strength: GG +1.6%, MT +1.6% (Arcelor Mittal ponders $3 bln stainless steel spinoff - FT), GOLD +1.6%, BBL +1.4%, RTP +1.0%... Other news: RFMD +5.2% (continued strength from Friday's 10% jump), LVS +4.0% (still checking for anything specific), SBUX +1.7% (Cramer makes positive comments on MadMoney), ABT +0.8% (Abbott Labs and Medtronic Resolve Global Vascular Patent Disputes)... Analyst comments: BEAV +6.2% (upgraded to Outperform at FBR Capital), LYG +5.1% (upgraded to Buy at Nomura).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CALM -10.4%, AET -7.7%, RYAAY -6.0%, PPD -4.8% (light volume), GLW -4.7%, HON -2.6%, ANR -2.0%... M&A news: FNFG -4.2% (First Niagara has agreed to acquire Harleysville National for ~$5.50 per share)... Other news: KV.A -25.5% (disclosed certain information related to current status of the SEC filings, previously disclosed govt investigations and liquidity position), PXP -11.9% (announces an update on its Tranquillon Ridge project), MYL -5.8% (workers overrode drug quality controls - Pittsburgh Post-Gazette), ACI -4.6% (commenced a 17 mln share common stock offering pursuant to an automatic shelf registration statement), HUM -4.5% and WLP -1.7% (down in sympathy with AET), C -1.8% (announces preliminary results of public share exchange)... Analyst comments: ADSK -2.6% (downgraded to Hold at Deutsche), AZN -1.7% (downgraded to Neutral from Outperform at Exane BNP Paribas), BA -0.9% (downgraded to Equal Weight at Barclays). -

Euroopa turud:

Saksamaa DAX +0.6%

Prantsusmaa CAC 40 +0.3%

Inglismaa FTSE 100 -0.0%

Hispaania IBEX 35 +1.2%

Rootsi OMX 30 -1.3%

Venemaa MICEX +2.0%

Poola WIG +0.3%Aasia turud:

Jaapani Nikkei 225 +1.5%

Hong Kongi Hang Seng +1.4%

Hiina Shanghai A (kodumaine) +1.9%

Hiina Shanghai B (välismaine) +1.4%

Lõuna-Korea Kosdaq +0.9%

Tai Set 50 +0.7%

India Sensex 30 -0.0% -

http://www.youtube.com/watch?v=whdsw2lqyeo&feature=related

-

Täna ja homme toimub Hiina ja USA vahel Strategic Economic Dialogue. Timothy Geithner kinnitas oma avakõnes hiinlastele, et USA poliitika on:

"committed to taking measures to maintaining greater personal saving and to reducing the federal deficit to a sustainablelevel by 2013."

EUR/USD on aga jätkuvalt tugevas korrelatsioonis aktsiaturgudega & hetkel on 1.4300 juurest tuldud allapoole 1.4252 peale (aktsiad USA's alustamas kauplemist väikses miinuses). Alanud on juuli viimane nädal & nädalavahetusel avaldatud kirjutistes oodatakse sellel nädalal kasumivõtmise suurenemist. Momentum on siiski tugev ja optimistlike pullide ette astumine on julge samm.

-

June New Home Sales 384K vs 352K consensus, M/M +11.0%

-

Economic Data Reviews: New Home Sales Up 11% in June

New home sales jumped 11% in June to an annualized rate of 384,000 units. The consensus estimate for June was 352,000, so the banner headline had an uplifting quality to it. Still, new home sales were 21.3% below the year-ago level, so it is misleading to label this report a "strong" report. It is better than expected but it isn't strong. Also, from a general market standpoint, we wouldn't put a lot of emphasis on this one report given that new home sales account for just 7% of total home sales in the U.S.