Börsipäev 7. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Tund aega enne USA turgude avanemist avaldatakse möödunud nädala andmete põhjal annualiseeritud esmaste töötu abiraha taotlejate arv - ootuseks ca 440 000. Kestvate töötu abiraha taotlejate number peaks jääma napilt alla 5 miljoni. Oodatust väiksemad töötuse numbrid oleksid loomulikult positiivseks märgiks ning suuremad numbrid negatiivseks märgiks.

Neljapäevale kohaselt avaldatakse Eesti aja järgi kell 17.30 maagaasivarude raport, kust on näha, kui kiiresti möödunud nädalal maagaasivarud USAs langesid. -

Bank of England leaves bank rate unchanged at 0.5%

-

LHV Maailma Pro all toodud investeerimisidee Fundtech (FNDT) teatas eile hilisõhtul, et on kindlustanud Global PAYplus lepingu maailma suurima 20 panga hulka kuuluva pangaga. Tõenäoliselt on tegu pikalt-oodatud Barclay panga lepinguga, kuid detaile saab kuulata Eesti aja järgi kell 15.00 peetava konverentsikõne ajal - link siin.

Lisaks andis Fundtech 2010. aastaks omapoolse tulude ja kasumiprognoosi. Tuludelt ootab ettevõtte juhtkond $132 kuni $135 miljonit, mis on $128.4 miljonilisest konsensusest korralikult ülevalpool. Non-GAAP EPSiks oodatakse $0.63 kuni $0.73, mille keskpunkt $0.68 on kergelt üle praeguse konsensusootuse $0.67. Seega positiivsed uudised Fundtechi investoritele. Aktsia ei kauple küll enam väga odavatel kordajatel ning on ka viimastel päevadel tugevalt tõusnud, kuid ainulaadse tooteportfelli ja väga maineka klientide nimistu tõttu peavadki aktsiale rakendatavad kordajad olema keskmisest kõrgemad. Soovitame jätkuvalt Fundtechi aktsiat osaks pikaajalisest investeerimisportfellist, kuna ettevõte lõikab kasu finantssektori taastumisest ning sealsete IT-kulutuste kasvust.

-

Numbrid oodatust väiksemad ning lähenemas territooriumile, kust võib varsti hakata ootama töökohtade juurdeloomisi.

Initial Claims 434K vs 439K consensus, prior revised to 433K from 432K

Continuing Claims 4.802 mln vs. 4.975 mln consensus; prior 4.981 mln -

Bank of America after hours üsna kena

-

Apple tgt raised to $260 from $235 at Barclays

-

BAC on jätkuvalt hea bet finantssektoris. Aktsia täna eelturul +1.7%.

Credit Suisse is making a major call this morning upgrading Bank of America (NYSE:BAC) to Outperform from Neutral with a $21 price target (prev. $17) and is adding the stock to their Focus List.

Pikemalt saab soovituse kohta lugeda siit.

-

Mitte ainult BAC ... C on viimase 3 päevaga pea 15 % tõusu teinud.

Latti tõstmine tulemuste eel ? -

Monsanto: Q2 roughly in-line; Fewer LatAm acres squeeze seasonally-light; tgt raised to $100 at Deutsche Bank

Ise bettida ei julgeks, küsimärke üsna palju ja viimased 5 päeva üsna jõudsasti kogu sektor kosunud. -

Eks ootus BAC 30 dollarit,arvan et 45. Seega ostusoovitus minu poolt

-

USA futuurid indikeerivad börside avanemist väikeses 0.1% kuni 0.3%lises miinuses, kuid mingeid suuremaid tõuse/languseid pole eelturul eriti olnud.

Euroopa turud:

Saksamaa DAX -0,36%

Prantsusmaa CAC 40 -0,11%

Inglismaa FTSE 100 +0,05%

Hispaania IBEX 35 -0,45%

Rootsi OMX 30 +0,07%

Venemaa MICEX N/A (börs suletud)

Poola WIG -1,09%Aasia turud:

Jaapani Nikkei 225 -0,46%

Hongkongi Hang Seng -0,66%

Hiina Shanghai A (kodumaine) -1,89%

Hiina Shanghai B (välismaine) -1,52%

Lõuna-Korea Kosdaq -0,67%

Tai Set 50 -0,25%

India Sensex 30 -0,48% -

The Song Remains the Same

By Rev Shark

RealMoney.com Contributor

1/7/2010 8:51 AM EST

The two sages Alert and Watchful, the sleepless and the vigilant, these two guardians of thy life's breath, are awake both day and night.

-- Atharva Veda

We started off the new year with a good gain on Monday and then two days of flat action in the indices. The market has been stronger than it looks, though, with good breadth and some extremely strong pockets of momentum, particularly in China-related stocks and commodity names.

Yesterday a number of the big-cap technology stocks that led the market in 2009 exhibited relative weakness, but it was contained and didn't seem to affect the broader market. The action was a bit unusual, and it is difficult to determine if it was just a one-day anomaly or an indication that market players are starting to lock in some gains that they have deferred for tax reasons.

We'll watch that group closely today to see how they act, but we also have to be cognizant of another possible negative -- is the very high level of complacency. There just isn't too much worry or concern out there, and I'm hearing complaints from the bulls that everyone should be even more bullish.

Positive sentiment isn't any big mystery, especially since we are at that point in the year when we typically have the most positive seasonality. That starts to come to an end now rather quickly, and it is going to be interesting if that has any impact on the overall mood.

We have a very important jobs report on Friday morning, and it's likely to be the catalyst for the next big move in this market. I suspect we may see another day of relatively flat action today while we await that news.

While we can always find some negatives in the market, the bottom line is that the price action is still very positive. We have not had any notable selling for a while, and our pullbacks have been shallow and quickly bought. While we are a bit technically extended on light volume, we still have not seen any signs that a rush for the exits is imminent.

Even more bullish has been some very good trading in a variety of small-caps. I'm seeing plenty of breakouts on good volume, and a slew of stocks are hitting new highs. Markets acting this way don't suddenly crash; the big swoons tend to come from weaker markets.

Until this market does something wrong, it deserves respect. While we always want to be vigilant, we don't want to start hitting those sell buttons until we have some price action that supports a more bearish posture.

We have a slightly negative open on the way. Weekly unemployment numbers came in roughly in line and retail sales numbers are looking mostly positive.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance/SSS: ZUMZ +14.5%, INSP +11.1%, PIR +9.5%, PLCE +8.3%, RT +8.2%, BBBY +7.0% (also upgraded to Neutral from Underweight at Piper Jaffray), ZIXI +5.9%, SHLD +5.8%, LEN +5.4%, LTD +4.9%, SHAW +4.5%, TJX +4.3%, STZ +4.3%, ARO +3.5%, WBSN +3.3%, RUE +2.4%, M +2.3%, WTSLA +2.2% (light volume), BLUD +2.2%... M&A news: ONT +25.4% (On2 Technologies and Google agree to amend merger agreement)... Select European financials showing strength: AIB +4.8% (upgraded to market Perform at Keefe Bruyette), IRE +3.1%, BCS +2.5%, LYG +2.0%, ING +1.7%... Other news: PEIX +24.4% (Resumes Production at Magic Valley Facility), HTRN +12.7% (light volume; increases Endocare guidance), VVUS +6.3% (announces positive results from Phase 2 study of Qnexa in Obstructive Sleep Apnea), DBLE +5.9% (Reports Fourth Quarter and Annual Production Results at the Company's Catalina Unit), ENER +3.8% (still checking), IRE +3.4% (still checking), PARD +3.2% (Announces 2010 Goals for Picoplatin; says focus is to secure partnership to continue development), OSIS +3.0% (awarded 10-year contract for cargo turn-key scanning solution by Puerto Rico Ports Authority), NGD +2.6% (New Gold announces exercise of El Morro Right of first refusal and partnership with Goldcorp)... Analyst comments: GNVC +9.0% (initiated with Buy at Roth), PKI +2.3% (upgraded to Buy from Hold at Deutsche Bank), BAC +1.5% (upgraded to Outperform at Credit Suisse), CB +1.0% (upgraded to Neutral from Underperform at Credit Suisse).

Allapoole avanevad:

In reaction to disappointing earnings/guidance/SSS: GME -14.4%, TSRA -11.1% (also downgraded to Neutral at BofA/Merrill), CBK -8.6%, HOTT -7.6% (also downgraded to Hold at Needham), ID -4.9%, JCP -3.8%, ANF -3.0%, BKS -2.9% (light volume), GYMB -1.8%, SMSC -1.2%... Select financial names showing weakness: RBS -4.4%, HBC -1.4%, STD -1.2% (downgraded to Neutral at HSBC)... Select telecom names trading lower: VOD -2.3%, DT -1.9%, FTE -1.7%... Select metals/mining related names showing weakness: HMY -2.4%, GFI -1.9%, AU -1.9%, RTP -1.7%, BHP -1.5%, BBL -1.3%, MT -1.3% (Arcelor Mittal to sign deal for south India plant - WSJ)... Other news: ZGEN -11.4% (prices a 14 mln share common stock offering at $6/share ), MGIC -9.3% (trading ex dividend), AES -6.6% (still checking), GSH -4.5% (still checking), IVR -3.7% (plans to make a public offering of 7,000,000 shares of its common stock), TTM -3.5% (sill checking, ), EPD -2.9% (commenced a 9.25 mln share common unit offerinG), ASML -2.4% (still checking), SWC -1.9% (pulling back from yesterday's surge higher; commented on the impressive 2009 recovery in platinum group metal prices)... Analyst comments: IVN -2.3% (downgraded to Sector Performer from Sector Outperformer at CIBC), AA -1.9% (downgraded to Hold at Citigroup), PPDI -1.7% (downgraded to Hold at Deutsche Bank), ROP -1.7% (downgraded to to Neutral from Overweight at JPMorgan), ABC -1.5% (downgraded to Hold from Buy at Deutsche Bank), LIFE -1.0% (downgraded to Hold at Deutsche Bank). -

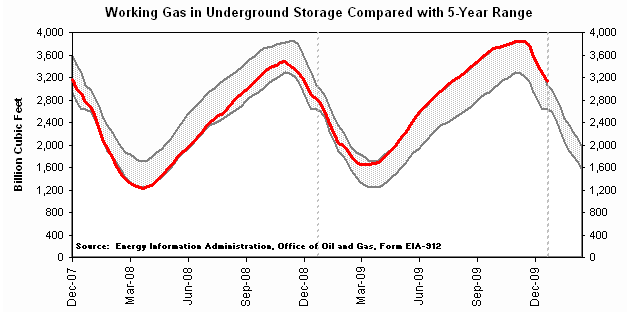

Natural gas inventory showed a draw of 153 bcf, analysts were expecting a draw of 154 bcf, with 21 ests ranging from a draw of 175 bcf to a draw of 136 bcf.

Maagaasivarud vähenesid vastavalt ootustele korralikult. Sellega jõudsid varud viimase 5 aasta varude ülemise piiri peale (olles veel kuu aega tagasi sellest oluliselt kõrgemal).

-

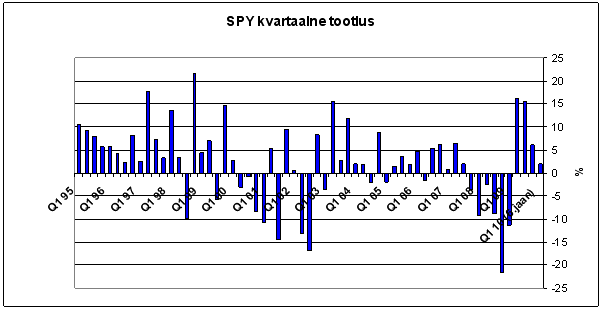

Ei ole siia mõnda aega pannud pilti aktsiaturgude kvartaalsete tootluste kohta. Paranan vea ja panen S&P500 indeksi liikumist jälgiva börsilkaubeldava fondi SPY dividenditootlust sisaldavad kvartaalsed tootlusnumbrid. Q1 09 oli see -11.3%, Q2 09 +16.3%,Q3 09 +15.4%, Q4 09 +6.1% ning Q1 10 eilse seisuga +2.0%.

-

Loll olen jätsin kopikaid Tallinna börsile, mhhh oleks pidand need ka BAC panema.HMM

-

kuigi neetud Baltikaga sai kopikatega 20 prossa teenitud,a ikkegi,hmmmm

-

purus tegi oma ppp

angelike äkki aaa ? -

eks ta ole(((

-

SUUR JA KOLE

-

Et kui aktsiaturu körvalt mehed ka seksivad mind,siis on päev kirjas))))

mis teha kui nümfo aktsiamaan -

Angelike:

http://www.albinoblacksheep.com/flash/youare -

eks ta ole idioot oled ise

ükski naine sinusugust ei taha,see pole enam selle jutuka teema -

Citigroup board member John Deutch provided notice to chairman of board that he will not stand for re-election - Reuters

-

General Electric unit signed agreement with Cosan to deliver 50 new AC44i locomotives for freight transport starting in 2010

-

Genzyme: Activist investor Carl Icahn may launch proxy battle at Genzyme, according to source - Reuters

-

Fed's Hoenig says worried Fed will be pressured to keep rates low - DJ

-

Hoenig says normal level for Fed Funds Rate "probably between 3.5 and 4.5 percent" - Reuters

Hoenig says appear to be in early stages of economic recovery; employment gains seem imminent - Reuters -

Global Energy (GEYI) - kas saaksite kaubeldavate aktsiate nimekirja panna. Aitäh.

-

Kahjuks ei vatsa antud aktsia ühelegi kriteeriumile: käive 10k ja hind $0.05. LHV Traderis on võimalik aktsiat kaubelda.

-

Amazon.com: Hearing positive comments from Piper on AMZN and GSIC

-

SPDR S&P Metals & Mining (XME) Mar 50 puts (volume: 10.0K, open int: 2530, implied vol: ~42%, prev day implied vol: 41%)

GE calls are seeing interest with strength in the underlying stock with ~2x the number of calls trading vs puts (203.7K vs 100.0K). Most notable are the GE Jan 16 calls (volume: 69.0K, open int: 117.8K, implied vol: ~31%, prev day implied vol: 27%) -

NB! Kes optsioonitehingute tegemisel kasutab hinnainfo saamiseks Yahoo Finance'it, siis täna on seal hinnad eilse seisu juures millegipärast n-ö kokku jooksnud ning adekvaatseid hindu sealt kindlasti ei näe!

-

Paistab, et turg on üsna kindel NFP jõudmises töökohtade loomiseni. Üsna kummaline, et keegi ei taha kasumit lukku lüüa. Turuosalised on vist juba päris kindlad, et isegi juhul kui NFP neg. üllatab, ostetakse turg ikkagi üles. Homme saab kahtlemata väga põnev olema.

-

Oeh ja nii kui kell sai 22:00 tuli kerge müügisurve.

-

U.S. warns banks to guard against risk of rising interest rates-- Bloomberg

Surve hoopis sellest. -

Earnings CalenderToday after the close look for the following companies to report: APOL, DMAN, DRWI, GPN, IHS, LWSN, MG, NUHC, and SCHN. Tomorrow before the open look for the following companies to report: AZZ, GBX, and PSMT.

-

Position limits in CFTC proposal will be 'generous,' sources say - DJ