Börsipäev 16. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Koos aasta lõpule üha lähemale jõudmisega on kokku kuivanud ka turgude kauplemismahud. Viimase kolme kauplemispäeva keskmine käive SPY'l on olnud ca 115 mln aktsiat, mis on keskmisest vaid ca 60%-65%. Mahtude languse üheks põhjuseks võib pidada seda, et hetkel väga kindel suund turgudel puudub - iseenesest aasta lõpus ei julge keegi turgu müüa, kuid samas ostuhuvi ei ole samuti üles näidatud, kuna juba mitu nädalat on turg n-ö raskelt käitunud.

Täna kell 15.30 teatatakse novembrikuu väljastatud ehituslubade arv (ootus 570 000) ning alustatud elamute ehituste arv (ootus 574 000). Mõlemad ootused on võrreldes oktoobri näiduga ca 5%-10% kõrgemad. Tootjahinnaindeksilt oodatakse kasvu ca 0.4% ning tuumikosalt 0.1%.

Kell 21.15 teatatakse Föderaalreservi intressimäära otsus, kust otsitakse vihjeid, kas, millal ja kuidas on Fed oma ekspansiivset monetaarpoliitikat koomale tõmbamas. -

Abu Dhabi Investment Authority väidab, et omal ajal sai nõustutud $8 miljardi eest Citigroupi (C) aktsiaid ostma hinnaga ca $35 aktsiast, üksnes põhjusel, et neile esitati teadlikult ilusatatud aruanded, mis ei vastanud tegelikkusele. Nüüd on kahe institutsiooni vahel tüli majas - Citigroup nõuab, et Abu Dhabi jääks kokkulepitule kindlaks, Abu Dhabi soovib aga lepingust taganeda või üle $4 miljardi valuraha kompensatsiooniks nõuda. Pikem artikkel Bloombergis.

-

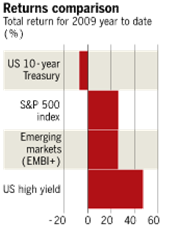

Spekulatiivsed võlakirjad on erinevate varaklasside lõikes vaieldamatult sellel aastal parima tootlusega olnud. Eriline nõudlus on olnud eelmisel aastal just enim langenud võlakirjade vastu (loe pikemalt):

Bonds trading at less than 50 cents on the dollar now account for only 1.1 per cent of the high-yield market, or $8.9bn in securities, down from 27.5 per cent, or $202bn in bonds, a year ago, according to JPMorgan data.

-

Läti & Leedu top kümnes (link):

-

Jaapani pangad tegid täna megaralli (nt Mizuho FG +15%), kuna Nikkei andmetel jäetakse pankadele vähemalt 10. aastat aega uute kapitalinõuete täitmiseks (ametlik teadaanne peaks tulema millalgi sellel nädalal):

Financial stocks in Japan were helped by a report in the Nikkei daily that the Basel Committee on Banking Supervision, which has been discussing introducing stricter capital requirements since September 2008 in an effort to prevent a recurrence of the global financial crisis, has agreed to effectively delay the enforcement of new capital adequacy rules for large banks, opting to create a transition period of at least 10 years. But a person familiar with the negotiations told Dow Jones Newswires the Basel proposal would not mention the reported 10 year delay, though would include a relaxed timeframe. "There won't be any specific numbers in the proposal," the person said. (marketwatch)

MFG graafik USAs:

-

Boeing 787 eilne testilend tundub analüütikutele meeldivat & UBS on täna andnud Zodiac Aerospace'ile ostusoovituse (ettevõte valmistab Dreamlinerile sisutust). Zodiac (ZC) kaupleb Pariisis +6.6% plusspoolel.

-

Kinnisvarahinnad Suurbritannias on kasvanud seitse kuud järjest ning kuigi tempo andis sügisest pisut järele, üllatab nõnda kiire taastumine paljusid. Nationwide hindab oma viimases kuuülevaates tõusutrendi oluliseks toetajaks tööjõuturu oodatust paremat seisu. Sest vaatamata sellele, et paljud ettevõtted on viinud täiskohaga töötajaid osalisele tööajale, mille tulemusel tuleb leppida ka palgakärpega, ei ole tagajärjed isiklikele finantsidele nõnda ulatuslikud, kui inimene oleks päris tööta jäänud. Kuna paralleelselt on kukkunud ka intressid, on maksejõuetute osakaalu kasv laenuturul osutunud arvatust väiksemaks. Citi on aga täna väljas julgustava kommentaariga Briti kinnisvaraarendajate ning - ehitajate osas, tõstes Baratt Developments, Redrow ja Taylor Wimpey soovitused "hoia" pealt "osta" peale, nentides et paranemise märke on näidanud nii kinnisvarahinnad, kinnisvaralanutaotluste arv, müügitehingud kui ka tarbija usaldus ning kogu sektor on võimeline üle elama kerget hinnalangust, ega pea seejuures kohe varade väärtus vähendama hakkama.

-

November CPI M/M +0.4% vs +0.4% consensus, prior +0.3%

November Core CPI M/M 0.0% vs +0.1% consensus, prior +0.2%

November Building Permits 584K vs 570K consensus

November Housing Starts 574K vs 574K consensus, prior revised to 527K from 529K -

SAS müüs ~300 MSEK eest oma osaluse MBO käigus AirBalticus ettevõtte juhtkonnale. Samuti müüdi SpanAir.

-

õigupoolest oleks vist õige kasutada vormi "müüb"

-

Euroopa turud:

Saksamaa DAX +0.92%

Prantsusmaa CAC 40 +0.54%

Inglismaa FTSE 100 +0.02%

Hispaania IBEX 35 +0.84%

Rootsi OMX 30 +0.95%

Venemaa MICEX +3.29%

Poola WIG +0.17%Aasia turud:

Jaapani Nikkei 225 +0.93%

Hongkongi Hang Seng -0,93%

Hiina Shanghai A (kodumaine) -0,59%

Hiina Shanghai B (välismaine) -0,52%

Lõuna-Korea Kosdaq +0,74%

Tai Set 50 +1.05%

India Sensex 30 +0.21% -

Set Up for Strength

By Rev Shark

RealMoney.com Contributor

12/16/2009 8:36 AM EST

The process by which banks create money is so simple that the mind is repelled.

-- John Kenneth Galbraith

Over the past year the market has had a tendency to be strong in front of the FOMC interest rate decision. We dipped a little yesterday, but the bullish troops are on the move this morning.

The FOMC announcement is at 2:15 p.m. EST, and the focus will be on any comments or indications about when we might see an interest rate hike. The key language is that conditions "are likely to warrant exceptionally low levels of the federal funds rate for an extended period of time."

Any change to the "extended period of time" clause is likely to generate a substantial market reaction. No one seems to be expecting the Fed to change that language at this point, but everyone will be looking very carefully for any subtle indications that the Fed is going to start taking steps to tighten up credit and drain liquidity.

The market has been in a trading range for a while and is set up particularly well for a strong move on the FOMC news. The major indices are all hovering around the same levels they were at a month ago and are struggling to break out to fresh highs for the year. The charts are coiled up, and the Fed news is likely to be the catalyst that starts us trending into the end of the year.

Trading over the last week and a half has been very choppy. The dollar has strengthened, and that has put some pressure on commodity-related stocks, and financials have struggled as they issue new stock in order to repay TARP funds. There has been little clear leadership and pockets of strong momentum have been hard to find.

Even though trading has been dull and there isn't much strong action, there isn't any compelling technical reason to be negative on the market. The indices have worked off overbought conditions and are in a trading range and knocking on the door of new highs. Seasonality also favors the bulls at this point.

Fundamentally the news flow has been generally positive. We have all the same bearish arguments we have for months right now, but market players continue to shrug them off while they worry more about how to tack on some additional returns as the year winds down.

We have a good setup for a positive reaction to the Fed, but there is a strong tendency for some whipsaws when the news is released. We have seen a "sell the news" reaction to the Fed the last couple of months, but the general inclination has been for a positive reaction after some initial swings back and forth.

We are opening on the positive side, but things should be fairly quiet until the Fed at 2:15.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: EMKR +14.9%, SAM +7.1%, RVI +4.6%, JOYG +1.9%, GE +1.0%, ADBE +0.9%... M&A news: FGXI +8.9% (to be acquired by Essilor Int'l for $19.75/share)... Select financial names showing strength: MFG +7.0%, ING +5.9% (ING capital increase was 97% subscribed - WSJ), DB +5.6%, CS +3.3%, BCS +2.8%, UBS +2.7%, BAC +2.0%, WFC +0.4% (common stock offering raises $12.25 bln)... Select oil/gas names trading higher: STO +1.7%, REP +1.6%, RDS.A +1.5%, TOT +1.4% (Hydrocarbon discovery on the OPL 223 license ), SU +1.4%, WFT +1.3%, PBR +1.0%... Select metals/mining names showing early strength: GOLD +2.7%, MT +1.8%, IAG +1.3%, SLW +1.2%, ABX +1.2%... Other news: ACHN +62.8% (announces positive preliminary Phase 1b proof of concept data with ACH-1625 to treat hepatitis C), GIGM +10.8% (announced strategic alliance with European online gambling leader Mangas Gaming), TWTC +5.1% (will replace Roper Industries in the S&P MidCap 400), ROP +4.0% (will replace ENSCO International in the S&P 500), SPWRA +2.0% (Montalto di Castro solar photovoltaic power plant, the largest in Italy, has been completed; initiated with an Outperform at JMP Securities), AZN +1.1% (Favorable vote from FDA advisory committee on benefit/risk of CRESTOR in JUPITER study ), GOOG +0.7% (Cramer makes positive comments on MadMoney)... Analyst comments: SOL +8.9% (upgraded to Overweight from Equal Weight at Morgan Stanley), RCL +3.5% (upgraded to Overweight at JPMorgan), SCHW +2.6% (upgraded to Buy at Deutsche), X +2.2% (upgraded to Buy at Keybanc), CCL +1.8% (upgraded to Overweight at JPMorgan), GLW +1.1% (upgraded to Buy from Outperform at Calyon).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ASFI -9.8%, HON -1.3%... M&A news: PLA -21.9% (under pressure with Bloomberg.com reporting Iconix Brand (ICON) is breaking off talks to buy Playboy Enterprises), TRA -2.2% (CF Industries will not seek to extend financing for acquisition of Terra; CF Industries has sold Terra shares to bring its interest in Terra below 13D reporting threshold), FACT -0.5% (Facet Biotech reiterates recommendation that stockholders not tender at $17.50 per Share)... Other news: SCMR -26.2% (trading ex dividend), HLCS -19.0% (announces $6.4 mln registered direct offering), TNL -13.0% (announces it has commenced and priced an offering of $50 mln aggregate principal amount of 7.00% convertible senior notes), BEP -9.0% (trading ex dividend), AUXL -8.5% (announces top line Ph IIb XIAFLEX Peyronie's results), GIII -5.9% (announces common stock offering), AIB -4.9% and IRE -1.9% (still checking for anything specific), EZCH -4.0% (announces public offering of ordinary shares), GFF -3.9% (announces offering of $100 mln of convertible subordinated Notes), C -2.0% (Abu Dhabi demands Citi scrap deal - WSJ)... Analyst comments: SNH -1.0% (downgraded to Neutral at Robert W. Baird). -

Time'i 2009. a inimene on Ben Bernankele:

The story of the year was a weak economy that could have been much, much weaker. Thank the man who runs the Federal Reserve, our mild-mannered economic overlord. (loe pikemalt siit)

2009. a on B. Bernanke aidanud USA majanduse jalule, kuid küsimus on jätkuvalt, kas intressimäärasid hakatakse õigel ajal tõstma & QE'ga ei liialdata. Kui Fed selle õigesti ajastab, siis on mees väärt suurematki auhinda.

-

GE kaupleb -0.3% @ 15.70

JP Morgan raised their tgt to $20 from $17 and Goldman raised their tgt to $20 from $18 -

Kogu nimekirja Time'i aasta inimestest alates aastast 1927 leiab siit. Ma ei tea, kui tõsiselt seda üldse võtma peaks - ses mõttes, et Greenspan oskas ka raha trükkida ja intresse langetada (tõsi, küll 'ainult' 1.0%ni ja mitte 0.0%-0.25%ni), kuid selle ekspansiivse rahapoliitika tulemuseks oli lihtsalt järgmine kriis - sedapuhku kinnisvaras. Igal teol on omad tagajärjed ning nii ei jää ka Bernanke rahatrükkimine negatiivse mõjuta.

Kes ei tea, siis näiteks 1938. aastal sai selle tiitli Adolf Hitler, 1939. ja 1942. aastal Joseph Stalin...

-

Senate Banking Panel Democrat Merkley says will vote against Bernanke confirmation - Reuters

-

mis ajast siis nüüd Stalini eesnimi Joseph oli :)

-

Eks erinevates keeltes erinevad kirjapildid (eesti Jossif, inglise Joseph ja Venemaa Иосиф) - kasutame inglise keele asemel siis vene keelt : )

Иосиф Виссарионович Сталин -

25 minuti pärast avaldab oma intressimäära otsuse ja selle juurde käiva retoorika Föderaalreserv. Siis on 'igavale' ja õhukesele kauplemispäevale pisut elavamaid minuteid oodata.

-

Sellel keskpanga-poolsel valitsuse krediteerimisel on vähemalt üks hea omadus - enamusele viimaste aastakümnete majandusteooriatele lastakse vesi peale. Ma ei mäleta, kas see oli Krugman või mõni teine karu, kes kirjeldas, kuidas Keynesi teooriate juurde tagasi pöördutakse. Mõte oli seal selles, et kui Keynes soovitas majanduslanguste silumisel valitsuse stimuleerimist ja avalike sektorite kulutuste suurendamist (peale seda, kui nominaalsed intressimäärad on nulli langetatud), siis mingil hetkel unustati see ära ja viimaste aastakümnete jooksul võimendus olukord selleni välja, et Keynesi teooriat ei maksnud suhu võtta. Akadeemikud olla naerma hakanud, sest pime usk allmighty-Fedi oli niivõrd võimas. Ja seda hoolimata 1987. aasta börsikrahhist või tollase perioodi karuturgudest, mis oleksid pidanud igasugustele efektiivse-turu-teooriatele põntsu panema. Rääkimata siis muudest napakatest mudelitest, kus juba eedlused ise on jaburad. Igal juhul võib kindel olla, et praeguse majanduslanguse taustal võtab majandusteooria uue suuna ja ilmselt tõuseb rohkem esile midagi behavioral finance'i taolist.

Ei suutnud seda artiklit üles leida, aga kui keegi ära tunneb, võiks lingi visata. -

US House approves $636 bln military spending bill, sends to Senate - Rueters

-

As expected, the FOMC leaves the fed funds tgt at 0.00-0.25%

Ja kokkuvõte otsusest ka Briefingu vahendusel:

Information received since the Federal Open Market Committee met in November suggests that economic activity has continued to pick up and that the deterioration in the labor market is abating. The housing sector has shown some signs of improvement over recent months. Household spending appears to be expanding at a moderate rate, though it remains constrained by a weak labor market, modest income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment, though at a slower pace, and remain reluctant to add to payrolls; they continue to make progress in bringing inventory stocks into better alignment with sales. Financial market conditions have become more supportive of economic growth. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability. With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve is in the process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing the pace of these purchases, and it anticipates that these transactions will be executed by the end of the first quarter of 2010. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. In light of ongoing improvements in the functioning of financial markets, the Committee and the Board of Governors anticipate that most of the Federal Reserve's special liquidity facilities will expire on February 1, 2010, consistent with the Federal Reserve's announcement of June 25, 2009. These facilities include the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility. The Federal Reserve will also be working with its central bank counterparties to close its temporary liquidity swap arrangements by February 1. The Federal Reserve expects that amounts provided under the Term Auction Facility will continue to be scaled back in early 2010. The anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30, 2010, for loans backed by new-issue commercial mortgage-backed securities and March 31, 2010, for loans backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if necessary to support financial stability and economic growth. Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen. -

Küll vist ei puuduta börsi teemat ennast aga tahtsin väga kiita Teie agente Järve Selveris. Ise pidin oma kaasat pea pool tundi pangakontori vastas ootama ja kõrv hämmastas kui mittepealetükkivalt saab ennast esitleda. Väga ilus!

-

Suhtlesin paar nädalat tagasi Lõunakeskuses nendega. Kusjuures samad sõnad, pealetükkivad nad ei olnud ja mulle see meeldis.

-

Rõõm kuulda! Anname omalt poolt tänusõnad edasi.