Börsipäev 5. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

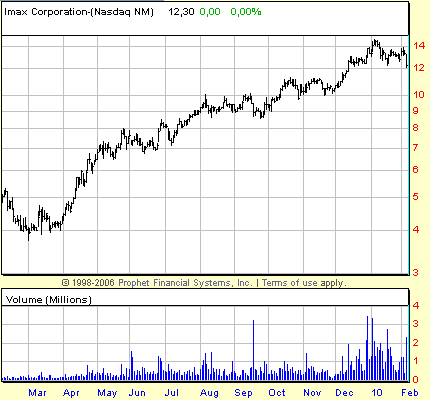

Imax Corporation (IMAX) on oma 3-D kinoelamuse pakkumisega hiigelsuurtel ekraanidel kuulsust kogunud. Kui mõned päevad tagasi tõstis Roth Capital enda poolt aktsiale antavat hinnasihti $21 peale, siis eile õhtul alustas aktsia katmist Gilford Securities hinnasihiga $18. Pärast eilset verist börsipäeva maailma aktsiaturgudel, mil IMAXi aktsia lõpetas päeva $12.3 peal, jätab see Gilfordi arvates ülespoole liikumiseks ruumi ca 50%. IMAX Corporation on ka LHV Pro aktsiavalik.

-

Täna kell 15.30 teatatakse USA tööjõuturul toimunud muutused 2010. aasta jaanuaris. Ametlik konsensusootus ootab 15 000 töökoha lisamist, kuid kolmapäevase nõrgemapoolse ADP raporti ja eile avaldatud kõrge esmaste töötu abiraha taotlejate numbri järel on vähemasti mitteametlikud ootused ilmselt jupp maad madalamale tõmmatud. Töötusmääralt oodatakse püsimist 10.0% peal ning töönädala pikkust sarnaselt eelmisele kuule 33.2 tunni juures.

-

Turg ei taha kuidagi leida usku, et Kreeka valitsus suudab järgneva kolme aastaga majanduse paremasse tasakaalu viia ning 10a võlakirja tulusus hiilib pärast kiiret kukkumist 10 aasta tipust tagasi kõrgemale. Lisan siia juurde graafikud ka Hispaania ja Portugali võlakirjaturust, mis on pärast krediidireitingute downgrade'e samuti rambivalgusesse sattunud.

Kreeka

Hispaania

Portugal

-

esimese tunni kohta baltikumi käive päris korralik

-

Kas pärast VIX-i eilset 20%-list hüpet on täna oodata USA-s rahulikumat päeva? Trading The Odds on toonud välja statistika, mille kohaselt viitab VIX-i üle 20%-line tõus ajaloolistel andmetel lühiajalist ülemüüdust ning põrget järgneval viiel kauplemissessioonil. Tänane tööjõutururaport muudab ajaloolisest statistikast juhindumise muidugi keeruliseks. S&P500 futuur kaupleb hetkel 0.3% punases.

Interesting to note that since 1991 (32 occurrences) the SPY never lost more than -0.51% on the close of the then following session (the exception of the rule was the year 1990), and closed higher on 27 out of 37 occurrences (thereof higher on the last 10 occurrences) on the then following session

-

see on mönna, natuke verd ka tallinnas

-

Päevad hakkasid?

-

veel mitte, paari päeva pärast

-

Verisematel hetkedel otsitakse kaitset telekomisektorist . Deutsche Telecom +1.5%, Vodafone +0.5%, France Telecom +0.33%

Stoxx 600 turuvaip

-

Erko poolt viidatud VIX statistika ja muu analoogne teave on oluline taustainfo, millega arvestada. SP’s pikaks selle peale ei lähe aga täna lühikese positsiooni avamine paariks päevaks on eelneva info valguses kindlasti välistatud. Mis muidugi ei tähenda, et täna kohe kindlasti ei järgne eilsele müügile follow-through, eriti peale NFP’d.

Trading The Odds, nagu sellistel puhkudel tihti juhtub, välistas millegipärast 1990.a andmed, kus langus oli -3,01% ja jättis mainimata päevasisese drawdown’i -5,33%. Ehk siis kujundatakse seisukoht ja otsitakse statistikast kinnitust. -

Hispaania on eilsele 6%lisele langusele täna veel ca 2.7% juurde kasvatanud ning ka ülejäänud Euroopa indeksid ca 2.5% langust täna lisanud.

-

Joel see on ainult suurepärane uudis ju. Muidu arvati juba, et olemegi paradiisis.

-

January Nonfarm Payrolls -20K vs +15K consensus, December revised to -150K from -85K.

January Unemployment Rate 9.7% vs 10.0% consensus, December 10.0%.

Average Weekly Hours 33.3 vs 33.2 consensus, prior 33.2. -

Jan. Nonfarm Payrolls: -20K vs. consensus of flat. Dec. revised to -150K from -85K. Unemployment 9.7% vs 10.1% expected.

-

November revideeriti +4K pealt +64K peale? see taandab detsembri revisjoni suures osas välja

-

tundub, et USA-s on täna väikest põrget oodata

-

SEC's Schapiro says short selling rule expected in coming weeks - DJ

-

USA tähtsamate indeksite futuurid on pärast tööjõuraporti avaldamist päris närviliselt üles-alla liikunud, kuid hetkel on eelturu miinust siiski vähendatud ja jõutud kuskile ca -0.3% juurde S&P500 indeksil ning +0.1% juurde Nasdaq100 indeksil.

Euroopa turud:

Saksamaa DAX -1,17%

Prantsusmaa CAC 40 -2,13%

Inglismaa FTSE 100 -1,12%

Hispaania IBEX 35 -0,58%

Rootsi OMX 30 -0,42%

Venemaa MICEX -1,83%

Poola WIG -2,54%Aasia turud:

Jaapani Nikkei 225 -2,89%

Hongkongi Hang Seng -3,33%

Hiina Shanghai A (kodumaine) -1,87%

Hiina Shanghai B (välismaine) -1,87%

Lõuna-Korea Kosdaq -3,65%

Tai Set 50 -1,73%

India Sensex 30 -2,68% -

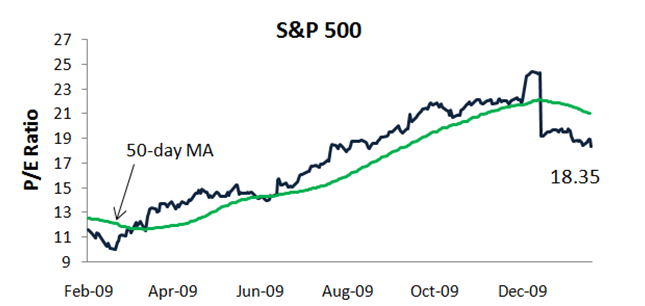

Korrektsioon & head tulemused on hinnataseme turul märgatavalt soodsamaks muutnud (link):

-

Jobs Picture Still Quite Bleak

By Rev Shark

RealMoney.com Contributor

2/5/2010 8:58 AM EST

The talk about a large revision to the baseline jobs number was, indeed, correct. There was a downward revision of 930,000 jobs. That is more than anticipated, but the action so far is mild. The other numbers were slightly worse than expected, but the household unemployment rate dropped to 9.7%. The problem with that is that the survey was changed and the household rate would have jumped to 10.6% otherwise.

There are so many seasonal adjustments and statistical games being played with these numbers that it is tough to have much confidence in them. I think the bottom line is that the employment picture still looks quite bleak.

The market reaction so far has been quite mild. The S&P500 is basically unchanged. Market players are trying to sort out these numbers and derive a clear picture, but it isn't easy.

I'm going to give the market some room to bounce here, but will remain focused on the short side into any upside. There certainly aren't many good long setups right now, unless you like to try to catch bounces off of support. That may work for some short-term trades, but it is likely to take some time before it makes sense to build longer-term positions.

The market is slowly inching into the green, which may induce some short covering and bottom fishing, but don't start believing that this market has bottomed and is now going to go straight back up.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PWER +22.3%, KOOL +17.6% (also reports distribution agreement with GE Healthcare), SFLY +8.6%, TSTC +6.2%, HA +5.9%, TSYS +5.4%, HLIT +5.1%, SRCL +2.8%, BZH +2.7%, BBND +2.5%, AXL +2.4%, TSN +2.1%, BEBE +1.9% (also Roth Capital upgraded to Buy from Hold), PNK +1.5% (light volume), HAIN +1.2%, SYT +1.0%... M&A news: ARG +19.5% (Air Products offers to acquire Airgas for $60.00/share in cash)... Other news: OPTR +18.0% (announces positive results from second fidaxomicin Phase 3 study in patients with clostridium difficile infection), AVII +9.2% (AVI BioPharma drug candidate AVI-5038 receives European Orphan Drug Designation for duchenne muscular dystrophy), BTIM +4.0% (light volume; reported recently-released results from an independent study evaluating the use of Hextend), TM +2.0% (Toyota eyes Prius recall - Reuters)... Analyst comments: WFR +2.4% (upgraded to Outperform at Credit Suisse), MOT +1.6% (upgraded to Overweight at Barclays), PKI +1.0% (upgraded to Outperform from Neutral at RW Baird), MA +0.5% (upgraded to Outperform from Market Perform at Wells Fargo).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PWAV -11.1%, PFWD -10.4% (also downgraded to Hold at Needham) , TTMI -8.9%, SIMG -8.7% (light volume), MFLX -4.6% (light volume), SNCR -3.6% (light volume), ILMN -3.5%, MD -3.5%, AET -2.8%, SFSF -2.6%, EGOV -2.4% (also downgraded to Market Perform from Outperform at Northland Securities following Q4 results), AYE -2.4% (light volume), SUN -2.0%, EW -1.9%, BMRN -1.7% (also reported "encouraging" preliminary data on BMN 110 for MPS IVA), GLW -1.4%... M&A news: KFT -0.5% (Kraft Foods is in receipt of valid acceptances in respect of at least 75%. of the existing issued share capital of Cadbury)... Select financial related names showing weakness: AXA -4.8%, LYG -3.7%, NBG -3.7%, ING -3.5%, IRE -3.4%, AIB -1.9%, CS -1.3%, HBC -1.1%... Select metals/mining names trading lower: MT -2.3%, RTP -2.0% (Rio Tinto hires new China boss to improve ties - Reuters.com), GOLD -1.9%, BBL -1.6%, GLD -0.7%... Select oil/gas related names showing weakness: TOT -2.5%, REP -2.2%, E -1.5%... Select drug names trading lower: AZN -1.8%, SNY +1.6%, NVS -1.5%... Select beverage names ticking lower: BUD -2.9%, DEO -1.8%... Other news: ENMD -7.1% (announces it completed a registered direct offering of 3,846,154 shares of its common stock, at a purchase price of $0.65 per share, to a single accredited institutional investor), SI -3.3% (still checking for anything specific)... Analyst comments: LEAP -5.4% (downgraded to Underweight at JPMorgan), JWN -3.2% (downgraded to Neutral at Goldman), COH -1.9% (downgraded to Neutral at Goldman), CIEN -1.4% (downgraded to Equal Weight at Barclays). -

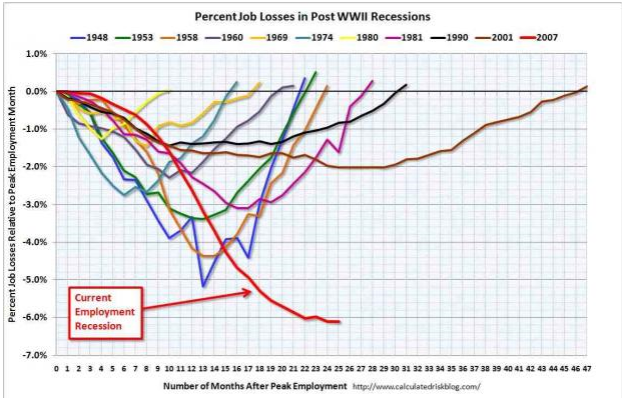

Võrreldes varasemate majanduslangustega näeb tööturu graafik jätkuvalt väga jube välja:

Allikas: CalculatedRisk (link)

-

Keegi Mari teeb TI foorumis huumorit.

"Börsil kauplemine on tegelikult sama lihtne, kui jänesejaht põhja-Soomes. Tuleb lihtsalt vaadata niimoodi silmadega, et kuhu jänes läheb. Siis roomad kohale ja tõmbad jänesele lihtsalt kilekoti pähe. Nii lihtne see ongi." -

Asto- seal TI foorumis on teisigi naljamehi.

-

Nafta -3.6% @ $70.5 barrelist. Arvestades seda, et kaks päeva tagasi kaubeldi $78 peal, siis see asi lõhnab mõne fondi sundmüügi järele...

-

Joel Kukemelk Re: Börsipäev 5. veebruar 05/02/10 20:05

Nafta -3.6% @ $70.5 barrelist. Arvestades seda, et kaks päeva tagasi kaubeldi $78 peal, siis see asi lõhnab mõne fondi sundmüügi järele...

Joel:

See on kuidagi tuttav lause :)

Oma paar aastat vana vist, siis hakkas kõik samamoodi. Ei midagi uut siin päikese all.

feels good to be short. -

Nafta puhul klassikaline müügi kontsentreerumine kitsas ajavahemikus, pluss liikumine läbi oluliste hinnatasemete - tulemuseks võimendatud positsioonide pimesi likvideerimine. Ei imestaks, kui CL tänane low (+/- 50c) jääb lühiajaliseks põhjaks, seda eeldusel, et järgmise paari sessiooni jooksul suudetakse üle 72,50 taseme liikuda. Fundamentaalne taust on samas karune.

(DOW JONES NEWSWIRES) Crude futures moved sharply lower after breaking through $72.43 per barrel, which was the January low and a key "support" level traders had been watching for a signal of whether the market would continue to trend lower following a steep drop Thursday that briefly touched the January low level.

"The market is hovering over yesterday's lows, which is a very important support level," said Andy Lebow, an analyst at MF Global in New York, before the market broke through the low levels. Lebow noted that the market had tested the low four times in last several days. "If we bust through that we could see some strong selling pressure," Lebow said. -

Earlier drop in crude oil partially attributed to report circulating that $1.5B commodity hedge fund may be in trouble

- There was some similar chatter circulating yesterday, but today's rumor is slightly more specific. Chatter seems to be eminating from a media report this morning that BlueGold Capital has lost 11% so far this year due to the decline in crude prices. BlueGold Capital has since denied the rumors they have suffered big losses. -

mis vip-iga toimub,kas tasub näppida

-

"There is nothing going on, and it's business as usual at BlueGold," Pierre Andurand, the firm's chief investment officer and managing partner, said in an e-mail. The firm specializes in energy and oil derivatives.

"There are many more participants than BlueGold trading the oil market," Andurand said.

"We trade liquid instruments and will never put ourselves in a bad situation, he added. "Sure we'll have drawdowns at times, but they will be controlled." -

Ma söön feik või päriskuulukat parema meelega kui fibonaccit, tänan :)

-

amatöör :))

-

vaal :)))

-

Fed's Hoenig says need to ensure recovery continues, "don't end up with new bubble down the line"; rate hike timing depends on economy - Reuters

-

December Consumer Credit -$1.7 bln vs -$10.0 bln consensus

-

harley, aga kuidas nüüd tundub?

-

sidekick:

arvad et ma jätan lühikesed possad nädalavahetuseks kätte? :))

ole mureta, kõik on kontrolli all! -

kui Dow oli 9835 ja S&P 1045, siis panid kinni?

-

Didn't every1?

-

"The concern (is) that we come in Monday morning and the situation may have worsened overseas, and so ahead of that, traders are staying close to shore and not making any big bets for now."

http://www.reuters.com/article/idUSTRE6030ZW20100205?feedType=RSS&feedName=businessNews&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+reuters%2FbusinessNews+%28News+%2F+US+%2F+Business+News%29 -

kuda sa harely sinu kogemusega unustasid selle ":)" panemata?