Börsipäev 10. november

Kommentaari jätmiseks loo konto või logi sisse

-

Pärast eilset rallit USA börsidel kauplevad ka Aasia indeksid kõrgemal, ent päevasisestest tippudest ollakse siiski madalamal. USA futuurid on sulgumistasemetest liikunud ca -0.3% punasesse. Makromajanduslikku infot jagatakse täna taas näpuotsaga, kui kõige huvipakkuvamaks võiks osutuda Saksamaa majandussentimenti kajastava ZEW indikaatori avaldamine kell 12.00 Eesti aja järgi. Konsensus ootab ühepunktilist taandumist oktoobrikuu 55-lt punktilt.

-

Pärast kolme kuu tippudet tegemist dollari suhtes ja kahe kuu kõrgeima taseme saavutamist euro suhtes on Briti naela kurssi täna nõrgestamas Fitchi kommentaar, et suurematest riikidest seisab Suurbritannial kõrgeima riski ees jääda oma AAA krediidireitingust ilma. Ehkki eelarve tasakaalustamatuse probleem vaevav pea igat Euroopa Liidu maad, on probleem Fitchi sõnul suurim just Suurbritannias. GBP/USD hetkel 1.664 versus 1.674 eile ning EUR/GBP 0.899 versus 0.895 eile.

-

ZEW indeks 51.5 versus oodatud 55 ning DAX tagasi nulli lähedal

-

Dollar jätkuvalt tasemel EUR/USD=1.50. USA futuurid on eilse ralli järel eelturul veidikenegi hinge tagasi tõmbamas: ES -0.4%, NQ -0.3%.

-

Telekomiettevõte Vodafone (VOD) teatas täna hommikul fiskaalaasta 1H tulemustest - puhaskasum oli 4,82x, mis om ca 2x suurem võrreldes eelmise aastaga. Orgaaniline EBITDA kukkus aga 7.9% ja müügitulud 3% - probleemiks on müügitulude langus Euroopas, mida osaliselt kompenseerib kasv Aasias ja Lähis-Idas. Positiivne on data revenue orgaaniline kasv ca 20%, kus ettevõte näeb suurt potentsiaali (nutitelefonid & 3G peaks populaarsemaks muutuma). Suurendati ka dividendimakseid: interim dividend of 2.66 pence a share, up 3.5% from a year ago.

Vodafone kaupleb Londonis -2.5% madalamal, kuna kulude vähendamine & dividendide maksmine ei ole turule uudis. Aktsia valuatsioon on odav & kui Euroopa tööturul olukord paranema hakkab, peaks aktsial korralikult tõusuruumi olema.

-

Credit Suisse kommenteerib positiivselt Euroopa aktsiaid:

Credit Suisse upgraded its stance on Continental Europe to 5% overweight from 5% underweight on Tuesday, the first time it has been overweight on the region since 2007. The broker said that Europe typically starts to outperform nine months after a trough in global lead indicators and when interest rate expectations start to rise. In addition, indicators suggest the same GDP growth as in the U.S., the region has lower leverage then the U.S., Japan and the U.K., while valuations are 14% below the U.S. The strategists also said that they are not dollar bears near-term. To finance the move, the cut their stance on Japan to benchmark, from 25% overweight. (marketwatch)

-

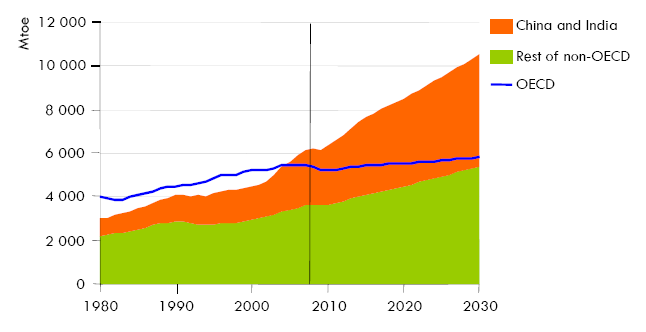

Rahvusvaheline Energiaagentuur on täna avaldanud oma värske iga-aastase raporti, mille kohaselt peaks toornafta nõudlus kasvama 1% aastas ning jõudma praeguselt 85 miljonilt barrelilt päevas 2030. aastaks 105 miljoni barrelini päevas. Võrreldes eelmise aasta prognoosiga on tänavust numbrit vähendatud 1 miljoni barreli võrra. Kogu kasv kuni 2030. aastani tuleb arenevate turgude arvelt, samas kui tarbimine OECD arenenud riikides peaks antud perioodil vähenema.

Huvitav on aga siinkohal lugeda The Guardiani eile avaldatud lugu, milles mitmed IEA allikad toovad välja organisatsioonisisese erimeelsuse. Vastupidiselt IEA ametlikule prognoosile, leiavad paljud, et isegi 90-95 miljoni barreli tootmine päevas on tegelikult võimatu, rääkimata 105 miljonist. Väidetavalt tehakse tegelikkusest optimistlikumaid prognoose selleks, et mitte välja vihastada ameeriklasi ning vältida ülemaailmset paanikat. Seega, kas peak oil võib olla lähemal, kui paljud arvata oskavad?

-

Leidub veel ka selliseid nägemusi:

"People should be cautious and skeptical. ... We've had the biggest credit and debt bubble the world has ever seen. I don't personally think that we'll get through this with a one-year, or two-year downturn," Albert Edwards, Societe Generale's head of global strategy told reporters in Hong Kong. Mr. Edwards expects global equity markets to fall to new lows next year.

SocGeni rõõmustaks müügitulude kasv:

Societe Generale points out that, if one excludes the financial sector, profits have been remarkably robust through the downturn, falling just 70 basis points from their peak in the US. That suggests there is not much scope for margins to rebound from here: top line growth needs to kick in.

-

Fed's Lockhart says current economic conditions are mixed; says commercial real estate a troublesome issue - DJ

-

Garrett: Dow 8,000 Before Long

http://moneynews.newsmax.com/streettalk/garrett_dow_crash/2009/11/09/283712.html -

Euroopa turud:

Saksamaa DAX -0.08%

Prantsusmaa CAC 40 -0.24%

Inglismaa FTSE 100 -0.12%

Hispaania IBEX 35 -0.13%

Rootsi OMX 30 -0.58%

Venemaa MICEX +0.47%

Poola WIG -0.10%Aasia turud:

Jaapani Nikkei 225 +0.63%

Hong Kongi Hang Seng +0.27%

Hiina Shanghai A (kodumaine) +0.09%

Hiina Shanghai B (välismaine) +0.86%

Lõuna-Korea Kosdaq -0.31%

Tai Set 50 -0.91%

India Sensex 30 -0.35% -

Watching a Much-Played Pattern

By Rev Shark

RealMoney.com Contributor

11/10/2009 8:14 AM EST

Constant repetition carries conviction.

-- Robert Collier

After a big gain in the indices on Monday, the market is set up to repeat the exact same pattern we saw in July, August, September and October. For the fifth month in a row now we have had a pullback that threatened to end the uptrend, but the market then bounced back in a straight line and made a new high.

We haven't yet made a seen a new high in the S&P 500 or the Nasdaq but the DJIA is outperforming and is already well above its prior highs.

What has been most surprising about this pattern of behavior is how we quickly we shift from a near breakdown to a euphoric recovery. Once we begin to bounce, we don't hesitate at all. We forget any negatives that were out there and just move back up in a straight line. The ease with which we make new highs is stunning.

The current bounce is now in its sixth straight day and comes after we got bad news with the unemployment rate hitting 10.2%, and after the market struggled for a couple of weeks with a "sell the news" reaction to many solid earnings reports. The character of the market had shifted during earnings season, but over the past six days we have totally forgotten the worries and doubts that were starting to blossom.

If the pattern of the last four months continues, we should see new highs in the S&P 500 and Nasdaq in very short order. Once we make a new high we tend to consolidate a bit and then see some profit-taking hit as the month winds down.

Recognizing this pattern of behavior is the easy part. The difficulty is that these "V"-shaped bounces we keep seeing do not create very attractive chart formations. We go from being oversold to overbought in a straight line and don't spend much time building bases. In addition, volume on the rallies has consistently been light, making the "V"-shaped moves even less trustworthy.

One of the great difficulties of the market this year is that traditional price-volume relationships have not worked. Generally we look for declines on increased volume to pick up momentum and for light-volume rallies to fizzle out. That has not been the case at all. For example, on the most recent bounce, volume declined three days in a row before picking up just slightly yesterday. It suggests that there is little institutional support for the move and that the action is therefore suspect, yet we don't seem to have any selling pressure, either.

Trading from charts has been much trickier this year, and the fact that the market is so correlated to weakness in the dollar makes it even more so. The big driving force yesterday was weakness in the dollar created when the G-20 nations acknowledged that they would continue to provide seemingly endless stimulus and bailouts. They have already flooded the economy with that cash, and with interest rates near zero it has no place to go but the market. No matter how great the bearish arguments may be, there is no way to battle the massive liquidity that has been created.

We have some very slight selling to start the day. There is little news of note and nothing major on the economic front until Thursday, when we have the weekly unemployment claims.

The market needs some consolidation at this point, but these "V"-shaped moves always raise the anxiety of the underinvested dip-buyers so we may not have much of a rest.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CYD +13.5%, HMIN +11.7%, PCLN +10.5%, BZH +8.7%, HRBN +5.7%, RAX +5.5%, JASO +5.1%, LGF +5.0%, DGI +4.7% (also upgraded to Buy at Sun Trust Rbsn Humphrey), FRPT +4.5%, GEOY +4.0%, HBC +3.6%, HOGS +3.4%, DSX +2.5%, AGM +2.2%, SF +1.9% (very light volume)... Other news: TASR +5.9% (announces that 2500 TASER X26 ECDs ordered by the United States Army Garrison Rock Island Arsenal), LL +5.9% (UCBH's place in the S&P SmallCap 600 will be taken by Lumber Liquidators), QGEN +5.0% (still checking), ALV +4.8% (still checking), AIG +4.7% (AIG will be able to repay fed loan, Moody's Says - Bloomberg.com), ATVI +3.6% (Eager fans greet "Call of Duty" video game launch - Reuters.com), NVAX +1.8% (begins Phase IIa study of seasonal influenza vaccine in older adults )... Analyst comments: TLCR +5.4% (initiated with Overweight at Morgan Stanley, JPMorgan and Wells Fargo), KR +2.7% (added to Americas Conviction Buy list at Goldman- Reuters).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PRKR -19.2%, MBI -12.7%, PIKE -11.0%, SDTH -9.5%, ESC -7.5%, SOLR -7.2%, FLR -6.3%, HOLX -6.0%, BCS -5.0%, GOLD -3.7% (Randgold Resources announces it is to fast-track its Gounkoto project), CLNE -3.4%, VOD -3.4%, ERTS -1.4%... Select financial names showing weakness: IRE -5.4%, BCS -4.2%, ING -2.9%, CS -2.0%, PUK -1.7%... Select chemical related names ticking lower: DD -1.8% (trading ex dividend), DOW -1.6,% SYT -1.9%... Other news: CRI -8.5% (will restate its financial statements), NS -5.0% (prices a 5 mln share common stock offering at $52.45/share), EPR -4.9% (announces proposed offering of 4,500,000 common shares), URI -4.8% (announces aggregate $550 million in senior notes offerings), SWM -4.7% (filed for a common stock shelf offering for an indeterminate amount), S -4.1% (announced near close actions to reduce labor costs by at least $350 million), CEF -3.2% (announces proposed offering), RDN -2.3% (lower in sympathy with MBI), BP -1.7% (trading ex dividend)... Analyst comments: CPST -9.2% (downgraded to Market Perform at Northland Securities), AIB -4.4% (downgraded to Underperform at Keefe Bruyette), ALU -4.3% (downgraded to Neutral from Outperform at Exane BNP Paribas), ENER -3.8% (downgraded to Neutral at JPMorgan and downgraded to Sell at Citigroup), BJ -3.4% (added to Conviction Sell list at Goldman- Reuters), TRW -2.1% (downgraded to Hold at Deutsche). -

Fed's Yellen says economy only likely to book 'moderate growth' - DJ

-

U.S. Treasury says housing rescue loan trial modifications rose to 650,994 through October from Sept's 487,081 - Reuters

-

Fed's Rosengren says systemically key cos need to hold more capital - DJ

-

Fed's Yellen see signs of jobless recovery

-

J.P. Morgan Chase to hire 1,200 loan officers

-

Drag me to hell.

-

$25 bln 10-year Note Auction: Yield 3.470% (3.475% expected); Bid/Cover 2.81x (10-auction avg 2.61x, prior 3.01x); Indirect Bidders 47.3% (10-auction avg 36.1%, prior 47.4%)

-

Obama Administration moves to speed broadband stimulus grants - WSJ

-

General Electric ticking higher with Bloomberg reporting that UTX is near purchase of GE unit for $1.8 bln

-

AMZN paneb ikka täitsa hullu, viimasedki shordid sealt vist nüüd välja pigistatud. Päeva tipuks tehti hetk tagasi $130.61, päris raju mineks ikka.

-

kuidas oleks võimalik kulla hinna kiire languse peale panustada??

-

Winston, vaata GLL

-

winston, nalja teed? Aasta lõpuks on kulla hind tänasest kõrgem. Kui sa just nüüd mõnda korrektsiooni ei taha kinni püüda.

-

winston kui kullas lühikeseks lähed, siis soovitan koos südamerohtutega :)

pidi päris hea kokteil olema!