Börsipäev 8. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Valdava osa päevast plussis kaubelnud USA indeksid reageerisid negatiivselt Bernanke eilsele sõnavõtule, milles keskpanga juht rõhutas, et Ühendriikide majanduse tervist ähvardavad endiselt mitmed märkimisväärsed tegurid, eelkõige piiratud krediidikättesaadavus ning nõrk tööjõuturg. S&P500 sulgus -0.24% madalamal ning Aasiaski on sentiment kergelt negatiivne.

USA poolel makrouudiseid täna napib, ent Euroopas avaldatakse nii Suurbritannias (kl 11.30) kui Saksamaal (kl 13.00) oktoobrikuu tööstustoodangu numbrid. Kuna eilne tellimuste näitaja Saksamaal osutus oodatust kehvemaks, võib pettumuse valmistada ka tänane toodangu statistika.

-

Reitinguagentuurid on paljude riikide puhul kahtlemas, et edasine majanduskasv ei saa olema piisav kõrge võlakoorma ja eelarve defitsiidi oluliseks vähendamiseks. Moody'se arvates võivad halvenevate finantside tõttu AAA reitingu piiri proovile panna nii USA kui Suurbritannia. Ning alles eile teatas Standard & Poor's, et võib langetada Kreeka praegust A- võlareitingut teist korda sel aastal:

The fiscal consolidation plans outlined by the new government are unlikely to secure a sustained reduction in fiscal deficits and the public debt burden,” a team of S&P analysts led by London-based Marko Mrsnik said in the statement. Without further measures, debt will reach 125 percent of gross domestic product next year, the highest among the 16 countries using the euro, S&P said. The ratings may be affirmed if the government’s strategy is “aggressive enough” to secure a significant and sustained decline in the public debt burden, S&P said. Otherwise, the rating could be cut a step to ‘BBB+

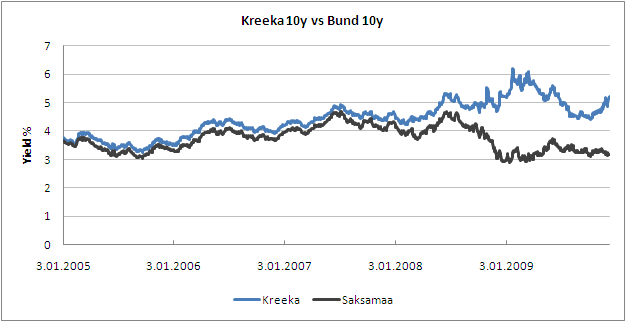

Allolevalt graafikult on näha, et spread Saksa valitsuse 10a võlakirja ja Kreeka ekvivalentse võlakirja tulususe vahel on hakanud taas laienema, kui investorid nõuavad suurema riski tõttu ka kõrgemat intressi. Novembri keskpaiga 140 baaspunktine vahe on nüüdseks kasvanud 202-ni.

-

Navigatsiooniseadmete tootja TomTom on täna ligi 7% tõusus, saades Morgan Stanleylt overweight reitingu. Pärast kolmanda kvartali tulemusi, milles tegevjuht teatas toodete keskmise hinna jätkuvast langusest, jättes ettevõtte edasised väljavaated küllaltki uduseks, on aktsia kukkunud 34% ning kaupleb hekel tippudest ca 50% madalamal. Kuid MS leiab, et hetke hinnatase peegeldab ülereageeringut kaasaskantavate navigatsiooniseadmete turu kollapsi mure tõttu. Analüüsimaja sõnul on aga seadmete nõudlus vastupidavam, kui turg tegelikult ootab.

"On a 5-year view, we do not see TomTom as a core tech holding given the structural uncertainty surrounding its key end- market," they said in a note to clients. "However, we think results over the next 12-18 months will surprise bearish investors"

-

NYTimes on koostanud päris hea ülevaatliku graafiku võimalikest osapooltest, kes võiksid dollari nõrgenemisest kasu saada ning kes kahju kanda. Link

-

Nii Suurbritannia kui Saksamaa tööstustoodangu numbrid osutusid oodatust nõrgemaks. Viimase puhul raporteeriti prognoositud 1%-lise kasvu asemel vähenemist -1.8% võrreldes septembriga, mille näitajat korrigeeriti varasemalt 2.7%-lt 3.1%-le.

Stoxx 600 kaotanud päeva esimeses pooles kätte võidetud 0.2%-lise plussi ning liigub nüüd juba -0.4% punases. -

Enne kui Euroopa hakkas pärastlõunast USA futuure jõulisemalt allapoole tirima, toetas neid eilne FedExi uudis, milles ettevõte ütles, et teise kvartali kasumiga suudetakse lõdvakäeliselt lüüa varasemat prognoosi ning seetõttu kergitati ootust 10% võrra. Tegemist on järjekorras juba teise kvartaliga, mil prognoose ülespoole korrigeeritakse. Mõjuteguritetena tuuakse välja nii kulude kärpimist kui ka tugevat nõudlust lennuteenuste järgi rahvusvahelistel turgudel, eriti aga Aasias ja Ladina-Ameerikas. FedEx ootab seega novembris lõppenud kvartali aktsiakasumiks 1.10 dollarit, kui eelnevaks prognoosiks oli 0,65-0,95 dollarit. Analüütikute keskmiseks ootuseks oli 0,85 USD.

-

3M sees FY10 $4.85-5.00 vs $4.94 First Call consensus; sees revs $24.5-25.5 bln vs $24.46 bln First Call consensus

3M reaffirms FY09 EPS of $4.50-4.55, ex-items vs $4.57 First Call consensus

-

Moody'se arvates võivad halvenevate finantside tõttu AAA reitingu piiri proovile panna nii USA kui Suurbritannia

Turg on kukkunud selle peale 80 centi, kardan, et kukub edasi

http://online.wsj.com/article/SB10001424052748704825504574582303781275842.html -

Kellele pakub huvi, võib pikemalt lugeda Kreeka süvenevatest võlaprobleemidest ning nende võimalikest tagajärgedest ülejäänud Euroopale Spiegel Online'i artiklist. Üks lõik sealt:

As the new Greek finance minister, Giorgos Papakonstantinou, recently announced, the country will need at least four years to get its deficit under control "without jeopardizing the economic recovery." But by then the government deficit will have reached about €400 billion, or about 150 percent of GDP. Servicing that amount of debt, even at current interest rates of about 5 percent, will make up at least one third of government spending

-

Tahaks peaaegu öelda, et short the market.

-

JPM langetas Venemaa overweight soovituse neutraalse peale. Venemaa aktsiaturg on kõrge beetaga & suures sõltuvuses toorainetest. Kui dollari nõrgenemine peaks lõppema & toorainetel on raskusi tõusu jätkamisega, siis on raske leida, mis Venemaa turgu ülespoole liigutab (JPM ei andnud underweight soovitust, kuna katalüsaatorid edaspidiseks tõusuks võivad olla kasvav nõudlus gaasi järele & hapude laenude vähenemine). Micex on sellel aastal kõige enam tõusnud turg & korraliku korrektsiooni oht on suur.

-

Kas mõni Venemaa short play investeerimiskonto alt ka kättesaadav on? RSX lühikeseks müük?

-

Ainult see ongi.

-

Aga selle jaoks on vaja Trader avada?

-

Ei, invest. kontolt saab ka lühikeseks müüa.

-

Mingi viimase aja uuendus, olen nagu vastupidisest pidevalt aru saanud?

-

USA ja UK reitingute kärpimine oleks muidugi huvitav - ma pakuks, et see tooks kaasa järgmise paanika, mille mõjusid alahinnatakse. Samas on sündmuse toimumine pigem ebatõenäoline, sest kui samasuguse jutuga kevadel välja tuldi, siis tegi USA üsna piltlikult selgeks, et käed taskus seda pealt ei vaadataks. Ka reitinguagentuuridel pidavat luukeresid olema...

Nii et win-win situatsioon oleks, kui ainult UK reitingut alandataks. :D -

Olge Venemaaga ettevaatlik, see JPMi downgrade oli eile väljas.

We are tactically downgrading Russia to neutral within global

emerging markets. Our concern is a potential correction in energy and commodity markets. PKX (Posco) and MTL (Mechel) are 2 names that are at risk. -

TaivoS, vaja on aktsepteerida laenu ja võimendusega tehningute eritingimused (seda saab kodulehel teha).

-

Venemaa reitingu alanduse kokkuvõte:

We are tactically downgrading Russia to neutral within global

emerging markets. Our concern is a potential correction in energy and

commodity markets.

• Financial investors are driving commodity markets; year-to-date

inflows are a record US$40 billion, and futures curves are in steep

contango. Investors are overweight on Russian and Brazilian equities.

The risk is a sharp reversal in this consensus trade.

• Potential catalysts for a correction in commodity prices are a strong

dollar, investor fatigue due to the negative carry, and regulatory

intervention. Commodity markets have lost their momentum and the

dollar has recovered following the recent US employment data.

• Russia looks attractive on a 12-to-18-month horizon, given the strong

expected economic and earnings growth plus a larger-than-average

discount to EM. Russia is forecast to experience the largest swing in

GDP growth between 2009 and 2010. But it is high-beta, commoditysensitive,

and a consensus trade. In our view it is prudent risk

management to move from overweight to neutral now.

• A key risk to our view is that flows into commodity funds remain

strong due to the combination of a belief that commodities are an

inflation hedge and record-low risk-free rates. -

Fitch on teinud teoks selle, millega S&P hetkel veel ainult ähvardab ning saatnud Ateena börsi -5%-lisse langusesse. Küsimärgid teiste suurriikide võimes oma kreediidireitinguid säilitada on toonud globaalsetele turgudele riskikartlikkuse tagasi: S&P500 futuur hetkel -0.95%

Euroopa turud:

Saksamaa DAX -1,84%

Prantsusmaa CAC 40 -1,73%

Inglismaa FTSE 100 -1,72%

Hispaania IBEX 35 -1,61%

Rootsi OMX 30 -1,48%

Venemaa MICEX -0,92%

Poola WIG -1,27%Aasia turud:

Jaapani Nikkei 225 -0,27%

Hongkongi Hang Seng -1,18%

Hiina Shanghai A (kodumaine) -1,06%

Hiina Shanghai B (välismaine) -0,61%

Lõuna-Korea Kosdaq -0,23%

Tai Set 50 -0,44%

India Sensex 30 +1,44% -

Rev Shark: Frothy Sentiment + No Leadership = Dangerous Waters

12/08/2009 9:02 AM

Avoiding danger is no safer in the long run than outright exposure. The fearful are caught as often as the bold.

-- Helen KellerOn Friday the indices failed to gain traction on what appeared to be very good jobs numbers. Yesterday we chopped around and went nowhere. This morning we are set to open lower as German industrial production falls and Greek debt is downgraded. We also have Meredith Whitney on CNBC sounding quite bearish once again. She made a timely negative call on Goldman Sachs (GS) a month ago and also did a great job of predicting the rally in July, so market players are understandably paying attention to her.

The market has been chopping around for a couple weeks now, which can be healthy consolidation and setup for some more upside down the road, but the problem now is that recent good news isn't helping the market and we are losing the tailwind of a lower dollar.

For months now, every time it has looked like we were going to crack and roll over, we've come roaring back. The negatives all of a sudden evaporate as the dip-buyers suddenly rush in and the bears scramble to cover shorts.

The question we keep having to ask is, "Will it be different this time?" One of these days the pattern of quick recoveries will be broken, but the million-dollar question is when.

Many of the bulls think that year-end pressures will help to hold the market up at least through December. They believe that many money managers have underperformed and will be trying to catch up by aggressively pursue some big winners.

The big problem is that too many people seem to be looking for that sort of action, and sentiment is extremely positive. In the contrarian world of the market, it's a bad sign when too many people are positive because it means they have most likely already acted on their beliefs. The positive setup in the indices can easily backfire on those who are overly optimistic about the year-end action. If we start to roll over, a lot of folks will be anxious to preserve the gains they already have and they'll move to the sidelines. Maybe they will still lag the indices, but at least they will still have profits to show for it.

The biggest problem I see in the market right now is that we don't have any leadership. Small-caps have acted a little better the last few days, but they topped out back in October and are still in precarious shape. The big-cap technology names, particularly Apple (AAPL), have been weak, and financials can't seem to get anything going on the repayment of TARP, which was supposedly a positive.

The major indices are still in trading ranges, but the underlying action looks tired. Volume is low, and other than a few China, solar energy and fertilizer names, the pockets of strength are quite limited.

The bulls may surprise us yet again and spark a sudden rally, but they have gone to the well so many times and so many people are a bit complacent that they will do it again with the benefit of positive seasonality. It is a dangerous setup and we have to keep our guard up, especially if the dollar continues to rally.

I'm not averse to putting on some long trades, but I'm not seeing many that I like. I'll continue to be cautious while this market churns and tries to figure out its next move.

No positions.

-

Madis,

Kevadel oli UK ja US jutt umbes see, et "US ja UK olid paremad kui Saksa, Kanada jne, aga nüüd lihtsalt sama head" nüüd mainitakse, et halvemad. Oluline positsioonide vahetus mu meelest -

Gapping down:

In reaction to disappointing earnings/guidance: EFUT -24.1%, KR -12.5%, IPSU -12.3% (light volume), CASY -5.3%, PBY -4.5%, MCD -2.4%, MTL -2.1%, MMM -1.6%... M&A news: DDRX -1.6% (Diedrich Coffee enters into agreement with Green Mountain Coffee Roasters to acquire Diedrich for $35.00 cash per share)... Select financial names showing weakness: RBS -7.7% (UK backs 167 bln pounds of overseas bad debt - Daily Telegraph; downgraded to Sell from Reduce at WestLB), NBG -7.0%, IRE -6.6%, BCS -3.7%, HBC -3.7%, LYG -3.0%, ING -2.7%, RDN -2.5%, RF -2.0%, STD -1.9%, DB -1.8%, CS -1.7%, MS -1.3%... Select metals/mining names trading lower: AU -2.7%, EGO -2.7%, GOLD -2.0%, BBL -2.0%, BHP -1.2%, NEM -1.1%... Select food/grocery related names ticking lower following KR results: SWY -5.5%, WFMI -3.4%, SVU -2.8%... Select telecom names trading lower: DT -2.8%, FTE -2.1%, VOD -1.8%... Other news: EBS -11.5% (HHS cancels RFP for rPA procurement and modifies their approach in favor of BAA for development of rPA vaccines), RSO -7.8% (prices public common stock follow-on offering at $4.50 and reports Q4 results), TCAP -6.1% (announces a 1.3 mln share common stock offering), GSIC -5.3% (announces 2,129,801 common share offering by former Retail Convergence stockholders), DLLR -4.3% (announces exchange for a portion of its senior convertible notes), CLMT -4.2% (announces the commencement of an underwritten public offering of 3,000,000 common units), KIM -2.9% (announces 25 mln share common stock offering), SCSS -2.2% (prices its public offering of 3.8 million shares at $4.75/share), WFC -1.0% (presenting at Goldman Sachs Financial Conference)... Analyst comments: DAI -3.2% (initiated with Underweight at Barclays), S -2.9% (downgraded to Neutral at Pali), AVB -2.1% (downgraded to Mkt Perform at FBR), EQR -2.0% (downgraded to Mkt Perform at FBR).

Gapping up:

In reaction to strong earnings/guidance: YONG +7.3%, FDX +2.4%, XLNX +1.8%, TEL +0.7%... M&A news: GMCR +1.0% (Diedrich Coffee enters into agreement with Green Mountain Coffee Roasters to acquire Diedrich for $35.00 cash per share)... Other news: THLD +8.8% (light volume; announces animals treated prophylactically with TH-302 showed decreased serum paraprotein compared to those not treated with TH-302), ARIA +6.9% (presents positive clinical proof-of-concept data on AP24534 in drug-resistant hematological cancers at ASH annual meeting), GERN +5.7% (presents interim clinical data on Its Telomerase Vaccine at the 2009 American Society of Hematology Meeting), WIN +3.3% (Cramer makes positive comments on MadMoney), UPS +2.1% (up in sympathy with FDX), ARO +0.9% (announces a $250.0 mln increase in its share repurchase program)... Analyst comments: MOT +1.5% (initiated with Outperform and $11 tgt at Bernstein).

-

Pikaajaliselt on üks võimalus olemasolevat võlga vähendada kõrgema inflatsiooni abil (vähendaks võla suhet laekuvatesse tuludesse, SKPsse jne), mis võib USA reitingu positsiooni kindlustada (aitaks vältida valusat maksude tõusu). See eeldab muidugi väga täpset rahapoliitikat & ühel hetkel võivad inflatsiooniootused käest minna (siiski tundub, et USA-l on soov seda teed minna).

-

abe, mõtlesin eelkõige seda, et kevadel andis Geithner (oli vist tema) mõista, et igasugune reitingu alandamine võib kaasa tuua reitinguagentuuride tegemiste (või ka tegemata jätmiste) päevavalgele toomise. Tollal oli see ebadiplomaatiliselt järsk avaldus, mille täideviimine mõjuks fitchide-moodyste usaldusele üsna kehvasti. Selles, et mõlemad riigid on reitingu alandamine ära teeninud, olen ammu veendunud.

-

Tol ajal oli probleem selles, et reitinguagentuurid panid järjest pange, läksid oma negatiivsete asjadega natuke liiale ja tekitasid inimestes suuremat paanikat. Rünnak Moodyse and co vastu tähendas lihtsalt, et a) Reitinguagentuurid liigses hoos b) mõelge inimesed ja analüüsige ka nende kommentaare, mitte ärge võtke kullana

-

turuga oleme nüüdseks (täna) jõudnud olukorda, kus edaspidine arvamine, kas üles või alla läheb keeruliseks. Ausalt öeldes oli see juba 5 minutit tagasi. Aga olukord ,kus ei saa enam aru või visioon häguneb, tähendab üht ..close positions fast

-

Dollari tugevnemine on ajutine nähtus. Paberit trükitakse aina juurde ja langeb jälle.

Dollari trükkimine ja odavnemine põhjustab varsti omakorda aktsiate tõusu. Mull paisub ... -

Tobedatel klisheedel pole infoväärtust.

-

Nõus abesikiga. Kui selge arusaam puudub, ei ole mõtet tegutseda.

-

Ohh jah maailma oma lõputute muredega. Mured kestavad sama kaua kui, elu planeedil Maa. Hea on seal kus meid ei ole.

-

jupiteril