Börsipäev 20. november

Kommentaari jätmiseks loo konto või logi sisse

-

Täna on USA börsidel tegu selle kuu kolmanda reedega ehk siis optsioonireedega, mil väljakirjutatud novembrikuu optsioonid lõppevad. Reeglina tähendab see, et suurematel aktsiatel ja indeksitel on kombeks ümmarguste numbrite juures sulguda, kuhu on kõige rohkem optsioone välja kirjutatud. Muidugi kui turud on närvilised, siis võivad ka liikumised olla suuremad.

Samuti on täna meie Börsihai viimane kauplemispäev. Viimane võimalus näidata oma teravaid haihambaid ning tabelis kõrgemale rühkida.

Olulisi makroraporteid USAst täna tulemas ei ole. Eelturul on USA tähtsamate indeksite futuurid ca -0.2% kuni -0.4%. -

Nokia teatas täna, et plaanib kaotada 330 R&D osakonna töökohta. Aktsia Helsingis -1.2% miinuspoolel.

-

See kids, this is how we catch Apple!

-

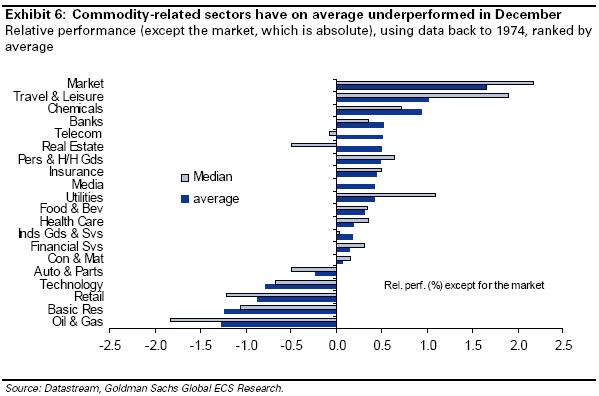

Kui jõulud peaksid jälle mustad tulema siis vähemalt investoritele annab aktsiaturgude detsembrikuu track record põhjust loota, et pühad tulevad sellegipoolest rõõmsad, leiab Goldman. FT Alphaville vahendab analüüsimaja kodutööd, milles on uuritud Euroopa turgude jõulukuu tootlusi alates 1974. aastast ning jõutud järeldusele, et detsember on osutunud keskmiselt kaks korda tulusamaks võrreldes eelneva 11 kuu keskmisega (1.7% versus 0.8%).

The better the performance has been from January to November, the more positive the return has tended to be in December.

We believe that this year is likely to exhibit a similar pattern. The market is up around 25% since the beginning of the year and we believe that the aforementioned concerns, although important, should not drive the market down.

Aga kuna käesolev aasta on juba korduvalt turgude hooajalisusest tingitud tõekspidamisi kummutanud, võiks teatud skepsisega detsembri rallisse siiski suhtuda.

Ajaloolised numbrid näitavad, et eemale taskuks aasta lõpus kõige rohkem hoida energiast, jaemüügist, tehnoloogiast.

-

DR Horton misses by $0.43, misses on revs. Reports Q4 (Sep) loss of $0.73 per share, $0.43 worse than the First Call consensus of ($0.30); revenues fell 34.6% year/year to $1.01 bln vs the $1.11 bln consensus.

-

Euroopa turud:

Saksamaa DAX -0.77%

Prantsusmaa CAC 40 -0.80%

Inglismaa FTSE 100 -0.61%

Hispaania IBEX 35 -0.78%

Rootsi OMX 30 -0.25%

Venemaa MICEX -1.12%

Poola WIG -0.46%Aasia turud:

Jaapani Nikkei 225 -0.54%

Hong Kongi Hang Seng -0.83%

Hiina Shanghai A (kodumaine) -0.19%

Hiina Shanghai B (välismaine) +0.53%

Lõuna-Korea Kosdaq +0.77%

Tai Set 50 -0.84%

India Sensex 30 +1.41% -

The Never-Ending Argument Continues

By Rev Shark

RealMoney.com Contributor

11/20/2009 8:37 AM EST

I argue very well. Ask any of my remaining friends. I can win an argument on any topic, against any opponent. People know this, and steer clear of me at parties. Often, as a sign of their great respect, they don't even invite me.

-- Dave Barry

Over the last three days, the rally that began at the end of October has begun to struggle. After two days of no progress on Tuesday and Wednesday, selling became a bit more aggressive on Thursday. In view of how fast we moved off the low we hit on Nov. 2, the pullback is still very mild, but it is good time to step back and weigh the plusses and minuses out there.

If you pull up a chart of the S&P 500 going back a year or so, the bullish case is obvious. We have been in an extremely powerful uptrend since March, and there is nothing to indicate that the trend is shifting. Ever since the move started eight months ago, market players have been trying to guess when we would top out and have been proved wrong again and again as the bulls keep things jumping.

To a great degree, this move has been driven by a weak dollar and a huge amount of liquidity created by the numerous bailouts and giant stimulus plans -- there are lots of very cheap dollars out there with nowhere else to go. That is the fuel that has been driving us, and there is nothing to suggest that it is about to come to an end. In fact, Congress is now talking about trying to enact a new jobs bill before the end of the year.

The bulls are also optimistic about traditional end-of-the-year seasonality. Seasonality is just a tendency and not a certainty, but the bulls argue that with so many money managers struggling to keep up with the indices this year, there is likely to be some efforts to catch up by chasing stocks higher.

The bearish case here is more difficult to make. We have had fundamental arguments throughout this rally that just haven't mattered. We all know that the real economy is not recovering at a pace anywhere near what the stock market is reflecting. Unemployment and its impact on consumer spending and sentiment can't be denied, and the problem of unwinding the monetary accommodation is going to be tremendous.

It is far easier to make a negative economic argument than a positive one, but the market is just not buying the bearish case yet. At some point the market will fall hard and the economic arguments will be cited as the reason, but it just isn't happening yet.

But the bears aren't completely without ammunition. We've seen a few troubling developments recently. During third-quarter earnings season we consistently saw selling on good news. We kept coming back from those selloffs, but good news has not been the same driving force as it was.

Another negative is the underperformance of small-caps and the narrowing of the market. The indices have been driven to a great degree by a handful of big-cap technology stocks, namely Amazon (AMZN) , Apple (AAPL) , Google (GOOG) , IBM (IBM) , Baidu (BIDU) and a few others. There are few hot pockets of momentum, and we seem to be highly dependent on further weakness in the dollar as a catalyst for oil, gold and other commodity stocks.

The overall picture is still positive, but we have to watch carefully to see if the cracks begin to expand. We have a little softness this morning on comments out of China about some slowness in its economy. That is pushing the dollar up and causing some weakness.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: HIBB +10.7%, VRGY +9.8%, CRMT +6.3% (light volume), DBRN +6.0%, SJM +5.2%, KIRK +2.0%... Other news: STXS +4.6% (still checking), TWB +4.3% (DBRN said the acquisition of TWB continues to progress with an anticipated completion date of November 25, 2009), IMGN +3.2% (light volume; announces second license taken by Amgen for right to use the company's TAP Technology), IBN +2.8% (light volume; lowers yld in bond sale, according to source - Reuters.com), MTXX +2.6% (files FDA Response Letter on nasal products)... Analyst comments: DDS +5.6% (upgraded to Buy at Deutsche), LINTA +2.4% (upgraded to Buy at Citigroup), AFL +1.1% (upgraded to Overweight at Morgan Stanley).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ADCT -14.8%, CHOP -10.3%, WTSLA -9.1%, DELL -6.6%, ARUN -6.1%, DHI -5.3%, FL -4.6%, INTU -2.5%, ANN -2.2%... Select financial names showing early weakness: ING -4.3%, DB -3.2% (Deutsche Bank CEO says 2010 to be another challenging year for banks - DJ), BCS -3.2%, LYG -3.0%, UBS -3.0%, RBS -2.7%, HBC -1.5%... Select metals/mining related names trading lower: HL -3.5%, PAAS -3.4%, GSS -3.4%, GOLD -3.1%, RTP -3.0%, IAG -2.8%, AU -2.7%, BBL -2.4%, BHP -2.1%, VALE -1.5%, ABX -1.3%, GG -1.2%... Select oil/gas related names trading lower: BP -2.3%, RDS.A -2.2%, TOT -1.9%, COP -1.0%... Select European drug names seeing weakness: AZN -1.8%, SNY -1.4%... Other news: EFUT -21.4% (announces its unaudited financial results for Q2 2009 and restatement of unaudited financial results for Q1), NVAX -12.5% (announces that it intends to offer shares of its common stock in an underwritten public offering), DRYS -5.1% (priced public offering of convertible senior notes; the offering size was increased from $300 mln to $400 mln), BCRX -4.3% (prices 5.0 mln common share offering at $9.75/share), LOGM -3.0% (announced the pricing of 3,125,000 shares of its common stock at $18.50 per share), NOK -2.8% (plans to align its research and development operations in Finland and Denmark), TLEO -2.4% (announces that its public offering of 6,500,000 shares of Class A common stock has been priced at $20.25 per share), PHM -2.2% (Cramer makes negative comments on MadMoney), BP -2.2% (still checking), WCRX -1.9% (prices 20.0 mln ordinary share offering at $22.25/share)... Analyst comments: FFIV -4.0% (downgraded to Hold at Auriga), FRED -3.5% (downgraded to Underweight at JPMorgan), NGD -3.0% (downgraded to Underperform from Sector Perform at Scotia Capital), CSX -2.3% (downgraded to Hold from Buy at Stifel Nicolaus), BTU -2.1% (removed from Conviction Buy list at Goldman - Reuters), D -1.9% (downgraded to Sell at Citigroup), VRSN -1.7% (downgraded to Neutral at Wedbush Morgan), RIMM -1.2% (downgraded to Neutral from Buy at FTN Equity). -

Oskab keegi öelda miks yahoo lehel EDC optsioonide butidel vahepeal mõned targetid puudu ja miks hindades muutust pole?

-

Kuna üsna paljudel tõusu ETF-idel toimub dividenimakse ja seetõttu kauplemas ka madalamal.

-

Mõistan aga mul endal on 145 PUT optioon tahaks umbeski teada mis väärtus sellel on hetkel kuna täna peab seda müüma

-

To:Barabas

Siin peaks olema hinna korrigeerimise kohta uudised üleval: http://www.optionsclearing.com/ -

Extraordinarily tight range in this usual momo favorite, $0.50 over the past hour

Optsioonireede mängud:) -

Norway reports mutated H1N1 virus - WSJ

-

On mingit põhjust CHK-l langemiseks?

-

Alari,oskad Sa öelda,miks BRP halted alates teisipäevast,samas kauplemine teise brasil telecom instrumendi BTM-i jätkub

Alari, oskad Sa öelda,miks BRP halted alates teisipäevast, samas teise brasil telecomi instrumendi BTM kauplemine jätkub.Kusagilt ei leia mingit infi. -

To:blackfox

BTM võttis üle 17.11.2009 -

Sprint Nextel: Moody's downgrades Sprint Nextel's ratings; outlook negative

-

Turul täna siis tavaline kohal tammumine, kus käive vajus ikka väga ära. Nt: SPY ~130 mio on ikka väga väike.