Börsipäev 11. november

Kommentaari jätmiseks loo konto või logi sisse

-

Taaskord võrdlemisi vaikne päev, kui Ühendriikides tähistatakse täna Veteranide päeva. Avatuks jäävad aktsia- ja futuuriturud, ent kauplemist ei toimu võlakirjaturul. Aasia on hommikul kauplemas kergelt positiivsel territooriumil tänu oodatust paremale masinatellimustele Jaapanis ja tööstustoodangu kiiremale kasvule Hiinas. Mõnevõrra negatiivsemat sentimenti lisas Hiina tarbijahindade prognoositust suurem langus ning uute jüaan-laenude mahu kukkumine oktoobris madalaimale tasemele sel aastal.

Rahulik tõotab kauplemissessioon tulla Euroopaski, kus päevakavas pole ühtegi olulist makrot. Bank of England kommenteerib kella 12.30 ajal pikemalt oma nägemust inflatsiooni osas, mille ähvardavale kiirenemisele lähitulevikus läinud neljapäeva kohtumisel viidati. Vihjed QE lõpetamise ning intressimäärade tõstmisest vajadusest võivad pakkuda tuge naelale.

USA futuurid liikunud hetkel 0.3-0.4% plussi.

-

11:30am GBP Claimant Count Change ootus 20.2K, eelmine 20.8K

11:30am GBP Average Earnings Index 3m/y ootus 1.5%, eelmine 1.6%

11:30am GBP Unemployment Rate ootus 8.0%, eelmine 7.9%

12:30pm GBP BOE Gov King Speaks

12:30pm GBP BOE Inflation Report -

EUR/USD 1.50'st kõrgemal & üritab septembri tippudest läbi sõita. Päeva quote: “I believe deeply that it’s very important to the United States, to the economic health of the United States, that we maintain a strong dollar,” Geithner told reporters in Tokyo today."

-

Samas, eks varsti tuleb hakata seda ka ameeriklastel endil tõendama. Freefalling dollar võib kaasa tuua paanika ja sellele järgneks välisinvestorite väiksem usaldus dollari-investeeringute tegemisel.

-

Euroopa aktsiad saavad täna JPMorganilt kiita:

"Despite a strong equity rally over the past few quarters, stocks do not appear stretched on various yield gap metrics. European equities still offer a dividend yield equivalent to the government bond yield, as high a ratio as at any time since March 2003"

"...other catalysts for markets could be an easing of the skepticism around the recovery, low inflation and accommodative central bank policy." (marketwatch)

Eile kirjutas Morgan Stanley, et kuna keskpangad ei andnud märku monetaarpoliitka muutmisest, siis peaks Euroopa indeksitel veel tõusuruumi olema:

"Fundamentally, we expect the market to get closer to our bull case index target of 1200 (latest reading ~1074) on MSCI Europe,consistent with the 35-year average of 15x PE on 12% ROE."

Allikas: Morgan Stanley

-

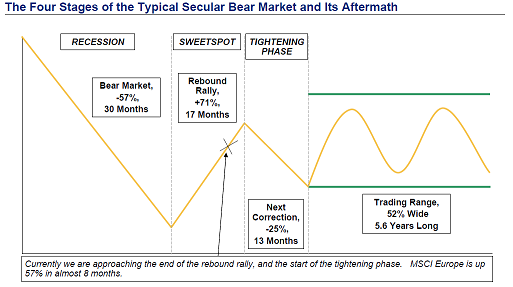

Pisut veel Morgan Stanley'st. Nimelt lõdva rahapoliitika lõppu nad veel ei oota, kuid ütlevad, et rahapoliitika karmistamise tsükli alguse korral on ajalooliselt parimad sektorid olnud kaitsvad sektorid ning toormaterjalide sektorid. Tehnoloogia- ja finantssektorid on olnud nõrgimad. Igaljuhul hoolimata ka monetaar- ja fiskaalpoliitika karmistamise võimalusest peaks nende järgnev lõik ka kõige suuremad pullid pisut mõtlema panema.

We expect a broader market. Winning stock picking strategies should switch from pure value to include growth and quality factors too, now, as we argue in today’s other piece Value, Growth & Quality Will Work Together by Edmund Ng from our team. We believe virtually all of our themes have a good risk-reward now, as well as in the tightening phase.

Viimane lause sellest parim (can't lose?).

-

Vaadates monetaar- ja fiskaalpoliitika seisukohast. Toormaterjal kallineb, kuna - intressid all ja dollar nõrk. Kuidas siis toormaterjal kallineb, kui intressid tõusevad ja dollar tugevneb?

-

Intressid tõusevad tavaliselt siis kui majanduses läheb juba hästi ja sellises keskkonnas kipub ka nõudlus toorainete järele keskmisest kõrgem olema. Eks intresse ju selleks tõstetagi, et inflatsiooni pidurdada.

-

Goldman Sachs prognoosib täna, et kullahind võib aasta lõpuks tõusta $1200ni.

-

Kui USA suurimad indeksid on päeva taaskord üle poole protsendi jagu kõrgemalt alustamas ja tegemas sellega värsked 2009. aasta tipud, on samal ajal USA dollar väga lähedal tegemaks värsked 2009. aasta põhjad teiste suuremate valuutade vastu...

-

Euroopa turud:

Saksamaa DAX +1.25%

Prantsusmaa CAC 40 +1.10%

Inglismaa FTSE 100 +1.03%

Hispaania IBEX 35 +0.20%

Rootsi OMX 30 +0.71%

Venemaa MICEX -0.20%

Poola WIG N/A (börs suletud)Aasia turud:

Jaapani Nikkei 225 +0.01%

Hong Kongi Hang Seng +1.61%

Hiina Shanghai A (kodumaine) -0.11%

Hiina Shanghai B (välismaine) +0.93%

Lõuna-Korea Kosdaq +0.55%

Tai Set 50 +1.55%

India Sensex 30 +2.49% -

How to Play This Hated Market

By Rev Shark

RealMoney.com Contributor

11/11/2009 8:23 AM EST

Love involves a peculiar unfathomable combination of understanding and misunderstanding.

-- Diane Arbus

Strong economic reports from China and Japan are putting pressure on the dollar and pushing the indices up sharply in early trading. If gains hold, we will see a new high for the year in the S&P 500 this morning. Gold is up strongly and is also trading at new highs.

So now for the fourth month in a row the market pulls back and comes close to breaking below its uptrend line and then suddenly roars straight back up on declining volume to make new highs. The only thing more surprising than that sort of technical pattern is how consistent it has been.

Another very interesting thing about this market is that market players have no great love for it. The latest AAII pool shows that bullish sentiment decreased to 44.4% from 48.3% and bearish sentiment increased to 26.7% from 24.7%. Those looking for a correction rose to 28.9% from 27%.

That is an amazingly high level of skepticism for a market that is hitting new highs, however it shows that one of the big driving forces is that we keep on climbing a wall of worry. People don't trust the market, but they keep inching in because they can't stand being left behind. The higher we go, the greater the frustration for those holding cash and the more likely they are to capitulate, do some buying and push us up even more

One of the most striking things about the market for months now has been how dour the mood has been as we keep on moving higher and higher. I don't ever recall such a low level of excitement and joy over a market that is as strong as this one. Message boards and Internet postings of all sorts just don't seem to reflect a very high level of excitement over the great trading. This market has made a move similar to the bubble top in 2000, but there is nowhere near the same sort of optimism that existed back then. It is one of the most hated market rallies I have ever seen.

There are probably several reasons for that. After what we went through last year, many market players have never regained their trust in the market. They suffered some big losses and now they are afraid to embrace a market that hurt them so badly.

What makes it even tougher for those who are already gun-shy is that they are unable to reconcile their dim view of the economy with this extremely buoyant market. While most folks feel the worst may be over, many are still extremely concerned about unemployment, housing and the pace of the economic recovery. How can this market be so strong when the economy is still so weak?

And add to the general suspicion of the rally a market that trades in a very unusual fashion. I've mentioned many times how standard price-volume relationships have not worked well in this market and how the propensity for "V"-shaped moves has been baffling many chartists. The market has also become highly correlated to movements in the dollar -- any weakness in the dollar triggers buying, as we are seeing this morning.

So what we have is a market that isn't trusted or loved and that trades in an odd fashion. That creates a huge wall of worry that we keep on climbing, and it makes for a difficult trading environment.

We must simply respect the forces that are driving things up and not question them too much. Conditions will change at some point, but nothing has been more painful than to anticipate it. While many obviously have some doubts, we have to set them aside until there is a change in the way the market acts.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CHLN +26.1%, ITP +25.2%, OCNF +9.0%, BITS +7.4% (light volume), ING +5.7%, TOL +4.9%, MFB +3.8%, AONE +2.8%, PAAS +2.1%... Select homebuilders/construction related names trading higher boosted by TOL results: MTG +7.6%, HOV +4.0%, BZH +3.7%, PHM +3.6%, KBH +3.5%... Select metals/mining names showing strength: HL +4.8%, EGO +3.6%, BBL +3.0%, IAG +2.9%, BHP +2.9%, SLW +2.9%, KGC +2.8%, MT +2.7%, GOLD +2.7%, AUY +2.5%, ABX +2.5%, RTP +2.3%, GDX +2.1%... Select China related names trading higher: SNP +1.5%, CHL +1.3%, PBR +1.2%, LFC +1.0%... Select casino related names trading higher: MGM +2.9%, LVS +2.5% (Las Vegas Sands to relaunch stalled Macau construction in January - WSJ), WYNN +1.6% (coverage resumed with a Buy at BofA/Merrill)... Select India related names trading higher: SAY +4.6%, TTM +4.4%, IBN +2.7%, INFY +2.6% (traded higher overseas after Som Mittal was quoted by the Economic Times saying that Indian software growth may return to over 10% in 2010, following single-digit percentage growth this year)... Other news: SURG +14.9% (signs definitive agreement with Stryker covering the Omni ultrasonic aspirator product line), GERN +6.6% (collaborators publish data on hESC-derived Glial Progenitor Cell Therapy in cervical spinal cord injury), AIS +5.6% (enters into license and asset purchase agreements with Ferring), RSTI +3.3% (still checking), NOK +2.6% (still checking), REGN +2.1% (Regeneron Pharms and Sanofi-aventis expand strategic antibody collaboration), EXM +1.9% (entered into two new charter agreements for the M/V Renuar and the M/V Elinakos), UPS +1.7% (sees 2010 volume growth, higher rates - Reuters )... Analyst comments: EDMC +1.6% (initiated with a Overweight at Piper Jaffray and Barclays, initiated with a Mkt Perform at William Blair and BMO, initiated with a Outperform at Barrington Research and initiated with Buy at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: STV -10.6%, AGO -6.2% (also files 10 delay 10-Q), FLO -5.7%, EM -4.9%, M -4.3%, RAH -3.5%, BOBE -1.1%... Other news: IRE -6.2% (still checking), PSE -5.4% (prices public offering of 2.7 mln common units at $20.74/unit), STON -4.5% (announces commencement of private $150 mln debt offering and announces public offering of 1,275,000 common units), MBLX -3.7% (commenced a public offering of shares of its common stock pursuant to its effective shelf registration), AIG -2.1% (AIG's Benmosche threatens to jump ship - WSJ)... Analyst comments: SIGM -6.8% (downgraded to Sell from Hold at Collins Stewart), PSEC -2.8% (downgraded to Mkt Perform at Wells Fargo), JASO -1.7% (downgraded to Sector Perform from Outperform at RBC Capital), AYE -1.1% (downgraded to Hold at Citigroup). -

Kui S&P500 indeksi oodatavate kasumite konsensus 2010. aastaks on ca $73 kuni $75, siis UBS tõstis selle täna $81 peale.

-

Tulen korra UBSi kasumiprognooside juurde veel tagasi. 2009. aasta pro-forma EPS ootus on neil $63.5, seega 2010. aastalt oodatakse ca 28%list kasumite kasvu. 2011. aasta EPS ootuseks on $91. See tähistaks 12%list kasumite kasvu ja ühtlasi uut S&P500 indeksi poolt teenitud kõrgeimat aastast kasumit.

Samas... selleks, et neid auahneid numbreid saavutada, tuleb ettevõtteil kindlasti suurendada läbimüüke. UBS ise ootab 2010. aastalt tulude 10%list kasvu. 3. kvartalis tulude kasvatamise ülesandega veel toime igaljuhul ei tuldud. -

Wal-Mart: Former Wal-Mart CEO expects 2010 to 'look a lot like' 2009 - DJ

Wal-Mart: Former Wal-Mart CEO expects 'very difficult' Christmas selling season - DJ -

Just jõulumüük on see, mis võib turu senisele rallile minu arvates kriipsu peale tõmmata. Erinevate varaste küsitluste tulemused on näidanud, et inimesed ei kavatse see aasta kingituste peale keskmiselt rohkem kulutada (muidugi see on subjektiivne, sest reeglina inimesed ei tea ise ka, kui palju neil eelmise aasta kingitused maksma läksid...). Novembri edenedes ja detsembri alates on erinevate analüüsimajade analüütikud kindlasti USA suurimate poodide traffic'ut jälgimas.

-

Must Reede ehk Tänupühade järgne suur ostuhulluse päev on see aasta 27. novembril.

-

Kas inimesed mitte iga aasta seda ei räägi, et see aasta eriti kinke ei osta ja siis nagu ikka tapavad üksteist poe ukse taga rüseledes?

-

American Intl CEO Benmosche says he is "totally committed to leading AIG," according to employee memo - WSJ

American Intl's CEO says Benmosche says he is 'continuing to fight' on employees' behalf, memo says - WSJ

Ja AIG spikes päeva tippudesse. -

HPQ kauplemine peatatud, miskit tulemas.

-

COMS kah halditud. HPQ võtab üle?

-

Arvatavasti midagi nende 2 vahel teoksil on aga eks peagi selgub.

-

Hewlett-Packard to acquire 3Com for $2.7 billion

-

Hmm

BRCD ja COMS mõlemad canceldasid Goldmani konverentsil osalemise sel nädalal.

BRCD müüakse praegu järelturul alla - 1 võimalik ostja vähem, pettumus, et BRCD polnud ülevõetav, natuke antakse loomulikult takeover preemiat ära..

Ma ei julge praegu ostma minna, aga ma pakuks, et spekulatsioonid saavad siit ainult hoogu juurde ja homme lõpetab aktsia kõrgemal kui tänane sulgumine oli.. st praeguse $8,67 asemel $9.25+ -

Ahjaa. Väidetavalt oli BRCD põhjendus konverentsilt puudumise kohta see, et CTO või kesiganes seal rääkima pidi, oli haigeks jäänud. Niiet KST.

-

Nõustun ka sellega, et BRCD on veel natuke vara maha kanda, aga see pole kauplemisideena mõeldud. Homse liikumise kohta ei oska midagi arvata. Tasub meenutada, et seal on võimalike kosilastena terve hulk ettevõtteid läbi käinud: HPQ (nüüd siis läinud), ORCL, DELL, JNPR, IBM. Ja see sektor on praegu hot. Võib kindel olla, et BRCD kohta hakkab lähiajal uusi kuulukaid ja spekulatsioone ringlema ning tuleb häid kauplemisvõimalusi.

Ahjaa.. COMS novembri $5 callid (Y! andmetel) täna: vol 3,961 vs 964 open int; detsembri $5 callid 3269 vs 210 open int. -

Krt HPQ on BRCD OEM partner ka, selle peale ma ei mõelnudki.. sellisel juhul on müügikanali kaotus ka veel lisaks ja kiiret taastumist oodata ei ole.