Börsipäev 26. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Tulemuste tabel eilsete teatajate ja liikujatega uuendatud - otselink tabelile on siin.

Tänase päeva tähtsaim USA makrouudis saabub Eesti aja järgi kell 17.00, mil teatatakse jaanuarikuu tarbijausalduse näitaja. Ootuseks on 53.5 punkti, mis oleks sarnaselt detsembriga pea sama näitaja. Turule meeldiks loomulikult võimalikult kõrge tarbijausalduse näitaja.

USA eelturg on ööga igaljuhul korralikku miinusesse kukkunud. S&P500 futuurid hetkel ca -0.8% ning Nasdaq100 -0.6%.

-

Suurbritannia majandus jõudis neljandas kvartalis ka lõpuks plussi, kuid 0.1% jääb paraku väiksemaks kui lootis näha konsensus (+0.4%).

-

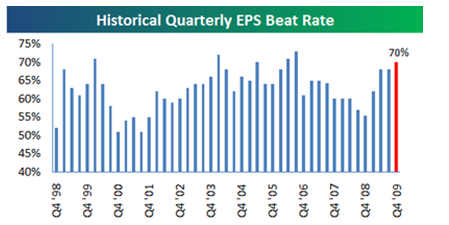

BIGilt graafik, mis näitab kui ilusad tulemused siiani on olnud (turu reaktsioon on selliste tulemuste peale üsna kole):

-

IMF ups US 2010 forecast to 2.7%, lowers 2011 estimate to 2.4% - DJ

-

Morgan Stanley upgraded to Outperform from Mkt Perform at William Blair

-

November S&P/Case Shiller Composite-20 Y/Y -5.32% vs -5.00% consensus, prior -7.28%

-

USA alustab päeva ca 0.5%lise miinusega.

Euroopa turud:

Saksamaa DAX -0.16%

Prantsusmaa CAC 40 -0.15%

Inglismaa FTSE 100 -0.14%

Hispaania IBEX 35 +0.38%

Rootsi OMX 30 -0.67%

Venemaa MICEX -2.22%

Poola WIG -1.30%Aasia turud:

Jaapani Nikkei 225 -1.78%

Hongkongi Hang Seng -2.38%

Hiina Shanghai A (kodumaine) -2.43%

Hiina Shanghai B (välismaine) -1.58%

Lõuna-Korea Kosdaq -2.27%

Tai Set 50 -1.44%

India Sensex 30 N/A (börs suletud) -

Lacking Leadership

By Rev Shark

RealMoney.com Contributor

1/26/2010 8:31 AM EST

The four most dangerous words in investing are, "This time it's different."

-- Sir John Templeton

Apple's (AAPL) earnings report last night wasn't quite as spectacular as it first appeared due to an accounting change, but it was solid and the stock is trading up this morning. We have plenty of reports yet to come, but many of the most important are already out, so earnings will have less of an impact going forward.

The most interesting thing about the market at this point is that we are at the technical juncture that so often surprised us last year. We rolled over and started to break down but we stabilized and bounced slightly yesterday. The action wasn't very strong, but it was positive and now we are steady again this morning.

Last year it was at this point where the market would continue to bounce and go straight back up. Anyone who had taken defensive action or had put on some shorts in anticipation that the market would make another leg down would find themselves leaning the wrong way and have to scramble to reposition. The market would just keep on going up and the chase -- and the short squeeze -- would be on.

Is that scenario going to play out yet again, or is it different this time? I'm less confident that the market is going to be able to reverse back up as easily. Several things are going on that are affecting the market character, and once we are past excitement over Apple and some other news like Ben Bernanke's growing chances of being reappointed, I am looking for more of a struggle.

The first thing that has changed recently is the political atmosphere. Last year we rode a wave of liquidity created by giant bailouts and huge stimulus packages. The focus now is on controlling spending and on finding ways for Wall Street to repay the help it was given. Banks are in the cross hairs, and the flames of resentment against the financial industry are being fanned.

Another change weighing on the market is that China continues to clamp down on lending. The Chinese are worried about an overheated economy and a real estate bubble and are taking steps to rein things in. There has already been a substantial pullback in many China stocks, but they were very weak again last night on the latest move to cut lending. S&P cut its rating on Japan debt last night, which also helped pressure Asian stocks last night.

The weakness in Chinese stocks highlights another problem this market faces -- the lack of any good leadership. We had a little life in regional banks on the assumption that federal crackdowns on the large money-center banks would somehow benefit the smaller regionals. It seems to me that if money-center banks are restricted they are more likely to be competition for regional banks rather than less.

Outside of the regional banks, we really haven't had good leadership in this market. Some of the technology names like Intel (INTC) , IBM (IBM) and now Apple have had good reports, but the market reaction to the news has been tepid at best. This market needs leadership to attract the bulls and to create some new momentum.

So the big picture now is that we have a difficult technical setup, political headwinds and little upside leadership. If the bulls are going to have the same success they enjoyed last year, this is the point where they need to regroup and show they can do it. It is going to be particularly interesting to see if AAPL can hold on to its early gains or whether it acts similarly to the way Intel and IBM have.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: VMW +16.3%, VLTR +13.7% (also upgraded to Buy at Needham), MTXX +8.6%, PLXT +8.0%, PRXL +5.4%, TLAB +5.1%, ZION +4.7%, BHI +4.3%, EMC +3.6% (also up in sympathy with VMW; still owns 27% of company), ABC +3.3% (light volume), TRV +2.9%, AAPL +2.7%, SI +2.6%, OLN +2.4%, NVS +1.0% ... Other news: THLD +22.4% (presents clinical trial data from a phase 1/2 clinical trial of TH-302; 32% had a RECIST criteria partial response), MRNA +20.6% (issued patent for the use of nucleic acids to treat cancer), AMLN +15.5% (Carl Icahn files amended 13D; believes that Board functioning more satisfactorily than in the past), YMI +15.2% (light volume; announces FDA clearance for two ongoing Phase II nimotuzumab trials into USA), DVAX +14.8% (Reports Positive Phase 1b Data for SD-101 in Chronic Hepatitis C Infection), ALKS +11.3% (Amylin Pharmaceuticals, Eli Lilly and Alkermes are collaborating on investigational diabetes therapy, to BYETTA injection taken twice daily, in patients with type 2 diabetes--NVO just received approval for diabetes drug), FTE +6.5% (still checking), NVO +5.6% (FDA approves new treatment for Type 2 diabetes; FDA approved Victoza), CB +4.1% (up in sympathy with TRV), NCIT +3.1% (to be added to S&P 600), NEWS +1.5% (light volume; announces $10 common share repurchase)... Analyst comments: KRA +5.6% (initiated with a Outperform at Oppenheimer, initiated with Buy at BofA/Merrill, initiated with a Outperform at Credit Suisse), CSUN +3.6% (upgraded to Hold at Jefferies), LOGI +2.7% (upgraded to Hold at Citigroup), SPWRA +2.4% (upgraded to Buy at Jefferies), CTXS +2.3% (upgraded to Buy at Jefferies), AMAT +2.2% (upgraded to Outperform from Perform at Oppenheimer), CLS +1.1% (upgraded to Outperform at Credit Suisse).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: WFT -7.2%, CVO -5.7%, X -4.5%, ZRAN -4.4%, PKG -3.9%, RF -3.8%, DAL -3.6%, TXN -1.8%, JNJ -0.9%... M&A news: FUN -6.1% (discloses that no other parties expressed an interest in making an acquisition proposal for the Company; believes that the proposed transaction with Apollo maximizes value)... Select financials names showing weakness: LYG -4.3%, RBS -3.2%, CS -2.9%, BSBR -2.5%, HBC -1.6% (HSBC Holdings chairman hits at big bonuses - FT )... Select China related names ticking lower: KONG -3.8%, ACH -2.8%, CHA -2.4%, LFC -2.0%... Select metals/mining names showing early weakness: SLV -4.1%, RTP -3.3%, SLW -2.6%, BHP -2.3%, GFI -2.3%, EGO -2.2%, BBL -1.9%, IAG -1.9%, GOLD -1.9%... Select oil/gas names trading lower: STO -1.6%, TOT -1.5%, RDS.A -1.0%... Other news: FUN -6.1% (discloses that no other parties expressed an interest in making an acquisition proposal for the Company; believes that the proposed transaction with Apollo maximizes value), GNVC -5.6% (continuing to pull back following yesterday's 10%+ draw), PALM -3.2% (still checking), PXP -3.0% (announces 2009 operational results: reports 23% increase in total proved reserves and 320% reserve replacement ratio), AKS -2.7% and NUE -2.1% (down in sympathy with X), ARCC -2.2% (announces public offering of 19 mln shares), KFT -1.6% (Bloomberg reporting that CBY UK workers planning protest against takeover)... Analyst comments: JCI -2.1% (downgraded to Neutral from Buy at UBS), HSY -2.1% (added to Conviction Sell from Not-Rated at Goldman). -

Uuendasin taaskord ära tulemuste tabeli - enamus ettevõtteid jätkab ootuste ületamist.

-

US House Majority leader Hoyer says Democrats would preserve tax cuts for middle class - Reuters

-

January Consumer Confidence 55.9 vs 53.5 consensus, December 53.6

-

Kirjutasime Balti börsiettevõtete ootustest tulemustehooajaks:

-

kas täna juhib turgu õunake

-

Õunake teeb ilusat sõitu ja veab turgu. Kas uued tipp täna?

-

Huntington Banc (HBAN) CEO bought 102k shares at $4.86-4.89 on 1/26.

-

iShares DJ Broker Dealer slide to new session low under its 200 day

-

Bloomberg reports that Rep Markey (Dem, Mass) proposes a measure to recoup $54 bln in Oil Royalties

-

Uuendasin tulemustetabeli nüüd ära ka õhtuste numbrite ja päevaste liikumistega. Hoolimata korralikest numbritest on aktsiaid siiski kiputud tulemustejärgselt müüdama...