Börsipäev 5. november

Kommentaari jätmiseks loo konto või logi sisse

-

Nagu oodata oligi, tõi Föderaalreservi raport turgudele korralikult volatiilsust. Päeva lõpuks sai nõrkus aga tugevusest jagu ning kaugel ei olnud turgude miinusesse langemine. Järgmine olulisem sündmus, mida turg nüüd ootab, on reedene oktoobrikuu tööjõuraport, kust tahetakse näha, mil määral paraneb olukord tööjõuturul. Mitmed analüüsimajad ootavad töökohtade lisandumist juba 2010. aasta jaanuaris ehk kolme kuu pärast... seega peavad töökohtade kadumised praegu tugevalt koomamale tõmbuma, et neid ootusi täita. Aga see siis juba reedel.

Täna tuleb tund aega enne turgu 3. kvartali tootlikkuse näitaja (ootus 6.5%), esmaste töötu abiraha taotlejate arv (ootus 522 000) ning kestvate töötu abiraha taotlejate arv (ootus 5.7 miljonit).

Varasel eelturul kauplevad USA tähtsamate indeksite futuuurid ca -0.3% kuni -0.4%. -

Euroopas tasub täna jälgida Inglise Keskpanga intressimäära otsust - turg ei oota muutust, kuid Suurbritannia kolmanda kvartali majanduslanguse järel (-0.4% vs oodatud +0.1% tõusu) ootavad paljud analüütikud QE programmi suurendamist.

Euroopa Keskpank teatab täna samuti oma intressimäära otsuse - mingit muutust ei oodata.

“Policy is set to be tightened in a synchronised manner globally, with most central banks happy to ride in the central bank ‘peloton’. Central banks, like cyclists, benefit from lesser headwinds by moving together and feeding off the liquidity glut that über-expansionary monetary policies have helped to create...” (Morgan Stanley)

-

ECB pressikonverentsi saab kell 15.30 kuulata siit.

-

Lex kritiseerib laovarude liiga kiiret tõusu, mis võib tekitada juba järgmise aasta esimeses kvartalis double-dip majanduslanguse. Loogika:

Say a recovering jeweller forecasts demand for 10 watches and orders accordingly. The wholesaler then sees this growth in demand and, scared of stock running out, orders 15 watches from the watchmaker. The watchmaker, in turn, interprets this growth as a trend and buys enough materials to make 20. Eventually everyone is oversupplied, the reverse situation plays out and orders evaporate, taking jobs with it. All the while, consumer demand may have grown only slightly.

-

Mervyn King (BOE) teatavasti on odava sterlingu fānn, saab nāha mis tarkusetera ta tāna poetab. pōnevust ja volatiilsust saab olema, thats for sure.

-

Aga et momentumi ilus luuletus homsest börsipäeva foorumist kaduma ei läheks, panen selle siia : )

momentum Börsipäev 6. november modify 05/11/09 11:48

Õues sajab lund. Istun soojas toas ja joon vaarika teed. Vanaema juurest korjatud. Lumehelbed hõljuvad, liuglevad, värelevad, võbisevad, vajuvad, saabuvad vaikselt maa peale. On 2009 aasta novembrikuu kuues päev.

:P

Topd Re: Börsipäev 6. november modify 05/11/09 11:50

kas mitte ikka 5 november pole täna

matu111 Re: Börsipäev 6. november modify 05/11/09 11:51

oled ikka kindel et vaid vaarika tee on ?

momentum Re: Börsipäev 6. november modify 05/11/09 11:51

momentum Re: Börsipäev 6. november modify 05/11/09 11:51

pagan, läks jah kuupäevaga sassi. Mis teha. Ma olen praegu esimesest lumest erutatud. -

Kolin igaks juhuks lumehelvestega siia ka. Joel ähvardas teema kustutada. :(

-

momentum, Jüri Lina näeks siin MITUT väga EVIL sümbolit :-D

-

esimene insider juhtum eestis:

Siseinfo kasutamine viib SEB Enskilda töötaja kohtusse

http://www.ap3.ee/Default2.aspx?ArticleID=8ae6d5a0-aa4b-4db6-9330-85166cc3148f&ref=rss -

Inglise keskpank otsustas jätta intressimäära ootuspäraselt 0.5%-le, kuid nii nagu spekuleeriti, suurendati võlakirjade ostuprogrammi 25 miljardi naela võrra. BOE indikaatorid näitavad, et Briti majandus peaks üsna pea elavnemise märke näitama

-

BOE'lt tuli ka vihje: "inflation rising sharply over near-term on energy costs".

-

Euroopa Keskpank jättis intressimäära 1%-le, kuid olulisem info juba 45 minuti pärast algaval pressikonverentsil, millele Joel on hommikul juba kenasti lingiga viidanud

-

Cable_guy, see ei ole iseenesest vihje, vaid pigem olukorra nentimine. Mäletatavasti oli just eelmise aasta sügis see, kus energiahinnad ära kukkusid ja oma põhjad veebruaris-märtsis tegid, mil nafta barrel $35 maksis. Ning nii ongi nüüd, et tänaste hindade korral on madala võrdlusbaasi tõttu energiasektoris toorme hinnad justkui 50% kuni 100% tõusmas.

-

Initial Claims 512K vs 522K consensus, prior revised to 532K from 530K; Continuing Claims falls to 5.74 mln from 5.81 mln

-

Q3 Unit Labor Costs-prelim -5.2% vs -4.2% consensus, prior -5.9%; Q3 Nonfarm Productibvity +9.5% vs +6.5% consensus, prior +6.6%

-

Initial Claims 10 kuu madalaim ja Nonfarm Productivity 6 aasta kõrgeim tase

-

Enne jäi välja JC Penney võrreldavate poodide jaemüüginumbrid. Isegi kui seis tööjõuturul on paranemas ning ameeriklased on end tööl efektiivsemalt mobiliseerimas, ei tähenda see veel otseselt seda, et tarbija poodi rohkem raha peaks jätma. JCP same store sales igaljuhul alla ootuste.

JC Penney reports October same-store sales were -4.5% vs. -2.6% Briefing.com consensus; guides Q3 sales to $4.2 bln vs. $4.17 bln consenus -

Euroopa turud:

Saksamaa DAX +0.11%

Prantsusmaa CAC 40 +0.31%

Inglismaa FTSE 100 -0.01%

Hispaania IBEX 35 +0.58%

Rootsi OMX 30 +1.00%

Venemaa MICEX +2.30%

Poola WIG +1.02%Aasia turud:

Jaapani Nikkei 225 -1.29%

Hong Kongi Hang Seng -0.63%

Hiina Shanghai A (kodumaine) +0.85%

Hiina Shanghai B (välismaine) +0.96%

Lõuna-Korea Kosdaq -0.91%

Tai Set 50 -0.89%

India Sensex 30 +0.95% -

Be Careful With Long-Side Exposure

By Rev Shark

RealMoney.com Contributor

11/5/2009 8:23 AM EST

One cannot manage change. One can only be ahead of it. --Peter F. Drucker

Although the market has been in positive territory the last three days, it hasn't been very easy. We have bounced back from some oversold technical conditions, but the bulls and dip-buyers aren't showing the energy.

The hallmark of the rally off the March low was that once we started to bounce, we'd continue to go straight up with barely a pause. The bears were squeezed, and the underinvested bulls would panic and start chasing stocks back up. This time the market is struggling to regain upside momentum, and what is particularly troublesome is that good news is consistently being sold.

Yesterday after a little dithering we sold off hard on the FOMC announcement, which most would consider to be good news. There was acknowledgement that the economy is improving and reassurance that interest rates would remain low for some time. Some would argue that low rates aren't really great news, but they have been the primary driving force behind this market. Despite the reassurance of an "easy" Fed, we were greeted with another sell-the-news response.

It was with the prior FOMC announcement that we saw the first real sell-the-news response in this market since the March low. Since then, it has been a consistent theme, and we have been unable to make any progress.

Last night we had more good earnings news, this time from Cisco (CSCO) , which is giving us a little bit of a bounce after a very ugly finish last night, but you can bet that the sellers are already looking to fade the strength. It is a pattern that has been working lately, and if there is one thing we can count on traders doing, it is staying with a pattern that works.

Many folks are counting on a rally into the end of the year to put this market back on track, but we can't let that hope distract us from the obvious fact that the character of the market has been different lately. We have weakness in the financial sector, an absolute slaughter of many small-caps and a tendency to sell any good news. The bears are gaining ground, and we have to respect that fact.

We are going to have an interesting test of the bulls again today. They have the Cisco earning news to work with, and the news flow certainly isn't bad. However, there is a very important jobs report in the morning, and the intraday reverse yesterday is likely to shake confidence. In September when we reversed intraday on an FOMC interest rate decision, we continued down for two more days before finally bouncing.

The bears are becoming more confident about selling into strength and don't seem as worried that we will have another V-shaped bounce. The bulls have had the opportunity to trap the pessimists once again, but they haven't been able to do it lately.

Until the bulls show that they haven't lost the vigor that served them so well all summer, we will have to be very careful with our long-side exposure.

-----------------------------

Ülespoole avanevad:

Gapping up In reaction to strong earnings/guidance: PARL +16.6%, SANM +13.1%, VLNC +12.9%, TRMA +12.7%, FSYS +12.3%, GGC +11.7%, MEA +11.4%, THOR +11.2%, ONNN +9.8%, IMGN +8.2%, THQI +7.6%, DOX +6.3%, KNDL +6.2%, CECO +5.9%, COGO +5.2%, AMMD +4.9%, MELI +4.3%, MCHP +4.1%, CSCO +3.4%, QCOM +2.4%... Select retail stocks showing strength on SSS: PLCE +6.5% GPS +2.3%... M&A News: RX +13.0% (IMS Health nears deal to sell itself to TPG and Canada pension plan)... Select European banks showing strength: IRE +3.4%, AIB +2.8%, ING +2.7%, BCS +1.8%... Other news: ROYL +12.3% (announces the company announced a new field discovery near its successful Lonestar field), TRA +5.4% (sends letter to shareholders, recommends rejection of CF offer), CGA +2.5% (launches three new fertilizer products), BCRX +2.0% (announces that it has received an initial order for 10,000 courses of intravenous peramivir with a value of $22.5 mln under a newly issued contract with the Department of Health and Human Services), RIMM +1.9% (announces its Board has authorized a buyback of up to $1.2 bln, or approx 21 mln common shares based on current trading prices).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SMSI -17.3%, GCA -14.1%, AUTH -11.25% (light volume), INOD -10.6%, WFMI -9.7%, ANSS -9.6%, FTEK -9.3%, GLBL -8.3%, ATPG -7.1%, ANDE -4.6%, MUR -2.4%... Select retail stocks showing strength on SSS: ARO -9.7%, AEO -9.6%, FRED -3.0%, ANF -1.1%... Other news: CF -7.7% (co comments on Agrium's latest revised proposal; says AGU's offer represents substantially lower multiples of EBITDA than CF Industries' offer for Terra Industries). -

Joel, ma vāljendusin ebatāpselt. pidasin silmas kaudset vihjet intressimāārade tōstmisele "mitte vāga kauges tulevikus", kuna inflatsioon on tulekul.

-

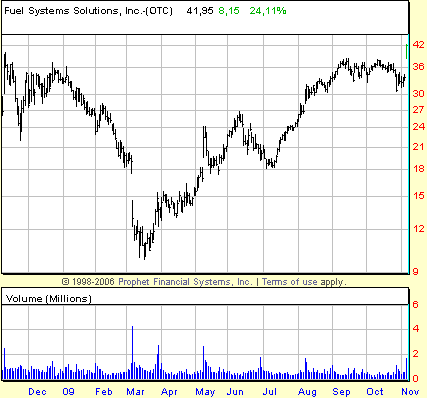

Tänase päeva üks suurimaid võitjaid on Pro endine investeerimisidee Fuel Systems Solutions (FSYS). Aktsia on suurepäraste tulemuste peale tõusnud 25%.

Fuel Systems Solutions beats by $0.34, beats on revs; guides FY09 revs above consensus (33.80)

Reports Q3 (Sep) earnings of $0.77 per share, excluding non-recurring items, $0.34 better than the First Call consensus of $0.43; revenues rose 10.1% year/year to $116.2 mln vs the $104.3 mln consensus. Co issues upside guidance for FY09, sees FY09 revs of $416-425 mln vs. $379.72 mln consensus. The co is targeting 2009 gross margin between 30%-32% and 2009 operating margin to be between 14%-16%.

-

Aktsiaturg on igaljuhul täna väga korraliku rallipäeva teinud. Meenutab viimaste kuude põrkepäevi, kus investorid on oodanud, et langus muutuks suuremaks kui 3% kuni 5%, kuid ongi niimoodi lihtsalt mängu kõrvalt pealt vaatama jäänud kuni uute tippude tegemiseni. Madala käibega on lihtsalt järjest kõrgemale tiksutud. Seega eks praegu n-ö mõningane benefit of a doubt siin pullidele antakse... kuid homne tööjõuraport igaljuhul väga oluline ning tänane ralli nõutab selle jätkumiseks ilusat näitu homme.

-

Eks nii ongi, et kui lapsed liivakastis mängides hoogu satuvad, siis lõpuks jookseb keegi neist ikkagi pillides koju.

-

Nouriel Roubini says 'worst is behind us,' Bloomberg reports

Halleluuja!