Börsipäev 8. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Tänase päeva tähtsamad makrosündmused tulevad USAst kell 15.30, mil avaldatakse detsembrikuu tööjõuraport. Kas detsembris suudeti tõesti näidata töökohtade lisamist või jätkus veel koondamine? Nii-öelda ametlikuks konsensusootuseks on ca -35 000 töökohta, tunnipalga kasvuks +0.2%, töötusmääraks 10.0% ning töönädala pikkuseks 33.2 tundi.

Päeva jooksul peaks tegema avalduse majanduse teemal ka Barack Obama - ses osas on juba ringi liikunud ka spekulatsioonid, et ehk on see avaldus seotud kuidagi koondamiste lõppu jõudva detsembri tööjõuraportiga. -

Euroopa pangad saavad täna kiidulaulu:

Barclays (+2.9%) was upgraded to buy from neutral on Friday at UBS, based on attractive valuations. UBS said while the external environment remains challenging, the moves Barclays has taken to recapitalize and the earnings it has achieved despite headwinds leaves it better positioned to face those challenges.

Deutsche Bank (+2.6%) was also upgraded to buy owing to "ambitious, yet credible" 2011 targets and attractive valuations as well. The market is too cautious on the bank's potential earnings improvements, which should be driven by cost savings and lower loan loss provisions, said UBS (marketwatch).

Citigroupi lemmik valik Euroopa investeerimispankade seas on Credit Suisse:

CS (+3%) remains our preferred stock amongst the major investment banks, on the back of significant operating leverage potential in theasset gathering businesses, across-the-board market shares gains in investmentbanking, and significant capital strength. At a 2011E PE multiple of sub-8x, webelieve that the stock remains inexpensive given its business mix.

-

Mobius on andnud päris pika intervjuu (link siin), kus kiidab arenevatel turgudel käimasolevat suurt pullirallit. Päris pikalt räägib ka Hiinast ja hiinlaste tarbimisvõimest, mis võib tema arvates inimesi positiivselt üllatada.

-

Illustreerimaks ootusi tänase tööjõuraporti osas, panen siia ühe lõigu Bloombergist, kus oodatakse põnevusega töökohtade lisandumist pärast 2 aastast pausi... või siis halvemal juhul töökohtade samaks jäämist (kuid mitte vähenemist):

Jan. 8 (Bloomberg) -- The economy in the U.S. probably stopped losing jobs in December for the first time in almost two years, a sign the recovery strengthened heading into 2010, economists said before a report today.

Payrolls were probably unchanged after falling every month starting in January 2008, according to the median of 76 economists surveyed by Bloomberg News. The unemployment rate may have held at 10 percent, near the 26-year high of 10.2 percent reached in October. -

& marketwatchist vaatab vastu pealkiri: "At last, payrolls could gain".

Economists surveyed by MarketWatch are looking for payrolls to rise by a seasonally adjusted 15,000 in December.

-

Kui keegi mu eespool pandud Mobiuse linki lõpuni kuulas, siis ca viimase kolmandiku juures räägib Mobius ka Venemaa atraktiivsusest ning ütleb, et on ka Ida-Euroopasse juba raha pannud, kuna näeb seal väga häid võimalusi. Samuti kiidab Vietnami, Ukrainat, Kasahstani, Nigeeriat, Saudi-Araabiat ning ütleb, et Dubai võlakriis pakkus samuti võimalust odavate aktsiate kokkuostmiseks Lähis-Ida regioonist.

-

Volatiilsusindeks VIX on aastalõpu ja -alguse püsiva ostusurve tulemusena langenud juba 19 punktini. Ajalooline keskmine on ca 20.3 punkti ning eilne näit oli madalaim alates 2008. aasta augustist. See näitab hirmu puudumist ja ahnuse võidukäiku, mis iseenesest on hoiatav märk.

-

Kui analüüsida,DUBAI kriisi oleks jah vöind ära kasutada

-

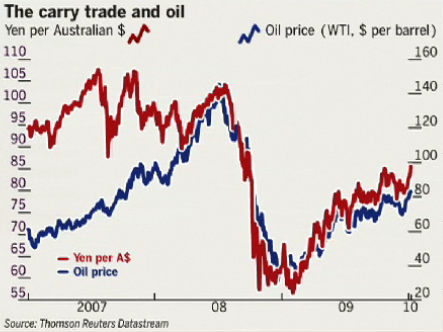

John Authers toob välja päris hea korrelatsiooni carry trade'i & nafta hinna vahel:

Jeenis/Austraalia dollar on üks kallasikaline carry trade (laenatakse raha madala intressimääraga riigist & pannakse kõrgema intressimääraga riiki, mille taga Austraalia puhul on suuresti toorainete eksport). Kuna nafta hind liigub jeen/AUDiga käsikäes, siis tekib küsimus, kui palju spekulatiivset raha on aidanud nafta hinna 80 dollarist kõrgemale lükata? kuigi eelmisel aastal olid kõik asjad tugevas korrelatsioonis, on see üsna hoiatav graafik.

-

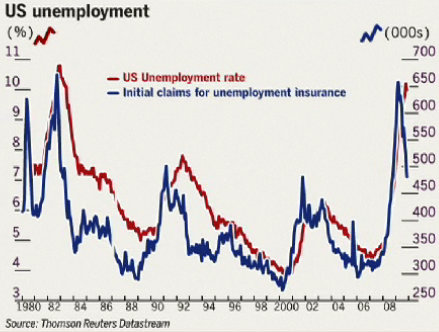

Authersilt veel üks hea graafik, mis näitab, miks konsensus on tänase tööjõuraporti suhtes väga optimstlik (töötusemäära aitab päris hästi prognoosida töötu abiraha taotluste järsk vähenemine):

15 min veel jäänud siiani selle aasta tähtsaima makrouudiseni.

-

0ngi aasta tähtsaim makrouudis nii vara ära?

-

December Nonfarm Payrolls -85K vs 0K consensus, November revised to +4K from -11K.

December Average Hourly Earnings M/M +0.2% vs +0.2% consensus, prior +0.2%.

December Unemployment Rate 10.0% vs. 10.0% consensus; prior 10.0%.

December Weekly Hours 33.2 vs 33.2 consensus, prior 33.2. -

UPS raises Q4 guidance to $0.73-0.75 vs $0.63 First Call consensus, up from $0.58-0.65

-

USA tähtsamate indeksite futuurid alustavad oodatust nõrgema tööjõuraporti järel päeva ca 0.3% kuni 0.5%lise miinusega.

Euroopa turud:

Saksamaa DAX -0,45%

Prantsusmaa CAC 40 -0,01%

Inglismaa FTSE 100 -0,33%

Hispaania IBEX 35 -0,49%

Rootsi OMX 30 +0,15%

Venemaa MICEX +0,01%

Poola WIG +0,16%Aasia turud:

Jaapani Nikkei 225 +1,09%

Hongkongi Hang Seng +0,12%

Hiina Shanghai A (kodumaine) +0,10%

Hiina Shanghai B (välismaine) +1,18%

Lõuna-Korea Kosdaq +0,64%

Tai Set 50 +0,78%

India Sensex 30 -0,43% -

A 'Sell the News' Dip Would Be Welcome

By Rev Shark

RealMoney.com Contributor

1/8/2010 8:13 AM EST

The trouble with unemployment is that the minute you wake up in the morning, you're on the job.

-- Slappy White

The first week of 2009 has been a good one for the market -- even better than the indices indicate. Under the surface we have had tremendous strength in banks and financials as well as some hot action in energy, commodities and various small-caps. This strong action has been covered up to some degree by profit-taking in big-cap technology names like Google (GOOG) , Apple (AAPL) and Amazon (AMZN) , which led the market much of last year. As a result of this shift, the S&P 500, which is more heavily weighted with financials, is up 2.38% while the Nasdaq 100, which holds more technology names, is up less than 1%.

Strength in the first week of the new year isn't too surprising, as the period has a history of strong gains. This positive seasonality typically starts to slow now, and we often have some sharp dips in mid-January as market players take gains before the kickoff of earnings season.

After the upbeat action of the last four days, we are in an interesting position as we await the December jobs data. Unemployment has been the weakest area in the economic picture, but there have been some positive trends and expectations for some solid numbers today are quite high.

So has this market already discounted some good news in the jobs report? We had one fairly sharp dip in early October but have been trending up pretty steadily since then. Market players have grown quite complacent, but who can blame them when there has been little more than some shallow dips?

The dilemma of this market is that it has done nothing wrong technically, but the low-volume wedging action higher doesn't give us very good support. If and when we do correct, conditions are ripe for a sharp and sudden spike down. The very tenacious dip-buyers have prevented any real pullbacks lately, which is one of the main reasons that sentiment has stayed so positive. When the dip-buyers finally falter, it will be an ugly trap for overly complacent bulls.

I really don't know what to expect from the jobs report this morning, but the risks of disappointment are pretty high given that we have already made a good move amid high expectations. I would not be at all surprised to see a "sell the news" reaction, especially as market players uncover seasonal adjustments and the other statistical games that are at work.

But even if we do see some downside action in the jobs news, plenty of strong charts out there will be even more appealing once they consolidate a bit. A healthy market needs to purge itself once in a while, and doing so now with earnings season fast approaching would not be a bad thing.

Let's see what the numbers bring this morning and go from there.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: NUHC +8.2% (light volume), DRWI +7.8%, PARL +7.4% (light volume), SLTM +6.4%, BLT +5.0% (light volume), SCHN +3.0%... Select security related names showing strength after Obama ordered improvements in security policy: ICXT +7.4%, IDN +6.5%, OSIS +4.5% (tgt raised to $35 at Roth following Rapiscan division 10-year contract announcement yesterday morning), ALOG +2.0%... Select financial related names showing strength: DB +2.5% (upgraded to Buy at UBS), UBS +2.4%, BAC +1.6%, RF +1.5%, ING +1.4%, BCS +1.1% (upgraded to Buy at UBS)... Other news: IDSY +24.6% (acquires GE Asset Intelligence), CYCC +14.6% (continued momentum), DYP +11.1% (still checking), CYTX +8.8% (says FDA grants 510(k) marketing clearance for its PreGraft system), BCRX +6.8% (partner filed NDA in South Korea for intravenous peramivir to treat patients with influenza), BKS +4.3% (will replace MPS Group in the S&P MidCap 400), SWKS +1.8% (Cramer makes positive comments on MadMoney), ALOG +1.1% (receives $10 million order for its explosives detection systems), BJRI +1.1% (files for $75 mln mixed shelf offering)... Analyst comments: VE +4.2% (added to Conviction Buy list at Goldman), ALTH +4.1% (initiated with an Overweight at JP Morgan), DAN +3.4% (initiated with a Buy at Goldman), CMG +3.4% (upgraded to Overweight at Morgan Stanley), RDN +2.6% (upgraded to outperform at Macquarie), HAL +2.2% (upgraded to Buy from Neutral at Goldman), WOR +1.6% (upgraded to Buy at KeyBanc Capital Mkts), NBR +1.6% (upgraded to Neutral from Sell at Goldman), AGU +1.5% (upgraded to Buy at Citigroup), JCP +1.1% (upgraded to Neutral from Sell at Goldman), EW +0.8% (added to Conviction Buy from Buy at Goldman).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: APOL -5.1%, AZZ -4.7%, LWSN -4.6%, GHDX -4.0%, BBY -2.1%, GPN -1.8% (also downgraded to Mkt Perform at Barrington Research )... Other news: SNTA -16.3% (priced a ~5.55 mln share common stock offering at $4.50/share ), YZC -4.3% (still checking), EJ -3.7% (still checking), GERN -1.4% (files S-3 to sell 228.1K shares of common stock)... Analyst comments: EWBC -4.7% (downgraded to Mkt Perform at FBR), HGSI -4.0% (downgraded to Neutral from Buy at Goldman), ARO -2.9% (downgraded to Underweight at Barclays), STX -2.7% (downgraded to Neutral from Buy at Goldman), TEN -2.6% (downgraded to Neutral from Buy at Goldman), PCS -2.4% (downgraded to Sell from Hold at Soleil), M -2.2% (downgraded to Neutral from Buy at Goldman), CL -1.5% (downgraded to Neutral from Overweight at JP Morgan), TEF -1.5% (downgraded to Sell at ING), TJX -1.4% (downgraded to Equal Weight at Barclays), GS -1.2% (ests cut below consensus at Citigroup), BA -1.1% (downgraded to Neutral at Macquarie ), KO -1.1% (downgraded to Neutral from Overweight at JP Morgan). -

Fed's Rosengren says recovery in jobs market to be slow process - DJ

-

Nasdaq Comp sets new session high of 2309, this wk/52-wk high is at 2314

Resistance above in the 2326/2335 area. -

Täna jäi Bloombergist silma selline lause:

Federal Reserve Chairman Ben S. Bernanke has pledged to maintain record-low interest rates until joblessness subsides.

Elame näeme kuidas selle lubadusega jääb. -

Verizon guides Q4 EPS below consensus- 8-K Filing

-

Verizon ests and tgt lowered to $36 at Pali Research due to lower revenue and margin estimates in the wireline business

-

Obama awards $2.3 bln in tax credits under recovery act for companies investing in clean energy technology, says White House - Reuters

-

Greece confident EU will endorse its stability plan, according to Fin Min - Reuters

-

Fed's Lacker says must be careful to keep inflation in check - DJ

-

Fed's Lacker not expecting a huge increase in mortgage rates when Fed MBS program ends - Reuters

-

Fed's Lacker says "conceivable" that Fed policy rate would be the rate on excess reserves - Reuters

-

Nov Consumer Credit -$17.5 bln vs the -$5.0 bln consensus

-

Kas siit nüüd veel jõudu minna või esmaspäeval lastakse aur välja? Sellise data peale nii uhket liikumist poleks ilmaski ette kujutanud.

Päeval jäid retaili andmed foorumisse panemata, mille parandan nüüd:

November Wholesale Inventories +1.5% vs -0.3% consensus, prior revised to +0.6% from +0.3%