Börsipäev 17. november

Kommentaari jätmiseks loo konto või logi sisse

-

Vaatamata Bernanke küllalt negatiivsetele kommentaaridele, jätkasid USA olulisemad indeksid oma rallit 13 kuu tippude juurde. Aasia turgudel on seevastu investorid Föderaalreservi juhi nenditud võimalikke tagasilööke maailma suurima majanduse taastumisprotsessis märksa tõsisemalt võtmas ning sealsed indeksid kauplevad hommikul kerges miinuses: Nikkei -0.6%, Hang Seng -0.5%.

USA-s avaldatavast makrost peaks täna enim huvi pakkuma oktoobrikuu tootjahinnaindeks (kl 15.30) ning tööstustoodangu muutus (kl 16.15). Eurotsoonist olulist infot ei tule.

-

Marc Faber leiab, et praegustelgi hinnatasemetel on aktsiad suhteliselt odav vara, kui kõrvutada seda sularahaga, mis pakub 0%-list intressi. Seega teatud mõttes kaitsevad väärtpaberid ekspansiivse rahapoliitika eest ning nii kaua kui Bernanke maailma dollaritega üle ujutab, jätkub ka inflatsioon erinevates varaklassides. Link Bloombergi videole

-

ING on hästi välja toonud, kuidas euroala ettevõtetele tekitab kallim euro probleeme. Euroala ettevõttete müügitulud kukkusid kolmandas kvartalis 12.5% yoy ja eps 27.1% yoy. Samas väljaspoole euroala kukkusid Euroopa (nt UK, Šveitsi etc) ettevõtete müügitulud 2.6% ja eps 1.2% yoy. Eile tõi probleemi ilmekalt esile EADSi finantsjuht, kelle sõnul: “prolonged weakness of the dollar remained one of the biggest challenges to profitability” (loe siit) . Naljakas ikka, kuidas eur/usd'i tõus paneb Euroopa aktsiad rallima... (täna vastupidi - eur/usd kukub & Euroopas algas päev miinuspoolel).

-

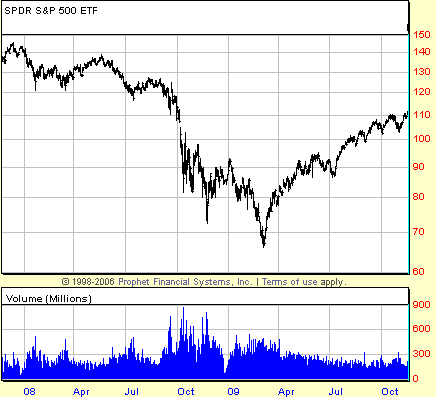

29. septembril 2008. aastal jättis USA finantssektori n-ö bailout plani vastu võtma. Tulemuseks oli SP500 indeksi ühepäevaline 7.8%line kukkumine. Mäletan seda veel, nagu oleks see juhtunud alles eile, tegelikult on sellest aga juba üle aasta möödas. Tol hetkel tundus, et ees on ootamas väga segased ja keerulised ajad. Kes selle päeva lõpus SP500 indeksit ostsid, olid eilseks koos dividenditootlusega 13.5 kuuga kokku teeninud +2.4%. Raha polegi kaotatud, vaid seda on kasvatatud.

6. oktoobril ütles UBS, et ees on ootamas selge majanduslangus, millest väljumine võtab aega vähemasti 2 aastat. 6. oktoobri päeva lõpust SP500 indeksi ostmine oleks tänaseks 13 kuuga koos dividendidega kokku tootnud +9.0%.

10. oktoobril saavutas TED spread (näitab üldist krediidiriski majanduses) oma selle kriisiaegse tipu 4.65% peal. Sel päeval ostetud SP500 indeksi tootluseks oleks 13 kuu järel tänaseks kujunenud +28.9%.

Kui tollal olid kõik kindlad, et Suure Depressiooni järgse suurima majanduskriisi vältimine on võimatu ning hea, kui Suurt Depressiooni ennast ei kordu, siis reaalsus ca aasta jagu hiljem on näidanud, et tolleaegsed hirmud osutusid valeks. Maailma keskpankurite hiiglaslik likviidsuseksperiment on töötanud. Nüüd oleme minu arust aga vastupidises olukorras. Väga suur enamus on kindel, et käimas on maailma majanduste jõuline paranemine/kasv. Veelgi enam, pea kõik on veendunud, et kasv saab olema tugev. Kui tollal eksiti (ehk hinnati valesti valitsuste ja keskpankade sekkumisvõimet), kas ei ole siis võimalik, et ka seekord ollakse eksiteel oma agressiivsete majanduskasvu prognoosidega ning keskpankade poolse likviidsuse mitte-kokkutõmbamisega?

-

Fundamentaalnäitajaid austavatele investoritele kallab Shark RealMoney all küll külma vett peale, öeldes niimoodi:

Shark: "This market doesn't care about fundamentals, so why worry about Meredith Whitney's comments? /-/ Sometimes it pays not to think too hard. This is one of those times."

Minu tõlgendus sellest - ühesõnaga peolt tuleks tema arvates lahkuda alles siis, kui esimesed joogised külastajad on põrandad täis oksendanud. -

October PPI M/M +0.3% vs +0.5% consensus, prior -0.6%

Oct Producer Price Index Ex Food & Energy YoY +0.7% vs 1.4% consensus

October Core PPI M/M -0.6% vs +0.1% consensus, prior -0.1%

Oct Producer Price Index YoY -1.9% vs -1.8% consensus -

Väga suure karuna tuntud Gary Schilling on andnud ühe intervjuu, kus ta väidab jätkuvalt, et tõenäosus, et ta oma negatiivses vaates eksib, on väga väikene - link siin. Schilling ootab pikisilmi (pettumust-valmistavaid) jõulumüügi tulemusi.

-

Goldman Sachs tunnistab, et on oodanud arenenud riikides suuremat nõudlust kütuse järele (samas positiivne üllatus on tulnud arenguriikidest):

The market remains caught in the tug-of-war between weaker-than-expected DM demand, which creates near-term downside risk and stronger-than-expected EM demand, which creates longer-term upside risk, leaving the market in a new higher trading range.

Emerging markets demand has continued to surprise to the upside over the past months, yet this failed to offset the lag in developed market distillate demand, leading inventories to draw more slowly than we anticipated. However, the market is increasingly expecting EM demand to crowd out future OECD demand growth, and is putting upward pressure on long-dated prices, leaving the market in a new higher trading range of $75/bbl to $82/bbl. (pikemalt siin)

-

Euroopa turud:

Saksamaa DAX -0.27%

Prantsusmaa CAC 40 -0.38%

Inglismaa FTSE 100 -0.44%

Hispaania IBEX 35 +0.01%

Rootsi OMX 30 -0.51%

Venemaa MICEX -0.92%

Poola WIG -0.24%Aasia turud:

Jaapani Nikkei 225 -0.63%

Hong Kongi Hang Seng -0.13%

Hiina Shanghai A (kodumaine) +0.23%

Hiina Shanghai B (välismaine) +2.69%

Lõuna-Korea Kosdaq -0.80%

Tai Set 50 -0.14%

India Sensex 30 +0.11% -

Emotion, Not Fundamentals, Driving This Market

By Rev Shark

RealMoney.com Contributor

11/17/2009 8:23 AM EST

When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotion. --Dale Carnegie

One of the things that make the market so difficult at times is that forces that drive it often have nothing to do with the fundamentals. We have a particularly good illustration of that right now. This market has been running almost straight up since the first of November not because the economy is recovering so fast or because business is so much better but because the dollar is weak, there is a large amount of liquidity, and too many people are underinvested and trying to catch up as the market flies higher and won't let them in.

In the short term, in particular, the market does a very poor job of reflecting the true fundamental situation. Investors never agree as to what the reality of the fundamentals is anyway. On any given day you'll have both bulls and bears with cogent, logical, insightful arguments about why our situation is so wonderful or so ugly. Just because the market isn't listening to one side doesn't mean that side is wrong. It simply means that the market may have other forces at work that are driving it.

The great challenge of this market right now is trying to reconcile this amazing bull run since March with the generally held view that we have a tepid economic recovery at best and will face substantial problems down the road as accommodative monetary policy is unwound and we suffer the fallout from a weak dollar. Given the move we have already seen so far this year, it is extremely difficult for many investors to believe that we are still pricing in better fundamentals down the road.

The key to navigating this market is to remember that it isn't about the fundamentals but about the emotions. When the emotions become negative, then the bearish fundamental arguments will matter, but for now it is irrelevant how smart or insightful these arguments are. The bulls are in control of the market, and therefore any bearish arguments are irrelevant.

Yesterday, well-known bank analyst Meredith Whitney made some negative comments about the market in the last hour and pushed things down. That earned her much criticism for being a grandstander and trying to be sensational. Maybe that's true, but just because the market is ignoring her negative arguments doesn't mean she is wrong. The market just doesn't care about the things she is focused on right now. I assure you, though, that when we see some weak action in this market, the negative arguments she is making now will be cited as the reason for it.

Our job is to be aware of the bullish and bearish fundamental arguments and to make sure we stay with the one that is in favor. We might not agree with it, but we have to realize that it is the mood of the market and not the fundamentals that determines whether the pessimists or optimists are in control.

It is impossible to predict with any degree of accuracy when the market will shift based upon a fundamental analysis. At this juncture, all we really need to know is that the market is extremely strong. It isn't because fundamentals are so fantastic or the bears so terribly wrong. It is because the psychology is supporting the buyers. At some point it will shift, not because of a change in fundamentals but because of a change in emotions.

Early indications this morning are for a little weakness as the dollar bounces back up a little. Overseas markets were mostly down slightly as they digested yesterday's big gains. We have PPI and capacity utilization numbers coming up later this morning, which may cause a jiggle, but for now it looks like we will have a sedate open.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ZOOM +28.2%, TMI +21.6%, CEU +8.6%, JST +8.4%, EJ +7.7%, SPRD +8.3%, SINA +7.2%, AGO +6.0% (light volume), SKS +4.2%, COV +2.5%, CSIQ +2.1%... M&A news: SMTL +31.0% (Semitool to be acquired by Applied Materials for $11/share in cash)... Other news: NGSX +17.0% (receives FDA approval of Qutenza 8% patch for treatment of postherpetic neuralgia), BPHX +9.9% (awarded a multi-million dollar contract by IBM to modernize mission critical systems of a global tier 1 retail chain), APWR +8.8% (-Power Energy Generation Systems and U.S. Renewable Energy Group announce plans to build wind energy turbine production and assembly plant in U.S.), CSE +7.8% (entered into a definitive agreement to sell substantially all of its healthcare net lease portfolio to Omega Healthcare Investors), NAL +4.4% (Cramer makes positive comments on MadMoney), ONCY +4.1% (collaborators present "positive Phase I/II trial results" in advanced solid Cancers with a focus on the head and neck), DUF +3.0% (Cramer makes positive comments on MadMoney), RSG +2.7% (Berkshire Hathaway discloses new position)... Analyst comments: AIS +6.2% (initiated with Buy at Merriman), PALM +3.3% (upgraded to Buy from Hold at Kaufman Bros), ALKS +2.7% (upgraded to Outperform at Leerink Swann), EAT +1.8% (upgraded to Strong Buy from Outperform at Raymond James).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PSUN -23.0%, FTK -14.6% (light volume), ADG -14.1% (light volume), JEC -9.9%, AOB -6.8%, CPSL -4.9%, HD -2.4%, TJX -1.8%, BCS -1.7%... Select financial related names showing weakness: IRE -8.5%, AIB -5.7%, CS -1.7%, HBC -1.5%... Select metals/mining names trading lower: AU -3.4%, GFI -2.5%, HMY -2.5%, KGC -2.1%, GOLD -1.9%, IAG -1.8%, RTP -1.7% and BHP -1.2% (Chance of new BHP-Rio bid less than 30%, Liberum Capital says - Reuters.com), ABX -1.6%, NEM -1.5%, EGO -1.3%, GG -1.2%... Other news: CERS -14.1% (Cerus receives FDA Blood Products Advisory Committee guidance for proposed INTERCEPT Blood System Ph. III trial design), PLA -9.6% (Golden Gate Capital is not and will not be involved in any way with any potential acquisition of Playboy Enterprises), SIVB -8.7% (files for $300 mln stock offering), MCHP -7.4% (Atmel Enters into Stipulation to Settle Microchip Offer Shareholder Litigation), SPWRA -6.3% (internal review identifies unsubstantiated accounting entries; also downgraded to Neutral from Overweight at Piper Jaffray, downgraded to Market Perform from Outperform at Raymond James), HOLX -4.3% (Annals of Internal Medicine publishes report recommends against routine breast cancer screening for women under the age of 50), BCRX -4.2% (announces proposed public offering of 5 mln shares of its common stock), ATML -4.1% (Atmel enters into stipulation to settle Microchip Offer Shareholder Litigation), SII -4.1% (announces public offering of 28 mln shares of common stock; downgraded to Neutral from Outperform at Credit Suisse), TGP -2.6% (announces that it prices its public offering of 3.5 mln common units at $24.40/unit), AWK -2.5% (announces 37.4 mln secondary common stock offering), ETN -1.4% (Berkshire Hathawy liquidates position), NVS -1.2% (Novartis Influenza A(H1N1) 2009 vaccine US interim data show lower doses of antigen may suffice)... Analyst comments: ZUMZ -3.9% (downgraded to Neutral from Buy at B. Riley), JOYG -1.9% (downgraded to Neutral at UBS), VRTX -1.2% (downgraded to Neutral at Merriman). -

October Industrial Production +0.1% vs +0.4% consensus, prior revised to +0.6% from +0.7%; Capacity Utilization 70.7% vs 70.8% consensus, prior 70.5%

-

Expertise

Or look at political experts. In the early 1980s, Philip Tetlock at UC Berkeley picked two hundred and eighty-four people who made their living "commenting or offering advice on political and economic trends" and began asking them to make predictions about future events. He had a long list of pertinent questions. Would George Bush be re-elected? Would there be a peaceful end to apartheid in South Africa? Would Quebec secede from Canada? Would the dot-com bubble burst? In each case, the pundits were asked to rate the probability of several possible outcomes. Tetlock then interrogated the pundits about their thought process, so that he could better understand how they made up their minds. By the end of the study, Tetlock had quantified 82,361 different predictions.

After Tetlock tallied up the data, the predictive failures of the pundits became obvious. Although they were paid for their keen insights into world affairs, they tended to perform worse than random chance. Most of Tetlock's questions had three possible answers; the pundits, on average, selected the right answer less than 33 percent of the time. In other words, a dart-throwing chimp would have beaten the vast majority of professionals. Tetlock also found that the most famous pundits in Tetlock's study tended to be the least accurate, consistently churning out overblown and overconfident forecasts. Eminence was a handicap. -

Barclay tõstab Exxon Mobili (XOM) hinnasihti ja ütleb, et suured ettevõtted on need, mis võivad aasta lõpus tootluste n-ö lukku löömisel teistest rohkem võita:

Briefing: Barclays Capital upgraded XOM to Overweight from Equal Weight and raises their tgt to $92 from $90 -

Fed's Lacker says economy has hit bottom, recovery is 'solidly' underway - DJ

Ja turg liigub ülespoole. -

Sources says that the first CMBS issue in a year to be done with overwhelmingly private money; Fed, which was prepared to lend over $150 mln, may only provide a small amount - CNBC

-

Fed says reducing maximum maturity of discount window loans to 28 days from 90 days effective Jan 14 - Reuters

-

Paistab, et täna ei huvita turgu isegi USD tõus 0.85% EUR vastu, mis eelnevalt on olnud tugevas korrelatsioonis.

Kuid ülesmineku käive on ikka eriti lahja, seega oleks siin pigem kergelt ettevaatlik.

The morning's action has come on below average volume (NYSE 385 mln vs midday avg of 515 mln; NASDAQ 890 mln vs midday avg of 1.05 bln) -

Hetkel CNBC peal juhitakse tähelepanu GS aktsia käitumisele, mis ei ole viimase tõusuga kaasa läinud ja käitub pigem nõrgalt. Samuti on XLF kauplemas küllaltki kitsas vahemikus.

-

Nov housing index kergelt nõrgem, oodati 19 vs 17 prior 18. Turul esimene reaktsioon alla, kuid kohe osteti tagasi.

-

Niih nüüd ka käive tagasi ja esimese hooga alla.

-

Finantssektorile üsna oluline Alari poolt toodud uudis, et discount window laenuperioodi tehakse jaanuarist lühemaks (ilmselt kasutasid pangad juba mõnda aega seda teistel eesmärkidel - nt võeti väga odavalt lühiajalisi laene ja investeeriti kõrgema tootlusega pikaajalistesse instrumentidesse)

-

Hetkel ongi arusaamatu, miks kasutati abiraha investeeringuteks? Ma pigem arvan, et varsti tuleb abiraha kasutamisel teisigi sarnaseid üllatusi.

-

Pakuks välja, et 4 kvartal ei ole enam pankade tuluallikana esireas (trading activity), käibed ära kukkunud ja enamus ennast nii täis ostnud, et ei märka õigel ajal kasumeid võtma hakata. Nüüd suure ringi küsimus, kas tulu saadakse edaspidi ainult varade üleshindamise näol?

-

PNC Bank Chairman Rohr says will repay TARP "within the next 15 months" - DJ

-

'osta ja hoia' ei tohiks ka järgmine aasta olla sama tootlik, nagu sel aastal, kus paljud varahinnad kasvasid kordades. Pankade kasumid kukuvad, peavad laenusid väljastama hakkama, mis ongi nende õige töö.

-

AAPL viimase paari minutiga 1.5 punkti kukkunud Needham-i downgrade peale.

AMZN sai samuti reitingulangetuse osaliseks, mis lõpetas ilma käibeta ülestiksumise ja kaupleb juba punkti võrra allpool. -

Geithner asub tunni jooksul samuti senati ette usutlusi andma, see peaks üsna põnev tulema. Kas USD ülespoole või vabalangusesse?

-

AMZN reitingulangetuse kohta pikemalt:

As mentioned earlier Needham downgraded AMZN to Hold from Buy saying they believe Amazon's current share price now implies a long-term revenue growth rate that will be increasingly difficult to achieve. The firm says from one perspective their valuation appears quite reasonable. For example, it assumes Amazon can grow revenues six percentage points faster than the U.S. e-commerce market, a target the company has easily exceeded for the previous 10 quarters. However the firm says, it's the implications of a growth rate materially north of 25% that are concerning. The firm says if Amazon were to grow 25% annually, for example, its revenues would increase over 10-fold to $220 bln in 2018; and the company would emerge as the second largest U.S. retailer, trailing only Wal-Mart (WMT). They believe such an increase is a stretch but realistic given Amazon's competitive position in the worldwide retail industry. However, the recent surge in the company's share price implies a revenue growth rate and revenues in the 10th year of their forecast that are beginning to border on the improbable.

-

Täna turul käive ikka täiesti kokku kuivanud, isegi SPY-l hea kui sinna 130-140 mio vahele päeva lõpuks kokku tuleb.

-

Ja isegi päeva lõpuks ei lisandunud käivet, kuid indeksitelt uued 2009 aasta tipud sulgemisel vormistatud.

-

Salesforce.com prelim $0.16 vs $0.16 First Call consensus; revs $331 mln vs $324.43 mln First Call consensus

Salesforce.com sees Q4 $0.14-0.15 vs $0.15 First Call consensus; sees revs $340-342 mln vs $334.58 mln First Call consensus -

Autodesk prelim $0.27 vs $0.23 First Call consensus; revs $417 mln vs $415.24 mln First Call consensus

Autodesk sees Q4 $0.19-0.24 vs $0.25 First Call consensus; sees revs $420-440 mln vs $433.48 mln First Call consensus

Autodesk sees FY10 $0.88-0.93 vs $0.90 First Call consensus; sees revs $1.68-1.7 bln vs $1.69 bln First Call consensus

CRM ja ADSK mõlemad ~5% languses. -

Peaks kiitvalt mainima ka AEZ, mis eile +13% ja täna +7%

ja PAL eile +10%, täna +3% -

kas Läti täna 18ndal suletud ?

-

jah, kuni epideemia lõpuni...

-

Lätis täna iseseisvuspäev: http://et.wikipedia.org/wiki/Vikipeedia:Valitud_s%C3%BCndmused/november

-

sellist asja peaks oma naaberriigi kohta ikka teadma, häbi häbi mulle

-

matu111

aga millal on Soome iseseisvuspäev ? -

üldiselt on see viktoriiniküsimus:

http://www.alavere.edu.ee/joomla/index.php?option=com_content&view=article&id=55:malumang&catid=6:teated&Itemid=8

aga paneme selle teema lukku nüüd.