Börsipäev 11. september

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia aktsiaturud olid täna valdavalt rohelised - põhjuseks eilne ralli USA aktsiaturgudel ning Hiina tööstustoodangu 12.3%line kasv augustikuus võrreldes aastataguse perioodiga. Üksnes Jaapan kukkus ca 1% jagu, pärast seda, kui teatas, et 2. kvartali SKP kasvas annualiseeritud tempos võrreldes 1. kvartaliga 2.3%, kuigi varem oli välja käidud ka 3.7%line number.

Makroraportite poolest mõjutab USA turgu kell 16.55 avalikustatav Michigani Sentimendi indeks (ootus 67.5 punkti) ja ja kell 21.00 Treasury Eelarve (ootus -$139.5 miljardit).

Muuhulgas möödub täna täpselt 8 aastat 11. septembri terrorirünnakutest USAs. -

Optimism kasvab ja pessimism langeb...

Mehhiko 10 suuremas ettevõtte aktsiad on lühikeste positsioonide hulk ehk langusele panustavate positsioonide arv terve selle aasta madalaimal tasemel. Kui karud on kapituleerunud, muutub edasine tõus problemaatiliseks. Link Bloombergi artiklile siin.

-

Olukord Tallinna börsil hakkab rõõmsamaks minema, võrreldes esimese kauplemistunniga:)

-

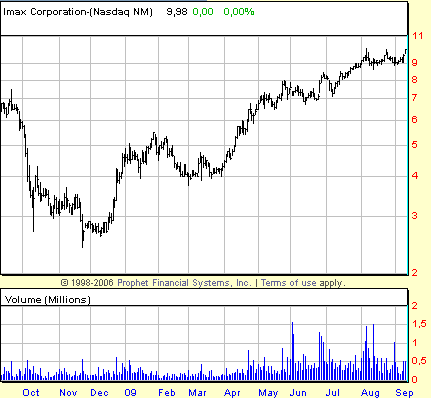

Kui kolmapäeval leidis IMAX ostuhuvi seetõttu, et Morgan Josephi analüütik ettevõtet CNBC peal promos, siis eilse aktsiaralli taga oli teade lepingu sõlmimisest Hiina firmaga, mis näeb ette 4 Imaxi tehnoloogiapõhise kino avamist Chongqing, Tianjin, Shenyang ning ühes veel seni kindlaks määramata linnas 2011. aasta lõpuks-2012. aasta alguseks. IMAX on agressiivselt laienemas ning selle kasvu eest on investorid nõus ka raha välja käima.

-

Imaxi üks bossidest on andnud intervjuu BusinessWeeki reporterile, milles keskendutakse ettevõtte väljavaadetele Aasias. Link videole

-

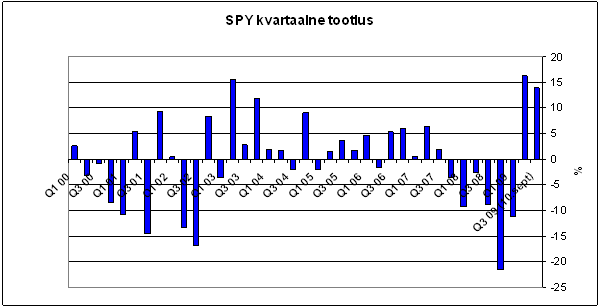

S&P500 indeksi liikumist kajastava SPY tootlused:

Q1 07 +0.7%

Q2 07 +6.4%

Q3 07 +1.9%

Q4 07 -3.7%

Q1 08 -9.3%

Q2 08 -2.5%

Q3 08 -8.8%

Q4 08 -21.6%

Q1 09 -11.3%

Q2 09 +16.3%

Q3 09 +14.0% (tänaseni)

Küsimus - kui paljud usuvad, et 2. kvartali jooksul nähtud 16.3%line tõus lüüakse 3. kvartalis (senimaani +14%) üle, kes arvab, et jäädakse alla? -

American Axle upgraded to Overweight at Barclays Capital; tgt raised to $13 (6.32 )

Barclays Capital upgrades AXL to Overweight from Equal Weight and raises their tgt to $13 from $8 as the recent GM agreement and a strong likelihood of a bank deal should remove liquidity concerns, enabling investors to focus on AXL's earnings in a recovery, which they view very favorably. Firm says they are bullish about the prod. outlook for AXL's top platform, the GMT900, and believe the Street materially underestimates demand for full-size trucks in the context of a recovery in SAAR, likely marketing programs focused on large pickups, and a 1Q10 bottoming in construction employment.

Analüütikud valamas õli tulle ja aktsia kauplemas eelturul +16% tõusus $7.35 tasemel. Eks aeg näitab, kas positiivsus selle aktsia suhtes on õigustatud või mitte.

-

FedEx tõstab prognoose:

FedEx sees Q2 EPS of $0.65-0.95 vs $0.70 First Call consensus

FedEx sees Q1 EPS of $0.58 vs $0.44 First Call consensus -

Et viimase aja tõuse ajaloolisse konteksti panna, siis olen graafikul välja toonud SPY kvartaalsed tootlused (dividendide väljamaksetega kohandatud sulgemishinnad):

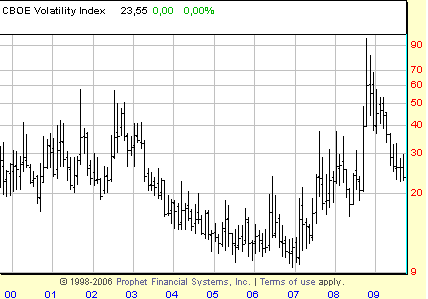

Huvitav pilt avaneb siis, kui siia kõrvale vaadata ka volatiilsust mõõtvat $VIX indeksit, mis sulgus eile 23.5 punkti peal. Vaadates praegusi ja 7-9 aasta taguseid kvartaalseid liikumisi, tekib vägisi tunne, et $VIX on volatiilsust täna alahindamas.

-

Two rockets fired from Lebanon hit inside Israel - Reuters

-

USA aktsiaturud alustavad päeva kerges plussis.

Euroopa turud:

Saksamaa DAX +0.69%

Prantsusmaa CAC 40 +0.91%

Inglismaa FTSE 100 +0.87%

Hispaania IBEX 35 +1.20%

Rootsi OMX 30 +0.28%

Venemaa MICEX +1.81%

Poola WIG -0.19%Aasia turud:

Jaapani Nikkei 225 -0.66%

Hong Kongi Hang Seng +0.44%

Hiina Shanghai A (kodumaine) +2.22%

Hiina Shanghai B (välismaine) +1.42%

Lõuna-Korea Kosdaq +0.62%

Tai Set 50 +0.47%

India Sensex 30 +0.29% -

The Lessons of Lehman

By Rev Shark

RealMoney.com Contributor

9/11/2009 8:21 AM EDT

What you need to know about the past is that no matter what has happened, it has all worked together to bring you to this very moment. And this is the moment you can choose to make everything new. Right now.

-- Unknown

Just about a year ago, Lehman Brothers collapsed and helped to accelerate the worst financial crisis since the Great Depression. The market is now acting as if that event is long forgotten and maybe even unimportant, but that makes it a particularly good time to reflect on the lessons learned.

The lessons of Lehman aren't new or unique, but it is very easy to forget some of these key concepts. The market is constantly pushing and prodding us to act in ways that put us at risk for substantial losses, and our natural inclinations have to be overcome repeatedly if we want to be successful investors or traders.

The events of the past year or so illustrate three main concepts quite well:

1. You can't predict market movement with any great precision, but if you focus on the price action you can protect yourself. You didn't need to be a great economist or have some special insight into subprime lending or complex debt instruments to protect yourself from the market plunge last year. You simply had to watch the price action and respect the prevailing trend. The market had topped out many months before the Lehman bankruptcy, and it was already in a primary downtrend when it occurred. The events need not have been specifically foreseen. If you were watching the price action in the overall market and reacted to it, you would have kept your capital safer.

Since March, we have seen this principle of deferring to the price action work the other way. The trend up has been steady, and if you've focused on it and ignored all the predictions and fundamental discussions, you have done well.

2. Trends last longer than you think. As the market downtrended following the events of Lehman, we heard constant bottom calls. Again and again pundits predicted that the worst was over and that a major turn was coming. If you jumped in when the first of these bottom calls were made, you still aren't back to even.

Trends are persistent things, and trying to predict when they might end is extremely difficult. Right now we are seeing the flip side of this to the upside. This trend upward that began in March has gone much further than almost anyone thought possible. No one thought the market would bounce straight up so strongly for so long. We have had numerous top calls in recent months, but they are unconfirmed by the price action and have been very costly if you acted too early.

3. Buy and hold doesn't work. Making up losses is one of the most unproductive things you can do in investing. If you simply buy and hold stocks, the likelihood is that you are going to suffer some tremendous losses that will take a very long time to make up. Folks who simply sat through the collapse still need huge gains to just get back to even. The argument for that behavior is that you can't predict the market, and you will miss out if you try. The market never stops you from buying back shares you have sold. Selling is just a form of insurance that can be undone at any time. If you make a bad sale, you can reverse it when the price action is better.

Don't just sit there and hold on to stocks that are acting poorly. Take action. Even if your moves prove to be wrong, you will end up better off in the long run if you learn to react to events rather than be frozen by them.

The current market environment reinforces these principles. We are seeing a persistent trend that has lasted longer than many have thought possible. The inclination to call a turning point is great and has caused many to ignore the price action. We also have the return of the folks who believe that the market will never go down again and that they should just buy and hold no matter what.

Unfortunately, stating these principles is a lot easier than applying them. It is always going to be a struggle to navigate the market, but that is why it is so potentially lucrative. The most important thing of all is to keep plugging away.

Once again we have a mild open indicated. That has been the case the last few days before the buyers heated up and produced some good gains. We are up five days in a row and are extended, but that has seldom been an obstacle to this market recently. The correction will eventually come, but don't be too fast to anticipate it.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CMRO +34.0% (light volume), QDEL +15.3% (anticipates "record quarterly results" driven by strong demand for Flu tests), ACET +6.4% (light volume), STLD +1.9%... Select financials showing strength: AIB +5.8%, AXA +2.2% (upgraded to Buy at BofA/Merrill), IRE +2.2%, CS +1.8%, SNN +1.7%, BX +1.8%, AZ +1.6%, GS +1.0% (tgt raised to $215 from $175 at Citigroup)... Select auto part related names trading higher boosted by AXL upgrade: AXL +16.3% (upgraded to Overweight from Equal Weight at Barclays), DAN +7.8%, ARM +3.5%... Select metals/mining names showing strength: MT +4.0%, HL +3.7%, EGO +3.3%, SLW +2.9%, GSS +2.9%, AUY +2.2%, IAG +2.2%, KGC +1.9%, RTP +1.9%, BHP +1.9%, BBL +1.9%, ABX +1.2%, GG +1.1%... Select iron/steel related names trading higher following STLD guidance: AKS +1.7%, NUE +1.6%... Other news: DCSO +47.9% (and FDA to Meet On September 29, 2009 to Discuss Potential Path for SURFAXIN Approval), CPE +14.5% (signed a purchase and sale agreement with Ambrose Energy), DCTH +7.5% (announces Data Safety Monitoring Board Unanimously recommends continuation of Delcath's phase III clinical trial), RYAAY +6.7% (still checking), BPI +6.4% (files to withdraw registration statement for public offering of common stock), NXG +5.6% (light volume; announces the discovery of a new zone of mineralization at its Young-Davidson property), SBAC +3.2% (Cramer makes positive comments on MadMoney), MPEL +3.7% and MGM +3.2% (up in sympathy with LVS), CLF +2.3% (increases production and sales volume expectations for North American business unit), AZN +1.9% and SNY +1.0% (still checking for anything specific), ECA +1.3% (proceeds with plan to split into two energy companies)... Analyst comments: RRI +8.6% (upgraded to Overweight from Equal Weight at Barclays), PGR +5.9% (raised to Buy from Sell by Goldman- DJ), GRMN +4.8% (upgraded to Buy at BofA/Merrill), TXT +4.1% (upgraded to Overweight from Equal Weight at Barclays), ELX +4.0% (upgraded to Buy at Argus), CR +3.4% (upgraded to Equal Weight from Underweight at Barclays), LVS +3.1% ( upgraded to Buy from Neutral at Sterne Agee), MTL +3.1% (reinstated with a Buy at Goldman- Reuters), SLB +2.0% (raised to Buy from Neutral at Goldman- DJ), BRCD +1.9% (initiated with an Outperform at Oppenheimer), MRVL +1.8% (initiated with Buy at Roth).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: BRC -5.9%, HWD -5.1%, NSM -1.6%... Other news: ARCC -6.9% (trading ex dividend), HZO -6.2% (announces it has commenced a public offering of 2.6 mln shares of common stock and agreement to amend credit facility), UBSH -4.1% (prices 4.725 mln common shares at $13.25/share), TBSI -3.4% (files 10 mln Class A Common Shares offering by the selling shareholders and $500 mln mixed securities shelf offering), ZINC -3.0% (increases the number of shares of its common stock to be sold to 7 mln from 6 mln shares), PVG -2.4% (prices 8,695,655 common units at $12.30 per unit), CREE -1.3% (priced an 11 mln share common stock offering at $35.50/share)... Analyst comments: CBS -3.6% (cut to Underperform from Neutral at Cowen), RNWK -3.0% (downgraded to Underweight at JPMorgan), AIG -2.8% (downgraded to Underperform at Wells Fargo), NWSA -2.3% (cut to Underperform from Neutral at Cowen), ITT -1.9% (downgraded to Equal Weight from Overweight at Barclays), CLX -1.5% (cut to Neutral from Buy by Goldman- DJ), BBY -1.3% (downgraded to Perform at Oppenheimer), NOK -1.1% (downgraded to Neutral at Baird), TYC -1.1% (downgraded to Equal Weight from Overweight at Barclays). -

Maagaas on jätkamas eilset 15%-list rallit täna +3%-lise tõusuga. Tooraine sai eile suuremat tähelepanu, kui EIA raport paljastas oodatust väiksema kasvu maagaasi varudes.

Kui vaadata alumist hooajalisuse graagikut, annab see maagaasi pullidel lisapõhjust uskuda, et hinnavahe kahanemine nafta suhtes võiks järgnevatel kuudel jätkuda.

-

Olen oma silmarõõmust Chesapeake Energy'st (CHK) siin foorumites korduvalt kirjutanud. Viimane kord, kui sellesse ettevõttesse investeerimise atraktiivsust välja tõin, oli 9. juulil, mil aktsia maksis $17.7. Tollal kirjutasin niimoodi:

"Seppälä poodides võib mõnes kohas näha hinnasiltide juures sellist lauset: "Kui sa nüüd ka ei osta, kas sa kunagi üldse midagi ostetud saad?".

Ma ei tea miks, aga kui ma seda lauset loen, lähevad mu mõtted CHK juurde. Buy low, sell high." (link siin)

Täna on aktsia läbi murdnud oma juuni ja augusti alguses tehtud tippude juurest $25 peal ning on kauplemas üle 5% plussis $26.5 peal - ca 50% enam kui 2 kuud tagasi. Kuigi koos aktsiaturu eufoorilise ralliga on lühemas perspektiivis korrektsioonioht tõusnud ka selles aktsias, on minu usk aktsia pikaajalise investeerimise atraktiivsusesse jätkuvalt tugev.

-

September University of Michigan Sentiment-prelim 70.2 vs 67.5 consensus, August 65.7

-

July Wholesale Inventories -1.4% vs -1.0% consensus, prior revised to -2.1% from -1.7%

-

Weekly Insider Trading Summary:

Notable Purchases -- TESO, LRP, PCU, ADPT, OFG, SNS, SBUX

Notable Sales -- AAWW, PSA, JCG, SLXP, JOSB, MD, GPS, STLD

Over the past week we've seen notable insider buying in the following stocks:

Tesco (TESO) 10% owner LRP V Luxembourg Holdings bought 722,919 shares at $7.52-7.60 on 9/3... Southern Copper (PCU) CEO bought 112,000 shares at $28.39-29.04 on 8/25-8/26... Adaptec (ADPT) 10% owner Steel Partners bought 977,100 shares at $3.03-3.04 on 9/8... Oriential Financial Group (OFG) Director bought 25,000 shares at $13.10 on 8/27... Stake n Shake (SNS) 10% owner Lion Fund bought 25,000 shares at $11.51 on 9/8... Starbucks (SBUX) Director bought 12,600 shares at $19.08-19.10 on 9/8... Chico's (CHS) Director bought 10,000 shares at $12.61 on 9/8...

We've seen notable insider selling in the following stocks:

Atlas Air Worldwide (AAWW) 10% owner Harbinger Capital Partners sold 1,909,810 shares at $24.55-26.50 on 9/8-9/10... Public Storage (PSA) Chairman sold 603,800 shares at $70.00-71.25 on 9/8-9/10... J. Crew (JCG) CEO and Director sold 510,000 shares at $32.84-33.05 on 9/4... Salix Pharmaceuticals (SLXP) 10% owner Deerfield Capital sold 1,025,953 shares at $12.96-13.32 on 9/8-9/10... JoS. A Bank (JOSB) Director sold 262,500 shares at $45.25-47.32 on 9/8-9/10... Midland Exploration (MD) Director sold 122,500 shares at $51.02-51.70 on 9/8-9/10... Gap (GPS) Director (pursuant to a Rule 10b5-1 trading plan) sold 277,013 shares at $21.27-21.75 on 9/8... Steel Dynamics (STLD) Director sold 300,000 shares at $17.03-17.33 on 9/9... Fastenal (FAST) Director sold 90,000 shares at $37.16 on 9/8... EMC (EMC) Director sold 190,000 shares at $16.24 on 9/8... Collective Brands (PSS) CEO and SVP sold 103,000 shares at $15.88-17.25 on 9/4-9/9... Saks (SKS) CEO sold 100,000 shares at $5.99 on 9/4... All sales exclude option sell offs.

-

Üsna tõepärane nägemus, muidugi juhul kui siit turg uutesse tippudesse ei spurdi. Lõhnab küll kerge kasumivõtu järgi, kuid ei tasu optimismi alahinnata:

The S&P 500 has rallied the previous five sessions and extended to a new 2009 recovery high in early trade today. While gains during this latest push have been broad based we have thus far not seen the key Finance sector (XLF) confirm the new highs. It is too early to suggest that we will not get the confirmation as the XLF was also up the last five days but it is something to monitor because as the daily chart highlights, non-confirmations in January and June did at least lead to a period of consolidation for the market.

Tehnoloogia samuti täna raskemalt käitumas, eriti semid.

Nafta kukkunud samuti kivina ja okt futuurid kauplemas juba alla $70 barreli eest. -

Marc Faber on Bloombergi pooletunnises podcastis käsitlemas põhjalikult keskpankade ja valitsuste lähenemist praegusele kriisile ning leiab, et stimullerimised pole tegelikult lahendanud midagi ning 5-10 aasta pärast seisame silmitsi veelgi suurema kriisiga. Intervjuus puudutab ta veel dollarit, inflatsiooni, aktsiaturgude rallit ning mitmeid muid teemasid.

http://media.bloomberg.com/bb/avfile/Economics/On_Economy/v_HktXiW4leI.mp3