Börsipäev 28. august

Kommentaari jätmiseks loo konto või logi sisse

-

Algamas on augustikuu eelviimane börsipäev ning börside jaoks aktiivsem sügisperiood on juba otse ukse ees. Täna enne turgu teatatakse ameeriklase keskmise sissetuleku muutus juulikuu kohta, mille ootuseks on +0.1% (juunis oli -1.3%) ning keskmise kulutuse muutus, mille ootuseks on +0.2% (juunis oli +0.4%).

Kuigi lääne-maailma turud jätkavad positiivse infovoo toel oma 11 kuu tippude juures kauplemist, tooksin ohumärgina välja taaskord Hiina kodumaise aktsiaturu, mis ei ole pärast augustikuu alguses alanud korrektsiooni taastunud ning on tippudest langenud ca 18%. Hetkel on Shanghai A indeks täna -2.7%. -

Tõstame Tallinna Kaubamaja soovituse Neutraalse pealt Osta peale. Lühidalt Baltic Morning Newsis siin. Pikema kommentaari avaldame päeva peale.

-

Nikkei ends up 0,5%. Shanghai on Shanghai.

-

ei maksa nüüd liigselt Hiinale keskenduda - näiteks Lõuna-Korea ja India indeksid on praktiliselt tippude juures ja MSCI Asia Ex Japan või mõni muu sarnase indeksi korrektsioon ka pole kuigi järsk

-

Nikkei tõusu taga kindlasti ka pühapäeval toimuvad valimised, kus rahvas loodab võimuvahetusega “muutust”. Ise arvan, et majanduse jaoks võimuvahetus pöördepunkti rolli siiski ei mängi (aga ei saa alahinnata, mida rahvas tajub). Kirjutasin Jaapanist pikemalt siin.

Reedel avaldatud data kinnitas Jaapani rasket olukorda – juuli töötusemäär tõusis 5.7%’le (kõrgeim tase alates 1960. aastast, kui seda mõõtma hakati). Positiivne on ekspordimahu kasv (juulis +2.3% MoM), kuid see püsib võrreldes aasta tagusega ikka väga madalal (-27% YoY) & eksporti väärtus jätkab langust kalli jeeni tõttu (-1.3%MoM & -36.5% YoY).

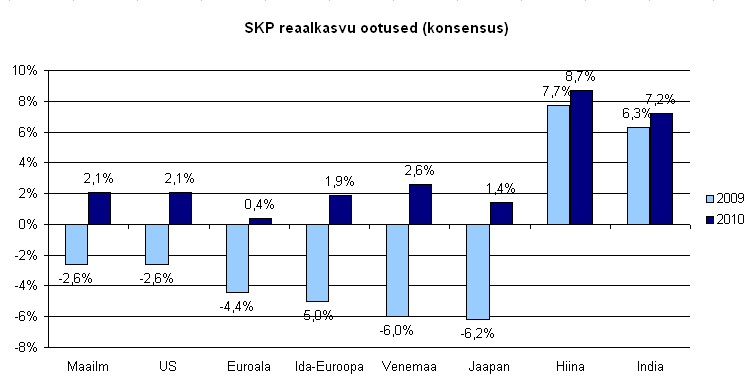

Kui vaadata ka konsensuse ootusi suuremate riikide majanduskasvu osas, siis sellel aastal juhib seda nimekirja altpoolt samuti Jaapan:

-

noh, hiina kommunistlik partei ei pidavat ka laskma shanghail kukkuda enne revolutsiooni aastapäeva 1. oktoobrit :)

-

ja miks siis LHV pensionifondides on jaapani osakaal aktsiatest koguni pea 15%? Sõnad ja teod ei lange hästi kokku?

-

jaapanlased paigutavad raha jätkuvalt suka säärde ja on rahul (nemad kutsuvad oma sukasid geishadeks vististi).

-

tiny, see isklik arvamus, mis toob välja selle, et poliitilne võimuvahetus ei sünnita uut Jaapani & hetkel ei tundu see olevat põhjus pikaajaliselt aktsiaid soetamiseks (poliitikute lubatud "muutust" oleme ka ise näinud). Aga nagu tänane Nikkei tõus kehva makro peale näitab, siis võib DPJ'i võit esmaspäev veel ostjaid turule meelitada.

-

Ymeramees, Jaapani kõrge säästmismäär on õnneks vähenenud, kuid jätkuvalt on ettevõtted raskustes selle investeerimisega:

A recent report on Asian imbalances by Morgan Stanley shows that throughout the boom-and-bust periods since the early 1980s, investment has consistently fallen short of savings (see chart 2). Households, which used to be Japan’s greatest hoarders, put less aside in the years before the financial crisis as a combination of low wage-growth and an ageing population took its toll: the household-saving rate fell from above 10% in the 1990s to about 2.2% in 2007. But the country continued to spend less than it earned because exporters squirrelled a chunk of their profits away. (The Economist)

-

Üks intervjuu Lynchiga Schroderist , kes soovitab investoritel täna rohkem tähelepanu pöörata suure turukapitalisatsiooniga kvaliteetaktsiatele, mis on senise ralli maha maganud. Link siin.

Lynch kiidab ka ühte minu viimase aja silmatera Nokia (NOK), öeldes, et aktsia on üleliia alla müüdud.

-

"ostame valimatult kõike päev" baltis ?

-

Sama juhtus 2006/2007 vahetusel:)

-

July PCE Core M/M +0.1% vs +0.1% consensus, prior +0.2%

July Personal Income +0.0% vs +0.1% consensus; prior revised to -1.1% vs -1.3% consensus.

July Personal Spending +0.2% vs +0.2% consensus; prior revised to +0.6% vs +0.4% consensus. -

Intel (INTC) raises Q3 revenue guidance to $9 bln, plus or minus $200 mln, above $8.55 bln consensus; raises gross margin expectations (19.47). Co raises guidance for Q3, sees revenue of $9 bln, plus or minus $200 mln, vs. $8.55 bln consensus, compared to prior guidance of $8.5 bln, plus or minus $400 mln. The gross margin percentage for the third quarter is expected to be in the upper half of the previous range of 53%, plus or minus two percentage points. All other expectations are unchanged.

Turud on Inteli prognooside tõstmise peale eelturul üha kõrgemale liikunud.

-

Pärast Inteli (INTC)-poolset prognooside tõstmist, on turgudel ralli tuurid jälle üles saanud. Mäletavasti nimetas INTC PC- turul põhja tehtuks juba Q1 järel ning kinnitas seda Q2 järel ning praegune prognooside tõstmine on nõudluse tugevust üksnes kinnitamas.

Euroopa turud:

Saksamaa DAX +1.76%

Prantsusmaa CAC 40 +1.44%

Inglismaa FTSE 100 +1.08%

Hispaania IBEX 35 +0.88%

Rootsi OMX 30 +2.15%

Venemaa MICEX +2.81%

Poola WIG +2.33%Aasia turud:

Jaapani Nikkei 225 +0.57%

Hong Kongi Hang Seng -0.71%

Hiina Shanghai A (kodumaine) -2.91%

Hiina Shanghai B (välismaine) -1.84%

Lõuna-Korea Kosdaq +1.28%

Tai Set 50 +0.84%

India Sensex 30 +0.90% -

More of the Same

By Rev Shark

RealMoney.com Contributor

8/28/2009 8:34 AM EDT

A trend is a trend is a trend.

But the question is, will it bend?

Will it alter its course

Through some unforeseen force

And come to a premature end?

-- Alec Cairncross

It's easy for market players to overthink the market action. That is especially the case now as we experience the most chaotic economic situations any of us have ever seen. It is almost impossible to not be influenced by the fundamental news and our personal experiences with a struggling economy.

This market continues to reward those who don't think too much but rather simply respect the power of the uptrend. Contemplating whether the market action has been justified has not been a moneymaker. The fact that so many people are struggling to embrace the market is a big reason it keeps running. There is a constant hunt to put money to work even among the skeptics, and that keeps producing action like yesterday, when market action looked weak at first but ended up gaining steam all day.

One reason we are seeing so many bearish comments about the market lately is that this action is almost monotonous in its consistency. Active market players tend to thrive on volatility and change, and this market is primarily a dream for the buy-and-holders who do nothing but sit and watch as things trend higher and higher.

My advice remains the same: Respect the price action and don't try to be overly anticipatory in looking for the market to collapse. There is little in the technical action that is negative other than the fact that we have trended much higher than most folks thought possible. Sure, there are plenty of fundamental arguments against this market -- there are always fundamental arguments against the market -- but they don't matter until they do. That is why we have to stay focused on the price action and not work too hard to convince ourselves that the fundamental arguments are suddenly going to cause everyone to head for the exits.

I'd love to offer some new and brilliant insight into the market, but the most scintillating observation I can make is that little has changed. The trend is still up, the bulls are in control and there are plenty of bearish arguments that just don't matter yet. Govern yourself accordingly.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: OVTI +15.4%, ARUN +14.3%, DLLR +11.9%, STM +7.7%, JCG +7.4% (also upgraded to Buy from Hold at Citigroup and upgraded to Hold at Needham), MRVL +7.2%, TIF +7.0%, DELL +4.2%, BNS +3.7%, CHU +3.5% (also China Unicom strikes iPhone deal - WSJ), , FRO +1.6%... Select financial names showing strength: CIT +14.1%, PMI +7.3%, MBI +7.1%, IRE +6.3%, ABK +6.1%, AIG +4.4% (Benmosche in no hurry to sell off AIG's assets - WSJ), C +4.4%, HBAN +4.1%, HIG +3.1%, FRE +3.1%, BPOP +3.1%, RF +2.9%, LYG +2.9%, GNW +2.2%, FNM +2.1%, BCS +2.1%, AIB +2.0%, FITB +1.6%, STI +1.5%, KEY +1.2%, MS +1.0%, BAC +1.0%... Select solar related names trading higher: JASO +4.2%, CSUN +3.7%, YGE +1.9%, SOL +1.4%... Select shippers ticking higher boosted by FRO results: DAC +3.4%, GNK +2.9%, DRYS +2.9%, EXM +2.6%... Select metals/mining names showing strength: AUY +2.1%, SLV +2.1%, BHP +1.7%, GOLD +1.7%, RTP +1.6%, SLW +1.3%, ABX +1.2% (initiated with Hold and $40 tgt at Jefferies), NEM +1.1% (initiated with Buy at Jefferies)... Select biotech/flu vaccine related names are ticking higher following SVA news: SVA +21.4% (wins Beijing Public Health Bureau's bid to supply seasonal Flu Vaccine Anflu to Beijing citizens), NVAX +2.7%, BCRX +1.8%, CRXL +1.3%... Other news: EURX +33.9% (announced FDA approval of its New Drug Application for ZENPEP), SCSS +21.2% (still checking), RTK +8.9% (continued momentum from yesterday's late day spike), ZQK +5.6% (still checking), NOK +4.2% (Nokia to roll out phone based on Linux software - WSJ), OMEX +3.9% (completed the first phase of Symphony project; Proceeds of any recoveries will be split with anticipated 78% of gross income retained by Odyssey), VG +2.5% (continued strength from this week's 300%+surge higher), BJ +1.1% (Cramer makes positive comments on MadMoney), HPQ +1.0% (up in sympathy with DELL)... Analyst comments: PSUN +7.7% (upgraded to Buy at Pali Research), WSM +3.2% (upgraded to Buy from Neutral at Goldman- Reuters), SNY +2.0% (upgraded to Overweight at JPMorgan), RY +1.7% (light volume; upgraded to Outperform from Neutral at Macquarie), HGSI +1.5% (UBC/IMMU will move to Phase III with 600 mg Epratuzumab; HGSI's Benlysta will hit the mkt ~ 2 yrs before Epratuzumab - Leerink Swann), BP +0.9% (initiated with an Outperform at Raymond James).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: NCTY -9.2%, BEBE -6.3% (light volume), MCRS -3.4% (also downgraded to Hold at Brean Murray), IMMU -2.8%, NOVL -2.3%... Other news: ALTH -16.3% (still checking), SNP -3.8% (traded lower overseas), GSI -3.5% (filed for a $60 mln mixed shelf offering), BWA -1.3% (Cramer makes negative comments on MadMoney)... Analyst comments: MOS -1.7% (downgraded to Neutral at UBS), BMY -1.2% (downgraded to Equal Weight from Overweight at Morgan Stanley), POT -1.0% (downgraded to Neutral at UBS), HTS -1.0% (downgraded to Neutral from Buy at BofA/Merrill). -

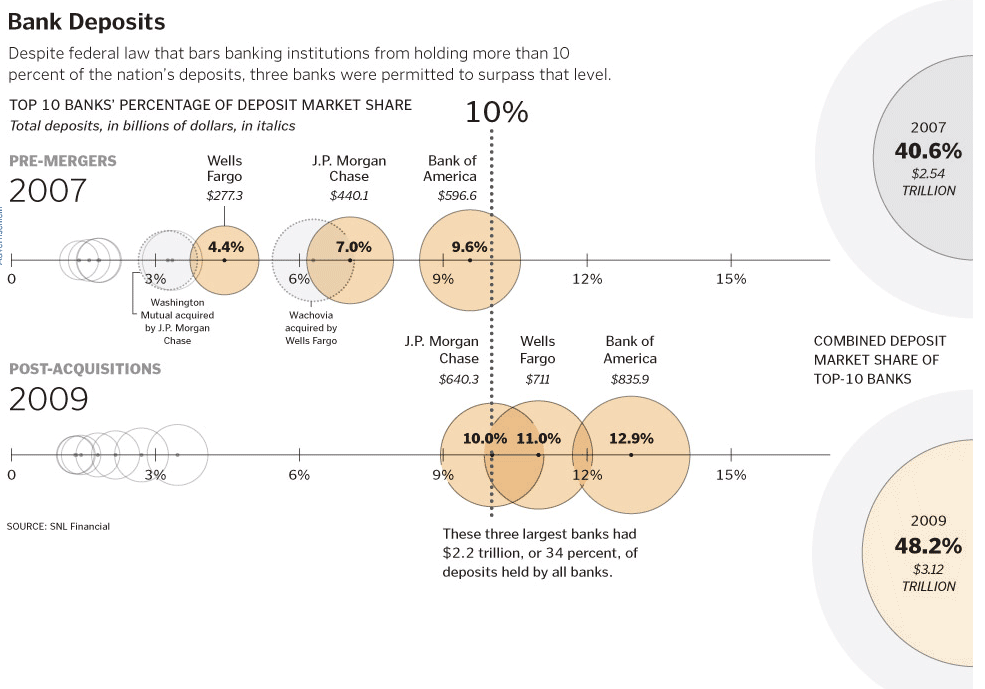

WaPo's on hea graafik, kus on näha, kes turuosa USA pangandussektoris saavad:

ehk

J.P. Morgan Chase, an amalgam of some of Wall Street's most storied institutions, now holds more than $1 of every $10 on deposit in this country. So does Bank of America scarred by its acquisition of Merrill Lynch and partly government-owned as a result of the crisis, as does Wells Fargo, the biggest West Coast bank. Those three banks, plus government-rescued and -owned Citigroup, now issue one of every two mortgages and about two of every three credit cards, federal data show (loe pikemalt siit).

-

Mis kummaline vaikus ? Avamisest saati ei ühtki avalikku arvamist!

-

heinos, tegu siiski reedega ja kuu eelviimase päevaga. Käive väga madal ja turgudel pigem äraootav seisukoht, seega polegi väga midagi kommenteerida... Aga jätkuvalt teeb mulle muret headele uudistele (Inteli poolt ootuste tõstmine) nõrgalt reageerimine.

-

Attächhh! Hääd ööd!

-

Ilusat suve viimast nädalavahetust kõigile minu poolt!

-

Njah

Mis siis, et AIG lendab üles alla ja seagripi mängud üsna huvitavad, siis oli jah päris rahulik reede. :)