Börsipäev 12. november

Kommentaari jätmiseks loo konto või logi sisse

-

Üle hulga aja näeme täna USAst ka mõningaid makro raporteid. Tund aega enne turgude avanemist tuleb esmaste töötu abiraha taotluste näit möödunud nädala kohta, kust oodatakse numbri järk-järgulist alanemist ja märke tööjõuturu seisukorra paranemise kohta. Konsensusootuseks on 510 000. Kestvate täätuabiraha saajate number peaks jääma 5.7 miljoni juurde.

USA futuurid on varastel hommikutundidel pisut hoogu maha võtnud ning tähtsamad indeksid ca -0.4% kuni -0.5%. S&P500 ja Nasdaq100 indeksid on juba 8 kauplemispäeva järjepanu suutnud kõrgemal lõpetada.

-

Selle aasta suurimatest järjestikustest tõususeeriatest:

Nasdaq100 (QQQQ) - juulikuus tõusti järjestikku 12 börsipäeva, septembris 9 päeva, oktoobris 8 päeva ning praegu siis novembris ka 8 järjestikust plusspäeva.

S&P500 (SPY) - käimasolev november 8 päevaga, juulis 7 päeva, oktoobris 6 ja septembris 5 järjestikku tõusupäeva. -

Kes veel ei ole aru saanud, mis QE ja 'buy all' taga on, siis selleks on Scylla :).

-

Üks intervjuu Hiina jüaani täielikult kaubeldavaks muutumise teemal - ING arvab, et protsess selles suunas on juba käimas ning 5-10 aasta pärast võib see ka reaalsuseks saada. New world power? Ja mis saab dollarist, kui maailma keskpankurid hakkavad oma reservvaluutade baase diversifitseerima dollarist eemale ja kaasavad üha rohkem eurot, jeeni ja jüaani? Link siin.

-

Nagu Condon ütleb, siis siiani on Hiina teinud beebisamme & USA saab aru, et dollarile pole hetkel alternatiivi. Kui reaalseid samme hakatakse astuma, siis on oluline, kas USA hakkab dollarit kaitsma? Reeglina konkurents sunnib midagi tegema...

America has a unique ability to borrow from foreigners in its own currency, and wins when the dollar depreciates, since its assets are mainly in foreign currency and its liabilities in dollars. By one estimate America enjoyed a net capital gain of around $1 trillion from the gradual depreciation of the dollar in the years before the crisis. (link siin)

-

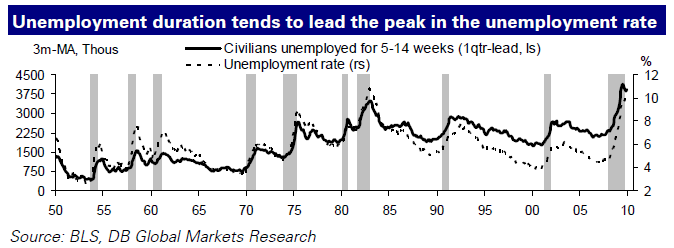

WSJs üks DB soovitus tööturu trendide avastamiseks:

“More important…the peak in unemployment duration as measured by the number of people employed between 5 to 14 weeks is an excellent leading indicator of the labor market,” he said. “In the past, this series peaks one quarter ahead of the unemployment rate. [So] if history repeats, the unemployment rate should peak this quarter.”

-

Euroala tööstustoodang tõusis septembris 0.3% mom vs oodatud 0.5% mom. Septembris oli langus 12.9% yoy. Postiivne oli augustikuu IP korrigeerimine 0.9% kasvu pealt 1.2% mom kasvule.

-

Wal-Mart prelim $0.84 vs $0.81 First Call consensus; revs $98.67 bln vs $99.88 bln First Call consensus

...rasies guidance for FY10, sees EPS of $3.57-3.61, up from $3.50-3.61, vs. $3.58 consensus. (briefing)

-

Morgan Stanley on teinud hea graafiku, kus võrdluseks välja toodud nelja maailma suurima keskpanga bilansid - vt siit.

-

Pilk ka Walmarti segmentide tegevuskasumi marginaalidesse:

Q3 09:

Walmart USA - 7.3%

International - 4.3%

Sam's Club - 3.4%

Q3 08 ehk aasta tagasi:

Walmart USA - 6.9%

International - 4.8%

Sam's Club - 3.2% -

Initial Claims 502K vs 510K consensus, prior revised to 514K from 512K; Continuing Claims falls to 5.63 mln from 5.77 mln

-

Insured Unemployment Rate on 4,3% varasema 4,4% asemel - veel 19. september oli 4,6%

-

Euroopa turud:

Saksamaa DAX +0.29%

Prantsusmaa CAC 40 +0.31%

Inglismaa FTSE 100 +0.24%

Hispaania IBEX 35 +0.50%

Rootsi OMX 30 +0.90%

Venemaa MICEX -0.08%

Poola WIG N/A +0.35%Aasia turud:

Jaapani Nikkei 225 -0.68%

Hong Kongi Hang Seng -1.01%

Hiina Shanghai A (kodumaine) -0.08%

Hiina Shanghai B (välismaine) +2.55%

Lõuna-Korea Kosdaq -0.20%

Tai Set 50 -3.44%

India Sensex 30 -0.91% -

Play the Pattern Until It Breaks

By Rev Shark

RealMoney.com Contributor

11/12/2009 7:30 AM EST

It is strange how many rational beings believe the ultimate truths of the universe to be reducible to patterns on a blackboard.

-- Frederick Pollock

On Wednesday the S&P 500 managed the unusual feat of jumping almost straight up for the seventh day in a row to make a new high for the year. This is the third month in a row that we have seen almost the exact same pattern. After we make a new high, the tendency has been for us to stall out at the new high for a week or so and then roll over and close the month poorly before we repeat the pattern again.

It is fascinating that the market has been so consistent in producing these "V"-shaped bounces, but the problem is that they aren't particularly easy to trade, especially when volume tends to decline as we go higher. The quick shift from a technical near-breakdown to a new high just isn't very typical market action. I'd be very surprised if we have ever had this pattern repeat itself almost exactly for three months in a row.

So where do we go from here? If the pattern holds, we might have a few more days of upside but then we'll churn for a while and then see selling as the month winds down. Of course, trying to catch the exact point when we turn down is extremely difficult and tends to lead to short squeezes if the bears are overly aggressive too early. We saw a good example of this yesterday when we gapped up and surprised those who didn't believe another "V"-shaped bounce to new highs was possible.

What is so frustrating about this market is that it just doesn't lead to the creation of good chart patterns, and they become even worse the longer the rally continues. So the folks who hesitated to buy extended charts become anxious to buy any dip at all. That mindset keeps the dips extremely shallow and never allows for any of the healthy consolidation that technicians look for.

The other tricky thing about this market is how strongly the action is tied to any movement in the dollar. Any pressure on the dollar automatically triggers the buying in gold, energy and various commodity-related names. The "short dollar, long commodity-related equities" trade is so obvious to everyone now that we have to watch for any sign that it is unwinding. When it does reverse, the market reaction is going to be very ugly, very fast, but for now no one seems to be at all worried about that.

Although it has been a tricky trading environment, above all else we have to respect the fact that this market is acting very strongly. Many traders are tempted to keep on trying to short this rather illogical action, and it just isn't working very well. Ironically, the more they try, the more likely the market is to continue to act in an unusual fashion.

Our job here is to monitor the action closely and react as conditions change. If the typical pattern holds, we should have some flat action and then a couple of days of sharp down action, but we can always count on some surprises from the market beast.

Wal-Mart (WMT) is out with earnings this morning that are slightly ahead of expectations, but the stock is trading down on light guidance for the fourth quarter. Weekly unemployment claims are coming up, and we'll likely see a reaction to that data. Asia was weak overnight and we have a little softness in premarket trading.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: HPJ +29.3%, JMBA +18.3%, GRRF +14.9%, CAAS +12.5%, CTRP +9.7%, BT +5.8%, KONG +4.8%, CGA +2.0%... M&A news: COMS +32.7% (3Com to be acquired by HPQ for $7.90 per share in cash), UBET +12.4% (Churchill Downs to acquire Youbet.com in a transaction valued at ~$126.8 million; transaction represents a per-share value of Youbet common stock of ~$2.84/share)... Other news: KNDI +8.0% (completed the sale of 30 modified, electric COCO hardtops to the Postal Service), JDSU +5.8% (Cramer makes positive comments on MadMoney), CVGW +3.9% (will replace Sterling Financial in the S&P SmallCap 600 Index)... Analyst comments: CBEY +2.1% (upgraded to Outperform from Market Perform at Raymond James based on valuation), GSK +1.3% (initiated with an Equal-weight at Barclays).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: GMCR -11.3%, TTEK -6.6%, ONTY -4.6% (light volume), AEG -4.1%, CSC -3.3%, AMAT -2.6%, AAP -2.5%, HPQ -1.2% (also announces will purchase COMS at a price of $7.90 per share in cash or an enterprise value of approximately $2.7 bln)... Select financial related names trading lower: IRE -6.1%, RBS -3.1% (Royal Bank of Scotland chairman under fire over Anglo board role - FT), BX -2.3%, ING -1.9%... Select India related names showing weakness: IBN -4.4%, SAY -3.6%, WIT -2.1%... Select metals/mining names showing weakness: DROOY -5.1%, GOLD -2.3%, RTP -1.6% (Australia says China extends Rio Tinto probe - FT ), IAG -1.5%, ABX -1.0%... Other news: KV.A -13.1% (discloses it is pursuing other initiatives to generate cash), PDC -7.8% (announces offering of up to 3.82 mln shares of common stock), JRCC -7.8% (to offer $125 mln convertible senior notes), BRCD -5.4% (repeatedly been the target of HPQ takeover chatter; downgraded to Neutral from Overweight at Piper Jaffray, downgraded to Hold from Buy at Lazard), PLX -5.1% (still checking), BZ -2.0% (announced a 17 mln share common stock offering by selling shareholders)... Analyst comments: BKE -3.8% (initiated with a Sell at Goldman; tgt $27 - Reuters). -

30-aastase võlakirja oksjon oli oodatust oluliselt nõrgem. Oodatud 4.42%lise tulususmäära asemel kujunes tulususeks 4.47%. Kuna tegu 30-aastaste ehk väga pikkade võlakirjadega, on selline 0.05%punktiline vahe võrreldes ootustega väga suur. Mida kõrgemad on võlakirjade intressid, seda kulukamaks läheb USA hiiglasliku eelarve defitsiidi finantseerimine.

Kui 10-aastase võlakiri oli päeva alguses languses, siis nüüd on see hüpanud plussi ja kaupleb üle 3.50%. -

October Treasury Budget -$176.4 bln vs -$165.0 bln consensus, prior year -$155.5 bln

-

Ühe kuuga on siis genereeritud defitsiiti ca 1.9 triljonit krooni. Palju see teeb siis? Ühe kuuga on jõutud ca 21 Eesti riigieelarvet miinusesse. Ehk teisisõnu finantseeriks kogu Eesti aastane riigieelarve USA defitsiiti 1.5 päeva....

-

TICK püsib 1000 all, kerge närvilisus õhus.

-

Selle aasta pikim järjestikune tõusupäevade arv saab tänasega siis SPYs läbi.

-

eile siis pärast börsipäeva lõppu olid 3kv tulemused PAL.

http://finance.yahoo.com/news/NAP-Announces-Third-Quarter-iw-453116176.html?x=0&.v=1