Börsipäev 17. september

Kommentaari jätmiseks loo konto või logi sisse

-

USA jaoks sügaval öisel ajal toimuvad sealsel eelturul väga veidrad liikumised. Kiiret ülespoole spike'i võis näha nii ES'is kui NQ's:

-

Kuigi Jaapani keskpanga sõnul pole saareriigi majandus enam halvenemas ning täheldada võib märke uuesti tärkavast elujõust, valmistab küsimus viimase tugevuse kohta veel palju muret. Ühest küljest on tootmis- ja teenuste sektor näidanud viimastel kuudel nõudluse kasvu, kuid teiselt poolt hoiab sellel kaant peal rekordiline töötus, langevad palgad ning -2.2%-line deflatioon, mis ettevõtete kasumeid sööb. Sestap arvatakse, et intressimäärade tõstmine jääb veel väga kaugeks teemaks, kuid valjemalt võidakse hakata varsti rääkima detsembris vastu võetud lisameetmete lõpetamise võimalikkusest, mille eesmärgiks on kapitali kättesaadavuse suurendamine korporatiivsektori jaoks.

Tõenäoliselt jätab intressimära samaks ka Šveitsi keskpank oma tänasel kohtumisel (0.25%) ega kavatse majanduskeskkonna paranemise märkidest hoolimata veel QE meetmetest loobuda. -

Paar mõtet viimase 24 tunni liikumiste kohta erinevates varaklassides. Aasia on varahommikul USA järel samuti uutele tippudele liikunud (Hiina börsidest tegi Hongkong uued selle aasta tipud, kuid Shanghais on veel ruumi augusti alguse tippude juurde jõudmiseks).

Valuutaturul on EUR/USD viimase seitsme päevaga tõusnud uue 2009. a tipu juurde ($1.474) - siit võib näha küll mõningast kasumivõtmist, kuid siiani on trend sama aktsiaturgudega & dip-buyerid peaks kohe platsis olema. Nõrgem dollar on kulla hinna tõstnud $1025 dollari peale & siit rünnatakse ilmselt eelmise aasta märtsi tippu 1030 dollari juures.

Kõige huvitavam on viimaste päevade liikumiste juures aga võrdlemisi stabiilne olukord võlakirjaturul:

USA valitsuse 10. aastase võlakirja tulususe püsimine 3.47% juures näitab, et ilmselt ei ole erinevate varaklasside ralli taga mitte niivõrd suur hirm kasvava inflatsiooni pärast, vaid rohkem kütab rallit jätkuvalt suurenev riskitaluvus (+ üha rohkematel investoritel on valus rallit kõrvalt vaadata). Lühiajaliselt ei saa trendi vastu võidelda, kuid siit tundub iga päevaga suurenevat korraliku kasumivõtmise võimalus.

-

USA turul on täna makrost tähelepanu pälvimas augustikuu alustatud uuselamute, ehituslubade ja läinud nädala esmaste töötuabiraha taotlejate arv (kl 15.30). Pool tundi pärast turgude avamist avaldatakse Philadelphia Fed indeks.

Esmaste töötuabiraha tatlejate arv osutus eelmisel korral oodatust paremaks, vähenedes 26 000 võrra 550 000-ni, kui konsensus prognoosis 10 000 võrra suuremat numbrit. Taotlejate arvu vähenemine on alates juuni lõpust jäänud aga visaks, hoides pea kolm kuud taset 600 000 ja 550 000 vahel. Konsensus leiab, et läinud nädalal võis number taaskord kasvada 5000 võrra 555 000-ni.

-

The Economist on pühendanud üsna hea ja ülevaatliku saidi tiksuvale globaalsele võlale, mis peaks tähelepanu äratama järgmisele äikesepilvele horisondill. Valitsused on üle maailma pumbanud majandustesse raha, seda nii otseste rahasüstide, ülevõtmiste, maksude vähendamiste ning sotsiaalsete programmide läbi. Selleks võetakse võlgu, mis pole kollektiivsel tasemel olnud nõnda kiiretempoline alates Teisest maailmasõjast. Kui IMF andmetel ulatus maailma kümne rikkaima riigi koguvõlg 2007. aastal 78%-ni SKT-st, siis 2014. aastaks prognoositakse võlakoorma kasvamist 114%-ni, mis tähendaks ligikaudu 50 000 dollarilist summat ühe kodaniku kohta.

-

Ka nii arvatakse...

From the National Post

“The US has experienced six recessions since 1972. At least five of these were associated with oil prices. In every case, when oil consumption in the US reached 4% percent of GDP, the U.S. went into recession. Right now, 4% of GDP is US$80 a barrel oil. So my current view is that if the oil price exceeds US$80, then expect the U.S. to fall back into recession,” wrote Steven Kopits, managing director for U.K.-based energy-consulting and -research firm Douglas-Westwood LLC in New York.

Kopits is a poster boy on all the “peak oil” websites….If Kopits is correct, so much for “green shoots”….Here is the roller-coaster cycle he points out: Higher oil prices mean recessions, recessions mean less consumption then lower oil prices which leads to less exploration and supply which leads to higher oil prices and recession again…

The reality suggests that there are only two antidotes to this vicious cycle. Gradual price increases mitigate the negative effect of oil price increases. Recessions follow jumps of 50% within one year. The Saudis and OPEC plus other producers would have to play a role in modulating prices. Or else consuming nations must reduce consumption dramatically through legislation, taxation and rationing…

Kopits on demand: “Consumption will tend to grow faster in developing economies for two reasons. First, by their nature, developing economies should grow faster than mature ones….So faster economic growth means faster growth in demand for oil. Further, oil consumption growth follows an “S”-curve. At low levels of GDP, oil demand growth is quite slow. Once a country has reached middle class income levels, per capita oil consumption stabilizes. However, in the middle, as a country becomes middle class, oil demand growth can be explosive. Take South Korea, for example. South Korean per capita oil consumption peaked in 1996; however, in the previous 12 years, the country’s consumption increased nearly fourfold. China is now firmly on the S-curve. Based on South Korean experience, we would expect Chinese oil demand to stabilize at around 50 mbpd around 2032-2035.”

(China currently 8 million per day, US 20 million, Japan 5 million).

Kopits on price: “If you have a flat—or heaven help us, declining—supply of oil, then the emerging and fast-growing economies will have no choice but to start bidding away the oil from the advanced or slow-growing economies. That is consistent with what we’ve seen in the data starting in about 2006. For China to grow, it will have to take away the oil of Japan, the US and Europe, just as it has in the last three years.” -

Pärast paarikümnepunktilist hingetõmmet septembri alguses on SP500 jätkamas oma võidukat maratoni, kaubeldes nüüdseks 11 kuu tippudel. Kuigi pool septembrist on veel ees, siis investoritele ajalooliselt kõige negatiivsemaid emotsioone pakkuva kuu kurikuulsus on praeguseks osutunud sama vähe paikapidavaks kui "sell in may and go away" strateegia toimimine sellel aastal.

Tavapärasest tugevamaks osutus sügiskuu aktsiaturgudel ka 2007. aastal, kuid -10%-line korrektsioon oli kohe nurga taga ootamas.

-

FedEx prelim $0.58 vs $0.58 First Call consensus; revs $8.0 bln vs $8.24 bln First Call consensus

FedEx reaffirms Q2 $0.65-0.95 vs $0.83 First Call consensus -

FedExi numbreid on vist keskmiselt olulisteks indikaatoriteks peetud?

-

On küll, kuid FedExi uudised on juba aktsiasse sisse hinnatud tänu 11. septembri teatele, milles ettevõte tõstis oma kolmanda kvartali prognoose ning nüüd neid kinnitab. Samuti teatati siis Q1 eeldatav aktsiakasum (0.58), kuid siis oli konsensuse ootuseks 0.44 USD. Seega konsensus on liigutanud oma nägemust järgi.

-

Aug Building Permits 579K vs 583K consensus; prior 564K

Weekly Initial Jobless Claims 545K vs 557K consensus; prior revised to 557K from 550K

Continuing Claims 6230K vs 6100K consensus; prior revised to 6101K from 6088K

Aug Housing Starts 598K vs 598K consensus; prior revised to 589K from 581K

USA futuurid on võrreldes paari-kolme tunni taguse tasemega kaotanud oma 0.3%-lise plussi ning alustamas päeva nulli lähedal. Data pole erilisel määral mõju avaldanud. -

Mis päeva ootame täna homme? Kas zigzagi või rahuliku liini? Kas optsiooni reede mängib ka mingi rolli?

-

Siiani on pärast päeva algust ostjad turule tulnud & vaikselt ülespoole liigutud. Täna ootuspärase makro peale futuurid nulli lähedal. Tänastelt tasemetelt oleks ostutees USA börsidel majanduse kiire taastumine stiimulite toel (tugev jaemüük näitab, et ilmselt oodatust veelgi kiiremini) & koos madalate intressimääradega (eeldusel, et nad jääks ka järgmine aasta madalale) võib see olla hea setup veel mitu kuud ostmiseks. Valitsusest sõltuv nõudluse mudel on aga mulli tekitamine & mida rohkem siit edasi turgu ostetakse, seda suurem võib ühel hetke langus olla (ei tea täpselt millal (see rohkem pikaajalisem & äkki alles kevadel?) & trendiga võitlemist pole mõtet teha)… homne optsioonireede toob turgudele reeglina volatiilsust.

-

Don't Count on a Collapse

By Rev Shark

RealMoney.com Contributor

9/17/2009 7:41 AM EDTAn utterly fearless man is a far more dangerous comrade than a coward."

-- Herman Melville

After moving up for eight of the last nine days, the biggest regret of investors is that they had doubts and/or fears about this market. The action has been so positive that even the slightest hesitancy to fully embrace it has been very costly.

In retrospect, it's always very easy to see how simple this investing stuff could have been. All you had to do was be extremely bullish and stay that way, and you would have done quite well. The reason, however, that such a course of action would have paid off so well is because it was counterintuitive and a very difficult thing to do.

Although we are now hearing plenty of explanations about how this positive action is so obvious and fully justified, several months ago, no one saw this dramatic positive action coming. Even the most positive bulls were not looking for the market to go up in a straight line for so long after the destruction that occurred last year and early this year. You would have had to have been truly fearless and maybe even a bit foolish to jump in this market in anticipation of a nonstop ride straight up to the stars.

That is where we are now, and rather than focus on how far we have come, the question we have to grapple with yet again is how much longer it can continue. No one knows the answer to that. Some think they know, and most have already been proven dramatically wrong as the market rallies right through the points they thought might be a top. Timing this market has been an impossible task, especially if you are looking for a major turn.

The most important thing to keep in mind is not to look for a total and complete market collapse to suddenly occur. Markets with this much momentum will suffer from some bouts of profit-taking, but they don't typically just roll over and go straight back down. That is particularly so in this environment, in which there is a huge amount of underinvested bulls out there who are anxious to buy pullbacks. In fact, we probably have the bulls rooting for a pullback just as much as the bears as they are tired of standing on the sidelines waiting for some easier entry points.

When momentum in a market like this dries up, you can see some pretty sharp drops, which will cause some pain, but it will take much more than one or two big down days to really change the trend of the market.

At the moment, the bulls are acting totally fearless. They have no worries other than not being bullish enough. That will eventually be the emotion that causes the market to top out, but it will be a process that plays out rather than occurs suddenly in the matter of a day or so.

Once again, the early indications are rather mild. The last few days we started that way, dipped slightly and then trended to new highs the rest of the day. The dip buyers run over the brave bears in a matter of minutes. At the moment, there is nothing happening to indicate that a change in trend is at hand. We are technically extended, just like we were a week ago, but the strong momentum has overwhelmed any such concerns.

Gapping downIn reaction to disappointing earnings/guidance: CKR -6.7%, CLC -4.8%, DBRN -3.8%, AGP -3.6%, EK -2.7% (expects to raise up to $700 mln through a series of financing transactions), ORCL -2.6%, FDX -1.4%... Other news: SNV -7.0% (prices 150.0 mln common share offering at $4.00/share), UWBK -7.0% (prices 20.0 mln common share offering at $4.00/share), RIGL -5.7% (announces a 6 mln share common stock offering pursuant to an effective shelf registration statement), AUXL -4.9% (sees "sell the news" reaction after confirms FDA Arthritis Advisory Committee approves XIAFLEX for Dupuytren's contracture), AIB -4.3% anf IRE -2.7% (pulling back from yesterday's 20%+ jump higher; also WSJ reports Ireland's loan plan meets opposition), VVUS -3.2% (announces 9 mln common share offering), DARA -3.0% (signs definitive agreement to raise $1.2155 mln in registered direct offering), SFD -2.1% (prices ~21.7 mln shares at $13.85/share), EBAY -1.3% (Skype founders balk at eBay deal - WSJ)... Analyst comments: MT -2.8% (downgraded to Hold from Buy at Societe Generale), PCX -2.7% (downgraded to Neutral from Buy at UBS), ABB -2.4% (downgraded to Hold at Deutsche), BWA -1.9% (downgraded to Hold at Keybanc), BTU -1.6% (downgraded to Neutral from Buy at UBS), MHS -1.5% (cut to Neutral from Buy by Goldman- DJ).

Gapping upIn reaction to strong earnings/guidance: DDMX +10.1% (light volume), PIR +3.8%, TSRA +2.5%... Select airlines showing strength boosted by AMR financing news: AMR +23.1% (announces $2.9 bln in additional liquidity and new aircraft financing), CAL +5.2%, LCC +4.6%, UAUA +4.5%, DAL +2.6%... Select casino related names trading higher: MGM +4.8% (announces proposed private placement of $350 mln in senior unsecured notes due 2018 and discloses possibility of impairment charges related to CitiCenter; also upgraded to Buy at Argus), LVS +2.6%, WYNN +1.6%... Select shipping names ticking higher in early trade: DRYS +3.7%, FRO +1.5%... Other news: HYTM +88.4% (enters into agreement with Ford Motor Company for Catasys Integrated Substance Dependence Solution), RNN +35.3% (Rexahn Pharmaceuticals and Teva Pharmaceutical agree to close on a license agreement), IVAN +28.1% (review confirms "world-scale status" of Ivanhoe Energy Ecuador's Pungarayacu heavy-oil field in Ecuador), YMI +23.4% (reports nimotuzumab approved for marketing in Mexico), BBI +13.9% (Blockbuster upgraded to 'B-' from 'CCC' at S&P; outlook stable), BSTC +12.1% (light volume; confirms FDA Arthritis Advisory Committee approves XIAFLEX for Dupuytren's contracture), IMGN +8.0% (announces Amgen has licensed rights to use the company's TAP Technology for a solid tumor target), XNPT +6.6% (light volume; announces Positive Ph. 2b results for GSK1838262 reported for neuropathic pain associated with post-herpetic neuralgia), ARKR +6.5% (before the close declared special dividend of $1.00; will resume paying a regular quarterly dividend of $0.25 per share beginning with Q1), QDEL +5.6% (obtains special 510(k) clearance to add 2009 H1N1 Influenza A virus reactivity information to the QuickVue Influenza A+B test package insert), CERS +5.3% (still checking), FMS +4.6% (still checking), PT +4.4% (still checking), NITE +3.7% (Cramer makes positive comments on MadMoney), HBC +1.6% (still checking for anything specific)... Analyst comments: SSW +6.8% (upgraded to Buy at BofA/Merrill), FWLT +4.6% (raised to Buy from Neutral by Goldman- DJ), LAMR +4.3% (initiated with a Buy at Lazard Capital), GNW +3.7% (upgraded to Buy at Deutsche), GIVN +3.2% (upgraded to Outperform at Oppenheimer), OCLR +2.8% (upgraded to Overweight at Thomas Weisel), USB +2.4% (upgraded to Buy at Rochdale), NUE +1.8% (upgraded to Buy at Citigroup), PBI +1.1% (upgraded to Buy at Brean Murray).

-

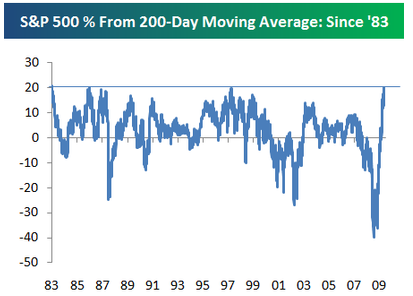

Siin veel üks eilne Bespoke'i graafik, mis näitab, millise hooga turg on üles ostetud:

-

Keegi oskab öelda miks turg nii käitub või põhjuseks ainult volatiilsus enne optsiooni reedet?

-

Miks SPY vonklema on lubatud?

-

Neljapäev on teadupärast vonklemispäev.

V-recovery on ka tegelikult vonklev recovery. Aga sellest valjult ei räägita. -

Väga hea, kuid miks siis viimase 2 nädala jooksul on turg nagu joonlauaga tõmmatult sirgelt üles liikunud? Tõus ilma mingi hälbeta, aga täna selline "anomaalia".

-

Ja nüüd näidatakse veidi hambaid:)

-

Kas arvad Alari et turg võib edasi ka alla minna?

-

Kuulge, mehed, mis te teete? Turg on mingeid null-koma protsente all ja kohe on kisa lahti? ;-) S&P 500 võib 1000det punkti ka testida, ilma, et (tehniliselt) midagigi väga juhtunud oleks...

-

Momentumit ei murra päevaga, kuid tundub et täna võiks ka madalamaid tasemeid näha.

-

To: Karum6mm

Pigem oli antud kommentaar mõeldud just tänase päeva lõikes, mitte pikemas perspektiivis:) -

Kuidagi jube tuttav tunne 2007 aastast, kui turg ei tahtnud ega tahtnud alla tulla. Tugevust näitasid just staarid nagu GOOG ja GS jne. (GOOG tegi veel all time high enne apocalypse.)

Huvitav kas C-l reedese opt. aegumise eelmängud,kui nii siis pakuks, et homme sihitakse 2 strike vahele $4.5 tasemele. -

Vandenõuteoreetikutele oleks GS poolt antud sihi täitmine ja turu ärakukkumine kullasoon:)

-

Alari, mis sa selle Citigroupiga öelda tahtsid? Vabanda minu rumalust.

Võtsin täna just positsiooni sinna, kas tasub olla valmis millekski hullemaks?? :P -

To: Henri XI

Esmaspäeval saab C liikumisest ehk õigema suuna aga tundub, homme hoitakse pigem 2 strike vahel ehk ~$4.5 tasemel. (See muidugi juhul, kui turul mingit suuremt liikumist ei tule.) -

Oskad äkki oma prognoosi panna, et kas tegin õigesti või valesti, kui sisenesin sellesse? :)

Küsin niisama huvipärast. Loen erinevatest kohtadest, osad ütlevad, et sellega läheb jamaks, teised väidavad, et on alahinnatud ja 5.75 peaks tema väärtus olema. Eks aeg näitab. :)

Kuidas hindad seda uudist, et USA valitsus plaanib Citigroupist väljuda? Kas see peaks hinna alla või ülesse lükkama?

Ise suudan mõelda, et suur kogus värskeid aktsiaid turul peaks mõjuma hinda alandavalt, kuid teisest küljest, kui antud ettevõte on juba suuteline omaljõul tegutsema, siis peaks see olema justkui märk selle tugevusest. Võibolla olen asjadest valesti arusaanud :) -

Deutsche on väljas DNDN teemal:

FDA just issued draft guidance for cancer vaccines

http://www.fda.gov/BiologicsBloodVaccines/Guidance ComplianceRegula-

toryInformation/Guidances/Vaccines/ucm182443.htm

FDA ok with a therapy not delaying progression, but extending sur-

vival

The FDA guides that time to tumor progression may not be an appropriate

endpoint for cancer vaccines. They note that the immune response

launched against the tumor may take longer than the time it takes for a

tumor to progress. In our view, this implies the FDA will likely be support

approval Provenge eventhough it did not delay tumor progression but rather

exhibited a survival benefit.

Guidance for monitoring activity of cancer vaccines in-line with

Provenge Quality Control

The FDA also notes that multiple assays may be needed to identify and

measure the component immune responses. They recommend that if pos-

sible at least 2 immunological assays should be used in an attempt to

monitor the proposed immunologically-meidated immune response. They

suggest creating an assay to monitor T-cell or antibody responses in vitro or

in vivo. These recommendations are in-line with the controls Dendreon has

put in place to monitor Provenge. In the case of provenge, a CD-54+ test is

conducted as well as a T-cell in-vitro activity assay.

We believe guidance documents support Provenge approval

These are the first FDA statements that acknowledge the validity of

Dendreon's regulatory approach for Provenge. The guidance also appears

to be almost identical to the approach Dendreon has taken to monitor

Pole 100% kindel, aga see peaks olema uus ja see peaks olema positiivne.

Võtsin natuke DNDN pikaks üleöö @ $28.80.

Suurt kogust ei julge, ei tunne piisavalt tausta ja liiga haige aktsia ka.

7 minutit veel aega, kui keegi tahab ka riskida :) -

Põmst peaks nüüd olema vähimadki kahtlused kadunud FDA approvali osas. Küsimus vaid, et kas üldse oli kahtlusi.

Samas muidugi DNDN liigub ükskõik mille peale, nii et see võiks olla as good reason as any. -

Ma olen moron, müüsin umbes $28.95 avg maha.

-

Someone please just shoot me.