Börsipäev 1. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Tänase päeva tähtsaimad makrosündmused USAs: kell 17.00 teatatakse USA oktoobrikuu ehituskulutuste muutus (septembris oli see +0.8%, nüüd oodatakse -0.5%), novembrikuu ISM indeks (ootus 55.0 punkti) ning oktoobrikuu pending home sales (ootus -1.0%).

Õhtul kella 21 ajal teatatakse novembrikuu sõidu- ja veoautode müüginumbrid. -

Ja kel tõsise kauplemise vastu suur huvi, soovitan kindlasti hoida end kursis abesiki poolt algatatud portfell 'P' tehingutega (link foorumile siin). Abesiki on aastate jooksul oma kauplemisoskust tõestanud ning tehingute põhjusi, edu ja ebaedu vaagides on kauplemisega algust tegevatel huvilistel sealt väga palju õppida. Ning miks mitte ka teistel kauplejatel hea võimalus tehingute kohta sõna sekka öelda või ideid välja käia.

Mul on hea meel näha abesiki, et portfell 'P' reaalsuseks sai!

-

-

Nii kaua ku Austraalia keskpank on tegutsenud, pole rahapoliitika koordineerija kordagi varem oma ajaloos intresse kergitanud kolmel järjestikul kohtumisel - pretsendent, mis aga loodi täna, kui laenumäära tõsteti 25 baaspunkti võrra 3.75%-le. Veel septembris oli see poole sajandi madalaimal tasemel (3%). Laenukulude tase on nüüd keskpanga juhi sõnul piisav, et hoida iflatsiooni 2-3% vahemikus, mis viitab hingetõmbepausile intresside tõstmises vähemalt märtsi alguseni.

-

ei saa mainimatta jätta taas Dubaid kes avamisel taas -9%

-

tegelikult võiks jätta küll selle matta

-

Saksa valitsuse poliitika finantseerida osalisele tööajale viidud inimeste palgakärbet ('Kurzarbeit') on aidanud riigil vältida tööpuuduse kiiret kasvu vaatamata tööstustoodangu, ekspordi ja SKT kukkumisele. November oli tegelikult juba teine kuu sel aastal, kui tööpuudus hoopis vähenes, alanedes oktoobri 8.2%-lt 8.1%-le (eurotsooni keskmine oli septembris 9.7% ehk 11 aasta kõrgeim), samas kui analüütikud olid oodanud tõusu.

-

USA futuurid on eelturul korralikult ülespoole rühkimas. S&P500 indeksi futuurid +0.8% @ 1104; EUR/USD +0.4% @ €1=$1.506

-

EUR/USD kursil jääb 5 pipsi puudu, et 25 novembril saavutatud 1.5080 taset puudutada ning kuld teeb selle peale uue päevasisese rekordi.

-

Erinevalt Austraalia keskpankuritest teatas hommikul Jaapani Keskpank, et hoiab intressimäärade 0.1% juures ja pakub pankadele odavalt lühiajalisi laene, et võidelda deflatsiooniga. Pärast Tokio börsi sulgemist toimunud erakorraliselt kohtumisel ei tutvustatud aga QE meetmeid ja ei mainitud valitsuse võlakirjade ostmise suurendamist, mis oli paljudele pettumus.

-

& siin veel Jaapani Keskpanga enda sõnad:

"While Japan's economy is picking up, there is not yet sufficient momentum to support self-sustaining recovery in business fixed investment and private consumption. As for the outlook, the pace of economic improvement is likely to remain moderate until around the middle of fiscal 2010." (avaldust saab lugeda siit)

Seega riikide lõikes hakkab pilt erinevaks muutuma - nt Austraalias pole erakorralist abi enam vaja, kuid riigid nagu Jaapan & USA tunnistavad, et stiimuleid on kindlasti veel vara lõpetada (turud rallivad muidugi sõltumata kasvuallikast mõlemas grupis).

-

Ühtlane roheline toon võimutsemas globaalsetel turgudel. Samal lainel tõotavad avaneda ka USA indeksid, mile futuurid kauplevad hetkel +0,8% kõrgemal

Euroopa turud:

Saksamaa DAX +1,89%

Prantsusmaa CAC 40 +1,90%

Inglismaa FTSE 100 +1,70%

Hispaania IBEX 35 +1,54%

Rootsi OMX 30 +1,56%

Venemaa MICEX +2,26%

Poola WIG +1.10%Aasia turud:

Jaapani Nikkei 225 +2,43%

Hongkongi Hang Seng +1,34%

Hiina Shanghai A (kodumaine) +1,25%

Hiina Shanghai B (välismaine) +1,96%

Lõuna-Korea Kosdaq +1,02%

Tai Set 50 +3,5%

India Sensex 30 +1,61% -

Rev Shark: Watch for the New-Month Pattern Today

12/01/2009 8:39 AMOnce in motion, a pattern tends to stay in motion.

-- J.G. GallimoreFears over the Dubai debt crises are abating as Dubai World announced that it needs to restructure just $26 billion in debt and anticipates that a deal will be done quickly. European and Asia stocks jumped on the news and we are looking at a strong opening in the U.S. as well.

One of the things that have been so amazing about this market since March is how quickly we have recovered from each dip. Not only do we recover quickly, but once we start to run back up we seem to continue without pause. The smart move has been to jump in and ride the move and don't even think about the short side.

Today is the first day of December, and we have had a tendency this year for very strong action at the beginning of the month. In fact, in every month since the low in March we have strength in the early days of the month and then weaker action at the end of the month. November followed that script quite well with the dip on Friday. Some say that this pattern is due to new money coming into pension plans and funds. I'm not sure if that is the driving force, but the pattern is very clear and with the strong open this morning it is intact.

There have been some negatives in the market action lately, most notably the narrowness of the leadership, weakness in financials, frothy bullish sentiment, low volume and underperformance by small-caps. Those are all warning signs, but this market has done an exceptional job in ignoring all the traditional negatives. That is a big part of what has made it a very tricky and disliked market.

The mood feels very upbeat this morning, and once we start off strong, the pattern is for it to continue the rest of the day. Intraday reversals to the downside have been extremely rare lately, and I would not try to anticipate one today.

There hasn't been a lot of strong momentum in individual stocks lately, but I continue to like the action in China small-caps in particular. We really need the market to broaden out a bit for a better rally, but the bulls are looking feisty once again, and they may be looking for some new ideas to buy today.

-

Suuremad liikujad eelturul:

Gapping down in reaction to disappointing earnings/guidance: LTON -10.6%, OVTI -6.2%, NJR -1.5%... Other news: NLST -14.1% (Inphi Corp files lawsuit against Netlist), PLX -8.7% (Protalix BioTherapeutics and Pfizer enter into agreement to develop and commercialize Gaucher's disease treatment), SD -6.2% (to acquire Permian Basin properties for $800 mln; to offer 22 mln in common stock; to sell 2 mln shares of preferred stock for $200 mln), EXXI -5.8% (Announces Concurrent Offerings of Common Stock and Convertible Perpetual Preferred Stock), AGO -5.3% (announces 23.924 mln common share offering), VNR -4.4% (announces public offering of 2.25 mln common units), AIB -3.6% (Allied Irish Banks to suspend dividends - Reuters.com), HGSI -2.9% (announces proposed public offering of common stock), AXA -1.6% (trading ex dividend), ED -1.3% (announces public offering of 5 mln common shares), ICFI -1.1% (announced that it has commenced an underwritten public offering of 3.1 mln of its shares of common stock)... Analyst comments: NUVA -1.2% (downgraded to Mkt Perform at JMP Securities, downgraded to Hold at Brean Murray).

Gapping up in reaction to strong earnings/guidance: GES +8.5%, ALTR +4.1%, SPLS +2.9%... Select financial related names showing strength: UBS +2.4%, HBC +2.1%, STD +1.4%, CS +1.3%... Select metals/mining names trading higher: HL +3.6% (declares payment of preferred stock dividends in arrears and current preferred dividends), HMY +3.2%, RTP +3.0%, SLW +2.7%, GDX +2.6%, IAG +2.5%, GFI +2.4%, BBL +2.0%, BHP +1.5%, MT +1.4%... Select oil/gas names showing strength: BP +2.2%, XOM +2.1%, TOT +1.9%, PBR +1.8%, COP +1.6%... Select European drugs names trading higher: SNY +2.2%, AZN +1.4%... Other news: HDY +8.7% (signs agreement for exclusive dealing and letter of intent with Repsol for interest in offshore Guinea Oil and Gas concession), SYMX +8.2% (Synthesis Energy Systems and East China Engineering Corporation to collaborate on U-GAS technology projects), AIG +3.5% (moving forward with separation of ALICO), SVA +3.2% (obtains fourth H1N1 vaccine order from Chinese Central Government; Sinovac is required to produce an additional one million doses of PANFLU.1 ), BCRX +3.1% (strength attributed to report that Japan Health Ministry on Monday granted Shionogi & Co. a priority review for its peramivir influenza treatment), MDCO +2.7% (confirms it receives European approval for Angiox for use in heart attack patients undergoing emergency heart procedures), ERIC +2.4% (still checking), WSM +2.1% (Cramer makes positive comments on MadMoney), LOW +2.0% and HD +1.0% (WSJ reports the Obama administration is talking about home improvement incentives), NWL +1.4% (Cramer makes positive comments on MadMoney), F +1.2% (Geely taps China banks to back $1.8 billion Volvo deal - FT), JAH +1.1% (Cramer makes positive comments on MadMoney), GE +1.4% and CMCSA +2.7% (GE, Vivendi forge tentative deal on NBC stake - WSJ)... Analyst comments: NVAX +3.3% (initiated with Overweight at Piper), PKG +2.9% (added to U.S. Focus List at Credit Suisse), KGC +2.6% (upgraded to Overweight from Neutral at JP Morgan), FITB +2.6% (upgraded to Buy at Citigroup), ANR +2.2% (initiated with Buy at BofA/Merrill).

-

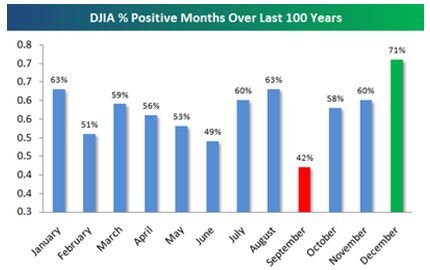

Enne USA avanemist veelkord meeldetuletuseks, et täna alanud detsember on ajaloos võrreldes teiste kuudega vaieldamatult kõige sagedamini kuu positiivselt lõpetanud (link graafikule):

-

Selleks, et nii volatiilsel aastal window-dressing'u efekt päris tore ei ei oleks, peaks ikka midagi väga "põnevat" juhtuma...

-

ISM kehv ja ülejäänud data peale esimene reaktsioon "sell the news"... aga juba hüpatakse üles tagasi:

November ISM Manufacturing 53.6 vs 55.0 consensus, October 55.7

October Pending Home Sales MoM +3.7% vs -1.0% consensus, prior +6.1%

October Construction Spending M/M 0.0% vs -0.5% consensus, prior revised to -1.6% from +0.8%

-

Kinnisvaraturg on USA majanduse jaoks väga oluline. pending home sales oli tugevalt üle ootuste.

October Pending Home Sales MoM +3.7% vs -1.0% consensus

ilmselt see turule meeldibki. -

Ma paneks ISMile turu jälgimisel korralikult rõhku - näitab hästi majanduse tervist. ISMi vajumine alla 50 viitaks korralikule nõrkusele majanduses & oleks ilmselt üks esimesi suuremaid müügisignaale.

-

ISM alla 50 näitab contractioni, üle 50 aga expansioni. Kuna valdav osa instantsidest ennustab USA majandusele lasvu nii 4Q09, kui 2010 ja edasi, siis ISMi vajumist alla 50 pole niipea mõtet oodata.

-

Fed's Plosser says must hike rates early to protect credibility, prices - DJ

Fed's Plosser says withdrawing liquidity in timely way key to keeping inflation expectations stable - Reuters -

Ford Motor reports November sales of +0.0% vs. +4.1% street expectation

Porsche Cars North America reports November sales in the U.S. increased 18% YoY to 1,626 units

Daimler AG reports November total cars sold for the Mercedes-Benz Cars Division in the U.S. increased 9.1% to 17,446

Subaru of America reports November sales increased 24% to 16,988 units sold

Automüüjatelt esialgu korralikud numbrid -

Thomson: Moody's lowers Thomson's Probability of Default to D

-

Fed's Plosser says dollar's recent decline must be seen in context of its rise during the crisis - Reuters

Ja turg rallib ülespoole. -

Tänase tõusu üheks veduriks on osutunud small-cap-id, kus RUT jõudnud juba +1.81% tõusu ja püsib pealpool 590 punkti.

-

Fed says bankers see positive economic trends - DJ

-

AMZN tänaseks tipuks $139.35 ja hetkel kauplemas $139 ümber. Selles hinnas peaks küll rekordiline jõulumüük sees olema, kui alla jääb võib pettumus üsna suur tulla ja ruumi allapoole küllaga.

-

Las Vegas Sands: Moody's confirms Las Vegas Sands' ratings; assigns negative outlook