Börsipäev 7. august

Kommentaari jätmiseks loo konto või logi sisse

-

Selle nädala tähtsaim majandusraport on tulemas nädala viimasel päeval - juulikuu tööjõuraport avaldatakse tund aega enne USA turgude avanemist ning turu konensusootuseks on Briefingu andmeil -325 000, kuid välja on käidud ka optimistlikemaid ootusi. Näiteks Goldman Sachs tõstis eile oma ootuse -300 000 pealt -250 000 peale. Võrdluseks tuletan meelde, et juunikuus kadus USAs -467 000 töökohta, seega ootused tööjõuturu paranemise osas on päris suured. Töötusmääralt oodatakse kerkimist 9.6% pealt 9.7% peale. Juulikuu tunnitasult oodatakse 0.1%list kasvu.

-

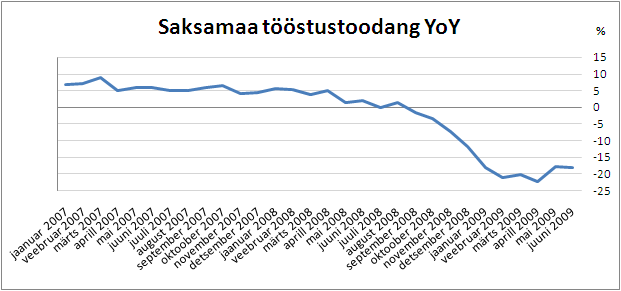

Euroopas on aga tähelepanu keskpunktis Saksamaa juunikuu tööstustoodang (Eesti aja järgi kell 13.00), mis tõotab anda põhjust uskuda riigi tööstussektori olukorra kiiresse paranemisse. Konsensuse ootuse löömise kõrge tõenäosuse annab eile avaldatud tehaste tellimuste arv, mis kasvas juunis kahe aasta kiireimas tempos (4.5% vs prognoositud 0.6%). Kuna tegemist on juba neljanda järjestikulise kuuga, mil antud makronäitaja on kosunud, hinnatakse potentsiaali majanduskasvu osas üllatamiseks järjest kõrgemaks ning -6% oodatav SKP langus 2009. aastal võib selliste trendide jätkudes osutuda liiga pessimistlikuks. Huvitavaks kujuneb selles osas Euroopa Keskpanga septembri kohtumine, kus vaadatakse üle eurotsooni SKP ja inflatsiooni prognoosid ning välistatud pole võimalus, et ootusi korrigeeritakse ülespoole.

-

USA Senat kiitis eile heaks 2 miljardi dollari suuruse lisasüsti cash-for-clunkers programmi, mille senine menu on jätnud paljude edasimüüjate parkimisplatsid tavalisest tühjemaks. Lähinädalatel peaks selguma, kuidas jätkub tarbijate reaktsioon ning kas autotootjatel on põhjust suurendada tootmismahtusid. Ford näiteks suudaks praegu oma Focus mudeli varuga vastu pidada 25 päeva, kui optimaalseks hinnatakse tavaliselt 65 päeva varu. Ning GM-i autode ja veokite on vähenenud juunikuu 82 päeva tasemelt augusti alguseks 64 päevale. Igasugustesse ületootmise plaanidesse on põhjust suhtuda ettevaatusega, kuna lühiajalise ergutamise lõppedes tabab müüki tavaliselt järsk langus.

-

Saksamaa tööstustoodangu muutus oli juunis üllatuslikult negatiivne (-0.1%) võrreldes maiga, mil näitaja sooritas 18 aasta kiireima tõusu(+4.3%). Analüütikud olid oodanud 0.5%-list paranemist. Aastataguse tasemega võrreldes langes juuni näit -18.1% vs -17.9% mais.

-

Merriman on Imaxit (IMAX) positiivselt kommenteerimas:

Merriman notes IMAX yesterday morning beat on revs and reported EPS of $0.05 vs their est of $0.04 and consensus of $0.02, they note true operating EPS was $0.08, due to a positive shift in revenue mix toward film-based revs, gross margin came in at 50.4% vs. their est of 49.5%. THey note there were string IMAX box office revs as JV and DMR revs are driving profitability. They also note their balance sheet is now stronger. They see appreciation potential for IMAX shares to $12.00-13.50 and view IMAX as the best operating leverage story in the theater space as it continues to benefit from ramping box office trends.

Avaldasime hommikul ka Pro all kvartalitulemuste kommentaari ning tõstsime hinnasihti.

-

Volvo saavad endale hiinlased?

Briefing: "Sky News reports the co is in talks with two Chinese companies to sell a majority stake in its loss-making Volvo Cars. Sources have told Sky News online that the US giant is talking to China's Geely Automobile and Beijing Automotive Industry Holding Co. But the company itself said it was too early to name companies and that a deal was not imminent. Spokesman John Gardiner said: "Our position is that nothing has changed and there have been no developments today. "But let me say this - it is probable that Volvo will be sold at some point." Mr Gardiner added that he was not expecting any major developments in the next two weeks." -

American Intl reports Q2 EPS of $2.30, may not compare to $1.67 First Call consensus; revs $29.53 bln vs $26.15 bln First Call consensus

AIG on selle peale eelturul kauplemas $26 juures ehk eilsest sulgumistasemest ca 15% kõrgemal. -

Sündmused USA tööjõuturul juulikuus:

Töökohad: -247 000 vs oodatud -325 000

Töötusmäär: 9.4% vs oodatud 9.6%

Tunnitasu muutus: 0.2% vs oodatud +0.1%

Töönädala pikkus tundides: 33.1 vs oodatud 33.0 tundi -

Nonfarm Payroll Revisions:

June revised to -443K from -467K

May revised to -303K from -322K

April unchanged from -519K

March unchanged from -652K

February unchanged from -681K

January unchanged from -741K -

Imaxi hinnasihti on tõstnud ka Roth Capital, varasema $12.5 pealt kergitati sihti $13.5-ni.

-

Kommentaar raporti kohta:

Employment Report Produces Positive Surprises

The headlines for the July employment report brought positive surprises all around. Nonfarm payrolls declined -247,000 (consensus -325K) while nonfarm payrolls for June (-443K) and May (-303K) were both revised slightly lower from their prior readings. The unemployment rate dipped to 9.4% (consensus 9.6%) from 9.5%, average hourly earnings rose 0.2% (consensus 0.1%), and the average workweek increased to 33.1 hours (consensus 33.0) from 33.0. These are headlines that should warm the administration in Washington and they will engender confidence in the idea that the worst of the downturn is over... So, too, will the indication that the manufacturing workweek increased 0.3 to 39.8 hours. That is a good portent for an improvement in industrial production, although with overtime hours staying flat, it is clear business isn't booming... It is easy perhaps to get a sense from the headline figures that the labor market is much improved. It is relative to what we witnessed just a few months ago, but it is still a troubled place. Payroll losses were reported across nearly every major category, with the exception of small increases in education and health services (+17K), leisure and hospitality (+9K) and government (+7K). Additionally, 1 out of every 6 workers over the age of 16 still lacks full-time employment. The number of discouraged workers was 796,000 in July, up by 335,000 over the past 12 months. The difficulty in finding a new job is best reflected in the extension of the average duration of unemployment to 25.1 weeks from 24.5 weeks. This is the highest since records began in 1948. More alarmingly perhaps is that 1 out of every 3 unemployed workers has been unemployed for 27 weeks or longer... The July employment report has some encouraging characteristics, but at the end of the day there were still 247,000 jobs lost in July, bringing the total number of jobs lost since December 2007 to 6.7 million. There isn't a whole lot to cheer about there.

-

Ja millal siis esimene intressimäärade tõstmine tuleb? Ilmselt hakatakse sellest nüüd vähe rohkem rääkima.

-

Paar päeva tagasi räägiti kulisside taga intressimäärade tõstmise võimalikkusest jaanuaris... siis pidasid seda paljud veel selgelt liiga varajaseks tärminiks.

-

USA turud avanevad oodatust parema tööjõuraporti valguses eilsest ca 1% jagu kõrgemalt.

Euroopa turud:

Saksamaa DAX +1.32%

Prantsusmaa CAC 40 +0.82%

Inglismaa FTSE 100 +0.32%

Hispaania IBEX 35 +1.16%

Rootsi OMX 30 +1.46%

Venemaa MICEX +1.24%

Poola WIG +0.22%Aasia turud:

Jaapani Nikkei 225 +0.23%

Hong Kongi Hang Seng -2.51%

Hiina Shanghai A (kodumaine) -2.85%

Hiina Shanghai B (välismaine) -3.41%

Lõuna-Korea Kosdaq +0.68%

Tai Set 50 -0.99%

India Sensex 30 -2.28% -

All Eyes on Jobs Data

By Rev Shark

RealMoney.com Contributor

8/7/2009 8:26 AM EDT

Many people quit looking for work when they find a job.

-- Unknown

This morning's jobs report has more importance than usual following a gigantic ramp in the market since the last report. What has been so difficult about the market for many is that the improvement in the action does not seem to be well supported by improvements in the economy.

The stock market always looks ahead and tries to discount events down the road, and plenty of reports show that things have become "less bad" in the economy, yet many folks are quite skeptical about the degree of optimism that is being priced into this market. The anecdotal experience of many is quite different than the euphoria that is being exhibited in the stock market lately.

Today's jobs report should give us some indication of how much good news has been priced into this market. It is only one report, and one that many dismiss as backward-looking and not predictive, but the reaction to it should tell us something about what is priced into this market.

Expectations are for job losses of 345,000, but Goldman Sachs lowered their numbers yesterday to 250,000 and there seems to be a fair amount of optimism about this even though the White House has been busy lowering expectations.

I will be watching for selling after an initial positive reaction to a good number. If we are unable to rally much on a strong report, that is an indication that the move of the last few weeks has anticipated and discounted this news already. Certainly we are pricing in something lately, and the fact that the market has been so strong must mean that many are looking for good news.

If we have a poor number and reaction, I will be looking for buyers to step in fairly quickly. We still have plenty of underlying support and lots of underinvested bulls who would like to add positions at better prices. I think they will quickly overlook the jobs numbers.

We are at a tricky juncture in the market where we are quite extended but still have plenty of folks who are looking to buy and will provide some strong support. Watch for some whipsaws on the jobs report and don't expect the initial reaction to last for long.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: MBRX +51.1% (light volume), CROX +30.2% (also upgraded to Overweight at Piper), CQB +18.5%, AIG +12.7%, NABI +9.9%, KNOT +9.2%, SAPE +9.1%, AINV +9.1%, UCBH +8.7%, HANS +8.5% (also upgraded to Buy at Stifel Nicolaus), BZH +7.9%, CBS +7.7% (upgraded to Buy at Benchmark), FSYS +7.6%, POWR +7.0% (light volume), EBS +6.0%, NVDA +5.2%, MIL +3.7%, EGOV +3.7%, CSC +3.0%, MCHP +2.0%, INT +1.9% (light volume), NILE +1.3% (light volume)... Other news: NPD +14.9% (still checking), C +3.2% (Citigroup officers disclose 2 mln share purchases in filings out after the close; also Cramer makes positive comment on MadMoney), NFLX +3.0% (announces authorization of new $300 mln stock buyback), VOD +1.4% (still checking)... Analyst comments: DHI +3.7% (added to Conviction Buy list at Goldman- Reuters), KG +3.4% (upgraded to Buy at BofA/Merrill), CSIQ +3.2% (upgraded to Accumulate from Source of Funds at ThinkEquity), PCS +1.2% (upgraded to Hold at Auriga).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: LEAP -19.0% (also downgraded by multiple analysts), ABK -18.1%, PMI -17.9%, OME -16.9%, SWSI -14.6%, RBS -13.9%, ERII -13.4% (downgraded to Neutral from Overweight at Piper Jaffray), SQNM -12.8%, STV -12.2%, LPNT -8.3%, AYR -6.8%, POM -4.9%, VRSN -2.7%, ASEI -2.1%... Select financials showing weakness: HBC -4.2%, IBN -2.5%, LYG -1.8%, PUK -1.8%... Select metals/mining names trading lower: RTP -3.9%, GOLD -2.7%, BHP -2.5%, GFI -2.5%... Other news: CAEI -17.0% (announces it has agreed to sell 17 mln shares of common stock at $1.65/share to certain qualified investors), SBCF -8.7% (announces public offering of 34,500,000 shares of common stock), KSP -7.8% (prices a 2.9 mln share common stock offering at $19.15/share), CAL -6.3% (prices a 14.4 mln share common stock offering), NGLS -6.3% (announced that it has commenced a 6 mln share common stock offering), BNE -4.4% (prices public offering of 10.5 mln shares of common stock at $5.96/share), PXP -4.0% (prices public offering of common stock at $24), SIRO -3.6% (prices 7.5 mln common share offering at $23.75/share), OSK -3.6% (prices 13.0 mln common share offering at $25.00/share)... Analyst comments: GENZ -1.5% (added to Americas Conviction Sell at Goldman- Reuters), SLF -1.3% (downgraded to Underperform at Credit Suisse). -

Intressimäärade langetamise osas on tõesti räägitud põhiliselt jaanuarist, aga ilmselt julgemad spekulatsioonid hakkavad veel selle aasta lõpu kohta käima. Kuigi Fed ise on viidanud, et määrasid kavatsetakse "kaua" madalal hoida. Samas on see ainult retoorika, ootuste tekitamine, mis reaalse vajaduse korral võib kiiresti muutuda. Samal ajal laiendatakse teisel pool lompi alles jõuliselt QE'd. Kuhu see kõik küll viib...

-

Enne tänast esitatud viimasest 19 tööjõuraportist on 6 ootusi ületanud ja 13 jäänud ootustele alla. Neil kuuel korral, kui ootusi ületati, lõpetati päev miinuses neljal korral ja plussis kahel korral.

-

Joel arvad et täna lõpetab miinuses?

-

Veidi pikemalt CIT Groupi teemal (+5.56%)

CIT Group reports "progress on restructuring"; completes drawdown of $3 bln secured credit facility, suspends dividends on preferred stock. Co provides an update on the progress of several components of its restructuring. On August 3, 2009, the company announced that it amended the terms of its pending offer for its $1 billion Floating Rate Senior Notes due Aug 17, 2009. The withdrawal deadline was extended until midnight, New York City time, at the end of Wed, August 5, 2009. The withdrawal deadline has passed and eligible bonds tendered, and not withdrawn, met the 58% minimum tender condition. The tender offer will expire at midnight, New York City time, at the end of Friday, August 14, 2009. On July 29, 2009, the company entered into an amended credit agreement with a group of its major bondholders. The company has received the final $1 bln in incremental borrowings under the Credit Facility, bringing the total loan size to $3 bln. CIT will use a substantial amount of the loan proceeds to support its small business and middle market customers. Also, CIT announced today that the Company's Board of Directors has decided to suspend dividend payments on its four series of Preferred Stock in order to improve liquidity and preserve capital while restructuring efforts are ongoing. Payments on the company's equity units are not affected by this decision.

-

Üsna naljakalt kirja pandud: "White House says Obama still thinks jobless rate will hit 10% this year".

Mõne mehe arvamust on ikka väga raske kõigutada. :) -

USD jätkuvalt tugev EUR suhtes ja nüüd nafta ka hakanud ära vajuma, kuid aktsiad ikka veel tippude läheduses.

-

Sector ETF strength & weakness @ midday

Leading Sector ETFs:

Reg banks- KRE +6%, RKH +4%, iShares REITS/real estate- ICF +5.5%, IYR +5%, Comm banks- KBE +5%, SPDRS homebuilders- XHB +5%, Finance- XLF +4%, IYF +3.5%, iShares transports- IYT +3.5%, iShares broker/dealers- IAI +3.5%, SPDRS retailers- XRT +3%, SPDRS cons disct- XLY +3%, Insurers- KIE +3%, SPDRS industrials- XLI +2.5%, Clean energy- PBW +2.5%, Steel- SLX +2.5%Lagging Sector ETFs:

Gold miners- GDX -1.5%, RBOB gas futures- UGA -1.5%, US bonds- TLT -1%, Livestock commods- COW -1%, Crude/WTI oil- USO -.5%, OIL -.5% -

Kas peale Obama kõne kergelt müügipressi näha?

-

vist ei ola nagu....

-

Turgude lakkamatu ralli on isegi suurimad karud pannud oma karususes kahtlema. Complacency on kahtlemata väga suur, kuid pöördepunkti, kus alainvesteeritud pullide ostujõud ja üksikute allesjäänud karude short squeeze otsa saab, on pea võimatu prognoosida...

-

beat that!

Lõuna-Koreas osutus üks viieaastane papagoi üllatuslikult oskuslikumaks investoriks kui enamus võistlusel osalenuid.

Kuus nädalat kestnud investeerimisvõistlusest võttis osa kümme investorit, kellele esitas väljakutse papagoi Ddalgi (Maasikas). Lind saavutas üldjärjestuses kolmanda koha, kirjutab Ilta-Sanomat.

Papagoi tegi oma investeeringu näidates nokaga 30 palli seast mõnele, millest igaüks tähistas teatud

aktsiat. Teisisõnu tegi lind otsuse juhuslikult.

"Tulemus oli hämmastav. Ddalgi sai alginvesteeringutl 13,7 protsendilise tootluse," ütles börsinõu andva firma Paxnet esindaja Chung Yeon-Dae. Võistlusel osalenud kaotasid algkapitalist keskmiselt 4,6 protsenti. (Delfi) -

June Consumer Credit of -$10.3 bln vs -$5.0 bln consensus, prior revised down to -$5.4 bln from -$3.2 bln

-

Kas täna pärast turgu sulgemist või järgmisel nädalal on ka oodata tähtsaid uudiseid?

-

Tulemuste hooaeg on läbi saamas, seega tulemuste poole pealt midagi väga olulist enam tulemas ei ole. Makroraportite poole pealt on järgmise nädala algus vaene ning olulisemad raportid tulevad alles neljapäeval (jaemüük ja esmased töötu abirahad) ja reedel (tarbijahinnaindeks ja tööstustoodang).

-

Kas see pole oluline?

12-Aug-09 14:15 ET FOMC Policy Announcement -

stocker, see jäi kiirel pilgul kahe silma vahele, kuid on ka alles nädala teises pooles.

Aga täna vaatab finantssektorist vastu päris huvitav pilt. Senised momod AIG, FNM ja FRE kõik ca10+% punases. Momentum running out of steam nevertheless? -

Parandaks Joeli AIG koha pealt, too ikka +20% üleva, $27.20 tasemel.

-

Aitäh Alari... reede õhtud : ) FNM ja FRE kõrval oli siis CIT ja mitte AIG, kuigi ka viimane tuli päeva tippudest üksjagu allapoole.

-

FRE nüüd enam nii maas ei ole, paistab. YTD new high.