Börsipäev 11. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Vaatamata oodatust selgelt nõrgemale tööjõuraportile lõpetati reedel päev USA turgudel plussis ning seega kujunes 2010.a avanädala S&P500 tõusuks +2.7%. Hiina eile avaldatud tugevad ekspordi- ja impordinäitajad on varahommikul toetamas positiivset sentimenti Aasia turgudel ning kergitanud USA indeksite futuure 0.4%.

Olulist makrot täna avaldamisele ei tule, küll aga hakatakse suuremat tähelepanu pöörama taaskord kvartalitulemuste avaldamistele, kui pärast turgude sulgumist teeb avalöögi Alcoa. Konsensus ootab alumiiniumitootja lõppenud kolme kuu käibeks 4816.62 miljonit dollarit ja aktsiakasumiks 0.06 dollarit (mullu -0.28 USD).

-

USA tähtsamate indeksite futuurid on igaljuhul hommikul taaskord kõrgemal kauplemas Nasdaq100 ha S&P500 futuurid hetkel +0.35%. S&P500 on sellega kõrgeimail tasemel pärast 2008. aasta oktoobrit ning Nasdaq100 on kõrgeimail tasemel pärast 2008. aasta augustit.

-

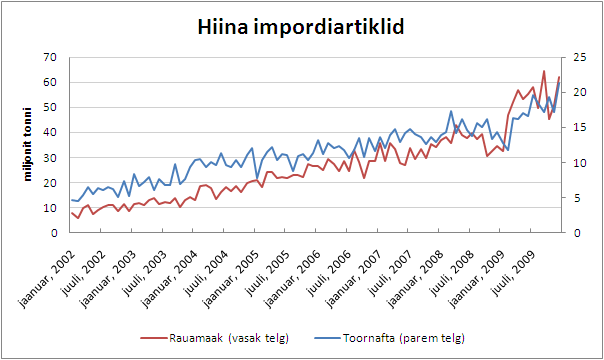

Hiina ligi 56%-lise impordikasvu detsembris võrreldes mullusega on põhjustanud eeskätt energiavarade ja toorainete suurenenud sissevedu tänu riigi tööstussektori kiirele taastumisele. Nii näiteks kasvas eelmisel kuul toornafta import rekordilise 21.26 miljoni tonnini ja rauamaagi import 80% võrreldes 2008.a detsembriga. Nõudluse kasvule viitavad numbrid ja dollari nõrgenemine on kergitanud täna hindasid nii metalli kui energiaturul: vask +2.9%, alumiinium +2.2%, tsink +3.5%, toornafta +0.9%. Nafta veebruarikuu futuur on hiilinud juba 15 kuu tippu (83.48 USD).

-

Lisan oma eelmisele postitusele täienduseks veel ühe graafiku, illustreerimaks miks makroarengutele Hiinas on globaalsetel energia-, metalli- ning paljudel teistel toorainete turgudel hakatud viimastel aastatel järjest rohkem tähelepanu pöörama.

-

Erko jutule energiateemadel jätkuks:

Citi tõstis oma pikaajalise naftahinna prognoosi $65 pealt $80 peale ja jõuab sellega teistele analüüsimajadele nüüd n-ö järgi. Lühemas/keskmises perspektiivis ootavad nad hinna jõudmist $90 juurde. -

Venemaa börs on käesoleval aastal esimest päeva avatud ning loomulikult tuleb ju ülejäänud maailmale järgi võtta + veel toorainete ralli = Micex +5.6%.

-

Naftahinnad on eelturul 1% jagu plussis ja tõusnud $83.6 peale. Võrreldes aastataguste $40liste barrelihindadega, teeb see aastaga üle 100% tõusu.

-

Ei tegele oma laenuportfelli refinantseerimisega ainult riigid, pangad ja suurettevõtted, vaid ka spordivõistkonnad. Täna on siis WSJ's uudis selle kohta, et Manchester Unitedi jalgpallivõistkond kavatseb välja anda ca $800 miljoni eest 7-aastaseid võlakirju, et olemasolevat võlga refinantseerida. Link siin.

-

Jim Cramer lisab hagu tulle ja ütleb järgmist:

"Stocks Ripe for an Explosion - from autos to banks to tech, stocks look ready to break out and drive higher." -

Suurim tõusja-börs siis täna Venemaa, kes nääride järel on teistele maailma aktsiaturgudele nii-öelda järele spurtimas.

Euroopa turud:

Saksamaa DAX +0.61%

Prantsusmaa CAC 40 +0,59%

Inglismaa FTSE 100 +0,49%

Hispaania IBEX 35 -0,05%

Rootsi OMX 30 +0,96%

Venemaa MICEX +5,92%

Poola WIG +0,92%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hongkongi Hang Seng +0,51%

Hiina Shanghai A (kodumaine) +0,52%

Hiina Shanghai B (välismaine) +0,49%

Lõuna-Korea Kosdaq +0,27%

Tai Set 50 +1,19%

India Sensex 30 -0,08% -

Mind the Trend

By Rev Shark

RealMoney.com Contributor

1/11/2010 8:21 AM EST

There are no mistakes or failures, only lessons.

-- Denis Waitley

The action in the first week of the new year looked much like what we saw in 2009. Just like last year, we moved straight up even though we were a bit technically extended and volume was not that great. All week long there was very strong underlying support that prevented any meaningful pullback. That frustrated underinvested bulls who never had an easy opportunity to add some exposure on a pullback.

If you dig a bit beyond the indices, the action looks even better. The financial sector was extremely strong and there was some very aggressive buying in small-caps, particularly the China names.

The primary thing that the indices failed to reflect was the aggressive sector rotation that was taking place. Big-cap technology names such as Google (GOOG) , Apple (AAPL) , Amazon (AMZN) , Baidu (BIDU) and Priceline (PCLN) were weak while money flowed into banks, housing and retails. This rotation was particularly vigorous on Thursday, but on Friday it reverted somewhat and the big-cap technology names bounced sharply. The net effect of this rotation was that a number of market segments acted much stronger than would be reflected by the indices.

So where do we go from here? The bearish argument is that we are technically extended and positive seasonality will begin to slow over the next couple of weeks. The early days of January sees new inflows into the market and lots of folks eager for a positive start. At some point in January, though, the market players who deferred taking gains in the prior year for tax reasons will typically take some gains.

Of course the lesson we learned over and over again last year was that trying to anticipate when this market will pull back is a recipe for disaster. Numerous times last year, especially at the start of the month, we just went straight up many days in a row and never had a meaningful pullback. Fighting the momentum just didn't work, and what made it even worse was that in many cases the rallies had poor technical setups and very weak volume.

Another bearish argument that has had little impact on the market action is that there is a very high level of complacency. Various sentiment surveys show that bullishness is at extreme levels generally associated with tops, but the upbeat mood has persisted for quite a while and so far it just hasn't matter. If you tried to time the market by how frothy it felt, you haven't had much luck.

So here we are, kicking off the second week of 2010 with another positive, upbeat open. The lesson once again is that we shouldn't fight the strength until we actually have some poor action. Market players just aren't ready yet to do much selling, and when they do shed some shares we have plenty of dip-buyers who are anxious to jump in very quickly.

As the old saying goes, "The trend is your friend" -- stick with it, no matter how unreasonable it might seem, until there is good reason not to.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: TUES +26.1%, MDRX +3.6%... Select metals/mining related names showing strength: EGO +2.6% (Cramer makes positive comments on MadMoney), AA +2.5%, GG +2.3%, GLD +2.0%, FCX +2.0% (Cramer makes positive comments on MadMoney), BBL +1.9%, BHP +1.7%, VALE +1.6%, MT +1.5%, RTP +1.4%... Select oil/gas related names trading higher: BP +3.0% (upgraded to Buy at Citigroup), E +2.7%, TOT +2.2%, REP +1.8%, COP +1.2%, PBR +1.1% (upgraded to Buy at Citigroup), CVX +1.1% (upgraded to Buy at Citigroup)... Select European drug names trading higher: SNY +2.2%, GSK +1.2%... Other news: EXXI +22.1% (Announces "Major Discovery" at Davy Jones Ultra-Deep Well in Shallow Water on the Gulf of Mexico Shelf), IDIX +14.7% (announces significant progress in three HCV programs), MAPP 14.5% (announces FDA will not require a second pivotal efficacy study for LEVADEX NDA submission), MMR +12.7% and PXP +9.4% (MMR announces a discovery on its Davy Jones ultra-deep prospect located on South Marsh Island Block), SSTI +7.9% (Cerberus among interested buyers Of Silicon Storage Tech - DJ), POL +7.5% (Cramer makes positive comments on MadMoney), BCRX +5.7% (announces two additional Peramivir partnerships), TWC +5.6% (mentioned positively in Barron's), ACH +5.5% (traded higher overseas), ZBB +3.9% (to receive $14.87 mln in clean energy tax credits), HUGH +3.9% (mentioned positively in Barron's), CACC +3.5% (ticking higher following positive newsletter mention), SVA +3.4% (ticking higher following positive newsletter mention), CAAS +2.5% (profiled in New America section of IBD), SOLF +2.1% (Solarfun Power awarded three PV module contracts totalling 12.65 MW in China), HBC +0.8% (mentioned positively in International Trader - Barron's)... Analyst comments: ACI +5.3% (upgraded to Overweight from Underweight at Morgan Stanley), GLW +4.6% (upgraded to Buy at Deutsche), NAT +4.1% (upgraded to Buy at Jefferies), TER +3.8% (upgraded to Outperform from Market Perform at FBR Capital), FRO +3.4% (upgraded to Buy at Jefferies), AMAT +3.1% (upgraded to Outperform from Market Perform at FBR Capital), SPWRA +2.8% (upgraded to Buy at Societe Generale), NTGR +1.5% (upgraded to Neutral from Sell at Goldman), INTC +1.2% (upgraded to Hold at Auriga), CLD +1.1% (initiated with a Outperform at Credit Suisse).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: HOGS -8.5%... Other news: ASBC -9.2% (announces $400 mln common stock offering), LIWA -8.9% (filed for $100 mixed securities shelf offering), FMX -6.6% (FEMSA agrees to exchange beer operations for 20% economic interest in Heineken), MNKD -5.0% (announced that it was informed by the FDA that the FDA will not be able to complete the review of MNKD's new drug applications by the action date of Jan 16, 2010), TRIT -4.1% (filed for $34.5 mln ordinary share offering), LPL -3.5% (still checking for anything specific), UNG -2.9%... Analyst comments: INFN -6.7% (downgraded to Sell from Neutral at Goldman ), LPS -1.3% (downgraded to Neutral from Buy at Goldman), Q -1.1% (downgraded to Market Perform from Outperform at Raymond James), BKC -1.1% (downgraded to Hold at Deutsche), DIS -1.0% (downgraded to Neutral from Buy at Janney Montgomery), RTI -1.0% (downgraded to Neutral from Outperform at Cowen). -

Fed's Lockhart says "reasonably comfortable" that inflation will remain in check for immediate future - Reuters

Fed's Lockhart sees risks in commercial real estate in 2010 - DJ -

Roubini Calls End Of Market Rally - In The 2H - DJ

DJ reports there's a limit to how much the equities market can rally, Nouriel Roubini says at a meeting of the Investment Management Consultants Association. By the 2H10 investors will begin to see this limit, since "a lot of the recovery looks like too much, too fast, too soon," he says. In the short term, temporary factors of liquidity, fiscal stimulus and dollar-funded carry trade will keep the rally going but it's not sustainable; "The corporate sector has spent the past year cutting the fat but after 7.5 million jobs lost, they are reaching the bone and the ability of the corporate sector to further slash costs will be restrained," he says. -

Fed's Lockhart says U.S. GDP likely 3.0-3.5% in 2H09-- Bloomberg

-

$10 bln 10-year TIPS Auction Results- Yield: 1.430% (1.432% expected); Bid/Cover: 2.65x (4 auction avg 2.59x, prior 3.12x); Indirect Bidders: 40.7% (4 auction avg 41.8%, prior 44.0%)

-

Kas oli Roubini see, kes viimasest kolmest karuturust seitse on õigesti ennustanud?

-

Obama administration to announce on Tuesday probe of FHA approved lenders, according to HUD - Reuters

-

Bank of America: SEC seeks to file new charges against Bofa on Merrill deal - WSJ

-

PVH raises Q4 EPS and revs guidance

-

Alcoa prelim $0.01 vs $0.06 First Call consensus; revs $5.4 bln vs $4.82 bln First Call consensus

-

Excluding charges, Alcoa said it earned 7 cents a share. Analysts had forecast 5 cents a share on sales of $4.9 billion.