Börsipäev 23. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Aasias plusspäev & Euroopas kauplemine alanud samuti plusspoolel. USAs saab reede olema huvitav börsipäev – enne turgude avanemist tuleb tulemustega Microsoft (MSFT) ja B. Bernanke peab finantssektori regulatsioonide teemal Bostonis kõne.

Makrouudistest avaldatakse kl 17:00 olemasolevate majade müük (konsensus 5.35 mln). -

Erakordsed ajad?

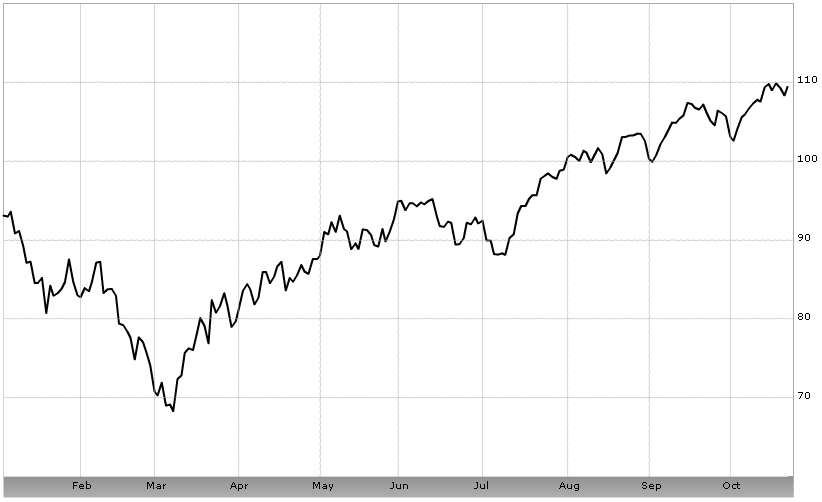

SPY:

Teun Draaisma, the strategist at Morgan Stanley who has made some shrewd timing calls over the last couple of years, points out that the average rally after deep bear markets is 70%. So this rally, while it has surprised some of us, is not out of line with history (allikas).

-

German October Ifo index rises to 91.9

-

Rootsi börsil on eile kehvadest tulemustest raporteerinud Ericsson tegemas korralikku põrget. Goldman Sachs tõstis Ericssoni aktsia täna conviction buy nimekirja:

...the company is likely to continue to keep taking market share, helped by its 70% sales exposure to emerging markets. Ericsson's dominant profession services business should keep growth strong at attractive margins, reducing earnings volatility, while high operational leverage on a reduced cost base should drive margins back to mid-teens... (marketwatch)

-

Üllatus Suurbritanniast - SKP kukkus -0.4% qoq vs oodatud 0.1% tõusu. Suurbritannia majandus on kukkunud kuus kvartalit järjest & võrreldes eelmise aasta kolmanda kvartaliga langes SKP 5.2% yoy.

-

GBP/USD nyydseks pāeva tipust 250 punkti allpool

-

Aitäh kõigile, kes käisid eile õhtul LHV Investeerimiskeskuses mu USA turuülevaate seminari kuulamas. Saime ruumi kenasti täis ning kuulajatelt tuli palju asjalikke küsimusi/mõtteid.

-

Joel, kas leidsite vastuse ka sellele, et mis saab edasi :)?

-

Minu lühemaajalisem nägemus turgude osas on negatiivne. See ei tähenda muidugi, et ma seda kellelegi agressiivselt peale tahaksin suruda - olen varemgi eksinud ja nii võib minna ka seekord. Kuid jah, lühemaajalisem nägemus negatiivne. Põhjuseid palju, kuid nende hulgas headele tulemustele nõrgalt reageerimine, complacency, fiskaalstiimulitega 'kunstlikult' (vähemalt osaliselt) ülespushitud makronäitajad, õiglaselt või pisut kalliltki hinnatud aktsiaturg (kindlasti mitte odavalt) jpm. Aga pikaajalisemalt usun, et aktsiaturgudel võimalusi investeerimiseks leiab ning kui peaksime langust nägema, siis ei tähenda see, et peaks nüüd turgudelt kohe ära jooksma ja pea padja alla panema.

-

Praeguse olukorra teeb väga raskeks QE analüüs. Hea näide on täna avaldatud Suurbritannia SKP languse reaktsioon - siin tuuakse hästi välja, et avaldamise järel kukkusid nael & kallinesid võlakirjad, kuid FTSE100 on 1.3% plussis. More QE anyone?

-

Küsiks nii:

kui 96% on lühiajaliselt negatiivsed turu suhtes

3,999999% ei oska arvata või ei neid ei koti

ja 0,0000001% on positiivsed

siis mis turg teeb sellises situatsioonis? -

A mis need ülejäänud 0.0000009% arvavad? :)

-

minust on jutt või?

-

0.0000009% istub hetkel kinni (vt. Raj and co)

-

Minu arvates on niimoodi esitatud küsimusele võimatu vastata : )

-

Kas sa arvad, et on rohkem või vähem rahvast lühiajaliselt negatiivne turu suhtes?

-

C tundub päris hea-huvitav ost olevat täna Merrilli kommentaari peale.

-

Hong Kong Central Bankers increase required down payment on luxury homes to 40% from 30% - WSJ

-

abesiki, they might not like it but they still buy it... Benchmarking.

-

Tulemuste tabel nüüd tänaste numbritega ära uuendatud - esimene veerg EPSi löömise osas pole meie tabelites veel kordagi niivõrd roheline olnud kui sellel tulemuste hooajal.

-

USA tähtsamad indeksid alustavad päeva taas korralikult plusspoolelt - S&P500 indeks on plussis ca 0.3% kuni 0.4%, Nasdaq100 indeks ca +0.8%.

Euroopa turud:

Saksamaa DAX +1.21%

Prantsusmaa CAC 40 +1.24%

Inglismaa FTSE 100 +1.62%

Hispaania IBEX 35 +0.84%

Rootsi OMX 30 +1.43%

Venemaa MICEX +0.54%

Poola WIG +1.48%Aasia turud:

Jaapani Nikkei 225 +0.15%

Hong Kongi Hang Seng +1.71%

Hiina Shanghai A (kodumaine) +1.85%

Hiina Shanghai B (välismaine) +0.96%

Lõuna-Korea Kosdaq +0.03%

Tai Set 50 N/A (börs suletud)

India Sensex 30 +0.13% -

Don't Try to Short This Market

By Rev Shark

RealMoney.com Contributor

10/23/2009 7:45 AM EDT

"Believe those who are seeking the truth; doubt those who find it."

-- Andre Gide

This market has two characteristics that have made it one of the most difficult bull markets I have ever experienced. First, is that entry points are so difficult. We have had very few meaningful pullbacks and when we do have one, we recover so quickly that there is never much consolidation. Stocks quickly become extended, once again, have minor pullbacks and then go straight up some more.

Markets with strong momentum never make entry points easy, but what has made this one even more difficult is how distrusted and disliked it has been on the way up. The many strong earnings reports and the way this market is acting make you wonder if we even had a recession, while unemployment, housing and the guy on Main Street are showing very limited signs of turning up.

Earnings this quarter have been extremely strong, even though expectations have gone up quite a bit since the very surprisingly strong showing in the second quarter. If there has been a major economic slowdown, we haven't seen much of it in the results of stocks like Apple (AAPL) , Amazon (AMZN) , Intel (INTC) and so on.

Yet despite the good news coming from the stars of the stock market, there is widespread belief that our economic recovery will be extremely slow. It is very difficult to reconcile the market with the economy, and this becomes even more difficult to understand the higher the market goes without a pause.

My best advice has simply been to not fight the trend. Even if you are skeptical about the economy and hate this market, don't try to short it. None of the bearish arguments matter right now, because they are being overwhelmed by a flood of liquidity and a steady diet of positive earnings news. If you jumped in on the short side following the late selloff on Wednesday, you were under water by the close yesterday. The bulls are in control and nothing else matters.

We have had some 'sell-the-news' reaction to earnings this quarter, but the news flow has been just too good for the selling to stick. Once again, this morning, we have seen very positive reports from the likes of AMZN, Capital One (COF) and Netgear (NTGR) . Microsoft (MSFT) is coming up shortly and I expect that it will also be quite upbeat.

The big challenge of this market is trying to find some good entry points when nothing ever rests for long. Even if you are wildly bullish, finding things to buy after the run we have had is not an easy task. That doesn't mean we should be selling, but we have to be careful about letting frustration make us reckless as we try to put cash to work.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: AMZN +14.8% (also upgraded by multiple analysts), HWAY +13.9% (also upgraded to Neutral from Underweight at Piper Jaffray and upgraded to Buy from Hold at Jefferies), SYNA +11.6%, ALGN +11.4%, MSFT +8.0%, COF +7.4%, NTGR +6.8%, NEU +6.2%, CPWR +5.6%, LSCC +5.6% (also upgraded to Outperform from Market Perform at Northland Securities), SCSS +5.5%, EPAY +5.3%, BUCY +4.4%, IR +4.1%, SYT +3.1%, WHR +2.7%, CAKE +2.5%, OFG +2.3%, HON +1.4%, SLB +1.2%, ELX +1.1%... Select China related names ticking higher: CEO +6.5%, LFC +3.6%, PTR +3.3%, BIDU +1.0%... Other news: CIT +10.7% (CIT Group in tentative deal with Goldman on loan - DJ), RODM +9.2% (modestly rebounding), RDY +1.8% (still checking)... Analyst comments: ALU +4.9% (upgraded to Buy from Neutral at Goldman - DJ), MSO +3.9% (upgraded to Neutral at JPMorgan), VLO +2.5% (upgraded to Overweight at Barclays), ERIC +1.8% (upgraded to Buy from Neutral at Goldman - DJ).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: NTCT -12.2%, SPWRA -9.9%, BRCM -8.9%, ACTG -8.1% (light volume), IBKR -7.6%, SNV -7.6%, CA -5.9%, VVI -5.9%, AGU -5.5%, WOOF -5.2%, MPWR -4.5%, WFR -3.8%, RMBS -2.5%, DECK -1.9%, JNPR -1.7%, CLS -1.6%, BSY -1.4%, CB -1.2% (also downgraded to Hold at Stifel Nicolaus), CMG -1.1%, AXP -0.9%... Select European financials showing weakness: AIB -4.3%, IRE -4.2%, CS -3.5%, UBS -2.3%... Other news: UQM -15.7% (filed for a common stock offering for an indeterminate amount pursuant to an effective shelf registration), ELN -9.2% and BIIB -5.1% (EMEA announces that it has started a review of the benefits and risks of Tysabri), QCOR -2.9% (implements two corporate governance actions), EQIX -1.8% (Cramer makes negative comments on MadMoney), GMXR -1.4% (prices 6.95 mln common shares (increased from 5.75 mln) at $15.00/share)... Analyst comments: GSK -1.8% (downgraded to Hold at Jefferies), CRL -1.7% (downgraded to Neutral at Baird). -

Canaccord Adams alustab täna Dendreoni (DNDN) katmist ostusoovituse ja $43lise hinnasihiga, uskudes, et lõplik heakskiit saadakse ravimile 2010. aasta 2. kvartalis.

-

SRS long @9.32 eelturul

eeldusel et majade müük on alla ootuste -

Võimsalt ootusi ületanud Amazonil (AMZN) ja Microsoftil (MSFT) tasub täna silm peal hoida. Kuidas käituvad need aktsiad päeva lõpuks? Eelturul on AMZN +18.5% ja MSFT +10.5%.

-

September Existing Home Sales 5.57 mln vs 5.35 mln consensus, M/M change +9.4%

-

eeldus ei töötand, scheisse. hoian SRS possu praegu sellegipoolest lahti veel

-

SRS kinni @9.53

parem 21 senti käes, kui....

Siiski, turg näis absorbeerivat oodatust parema numbri suht ükskõikselt. Näib, et ongi nii, et mingis mahus ootuste löömine on täiesti normaalne juba...

Kaalun uuesti pikaks minekut kui 9.40 lähedal kätte saab, siis jätaks nädalavahetuseks pihku. Miks: hmm, muud põhjust pole kui sisetunne -

See kids, that's how you teach discipline!

-

Eilne rakett PNC täna lisanud veel +4.5% ja kauplemas $53 tasemel. Ja disco käib edasi:D

-

Efektiivne turuteooria ja praktika.... Tänased Rick Bensignori mõtted RealMoney alt väärivad minu arvates ka siin kajastamist:

Rick Bensignor

Perfect Irrationality Is a Thing of Beauty

10/23/2009 11:09 AM EDT

Note the beauty of investor psychology and why behavioral finance is so darn important: yesterday's price action took out virtually every short from Wednesday. How many could have possibly gone home with a negative bet on at yesterday's close? So it is perfect that given GOOD news today, the market sells off. It is in the absurd that one can discover rationality. What a head game trading is! -

Seni kõik põrkeüritused ära müüdud ja müügitempo päris räige, kas nii ka päeva lõpuni?

-

Kahe poole tunniga on Dow openist ca 130 punkti alla tulnud. Sama tempoga päeva lõpuni teeks see ca 400 punkti. Dow oleks siis 4% miinuses - küll see oleks hea. Ma ei tea miks, kuid ilgelt hea oleks.

-

S&P 500 on 5 punkti tavalise käibeta tiksumisega tagasi võtnud ja EUR samuti USD vastu plusspoolele jõudnud.

-

Weekly Insider Trading Summary:

Notable Purchases -- ITW, GLUU, AEPI, SWY, DSW, CHTP, TIXC, PGNX;

Notable Sales -- CCL, CBSH, TRGT, LUK, GS, MHGC

Goldman Sachs (GS) Principal Accounting Officer sold 16,129 shares at $186.57 on 10/16 -

AMZN üle +25% tõusus, kauplemas $117 tasemel. Tundub kerge ülereageeringuna, kuigi tulemused tugevad. Läbi opti short paistab üsnagi hea mõte. Hakkab vist kergelt väsima samuti.

-

AMZN sulgub 20% tõusu juures, i hope

-

No kurjam, see on nüüd küll üle reageerimine: AMZN tipp $119.65 ??????

-

kas keegi oli ka enne tulemusi pikk ? 25% oleks mõistlik ära noppida

-

nõus, on ülereageerimine.

amzn 115 put @4.35 -

SPX on 1077 pealt põrganud juba korduvalt, kas nüüd murdub või tagasi üles?