Börsipäev 22. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

USAst tulevate tulemuste arv on üha hoogustumas - kõige mugavam on neil silma peal hoida läbi meie tulemuste tabeli, mis eilsete numbrite ja liikumistega taas ära uuendatud. Link on siin.

Majandusuudiseid täna USAst tulemas ei ole, seega tähelepanu pöördub tänasel eelturul tulemused teatavale General Electricule (GE) ning finantssektorile, mis eilse Obama prop-tradingu reguleerimise plaani tõttu kõvasti pihta sai. Küsimus on, et kas USA valitsusel on tõesti plaanis väga tugevalt hakata oma finantssektorit reguleerima või tehkase lihtsalt sõnadega kurja nägu, kuid reaalne sekkumise ulatus on väiksem. Hetkel on seda veel raske hinnata.

-

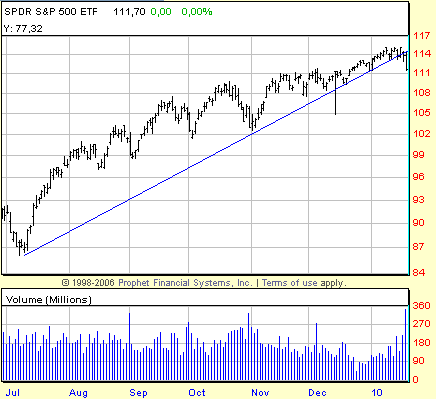

Erinevate uudiste koosmõjul kukkus eile igaljuhul S&P500 indeksi liikumist jälgiv börsilkaubeldav fond SPY juuli algusest kestnud tõusutrendi joonest suure käibega allapoole läbi.

-

Obama prop-traidingu reguleerimise idee enamvähem järgmine:

The bottom line is that banks will have to choose between owning a deposit-taking institution, with access to emergency federal funding, and supposedly higher-risk activities. That suggests that Goldman Sachs and Morgan Stanley could relinquish bank status, avoiding major changes to their businesses and challenging regulators to keep tabs on them outside the bank system. The proposals, then, could be more arduous for the largest, integrated banks, such as JPMorgan and Bank of America, which could also face limits on their growth from a new cap on bank size.

Nagu Joel ütles, siis hetkel kõik veel spekulatsioonid & esiteks soovitakse teada, kuidas Obama üldse prop-tradingut piiritleb:

The detail will make a huge difference. For example, pure proprietary trading – investment by the bank on its own, not clients’ behalf – at JPMorgan Chase contributes well below 1 per cent of revenues. But much client trading involves taking balance sheet positions and then holding them. So when does client work cross the line into prop trading? Determining what constitutes “sponsorship” of a hedge fund will also be crucial. Asset management vehicles that take short positions (and in which some banks invest alongside clients) could be affected. But lending and advisory services, such as prime brokerage and leveraged finance, seemingly will not be. (FT)

-

Bürokraatiat kui palju. Kui Morgan Stanley'l ja Goldman Sachs'il oleks piirangutest niisama lihtsalt võimalik mööda minna läbi oma pangalitsentsi tagasiandmise, siis tundub kogu see plaan kui üks suur farss. Kui vaja, olen pank, kui vaja, ei ole pank.

-

Vägisi meenub aeg kui USAs tohtis kommertspank tegutseda vaid ühes osariigis ja selleks, et üle riigi toimetada tuli bank holding company teha. Ja poliitikud olid rahul.

-

Esialgu tundub tõesti palju populismi olevat - pangad raporteerivad hiiglaslikest kasumitest (& boonustest) ja Obama tahab kiirelt näidata, et tegeleb probleemiga & teeb avalduse, kus kindlasti rohkem küsimusi kui vastuseid. Aga kahtlemata saab sellest kuum teema. JPM kommenteerib plaani mõju pankade kasumitele järgnevalt:

Overall, we estimate a negative 2011E EPS impact of -21% on average from IB proposed regulations including proposed OTC derivatives regulation. Obama’s proposals . . . have a bigger impact on earnings with -15% EPS dilution on average in 2011E, compared to B. Frank’s proposed OTC derivatives regulation with estimated -6% on average.

Enim riske nähakse just Goldman Sachsi EPSile:

Within our IB stocks, GS is most at risk with its principal investments business at risk and high fixed income gearing, with a potential total negative 27% EPS impact in 2011E from the Obama proposals (-20%) and proposed OTC derivatives regulation (-8%). GS is followed by DB due to its high fixed income profit generation with estimated -23% EPS impact.

-

Kui panganduse kasumid vähenevad, siis kukuvad sellega ka ka nende kasumite pealt riigieelarvesse teenitavad maksutulud. Oksa, mille peal ise istutakse, ei ole minu arvates kõige nutikam saagida.

-

Aga mis siis, kui see oks on kuivanud ja haigusi täis ning selle alles jätmine ähvardab lõpu teha tervele puule. Jääd korvitäiest õuntest ilma, aga vähemalt on ülejäänud puu alles.

-

Pankurid ja farmaatsitööstus on valdavalt vabariiklaste pärusmaa ning jutt oli paar päeva tagasi, et tervishoiureform võib tagasilöögi saada.Tulemus: tuleb tervishoiureform ja pangad jäetakse rahule (või tehakse palju kära aga sisuliselt jääb asi sinnapaika). Mõtte vaba lend..

-

Lamisen vaikselt ja pahuralt isekesi, et tegelikult on murelik: valitsused on ennast lõhki laenanud (us, Uk,), fundamentaased numbrid on kehvad, ettevõtete tulemused pigem halvad, hiina vähendab rahapakkumist, eu mängib kreekaga kõva meest, etc. Ja turg on extended ning pole nagu sellist tunnetki, et võiks üles minna, kas ainult minul? Pole nagu loogiline, et võiks tõusta.

Ja siis jääb Obama tervishoiureformist ilma ja peab enda mustanahalistele valijatele hakkama selgitama miks ta nendele lubatud raha hiigelpankade päästmiseks välja jagas, ehhee. Pigistabki pankasi avalikult ja küll nemad seal juba teavad milline meeleolu tänavatel valitseb kui praegu sellise sammu astuvad. Inimestel on kõrini igasugustest wall street pakettidest, nõrgenevatest valuutadest, kõrgemast maksustamisest- tuleb raiskamise-laenamise asemel säästma ja efektiivsust parandama hakata. ( Usk hakkab varsti kaduma, et sellest asjast kuidagi kavaldades välja saab. Ja nii nagu see asi praegu on üles ehitatud, siis voolab kogu see väljatulemine OPECisse ja BRIC nagunii. Lootust pole.)Tuleb üks korralik head and shoulders ja sõidame alla. juhhuu -

Meredith Whitney discussing the Volker Plan: 'Our bet is it goes through'; says it will not be pretty for banks or customers-- Bloomberg

-

Google (GOOG) downgraded to Hold at Collins Stewart; tgt lowered to $615

-

Euroopa näitas korralikku langust teist päeva järjest - USA futuurid on hommikul miinuses ca 0.5%.

Saksamaa DAX -1.14%

Prantsusmaa CAC 40 -1.06%

Inglismaa FTSE 100 -0.93%

Hispaania IBEX 35 -1.45%

Rootsi OMX 30 -0.22%

Venemaa MICEX -2.22%

Poola WIG -2.28%Aasia turud:

Jaapani Nikkei 225 -2.56%

Hongkongi Hang Seng -0.65%

Hiina Shanghai A (kodumaine) -0.95%

Hiina Shanghai B (välismaine) -2.08%

Lõuna-Korea Kosdaq -0.43%

Tai Set 50 -0.72%

India Sensex 30 -1.12% -

It's All Context

By Rev Shark

RealMoney.com Contributor

1/22/2010 8:39 AM EST

There is nothing either good or bad, but thinking makes it so.

-- William Shakespeare

The weakness in the market on Thursday is being blamed on President Obama for proposing new financial regulations designed to reduce risk taking by big banks. The political winds shifted after the stunning Senate election in Massachusetts, and many market players are now concerned that this is just the start of a populist campaign against Wall Street and the financial sector.

While the news is obviously not a positive, I contend that the market was technically ready for a correction and this news just provided an easy excuse. Had we had a more positive technical setup, the news probably would not have the same impact.

The media always look for reasons to explain why the market has moved the way it has. They see it as a simple cause-and-effect relationship.

Usually the news is not inherently good or bad. The technical condition of the market generally determines whether it is "good" or "bad." If we had the same bank regulation news last March, the market reaction probably would have been positive rather than negative. We have a negative reaction now because the market was extended and looking for a reason to correct.

We can see the exact same thing at work with earnings. By most measures the earnings news has been pretty good so far, but the market is not in good shape technically, hence we have had a "sell the news" reaction to strong reports.

It is all about context, and when the market is technically ready to correct, it is going to find a reason to do so regardless of whether we think the news flow is good or bad.

With that in mind, that big question now is whether this market is finally ready to undergo a more significant correction. The S&P 500 closed right at its 50-day simple moving average yesterday. We have only been below that point twice since April. We have had a few pullbacks since the lows in March but have always turned back up fairly quickly and made new highs.

As I discussed in my closing post last night, we really have no choice but to be more defensive when the market is exhibiting technical weakness as it is now. That didn't work very well at all last year when we'd just go right back up in a straight line, but there is just too much risk to anticipate that it will happen again.

The market went down hard enough that we are probably due for some reflexive bounce, but this is a time to play defense. If you are playing long, then you'd better have a very short-term time frame.

Google (GOOG) earnings disappointed last night, and GE (GE) is too much of a wallowing elephant to matter. The next key report is coming Monday evening when Apple (AAPL) reports, so we don't have a lot of new catalysts until then. In the meantime, we may see some fast bounce trades, but this breakdown is going to start giving us better short setups.

Make sure you protect that capital and don't be too optimistic about the chances of another very quick reversal and a move to new highs. This time may indeed be different.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CNXT +15.6%, ISRG +7.6%, JCI +7.1%, IGT +4.0% (also upgraded to Outperform from Perform at Oppenheimer), EZPW +2.5%, GE +2.0%, ERIC +1.6%... Other news: SOMX +106.8% (provides update on new drug application for Silenor for the treatment of insomnia), ANDS +12.6% (provides progress update on Phase II Study of ANA598 in Hepatitis C Patients), ENWV +7.2% (light volume; repurchases preferred stock from Oak Investment Partners), NRG +3.3% (will replace Sun Microsystems in the S&P 500 after the close of trading on a date to be announced), MED +3.1% (reounding from this week's 5 point decline), LOGI +2.4% (still checking), APWR +1.1% (still checking), KMP +0.8% (Cramer makes positive comments on MadMoney)... Analyst comments: NCS +5.4% (initiated with a Buy at Canaccord), CNX +5.2% (upgraded to Buy from Neutral at Goldman), BAS +4.7% (upgraded to Buy at Deutsche), JWN +3.2% (upgraded to Neutral from Underperform at BofA/Merrill), SPRD +2.4% (upgraded to Overweight from Equal Weight at Morgan Stanley), UNH +2.3% and OXY +1.6% (Hearing added to Buy List at tier 1 firm).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SYNA -11.0%, IBKR -7.8%, AMD -6.1% (also downgraded to Sell at Auriga), FSC -5.5% (also announces commencement of 7.0 mln common stock offering), GOOG -4.5% (also downgraded to Hold at Collins Stewart), COF -4.0%, KMB -3.5%, MSCC -2.8%, CBST -2.8% (light volume), AXP -2.3%, STI -2.2%, ED -1.8%, ELX -1.3% ... M&A news: KFT -1.1% and CBY -0.8% (Hershey rules out Cadbury move as it paves way for Kraft to seal deal - Financial Times)... Select financial names showing weakness: BCS -6.7%, DB -5.0%, RBS -4.5%, CS -4.2%, AIB -3.7%, IRE -3.5%, HBC -2.3%, UBS -1.8% (downgraded to Underperform from Neutral at Exane BNP Paribas)... Select oil/gas names trading lower: BP -1.2%, STO -1.0%... Select metals/mining related names under pressure: RTP -2.0%, GFI -2.0%, AU -1.9%, GOLD -1.7%, VALE -1.4%, MT -1.3%, BBL -1.0%... Select tech/internet related names ticking lower following GOOG results: SOHU -2.2%, BIDU -1.9%, YHOO -1.2%... Other news: ACHN -16.9% (prices public offering of 10.275 mln shares at $2.08/share), NAT -6.7% (announces offering of 4 mln common shares pursuant to effective shelf registration statement), FRE -3.1% (Fannie Mae, Freddie losses may hit U.S. - WSJ), FCEL -4.5% (still checking), PAG -2.0% (filed a registration statement for a proposed secondary offering of up to 5.75 mln shares of its common stock), DAI -2.1% and F -1.1% (still checking)... Analyst comments: BRKS -3.9% (downgraded to Sell from Hold at Citigroup), SLM -3.5% (downgraded to Neutral from Buy at Ladenburg), ZLC -3.2% (downgraded to Underperform from Buy at BofA/Merrill), KEY -3.1% (downgraded to Mkt PErform at Keefe Bruyette), JOYG -3.0% (downgraded to Neutral from Buy at Goldman), X -2.7% (downgraded to Buy from Conviction Buy at Goldman), FCX -2.3% (downgraded to Neutral from Buy at Goldman), ATMI -2.2% (downgraded to Sell from Hold at Citigroup), KLAC -1.9% (downgraded to Sell from Hold at Citigroup), PLD -1.9% (downgraded to Underperform from Market Perform at Wells Fargo), AMAT -1.8% (downgraded to Hold from Buy at Citigroup), BDX -1.5% (downgraded to Neutral from Overweight at Piper Jaffray). -

Treasury official tells CNBC that policy on prop trading will come back to the Treasury and it will be sensible

-

Apple removed from buy list at Deutsche Bank

-

CME Group sees volume spike as Bloomberg runs headlines from Meredith Whitney's pre-mkt note on the bank reform proposals, which said CME may benefit as orders go to exchanges

-

U.S. Democratic Sen. Boxer says opposes second term for Bernanke - Reuters

-

Barney Frank says will hold hearings on housing finance market and then move to a restructuring of Fannie, Freddie; will look at Federal Home Loan banks, the structure of FHA, Ginnie Mae - Reuters

-

CNBC reports right now, Ben Bernanke has 16 Yes votes, 11 No votes and 16 Undecided

Krutitakse põnevust üles:) -

VIX on jõudnud 2 päevaga 17-18 vahemikust 26 punktini. Muljetavaldav liikumine.

-

Täna siis jälle üpris verine päev börsil. Vördlen graafikuid, Tallinna OMX ja Nasdaq, paratamatult jookseb juhe kokku, kui Nasdaq miinus 2 prossa aasta algusest ja Tallinn 30prossa pluss aasta algusest.

Vaatan ja imestan, sest pole ju maj, buumi siin, töötus kasvab, maj suht niru jne.

Ma lihtsalt ei saa aru. Vöibolla seda lohutan, et tegemist fondide koti pähe tömbamisega Tallinnas -

angelike

Lohuta aga. Vist teist päeva juba ilma. Ei mingit tõusu... -

Nüüd hakkas langus pihta Nasdaqil, ei no normaalne

-

FAZ-i callid on hea kaup

-

Kui Tallinn OMX isegi 10 prossa plussi jääks, on igati hea

Eks näis, mis Tallinn OMX järgmine nädal teeb -

10 prossa plussis FAZ

mnja -

Eks seda ole juba üsna kaua rõhutatud, et kui kord see langus tuleb sisi võib olla üsna verine. Hetkel S&P 500 kauplemas alla 1100 punkti, mis psüholoogiliselt üsna oluline tase. Järgmine nädal saab kahtlemata väga huvitav olema, kuid pakuks et siit tuleb langusele veidi lisa.

-

Järgmine nädal saab ka huvitav olema, mis Tallinn OMX teeb. Kas verd tuleb .

-

lõpuks verine, eks veel tundlikum saab olema aasia esmasp,ja millist tampi eesti aktsiad võivad saada koridor võib päris kitsaks minna,aga eks paista

-

Angelike, Tallinn oli üles haibitud. Mingit hea uudisega tegelikult ju keegi börsiettevõtetest lagedale ei tulnud ja põhjus tõusuks igati puudus. Suures osas on Tallinna turul tomuvas ka LHV käsi mängus.. Tehke ise omad järeldused, kes antud tõusust kõige rohkem kasu lõikab ja kelle arvelt ning kes lolliks tehakse.

-

Obama selle tõusu sigitas ja nüüd ka tapab:) OMX kohta saab ainult kiidusõnu öelda,tragid poisid jõdsid just aastaks plaanitud tõusu õigeks ajaks ära teha. Järgmine nädal saab huvitav olema ,hirm ja ahnus käivad käsikäes,nobedad näpud saavad surnud kassi põrkest osa.

-

wunkerbol, vastupidi on hoopis. Baltikum kaigub headest uudistest, ettevõtete tulemused paranevad, eesti saab euro, intressid langevad, etc. Tegelikult polnud kohapealt mitte ühtegi kehva uudist, et aktsiad ei peaks rallima, aga õhk oli otsas ja muu maailm pakkus meile võimaluse hinge tõmmata.

-

Löikasin kasu 20minutiga oma mingitest jäänusrahadest ,mis olid jäänd. A positsiooni pole Tallinnas. Ma poleks seda uskund, mis Tallinnas toimuma hakkab. Seega loll olen

Im Failed -

vix-i vaadates võiks järgmine nädal korralik põrge tulla

-

Tibusid loetakse sügisel. Seniks mänguilu!

-

Mina näen küll oma rahakotis veel kroone. Sündmustest ette ei maksaks rutata, võib valusalt tabada. Ei ole see euro veel käes midagi ning tõenäoliselt otsustavad euro saatuse ikkagi maailmapankurid mitte Eesti. Intressidest niipalju, et uudistest võib välja lugeda keskpanga plaani intressi tõstmisest 3-4 kuu pärast. Marginaali hakatakase langetamas sel hetkel kui keskpanga intressi samal ajal tõstab. Seega pettus. Mine panka ja küsi laenu, intess on sama mis 6 kuud tagasi. Tulemused olid paremad, aga siiski miinus.

-

Peale seda verist kukkumist nasdaqil peaks pörge toimuma. A nagu LHV rääkis, et veel kukkumisruumi seal, palju siis veel.

Et Nasdaq oleks miinus 30 ja Tallinn pluss 30.Selle graaafiku siis salvestaks endale eluks ajaks. Ansip sai oma tahtmise, panen kommi ka siukse -

Kuidas YHI kokku kraapis, fondid tantsivad Saaremaa valssi, juuksurid ja taksojuhid ka,kui kauaks.

Vöi kuis see oli pidu KATKU AJAL -

oh angelikene, angelikene, mis sa arvad, kes see juuksurslashtaksojuht siin foorumis on?