Börsipäev 15. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

USA indeksite futuurid on hommikul eilsete sulgumistasemete juures. Eile õhtul pärast turu sulgemist tuli teade, et Wells Fargo (WFC) on otsustanud tagasi maksta valitsuselt kriisi üleelamiseks saadud TARP summad, mille peale liikus aktsia järelturul pisut ülesse. Samas tähendab see turule siiski suurt kogust uusi juurdetulevaid aktsiaid.

Briefing: Wells Fargo to repay entire $25 bln TARP investment; announces $10.4 bln common stock offering (25.49 +0.08)Co announced that, pursuant to terms approved by U.S. banking regulators and the U.S. Treasury, it will redeem the $25 bln of series D preferred stock issued to the U.S. Treasury in October 2008 under the government's Troubled Asset Relief Program (TARP), upon successful completion of a $10.4 bln common stock offering. Under terms of the authorization from the U.S. Treasury and banking regulators to repay the $25 bln investment made under TARP, WFC will: Issue common stock with proceeds of $10.4 bln. Raise $1.35 bln through the issuance of common stock to WFC benefit plans and in lieu of a portion of 2009 incentive cash and other compensation to certain Wells Fargo team members. Increase equity by $1.5 bln through asset sales to be approved by the Board of Governors of the Federal Reserve. To the extent those asset sales are not completed by the end of 2010, the co agreed it would raise a commensurate amount of common equity. After the TARP repayment and these initiatives, the co's estimated Tier 1 common equity ratio would be 6.2%, pro forma based on the September 30, 2009 ratio of 5.2%. Repaying TARP will eliminate $1.25 bln in annual preferred stock dividends, and will be slightly accretive to earnings per share in 2010.

Täna kell 15.30 teatatakse novembrikuu tootjahinnaindeks (ootus +0.8%, tuumikosal on ootuseks +0.2%), kell 16.15 novembrikuu tootmisvõimsuste ärakasutamise määr (ootus 71.1%) ning novembrikuu tööstustoodangu muutus (ootus +0.5%). -

USA novembrikuu tööjõuraport & esilekerkinud probleemid Lõuna-Euroopas on EUR/USDi toonud juba 1.456 juurde:

-

Nagu sukk ja saabas on EUR/USDiga liikunud ka kuld:

-

Atonen reo jälle lammutab ja hoiab kulla hinda EURis paigal :-)

-

UBS-i analüütikud on veendunud, et 2010. aastat karakteriseerib terasevarude täiendamine väljaspool Hiinat, mis peaks aitama kaasa märkimisväärsele taastumisele nii terase hindades kui ekspordis. Antud stsenaariumi realiseerumise korral oleks üks suurimaid kasusaajaid ArcelorMittal tänu operatsioonilisele võimendusele, mida maailma suurim terasetootja ärimudel lühiajaliste tarnelepingute suure osakaalu tõttu pakub. UBS tõstis MT aktsiahinna 28 eurolt 35 eurole. Novembris kirjutasin pikemalt Euroopa terasetööstusest siin.

-

Kreeka probleemid ning tõenäoliselt ka Saksaama pettumustvalmistanud oktoobrikuu tööstustellimused ja tehasetoodangu näitajad on tõmmanud sealsete finantsekspertide ootusi järgmise kuue kuu arengute prognoosimisel madalamaks, kui täna avaldatud ZEW indeks alanes novembri 51.1 punktilt detsembris 50.4 punktile. Bloombergi küsitletud analüütikute prognoose see siiski 0.4 protsendipunkti jagu ületas.

-

mis chart see eelviimases postis on? MT küll mitte. Või siis 2 aasta MT?

-

See on MT kahe aasta graafik (euronext)

-

November PPI MoM +1.8% vs. +0.8% consensus

November core PPI MoM +0.5% vs. +0.2% consensus; prior -0.6%

November PPI YoY +2.4% vs. +1.8% consensus

November core PPI YoY +1.2% vs. +0.9% consensus; prior +0.7% -

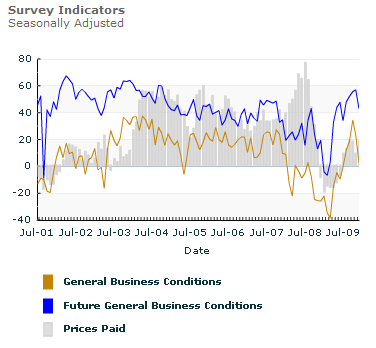

Dec Empire Manufacturing 2.55 vs. 24.0 consensus

-

USA suurim elektroonikakett Best Buy kolmanda kvartali aktsiakasum (0.53 USD) ületas eelmise aasta tulemust üle nelja korra ning konsensuse prognoosi 10 sendiga käibelt, mis mahtus täpselt prgnoosidesse (12.02 mld USD). Veebruaris lõppeva FY10 aasta EPS-i kergitati varasemalt 2.70-3.00 pealt 3.00-3.15 dollarile (konsensus 2.96 USD) ning müügitulude prognoosi 48-49 mld USD pealt 49-49,5 dollarile (konsensus 48.59 mld USD). Ettevõte on muuhulgas ka Raymond James analüüsimaja 2010.a TOP 10 nimekirjas ning investeerimise peamiseks teesiks on kapitaliseerimine Circuit City pankroti pealt. Vaatamata oodatust parematele tulemustele ja prognooside tõstmisele, kaupleb aktsia aga eelturul üle 4% miinuses, kuna suurem nõudlus madalama marginaaliga seadmete vastu sundis juhtkonda langetama oma ootust neljanda kvartali brutokasumi marginaali osas.

-

Viimane data ei ole type-o & ootused olid siin selgelt liiga kõrged:

-

Novembri tööstustoodang oodatust parem:

November Industrial Production +0.8% vs. +0.5% consensus; Capacity Utilization 71.3% vs. 71.1% consensus

-

Enamus Euroopa turge punases ning ka USA alustab tugevnenud dollari taustal päeva pihta miinuspoolelt.

Euroopa turud:

Saksamaa DAX -0,67%

Prantsusmaa CAC 40 -0,83%

Inglismaa FTSE 100 -1,08%

Hispaania IBEX 35 -0,80%

Rootsi OMX 30 -1,04%

Venemaa MICEX -0,19%

Poola WIG -0,64%Aasia turud:

Jaapani Nikkei 225 -0,22%

Hongkongi Hang Seng -1,23%

Hiina Shanghai A (kodumaine) -0,86%

Hiina Shanghai B (välismaine) -0,15%

Lõuna-Korea Kosdaq +0,29%

Tai Set 50 -0,01%

India Sensex 30 -1,29% -

Stick to Your Style

By Rev Shark

RealMoney.com Contributor

12/15/2009 9:11 AM EST

Accept the challenges so that you can feel the exhilaration of victory.

-- George S. Patton

After four quiet but positive days of trading, the major indices are all hovering around their highs of the year. There hasn't been much aggressive action or heavy-duty momentum over the past week of trading but the tone has been upbeat and the buyers are steady and unworried. It is a good example of how stocks are supposed to act during seasonally strong periods.

Overall the action looks quite healthy, the major indices aren't too extended and there doesn't seem to be any immediate catalyst for major selling. It is just some good old-fashioned bull market action.

So what is the hard trade at this point? Over on RealMoney Silver Doug Kass will occasionally say the hard trade is typically the best trade. In this market he sees the short side as being the more difficult trade.

In my view what constitutes the hard trade is a much more subjective matter. It depends a great deal on your style. There are those, like Doug, who are always looking for turning points in the market. For them the easiest trade is to short into strength and buy into weakness. The timing can be quite problematic but the approach can pay off well if you hit the turning points with a little accuracy.

This contrary approach to the market is one of Wall Street's favorite games. Just think how many times since March we have heard proclamations that we have seen the highs. And prior to that, when things were melting down, how often did we hear that the lows were in as we kept ticking down steadily?

For many market players, calling tops and bottoms is always the easier trade. That is their style and what they are inclined to do. They usually keep on doing it until they get it right.

My approach is what is known as trend following. I tend to stick with the trend until I see some good reason not to. Often this can feel like the more difficult thing to do, especially when a trend persists much longer than seems reasonable. Certainly this year the much more difficult trade for many has been to stick with the uptrend even though it often feels like we have run way too far, too fast.

The best thing you can do is to know what your style is and embrace it. If you are a trend follower, stick with it until you have reason not to. If you are someone who prefers to look for turning points, keep on doing that as long as it works for you.

Right now I see a market that is trending up on a steady flow of good news. The easy trade at times to try to try to predict major turning points, especially if you want to protect gains, but the right trade to make is the one that fits your style.

We have a little weakness this morning on slightly soft economic reports, but the focus is going to quickly shift to the FOMC interest rate decision that is due on Wednesday afternoon.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: AIM +23.7%, SNS +5.3%... M&A news: LIMS +42.1% (Abbott to acquire STARLIMS Technologies; this transaction does not impact ABT's previously issued ongoing EPS guidance for 2009)... Select solar stocks showing strength: JASO +3.8% (expects Q4 2009 shipments to exceed prior guidance; issues FY10 shipment guidance; announces a $75 mln share repurchase program), SPWRA +3.0% (provides update of audit committee investigation; says it has made "significant progress in internal investigation"), SOL +2.8%... Other news: ARRY +35.6% (Array BioPharma and Amgen partner in Type 2 Diabetes), WY +12.4% (announces intent to elect REIT status; timing under consideration; to eliminate the company's classified board structure), USEG +11.1% (Brigham Exploration announces Williston 25-36 #1H Bakken well produces at initial rate of ~3,394 BOEPD), ALXA +7.0% (announces submission of AZ-004 NDA), SGEN +6.3% (The Takeda Oncology Company announce strategic collaboration for novel late-stage lymphoma program Brentuximab Vedotin), JAZZ +3.7% (announces it has submitted a New Drug Application to the FDA for JZP-6 for the treatment of fibromyalgia), AMLN +2.0% (Exenatide Once Weekly provided superior glucose control compared to BYETTA in DURATION-5 study), WFC +1.9% (to repay entire $25 bln TARP investment; announces $10.4 bln common stock offering), KONG +1.7% (announces acquisition of Shanghai Dacheng Network), H +1.7% (Abu Dhabi wealth fund takes stake in Hyatt Hotels - Associated Press), ERTS +1.6% (Cramer says this stock is one to buy), HGSI +1.2% (announces submission of marketing authorization application to EMEA for JOULFERON)... Analyst comments: PCS +6.0% (initiated with Outperform at Bernstein), Q +4.2% (upgraded to Buy from Neutral at UBS), ACOM +2.5% (initiated with Buy at Jefferies, initiated with Buy at BofA/Merrill, and initiated with Overweight at Morgan Stanley), LEAP +2.3% (initiated with Outperform at Bernstein), BBT +1.6% (upgraded to Buy at Deutsche), PALM +1.5% (upgraded to Buy at MKM Partners; tgt raised to $20), AVB +0.7% (upgraded to Buy from Neutral at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: RTK -14.6%, BBY -5.2%, PAY -2.5%... Select financial related names showing weakness: AIB -11.3%, ING -5.1%, CS -3.7%, IBN -3.6%, DB -2.8%, HBC -2.7%, ZION -2.6% (initiated with a Sell at UBS), STD -2.2%, C -1.6%, BAC -1.2% (reports Nov trust data)... Select metals/mining names trading lower: RTP -3.3%, GOLD -2.8%, GFI -2.6%, EGO -2.1%, AU -1.9%, VALE -1.5%, BBL -1.4%, BHP -1.3%, NEM -1.2%, GG -1.0%... Select oil/gas names ticking lower: RDS.A -1.8%, BP -1.2%, TOT -1.2%, PBR -1.0%... Other news: GOK -7.0% (priced a 4 mln share common stock offering at $9.25/share), ELN -6.0% (Elan and Transition Therapeutics announce modifications to ELND005 Phase II Clinical Trials in Alzheimer's Disease), NVDA -5.1% (still checking), CNO -4.0% (announces a 45 mln share common stock offering), GY -2.2% (Announces $125 Million Private Offering of Convertible Subordinated Debentures)... Analyst comments: HON -2.1% (downgraded to Underweight at HSBC), FHN -2.0% (initiated with a Sell at UBS). -

Küll kaheaastase hilinemisega, kuid täna on viimaks kätte jõudmas hetk, mil 787 Dreamliner teeb oma esimese testlennu. Eesti aja järgi kell 8 algavat sündmust on võimalik jälgida siit.

-

CL King tõstab täna oma hinnasihti Robert Halfil (RHI) $30 pealt $35 peale ning toob selle põhjusena eelkõige ära paranenud olukorra ajutiste töökohtade turul, millele oma viimases analüüsis viitasime ka LHV Maailma Pro all.

-

BOE's Barker says no evidence of asset price bubble - DJ

-

December NAHB Housing Market Index 16 vs 18 consensus, prior 17

-

Bernanke says regulation likely to be more effective dealing with asset bubbles than monetary policy - Reuters

-

Bernanke says continues to believe Fed will be fully repaid by AIG - Reuters