Börsipäev 28. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Tulemustetabel eilsete teatajate ja liikujatega uuendatud - link siin.

Kell 15.30 teatatakse USA möödunud nädala annualiseeritud esmaste töötu abiraha taotlejate number - ootuseks on 450 000 (meenutuseks, et möödunud korral oli see ebaharilikult kõrge 482 000 juures). Detsembrikuu kestvuskaupade tõusuks oodatake +2.0% (vs novembri +0.2%) ning ilma transpordisektorita +0.5%.

Tulemustehooajal on reeglina kõige tihedamad päevad just neljapäevad ning seetõttu on sarnaselt eelmisele nädalale ka täna oodata arvukalt ettevõtete kvartalitulemusi. Tänased tähtsamad ettevõtted on Colgate-Palmolive, Altria, Ford, ScanDisk, Microsoft, Amazon.com, Nokia, Motorola jpt.

-

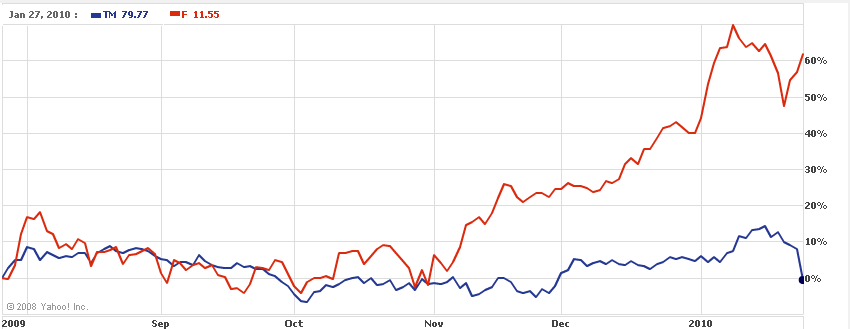

Strateegia- ja kulujuhtimise raamatutes leiab palju Toyota näiteid, kui teemaks on töö efektiivsus ka kvaliteet. Vaadates Jaapani autotootja suurt menu USA-s enne majanduskriisi, siis seda hindasid kõrgelt ka tarbijad. Kuid sagenenud juhtumid kinnijääva gaasipedaaliga on tinginud olukorra, kus Toyotal tuleb tagasi kutsuda nüüdseks juba 5.35 miljonit sõidukit, mis omakorda määrib Toyota kauaaegset imidžit ja väärtusi. Aktsia on pärast 21. jaanuaril väljastatud täiendavat tagasikutset kaotanud 15% oma väärtusest (loe lähemalt siit). Viimase õudusunenägu on aga rõõmustavaks uudiseks USA autotootjatele, eesotsas Fordile, kes saavad olukorda kasutada enda mängumaa tagasivõitmiseks koduturul.

-

Schwarzman Blackstone'ist on andnud intervjuu Bloombergile, kus arutletakse Obama finantssektori reguleerimise plaani üle. Link siin. Seni kuni regulatsioonide eesmärk oleks süstemaatiliste riskide vähendamine ja kasumlikkuse/kahjumlikkuse tsüklilisuse vähendamine, tundub idee okei, kuid pangandussektori kasumlikkuse terviku vähendamise katsed toovad suure tõenäosusega kaasa pankadepoolse väiksema soovi laene anda ja riske võtta.

-

Nokia Ab OY Reports Q4 Op prof €1.5B v €893Me, Rev €12B v €11.2Be

- Units shipped 126.9M v 108.5M q/q

- Devices and Services GM 34.3% v 30.9% q/q

- Q4 Market share 39% v 38% q/q

- Q4 Op margin 12.3% v 7.6% q/q

- Q4 Op Profit €1.47B v -€426M q/q

- Q4 ASP €63 v €62 q/q

- Q4 Estimated industry mobile device volumes 329M v 288M units q/q

- Q4 Devices & Services net sales +18% q/q

- Q4 Nokia Siemens Networks Net Sales +31% q/q -

"Loistava tulos Nokialta" tsiteerides Kauppalehtit.

-

Maailmas valitseb tasakaal - kui Applel läks kehvasti, siis kellelgi pidi hästi minema.

-

Arvukad eelturul numbrid teatanud ettevõtted nüüd tulemustetabelisse kantud - link siin. EPSi veerg võrreldes konsensusega on ikka väga roheline.

-

Makro oodatust pisut nõrgem, kuid kestvuskaupade tellimuste 0.9%line kasv vs oodatud +0.5% ilma volatiilse transpordisektorita aitab negatiivseid numbreid siluda.

Initial Claims 470K vs 450K consensus, prior revised to 478K from 482K.

December Durable Goods +0.3% vs +2.0% consensus; prior was revised to -0.4% from -0.7% prior revision.

December Durable Goods ex-trans +0.9% vs +0.5% consensus; prior was revised to +2.1% from +2.0%. -

Euroopa turud:

Saksamaa DAX +0.38%

Prantsusmaa CAC 40 +0.73%

Inglismaa FTSE 100 +0.61%

Hispaania IBEX 35 +0.98%

Rootsi OMX 30 +0.97%

Venemaa MICEX +2.17%

Poola WIG +0.59%Aasia turud:

Jaapani Nikkei 225 +1.58%

Hongkongi Hang Seng +1.61%

Hiina Shanghai A (kodumaine) +0.25%

Hiina Shanghai B (välismaine) +0.58%

Lõuna-Korea Kosdaq +0.19%

Tai Set 50 +0.24%

India Sensex 30 +0.10% -

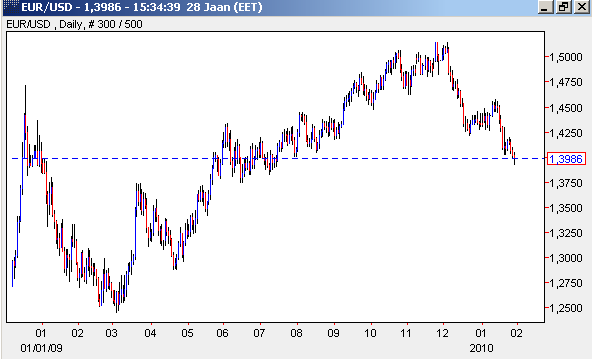

Euro saab Kreeka pärast valusalt pihta & EUR/USD kaupleb juba 1.4-st allpool :

Järgmine doominokivi peaks olema Portugal:

A downgrade for Portugal’s credit rating is “more likely than not” after its 2009 budget deficit was worse than expected, Fitch Ratings said on Wednesday, prompting the government to ask ratings agencies not to rush to judgement on any downgrade decisions.

-

Giving the Bulls Some Room Today

By Rev Shark

RealMoney.com Contributor

1/28/2010 8:42 AM EST

Politicians are the same all over. They promise to build a bridge even where there is no river.

-- Nikita Khrushchev

President Obama's State of the Union address last night wasn't the typical oratorical success and doesn't appear to be having any major impact this morning. He talked about a bank tax, a jobs bill and some tax credits for small business, but mostly he restated prior policy goals such as health care, cap-and-trade and greater transparency. It was a decent speech but it doesn't seem to be stirring up any strong emotions.

The only sector that is being affected is regional banks, which have been leading as they look to gain some competitive advantages due to the political attacks on the big money-center banks.

We have had an awfully lot of news flow lately to digest, and it continues today with a slew of earnings reports, the most important of which are probably Amazon (AMZN) and Microsoft (MSFT) after the close tonight. Earnings reports continue to be quite good, but the market reaction remains tepid.

After the FOMC interest rate decision yesterday -- which contained nothing surprising -- the market managed a decent little bounce and we have a little more strength this morning, but the overall technical picture is troubling. We are oversold enough that we can easily bounce further, but the technical overhead is formidable. On the S&P 500 we run into resistance at 1115, which is the 200-day moving average and would bring us back to flat for the year.

The million-dollar question is whether this market is going to act like it did much of last year or whether we're going to see more typical technical action. After stocks break down like they have over the last week, you just don't expect them to go straight back up as if nothing happened. Normally, sharp selling causes people to look harder for exit points and helps the bears gain more confidence.

Last year continually confounded market players when we recovered from every pullback as if nothing had happened. Many market players attributed this to the flood of liquidity created by bailouts and stimulus. Underinvested dip-buyers jumped in aggressively on every pullback because they were tired of being left behind as the market went up endlessly and never provided good entry points.

The recent selling has a different feel to it. We have been struggling for three days now, trying to bounce, and we haven't managed much vigor. We had a decent close yesterday after four straight weak ones, but it wasn't the sort of wild buying frenzy that was so common in 2009.

At this point the market is still technically oversold and the news flow is good enough to support a further bounce. It is going to be extremely interesting to see how a bounce acts at this point compared to last year. I believe it is different this time and that the market is going to struggle as it heads back up to key resistance levels.

I'm prepared for further upside at this point and will give the bulls some room, but I'll be looking to do some selling and shorting as we approach key technical levels. We have some room and I think the bulls may dominate for a few days, but I'll be looking for another downleg in the near future.

In addition to some earnings reports we should have the Ben Bernanke vote in the Senate. If he is reconfirmed -- and I expect him to be -- it will likely be a positive market catalyst.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: MEG +26.4% (light volume), NFLX +20.1% (also upgraded to Buy from Underperform at BofA/Merrill, upgraded to Buy at Merriman, upgraded to Buy at Jefferies, upgraded to Outperform from Market Perform at FBR Capital), EK +15.6%, PFBC +15.4%, ALGN +12.0%, NOK +12.0%, NTY +10.6%, SOA +9.7%, WSTL +9.0% (light volume), GNTX +8.9% (light volume), ARP +7.3%, LCC +5.1%, LIFE +4.8%, CBT +4.6%, TER +4.3%, HOKU +3.9% (also HOKU Scientific and Tianwei Announce Plans to Explore $50 mln Investment in Hawaii Solar Projects), CAH +3.8%, OXY +3.4% (light volume), TYC +3.2%, ETFC +3.0%, F +3.0%, CHKP +2.5% (light volume), GMCR +2.5%, TSCO +2.5%, HRS +2.4%, VAR +2.1%, MMM, TSM +2.1%, RYL +1.7%, NE +1.4%, CLS +1.3%, BMY +1.2%... Select financial names showing strength: AIB +4.8%, BCS +2.7%, FITB +2.6%, KEY +2.0%, LYG +1.8%, BAC +1.5%, GS +1.4%, MS +1.4%, C +1.6% (Citi mulling sale of real estate unit: Report - Reuters )... Other news: ASYS +11.3% (announces $19 mln in new solar orders; Total solar orders in FY10 surpass $70 mln), RGEN +6.8% (Repligen announces long term supply agreement with GE Healthcare for Recombinant Protein), VICL +6.5% (completed enrollment of the planned 375 subjects in its multinational Phase 3 trial of Allovectin-7), BIIB +2.7% (Icahn proxy materials sent to Biogen Idec, source says - Reuters.com), TSL +2.3% (announces sales agreement with ITEC in Germany), FRO +1.9% (still checking), SWKS +1.8% (Cramer makes positive comments on MadMoney), KERX +1.5% (to conduct conference call to discuss KRX-0401 clinical development program in colorectal cancer)... Analyst comments: SIGA +5.6% (initiated with Outperform rating and $11 tgt at RBC), STI +4.9% (upgraded to Buy from Neutral at Goldman; added to Conviction Buy list ), STM +4.4% (upgraded to Neutral from Underweight at Piper Jaffray), CME +2.3% (upgraded to Overweight at JPMorgan), APA +1.3% (upgraded to Outperform at Wellf Fargo), CAT +1.2% (upgraded to Neutral from Sell at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: KSP -14.5%, TTEK -12.8%, QCOM -9.3%, LSI -8.3%, KEX -8.3% (also downgraded to Hold at Stifel Nicolaus), SRDX -6.8%, ABFS -6.0% (also downgraded to Neutral from Buy at BofA/Merrill), FLEX -5.6%, CTXS -5.2%, POT -5.0%, MOT -4.7%, SYMC -4.1%, CVD -3.2%, LSTR -2.9%, AZN -2.9%, CCI -2.8%, BAX -1.7% (light volume), NSC -1.4%... Select potash/chem related names showing weakness following POT results: IPI -3.5%, TRA -2.3%, AGU -2.0%, MOS -1.8%, MON -1.4%... Other news: VRUS -5.9% (announces $30 mln common stock offering), WCRX -2.7% (announces FDA Issues Complete Response Letter for Low Dose Oral Contraceptive; also downgraded to Hold at Jefferies), TM -2.1% (extends massive safety recall to Europe - Reuters ), CXW -2.0% (announces Arizona notification not to renew contract at Huerfano County Correctional Center), SVA -1.8% (priced a 10 mln share common stock offering at $5.75/share), NVS (down in sympathy with AZN)... Analyst comments: CNK -5.0% (downgraded to Underweight from Equal Weight at Morgan Stanley), ME -1.9% (downgraded to Market Perform from Outperform at BMO Capital). -

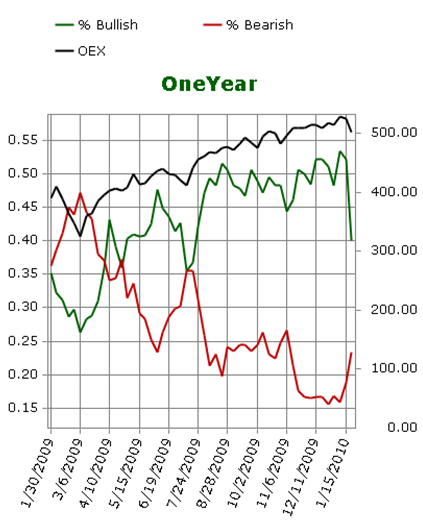

Pullide osakaal on viimaste nädalatega väga järsu kukkumise teinud (reeglina nii järsk kukkumine edaspidiseks hea märk pole) (link) :

-

Vastavalt New York Timesi allikatele on kuluaaride taga siiski arutelud Kreeka võimalikust väljapäästmisest salaja käimas:

Briefing: NY Times reports France, Germany and other European countries have begun discussing privately how they can come to the aid of fellow euro-zone member Greece, as doubts intensify over the country's ability to get its budget under control. Despite public attempts to discourage such expectations, discussions are underway, although the shape or scale of a possible bailout package has yet to be determined, according to officials in several capitals, all speaking on condition of anonymity. "Greece failing is not an option and lots of people think that we will have to intervene at some stage," said a euro-zone finance official, who was not permitted to speak publicly because of the sensitivity of the matter. "It doesn't have to happen, and we hope it won't, but it would be better than seeing a default." As a condition of any aid package, the center-left Greek government led by the Prime Minister, George Papandreou, would be asked to provide a more detailed program to bring the country's deficit of 12.7% of gross domestic product under control. -

Wells Fargo on täna Caterpillarit (CAT) tulemustejärgselt toetamas ning tõstab aktsiale antava soovituse 'outperform' peale. Hinnasihiks $63-$65.

-

Ford (F) raporteeris täna korralikest tulemustest:

Reports Q4 (Dec) earnings of $0.25 per share, $0.01 worse than the First Call consensus of $0.26; revenues rose 22.1% year/year to $35.4 bln vs the $32.6 bln consensus. Ford says that it plans to be profitable for full year 2010 on a pre-tax basis excluding special items, for North America, total Automotive and total company, with positive Automotive operating-related cash flow, based on its assumptions. Although positive, full year Automotive operating-related cash flow is expected to be less than the run rate implied by the strong second half 2009 cash flow. Recent performance was heavily influenced by seasonal factors, including normal year-end inventory reductions, and significant non-recurring factors such as tax refunds and higher production to rebuild depleted dealer stocks. Capital spending is expected to be in the range of $4.5 billion to $5 billion, as Ford continues to focus on its product plan. This planning assumption excludes Volvo and joint ventures that will be deconsolidated with the adoption of the new accounting standard effective Jan. 1, 2010 related to the consolidation of variable interest entities. On a comparable basis, 2010 capital spending is up about $1 billion from 2009. (briefing)

Ford on võimsalt kriisist taastumas. Nt võrreldes Toyotaga, kelle probleeme Erko hommikuses postituses mainis, on Fordi aktsia käitumine muljetavaldav:

-

Ford ei ole muidugi gaasipedaali jamas puutumata jäänud, kuid see uudis jääb tulemuste varju:

Ford has halted production of commercial vehicles in China after learning that the gas pedals came from the supplier involved in the Toyota recall, the Wall Street Journal reported Thursday. There have been no reports of the acceleration problems that made Toyota issue its massive recall.(marketwatch)

-

Greek Finance Minister says hasn't discussed bailout with EU or IMF--'No Plan B' - WSJ

-

nu kes ütleb, kuhu poole minek ? ei oska positsioneeruda

-

Päeva algus alla ja päeva lõpp ülesse.

-

Päeva algus tõesti nõrk. Viimaste nädalatega on kogu jõuluralli ära müüdud & pakuks, et väga ilusate tulemuste taustal tekkimas võimalik lühiajaline põrke kohta.

-

China Vice Premier Li says to maintain existing econ policy stance - DJ

-

Oskab keegi öelda is tasemel AAPL-i vastupanu?

-

kas võtta AMZN 125 strikega callid veebruari või mitte, kuidas AMZN tavaliselt ootustele vastab ?

-

AMZN puhul hetkel ikka täiesti loto ja vol nii kõrgeks aetud, et isegi mingi +/-3% liikumise puhul kasumit teenida üsna keeruline.

-

matu111, viimasel kaheksal kvartalil pole AMZN EPSi osas kordagi alla jäänud. Tulemustele reageeringu statistika muidugi pisut teine.

-

IMF's Lipsky says ready to help Greece in any way needed - DJ

-

Maagaasivarud langesid möödunud nädalal oodatust vähem:

Natural gas inventory showed a draw of 86 bcf, analysts were expecting a draw of 102 bcf, with ests ranging from a draw of 135 bcf to a draw of 80 bcf. -

TZA, kuigi veits hilja ehk

-

Jan. 28 (Bloomberg) -- NYSE Euronext said a technical error at the New York Stock Exchange, the world’s largest equity market, caused delays in current prices being delivered to customers.

http://www.bloomberg.com/apps/news?pid=20601110&sid=aavpePScNy60 -

Üle 2 prossa miinuses, Tallinn seevastu jälle rallitas. Mnja

-

Ja LHV pani siis ikka täppi, et lohutas eelmine nädal sellega,et see nädal kukkumisruumi küllaga)))))

-

talk is that Bernake doesn't have enough votes; that is why market is down.

-

Aga mingi pörge plusspoolele peaks ikka nüüd lähiajal ka saabuma.

-

angelike Re: Olympic Entertainment Group (OEG1T) 27/01/10 17:59

OK, üritan enam üldse mitte kommida))))) -

nju nju)))

-

Kas keegi võiks öelda AMZN veb. 150, 155 ja 160 call optioonid.?

-

Palun öelge kust võimalik näha AMZNi kohta kehtivaid optiooni sümboleid?

-

ära nii kaugeid optsioone võta

-

http://finance.yahoo.com/q/op?s=amzn

-

Tänud soovituse eest kuid ikkagi sooviks neid sümboleid.

-

Stocker tänud kuid LHVs hetkel need ei toimi.

-

$32 bln 7-year Auction Results: Yield 3.127% (3.153% expected); Bid/Cover 2.85x (11-month Avf 2.57x, prior 2.72x); Indirect Bidders: 51.1% (11-month Avg 50.2%, prior 44.7%)

-

Kas mul oleks kuskilt võimalik neid sümboleid saada? Ma saan aru, et need on kaugel kuid inimene kelle raha see on tahab neid saada ja mul ei jää muud üle kui osta need talle. Püüdis aapliga kaugelt kala kuigi ei soovitanud talle ja nüüd tahab sama amzoniga. Mis teha.

-

Mis optsioon täpsemalt huvitab? Saan siia kirja panna.

-

AMZN veb. 150, 155 ja 160 call optioonid.?

-

QZNBJ, QZNBK ja QZNBL

-

Tänud

-

Barabas, sa küsisid kehtivaid optsioone. Yahoos on praegu kehtivad.

Olin peaaegu sulle seda lehte pakkumas, kus vana süsteem: http://quote.morningstar.com/Option/Options.aspx?sLevel=A&ticker=AMZN -

US House will vote to raise debt limit next week, says Hoyer - Reuters

-

Werner Enterprises (WERN): Hearing added to Buy list at Deutsche Bank