Börsipäev 27. august

Kommentaari jätmiseks loo konto või logi sisse

-

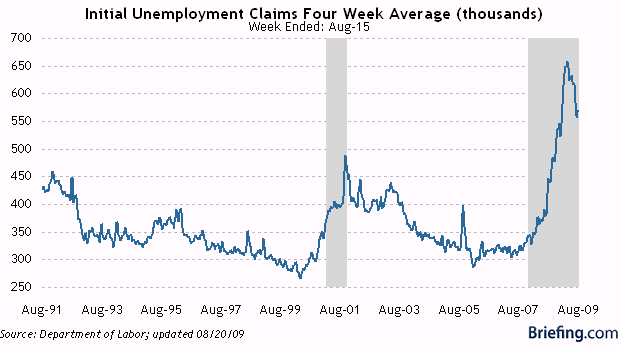

Täna on vaatluse all USA 2. kvartali SKP uuendatud number, millelt oodatakse varem raporteeritud -1.0% pealt allapoole korrigeerimist -1.5% peale. Lisaks korrigeeritud SKP numbrile teatatakse kell 15.30 ka SKP deflaator (ootus +0.2%) ning möödunud nädala esmaste töötu abiraha taotlejate arv. Kui üle-eelmisel nädalal oli näiduks 576 000, siis nüüd oodatakse selle näidu paranemist 565 000 peale.

-

Täna enne turgu on tulemustega tulemas Venemaa telekom Vimpelcomm, mille ADSid kauplevad USA börsil sümboli VIP all. Briefingu andmeil on aktsiapõhise kasumi konsensusootuseks $0.70 ning müügitulusid oodatakse suuruses $2164 miljonit.

Pärast turu sulgemist teatavad oma numbrid naiste seas populaarne jaemüüja bebe Stores (BEBE), millelt oodatakse EPSi $0.01 ning müügitulusid 131.5 miljonit, ning arvutihiid Dell (DELL). Delli EPSiks oodatakse $0.23 ning müügituludeks $12.6 miljardit. Lisaks on veel oma numbritega tulemas pooljuhtsektorist Marvell (MRVL), kelle bottom line konsensusootuseks on $0.14 ning top line ootuseks $618 miljonit.

-

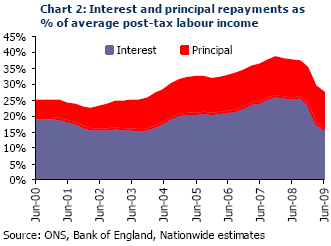

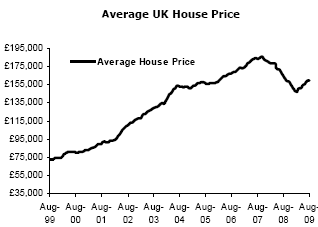

Kinnisvarahinnad Suubritannias kerkisid augustis viiendat kuud järjest, tõustes juuliga võrreldes 1.6%. Kuigi 12 kuu taguse perioodiga võrreldes jäävad hinnad endiselt madalamaks, on langus aasta baasil kahanenud -6.2%-lt -2.7%-le. Nationwide pakub sellise trendi üheks võimalikuks toetajaks madalaid intressimäärasid. Enne Inglise keskpanga intressilangetusi moodustasid kinnisvaralaenu intressid ja põhiosa tagasimaksed keskmisest maksujärgsest sissetulekust 38%. Tänu 0.5%-lisele baasmäärale, on laenukoormuse osakaal sissetulekust vähenenud 28%-ni. Ühest küljest saavad paljud endale taas laenuvõtmist lubada ja teisalt tunnevad jälle müüjad vähem finantssurvet oma kinnisvara turule panna. Seega nõudluse ja pakkumise tasakaal on käesoleval aastal hakanud vaikselt jälle müüjat soosima.

-

Vimpelcom 2Q 2009: turnover $2143 million, operating income per ADS $0.69.

-

Kui Saksamaa ja Prantsusmaa majandused suutsid teises kvartalis tõusta 0.3% QoQ, siis Hispaania SKP kukkus 1.1% QoQ (4.2% YoY, mis on suurim kukkumine alates 1970’st). Hispaania majanduse käekäik on väga sarnane Eestile - kasv põhines odaval laenurahal, mis tekitas tarbimisbuumi ja kinnisvaramulli & see lõhkes krediidikriisiga. Hispaania majandukasvu taastumise V-kujulised ootused tunduvad liiga optimistlikud ja arvan, et sealset pangandussektorit ootavad ees veel väga rasked ajad. Pikaajaliselt valmistab Hispaaniale probleeme madal tootlikkus & võlgades tarbijad ei rõõmusta kindlasti tulevikus intressimäärade tõusu peale. USA börsil järgib Hispaania aktsiate käekäiku börsil kaubeldav fond EWP:

-

USA 2. kvartali annualiseeritud SKP qoq näit korrigeeriti -1.0% pealt ümber -1.0% peale (ootus oli -1.5%). 2. kvartali eratarbimine oli -1.0% vs oodatud -1.3% ning esmaste töötu abiraha taotlejate arv 570 000 vs oodatud 565 000.

-

Ei saa aru. Joel, palun selgita veidike: SKP qoq näit korrigeeriti -1.0% pealt ümber -1.0% peale

-

Ehk korrigeerimise tulemusena (varasemalt raporteeritud number vs nii-öelda värske näit ehk 'advanced' näit) jäi lõplik number samaks.

-

oeg ja baltica haha

oli ikka tore osta üleeilse sipsaka peale eile 60k MDLK -

Nokia (NOK) tänase eelturu ca 3%lise plussi põhjuseks on ettevõtte teade, et teenuslahenduste arendamisel on asi tõsiselt kätte võetud ning et alates 1. oktoobrist on töös eraldi üksus nimega 'Solutions'. See näitab Nokia meelekindlust Ovi kasutajatearvu tõstmiseks tänase 54 miljoni pealt ca 300 miljoni peale 2012. aasta lõpuks.

Lisaks 'Solutions' üksuse rajamisele tutvustati täna esimesest Linux-põhist telefoni N900 Mozilla browseriga. Väidetavalt on korraga võimalik jooksutada mitut tosinat akent ning kasutajasõbralikkust lisab puutetundlik ekraan ja QWERTY täisklaviatuur.

Kuna Nokia aktsia on investeerimismaailmas hetkel analüüsimajade poolt vihatud staatuses ja suurem osa on oma rätiku downgrade'ide näol juba ringi visanud, siis on igasugused positiivsed sündmused ettevõtte ümber aktsiat kenasti tõstmas. Usun, et pikaajalistel investoritel tasub tänaste tasemete pealt Nokia aktsial silm peal hoida.

-

USA aktsiaturud alustavad päeva eilsete sulgumistasemete ligidalt.

Euroopa turud:

Saksamaa DAX -0.12%

Prantsusmaa CAC 40 +0.24%

Inglismaa FTSE 100 +0.25%

Hispaania IBEX 35 +0.25%

Rootsi OMX 30 +0.36%

Venemaa MICEX +0.12%

Poola WIG +0.96%Aasia turud:

Jaapani Nikkei 225 -1.56%

Hong Kongi Hang Seng -1.04%

Hiina Shanghai A (kodumaine) -0.72%

Hiina Shanghai B (välismaine) +0.13%

Lõuna-Korea Kosdaq -0.65%

Tai Set 50 -0.86%

India Sensex 30 +0.07% -

Hope Is a Bad Reason to Change Gears

By Rev Shark

RealMoney.com Contributor

8/27/2009 8:52 AM EDT

Hope is the only universal liar who never loses his reputation for veracity.

-- Robert G. Ingersoll

Although we have had three days of very sedate action and things look very quiet again this morning, there is no shortage of talk about whether or not the market is ready to top out. It shouldn't be too surprising that so many are focused on the death of this rally -- it has been one of the most difficult and disliked moves I have ever experienced. It's not only the bears who have been frustrated with this market that has gone up in a straight line for months -- bulls who could never position themselves properly or who exited too early are feeling the pain, too.

In retrospect, it shouldn't be at all surprising that a rally of this magnitude and intensity would leave so many confounded after the massive breakdown that we had experienced. If you weren't gun-shy about buying after what happened in the market from last summer to this past March, then you must have been living on another planet.

In addition to fresh memories about a market that destroyed a huge percentage of many portfolios, many investors still have serious doubts about the economic recovery. The experience of many with housing, jobs and the pace of the recovery in general is just not consistent with what they see the market doing. They can't help but doubt the market's optimism when the anecdotal evidence is so different.

The result has been one of the most unloved rallies that we have ever seen, but the fact that the uptrend has been so unloved is what has kept it going for so long with so few pullbacks. Folks don't want to embrace it, but they feel they have no choice and are tired of underperforming. They keep looking for chances to buy and have done so on every minor dip. The result has been a market that just doesn't pull back.

We have now had three days of flat action and we're seeing more and more calls for some sort of market consolidation at a minimum. When this has happened in recent months, the market confounded the bears and put in another leg up.

Are we really at a point where this very hated rally is about to pause? There are a slew of good fundamental arguments and even seasonal factors that favor the bears, but there is one big problem -- the market is still showing few if any signs of falling apart. Yes, we are extended and there is some signs of slowing momentum, but that has been the case numerous times in the last six months, and the bulls came roaring back each time.

I'd like to see some downside myself because I think it would lead to some better trading, but it just isn't happening yet. The biggest danger for market players is letting their hopes guide their investing. Until the character of the market actually changes, we have to stick with it no matter how much we may hope that we might pull back.

It is quiet out there this morning and not much is happening, and that makes it even more dangerous for folks who are hoping too hard for the market trend to be change. Don't let your hopes blind you to what is actually in front of you -- a market that still has not done much of anything wrong.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: JAS +9.2%, LONG +6.7%, CISG +4.5% (light volume), VIP +3.4%, GES +3.0%, FRED +1.6%, TD +1.5% (light volume)... Select financial related names showing strength: AIB +8.8%, AIG +8.8% (continued momentum with Forbes reporting AIG likely to rise sharply when trading resumes Thursday after co's chief said he was looking to its founder, Greenberg, for help in rescuing the co), PMI +3.5%, C +2.8% (Paulson buying Citi shares - NY Post), RY +2.3%, FNM +2.2%, UBS +2.1%, ING +1.7%... Other news: IMMU +83.1% (light volume, UCB and Immunomedics announce positive results for epratuzumab Ph. IIb study in systemic lupus erythematosus), ATSI +10.3% (announces FDA approval for a landmark clinical investigation of the ATS 3f Aortic Bioprosthesis), GERN +6.5% (comments on FDA hold on spinal cord injury trial), CLNE +5.5% (announces its customers and government agency partners awarded $34 million in DOE stimulus grants), WPRT +4.1% (continued momentum from yesterday's late surge higher), NOK +3.6% (still checking), CHU +3.4% (Apple must still complete negotiations with China Unicom, which is expected to carry the iPhone - WSJ), BEAT +3.0% (continued strength from yesterday's 25% jump), BA +2.4% (announces New 787 schedule; first flight of the 787 Dreamliner is expected by the end of 2009 and first delivery is expected to occur in 4Q10), NOC +2.2% (awarded $2.4 bln contract for USS Theodore Roosevelt refueling and complex overhaul and Department of Defense awards co $3.44 bln modified (ceiling increase) contract), BIG +1.4% and UPL +1.2% (Cramer makes positive comments on MadMoney)... Analyst comments: DLTR +2.1% (upgraded to Overweight at Barclays), F +1.2% (Hearing upgraded to Strong Buy at boutique firm), ANR +1.0% (reinstated with Overweight at Barclays).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CONN -10.8% (light volume), APWR -10.6%, SIGM -9.5% (also downgraded to Hold at Collins Stewart), ENER -5.0%, AEO -4.7%, DEO -4.0%, CWTR -2.9%, TOL -1.9%... Select solar related names ticking lower following ENER results: LDK -2.3%, CSIQ -1.4%, FSLR -1.3%, SPWRA -1.0%... Other news: ALKS -10.9% (discloses notification that Ortho-McNeil-Janssen Pharmaceuticals decided not to pursue further development of the four-week long-acting injectable formulation of risperidone; also downgraded to Hold at Jefferies), HGSI -5.2% (continuing to pull back from yesterday's afternoon weakness), CEL -4.4% (trading ex dividend), VG -4.1% (Apple says VG app delayed by technical issues-Barron's Blog; also Bloomberg.com article discusses rally in VG shares and says VG spokesman said solution for technical issue should be simple), ETP -2.2% (discloses it entered into an Equity Distribution Agreement), GNW -1.3% (files mixed securities shelf offering), PHM -1.0% (down in sympathy with TOL)... Analyst comments: MPW -2.4% (downgraded to Underperform at Wells Fargo). -

Tänane päev on üsna oluline kõikide Select Comforti aktsionäride jaoks, kes peavad hääletama, kas anda firma juhtida uuele omanikule või keelduda pakkumisest ning usaldada praegust juhtkonda retsessioonis kannatada saanud madratsitootja elluäratamises. Mais sai nimelt SCSS ühelt oma suurimalt aktsionärilt, Sterling Partnersilt, pakkumise omandada ettevõttes 35 miljoni dollari eest enamusosalus. Praegu 2.77 dollarit maksev aktsia kauples kevadel alla dollari ning toona kokkulepitud hinna alusel tuleks praegu müüa 50 miljonit aktsiat hinnaga 0.7 dollarit tükk. Kuna hetkel küündib Select Comforti emiteeritud aktsiate arv 45.6 miljonini, põhjustaks pakkumise aktsepteerimine olemasolevate investorite osaluse põhjalikku lahjenemist. Ühest küljest pakuks uus raha ettevõttele vajalikku likviidsust, teisalt näitasid teise kvartali ootusi ületanud tulemused, et senise kulude kärpimise strateegiaga on astutud vajalikke samme kasumlikkuse taastamiseks, mis muutis juhtkonna positiivselt meelestatuks ka järgmiste kvartalite suhtes.

-

Optimismist ja pessimismist rääkides...

Optimist ja pessimist langevad kuristikku. Pessimist: "Ma kukun!!" Optimist: "Ma lendan!!"

Realisti ülesanne on lihtsalt seda kuristikku näha/oodata ja langevari kaasas kanda. Ehk kui ajad on ärevad ja emotsioonid äärmuslikud, tasuks riskide hajutamiseks fully-invested portfellid ümber vaadata.

-

Natural gas inventory showed a build of 54 bcf, analysts were expecting a build of 52 bcf, ranging from a build of 45 bcf to a build of 59 bcf.

-

Finantssektor on jätkuvalt erakordselt kuum ning spekulatiivsed aktsiad on justkui raketiga kuu poole lennanud. AIG, FNM, FRE, C on kõik juba lõunaks läbi kaubelnud enam kui keskmise päevase käibe. AIG on müstilised +30%, C +10%.

-

C tõusu taga on Äripäeva uudis: http://www.ap3.ee/Default2.aspx?ArticleID=3d3ccfe1-fad0-4686-9ec2-b2a16eb8731b

:) -

Euro on viimase poole tunni jooksul dollari vastu kiiresti tugevnenud ning päevaga kerkinud 0.7% tasemel €1=$1.435.

-

Dell beats by $0.04, beats on revs and gross margins. Reports Q2 (Jul) earnings of $0.28 per share, excluding pretax expenses of $87 mln, or four cents per share, for organizational effectiveness actions, $0.04 better than the First Call consensus of $0.23; revenues rose 3.4% year/year to $12.76 bln vs the $12.59 bln consensus. DELL reports Q2 gross margins of 18.7% vs. 17.7% consensus, 17.6% last quarter. Co attributes higher gross margins to strong improvement in cost of goods sold, disciplined pricing, a sequential increase in sales from enterprise products, and a $69 million buyout of a revenue-sharing agreement by a vendor offset previously highlighted pressure from component costs, competitive pricing and revenue mix in client systems... In the third quarter, the company expects seasonal demand improvements from the Consumer and U.S. federal government businesses, but the quarter is also generally a period of slower demand from large commercial customers in the U.S. and Europe. Dell believes a refresh cycle in commercial accounts is more likely to occur in 2010, with IT spending improving first in the U.S. The company continues to see pressure in the form of component costs and areas of aggressive pricing in the near term, and continues to take actions to offset these items. The company will continue to focus on implementing cost improvements and strategic investments to improve operations for the long term.

Tulemuste peale on DELL päeva algusega võrreldes hüpanud 6% kõrgemale. -

Kui hommikul toetasin sooja sõnaga Nokiat (NOK), siis praegu on seda tegemas Davenport, andes ettevõttele upgrade'i.

-

Marvell prelim $0.18 vs $0.14 First Call consensus; revs $640.6 mln vs $619.83 mln First Call consensus.

-

N900 tundub olevat esimene väga tõsine oht iPhone´ile.

http://conversations.nokia.com/2009/08/27/finding-maemo-the-new-nokia-n900/

http://www.youtube.com/watch?v=SbxyLnwFSvI -

Select Comforti aktsionäridel õnnestus napilt tagasi lükata erkapitalil põhineva firma investeering, millega oleks emiteeritud uusi aktsiaid korraliku diskontoga. SCSS kauples järelturul pea 15% kõrgemal.