Börsipäev 19. november

Kommentaari jätmiseks loo konto või logi sisse

-

Eile kergelt negatiivsel territooriumil lõpetanud USA turud pole täna hommikul suutnud pakkunud Aasia indeksitele katalüsaatorit kindla suuna võtmises, mistõttu on liikumised seal jäänud võrdlemisi erisuunaliseks: Jaapan -1.3%, Hiina +0.3, Austraalia +0.2%.

USA makro osas langeb fookus esmaste töötuabiraha taotlejate arvule (kl 15.30), kui konsensus ootab läinud nädala numbriks 504 000 ehk tõusu 2000 võrra üle-eelmise nädala 502 000 suhtes. Continuing claims näitajaks prognoositakse 5 598 000 (eelmisel korral 5 631 000). Kella 17.00 ajal avaldatakse juhtivindikaatorid ning Philadelphia Fed indeks.

-

Nagu Erko juba kirjutas, siis kell 17.00 teatatakse oktoobrikuu juhtivad indikaatorid, millelt oodatakse 0.4%list tõusu (septembris oli +1.0%). Ärikliimat kajastavalt Philadelphia Fed küsitluselt oodatakse 12.2 punktilist näitu (oktoobris oli 11.5 punkti).

-

USD on EUR vastu juba ca 0.7% tugevnenud ning USA tähtsamad futuurid müügisurve all. S&P500 indeksi futuur -0.5% @ 1103 punkti.

-

Pankade agressiivse laenutegevuse ja inflatsioonihirmu najal kujuneva kinnisvaramulli eest Hiinas on hoiatanud nii kohalikud valitsusametnikud kui ka paljud analüütikud, ent eelmise aasta korrektsioon näib olevat justkui liiga kauge mälestus. Samal teemal kirjutas eile FT, milles riigi ühe edukaima erakätes oleva kinnisvarafirma Soho China juht Zhang Xin nendib järgmist:

"In Manhattan, they have vacancy rates of 10-15 per cent and they feel like the sky is falling, but in Pudong [the central business district in Shanghai] vacancy rates are as high as 50 per cent and they are still building new skyscrapers,” she said.

“If you look at GDP growth, then China looks like a new engine driving the global economy, but if you look at how growth is being created here by so much wasteful investment you wouldn’t be so optimistic.”

-

Väga huvitav kommentaar FBR Capitalilt Inteli ja kogu PC turu osas:

Intel: FBR Capital's 4Q09 PC build forecast worsens vs prior checks, now set to decline 1.5%. FBR Capital notes their checks into 4Q PC builds with the top five notebook ODMs and top four desktop motherboard makers are worse than our month-ago checks. Overall, they forecast 4Q PC builds to decline --1.5% q/q, worse than month-ago forecast of +5% growth q/q. Firm's contacts now expect notebook builds to grow +9% q/q (vs month-ago checks of +11.5%). Desktop builds are forecast to decline --16.5% q/q (vs month-ago checks of --4.5% q/q). The negative revision to 4Q motherboard builds is due to lower-than-expected October shipments, some component shortages, and a possible 3Q build-ahead. The slight negative revision to 4Q notebook builds is due to lower-than-expected demand for consumer ultra-low-voltage models. Firm leaves Intel 4Q financial estimates unchanged for now, but note a negative bias to estimates and will wait until they conduct their next round of checks one month from now before potentially cutting estimates. Firm maintains Market Perform rating with $27 tgt.

-

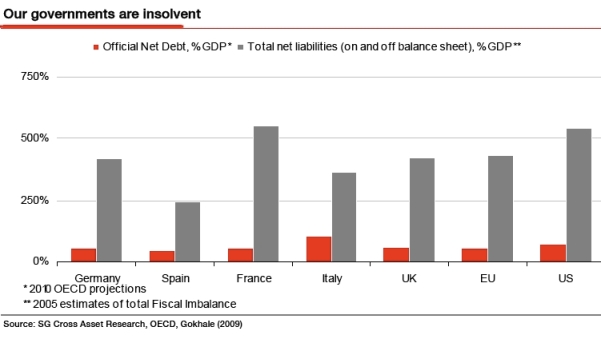

Maiade kalender pole ainus, mis 2012. aastal globaalset katastroofi ette kuulutab. Societe Generale’i halvima stsenaariumi kohaselt ähvardab maailma järgmisel kahel aastal tõsisem krahh, kui riigid ei võta midagi ette oma kasvava võlakoormaga. Isegi ilma lisakulutuste paisuks Suurbritannia avaliku sektori võlg 105%-ni, USA ja eurotsooni oma 125%-ni ning Jaapanil 270%-ni SKT-st järgmise kahe aasta jooksul. Ohjeldamatu laenamise jätkumine muudab ebastabiilseks maailmamajanduse, nõrgestades dollarit ning põhjustades langust aktsia- ja kinnisvaraturul. Nafta kukuks panga sõnul 2010. aastal 50 dollari juurde. Mis aitaks meie ostujõudu sellise stsenaariumi korral säilitada? Muidugi kuld. Paralleelselt leiab üks SocGeni analüütik, et 6300 dollarit väärismetalli ühe untsi eest maksta pole sugugi võimatu.

-

Aga kui nüüd mõtlema hakata... siis äkki maiad nägidki maailma lõppu selles, et kõik maailma rahamasinad olid 2012. aastaks töösse pandud ja enam ei saanudki raha juurde printida? Päikesetormidest rääkimine oli üksnes kujundlik, sest ju raha ongi tänapäeva majanduste päike....

-

Joel sa teed nalja eks ?

-

tegelikult asi hoopis nii, et sarnaselt Societe Generalele oli maiade 2012 maailmalõpu ennustus "worst case scenario", aga parematest variantidest vaikitakse

Societe Generalel on olemas ka paremaid stsenaariumeid, paljude makroandmete ennustamisel on nende prognoosid vahemiku ülemises otsas - näiteks tänase Philadelphia Fedi ootus on neil 17, aga 56 analüütiku keskmine ootus 12,2 ja mediaan 12,6 -

Lisaks FBR Capitali kommentaarile kirjutab BofA ML:

"Our industry model suggests that following a period of rapid replenishment of inventory and normalization of semi shipments to 'true' consumption levels, inventories in the supply chain are approaching a level suggesting a modest overshoot vs. equilibrium levels," (marketwatch)

(eile langetas BofA ML Inteli ostusoovituse neutraalse peale).

-

Võib arvata, et ei lähe kaua, kui Tavid selle SocGeni analüütiku Gold @ 6300 nägemuse endale esilehele riputab.

-

huvitav, kas on ka selliseid analüütikuid, kelle jaoks maailmalõpp alles aastal 2012 on enam-vähem "best case scenario"?

:-) -

kristjan, Joeli jaoks on, siis ta saab öelda "mul oli õigus" :)

-

Henno-Henno... mul oli ju küsimärk ikka lausel lõpus ju. Ja samuti ka kohustuslik diskleimer : )

-

Initial Claims 505K vs 504K consensus, prior revised to 505K from 502K; Continuing Claims falls to 5.61 from 5.65 mln

-

Euroopa turud:

Saksamaa DAX -0.64%

Prantsusmaa CAC 40 -0.71%

Inglismaa FTSE 100 -0.54%

Hispaania IBEX 35 -0.73%

Rootsi OMX 30 -0.83%

Venemaa MICEX -1.41%

Poola WIG -1.07%Aasia turud:

Jaapani Nikkei 225 -1.32%

Hong Kongi Hang Seng -0.86%

Hiina Shanghai A (kodumaine) +0.52%

Hiina Shanghai B (välismaine) +0.81%

Lõuna-Korea Kosdaq +0.68%

Tai Set 50 -1.39%

India Sensex 30 -1.25% -

Time for Defense

By Rev Shark

RealMoney.com Contributor

11/19/2009 8:15 AM EST

Defense is superior to opulence.

-- Adam Smith

Early indications show that the market will open a bit soft this morning. There isn't any particular bad news out there other than some downgrades of Intel (INTC) , Texas Instruments (TXN) and the semiconductor sector, but even after two days of fairly flat action, the indices are still somewhat technically extended and in need of further consolidation. There hasn't been any bad news lately to provide an excuse for sellers to lock in gains, but overseas markets have been weaker and we have the weekly unemployment claims number coming up. There is a little nervousness in the air, and that is why we are soft.

The dilemma of this market right now is that the indices, other than the small-caps, have been acting very healthy. They are a bit extended and we have not had volume patterns that support us very well, but there is obviously strong underlying support from the dip-buyers. We also have positive seasonality as the year winds down and there hasn't been anything surprisingly bad to scare the bulls. The biggest negative we have is probably a fair amount of complacency, but until the bulls feel some fear, that isn't going to matter much.

Since this rally began back in March, it has progressed in the face of great skepticism and doubt. So many of the bulls are in because the trend is up, but they don't really believe in this market and will be quick to hit the exits once we start to struggle. There has been some very aggressive dip-buying because the market has not provide easy entries, but this underlying support is likely to dry up fairly fast if we ever have a few failed bounces.

The bounces have been so fast and furious for so long that traders continue to make them self-fulfilling to some degree. It is only when we have a series of failed bounces that the trend will start to shift. It looked like that was starting to happen at the end of October but once again we pulled off a remarkable recovery at the start of November and went up on declining volume to make a new high once again.

We have been wavering on the edge of a new high for a few days now, but I've been finding it extremely difficult to find new buys because so many charts are too extended on light volume. I've found that a focus on individual charts often serves as a good timing device. If charts are too extended or not set up well, you end up with more idle cash and that helps you to be out of the market when we are most prone for a correction.

The bears have a chance to get a little action going this morning but it is too early to count out the dip-buyers. We'll see how weekly claims look and gauge the mood for some profit-taking, but at this point all we have is a slightly extended market that needs consolidation. We'll just have to wait and see whether it turns into something more troubling.

It wouldn't hurt to tighten up stops and/or consider some hedges at this point. Some defense after the move we have seen looks like a good idea.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ALN +28.5% (light volume), DCI +7.1%, CYBX +4.9%, NTAP +4.3%, SHLD +3.7%, STP +3.5%, WSM +3.4%, TSL +2.9%, SMRT +2.7%... Other news: SRZ +10.5% (completed the sale transaction for 21 wholly owned assisted living communities, located in 11 states, with BLC Acquisitions), XIDE +9.4% (supplying batteries for all-new Toyota Highlander), BTE +5.1% (Cramer makes positive comments on MadMoney), GERN +3.3% (presents interim clinical data on its telomerase inhibitor drug at AACR-NCI-EORTC), SYX +3.3% (declares $0.75 per share special dividend), OC +2.1% (Cramer makes positive comments on MadMoney), WSO +1.9% (Cramer makes positive comments on MadMoney)... Analyst comments: SOLF +1.9% (upgraded to Outperform at Oppenheimer).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CMED -17.4%, HOTT -12.0% (also downgraded to Underweight from Neutral at Piper Jaffray, downgraded to Sell at Citigroup), DKS -7.3%, SMTC -6.8%, GYMB -3.2%, JACK -2.7%, ROST -2.6%, WGOV -2.4%, PETM -1.1%... Select metals/mining names showing early weakness with strength in the dollar: GOLD -3.1%, BHP -2.4%, BBL -2.2%, SLW -2.1%, RTP -1.8%, MT -1.7%, VALE -1.6%, GLD -1.1%, GG -1.1%, SLV -1.0%... Select financial related names trading lower: AIB -5.6%, DB -3.0%, BBV -2.3%, HIG -2.0%, UBS -1.9%, CS -1.8%, SIVB -1.8% (prices 7.8 mln common share offering at $38.50/share), HBC -1.8%... Select oil/gas names showing weakness: RDS.B -2.1%, RDS.A -1.5%, SU -1.5%, DVN -1.1%... Select shipping related names trading lower: NMM -8.1% (announces public offering of 4 mln common units), ESEA -5.6%, NM -4.2%, EGLE -4.0%, FRO -3.6%, DSX -3.2%, GNK -2.7%, DRYS -1.8%... Other news: AFFY -6.1% (announces proposed public offering of common stock), DPM -5.3% (to expand presence in Michigan with $45.1 mln acquisition of gas gathering and treating assets; also announces it has commenced a 2.5 mln share common unit offering), TEN -2.5% (prices 12.0 mln common shares at $16.50/share), NOK -2.4% (still checking for anything specific), CEDC -1.7% (prices 10.25 mln common share offering at $31.00/share), MVIS -1.0% (announces proposed public offering of common stock)... Analyst comments: LSI -4.7% (downgraded to Neutral at BofA/Merrill - Reuters), ASML -4.5% (downgraded to Neutral at BofA/Merrill), NSM -4.0% and MXIM -4.0% (downgraded to Underperform at BofA/Merrill - Reuters), PGR -3.8% (downgraded to Underperform at BofA/Merrill), INTC -3.1% and TXN -2.9% (downgraded to Neutral at BofA/Merrill - Reuters), ARMH -2.9% (downgraded to Underperform at BofA/Merrill), MRVL -2.7% (downgraded to Neutral at BofA/Merrill - Reuters). -

Saudid toetavad dollarit:

IMF's SDR can't replace US dollar as reserve currency, Saudi central banker says - DJ. -

November Philadelphia Fed 16.7 vs 12.2 consensus, October 11.5.

Q3 Mortgage Delinquencies 9.64%, prior 9.24%.

October Leading Indicators +0.3% vs +0.4% consensus. -

Societe Generalel tänase Philadelphia Fedi ootus oli 17, aga tuli 16,7ehk täpne ennustus ... ehk siis aastal 2012 ootabki meid ees suure tõenäosusega globaane katastroooof ?!

-

Follow-up: Haven't heard anything specific out of the Senate Finance Cmte hearings that would have lit a fire under MA and V (see 10:54)... Still checking to see if the sudden spike in these names is news-related

-

Moody's says U.S. commercial real estate prices continue decline in September - Reuters

-

MasterCard: Hearing Credit Suisse out very postive now on MA and V, following GAO report

-

Peale esimest pooltundi turgudel taas tavapärane muster, kus ilma käibeta lihtalt tiksutakse üles.

-

Dell prelim $0.23 vs $0.28 First Call consensus; revs $12.9 bln vs $13.18 bln First Call consensus