Börsipäev 3. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Täna kell 15.15 avaldatakse ADP töökohtade hõivatuse muutuse näitaja veebruarikuu kohta. Üldiselt on tegu olnud hea 'eelvaatega' reedel avaldatavasse veebruarikuu tööjõuraportisse. ADP'lt oodatakse ca -20 000list näitu. Kell 17.00 avaldatakse veebruarikuu ISM teenindusindeksi näit (ootus 51.0, mis oleks pisut parem kui jaanuaris), kell 17.30 naftavarude raport ning kell 21.00 Föderaalreservi Beeži raamatu sisu.

USA eelturg on praegu hommikul eilsete sulgumistasemete juures. -

Retail trade volume in the 16-nation euro zone fell by 0.3% in January and was down 1.3% compared to the same month last year, the European Union statistics agency Eurostat reported Wednesday. Economists had forecast a 0.5% monthly fall. December sales were revised up to show a 0.5% rise compared to an earlier estimate that showed flat activity.

-

FTSE suhtelise tugevuse taga on UK PMI näit:

Activity in Britain's dominant services sector expanded at a stronger-than-expected pace in February, according to purchasing managers. The CIPS/Markit purchasing managers index rose to 58.4 for the month, up from 54.5 in January and topping forecasts for a more modest increase to 55.5. A reading of more than 50 means a majority of managers saw a rise in activity, while a figure of less than 50 signals contraction. The services sector accounts for more than 75% of British economic activity. The British pound rebounded after the data to trade at $1.5049 versus the dollar up 0.6% on the day. -

Pragcapis hea kommentaar VIXi kohta. Graafik räägib enda eest (link):

-

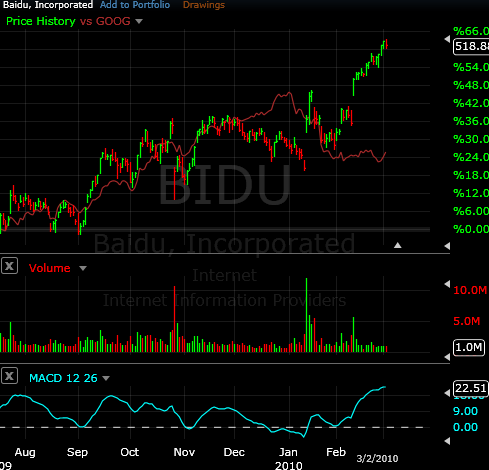

BIDU näitab tänasel eelturul kerget nõrkust, kuigi -1.5% võib olla ka kõikumine üldise fooni taustal. Kuna valuatsioon on juba nii kõrge, siis mul tundub, et turg tõlgendab igasugust posiitivset uudist teemal GOOG+Hiina automaatselt BIDU kahjuks. Näiteks see:

China Unicom to sell Android phones despite spat

Võib-olla GOOG ei kavatsegi Hiina turult ära minna ja võib-olla peab BIDU tulevikus siiski tugeva konkurentsiga arvestama. Sellised kõhklused on sellise valuatsiooni juures kerged tulema. -

Kui BIDU tehnilist pilti vaadata, siis siit võiks tulla kergelt alla. Konsolideerumist eriti ei usu.

-

Morgan Stanley soovitab aktsiate ostmisega hetkel ettevaatlik olla:

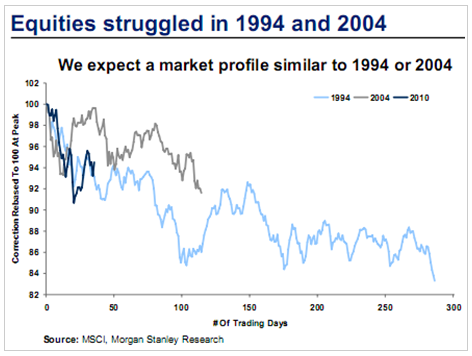

“Fundamental headwinds remain from policymakers shifting to tightening mode, moderating growth prospects and higher uncertainty generally (including sovereign concerns). We would like to wait for more clarity on these issues e.g. an easing in Asian inflation fears, a change in Fed language being out of the way and some re-basing in growth expectations. We will keep in mind the key 1994/2004 levels on growth indicators such as negative readings on the ECRI and earnings revisions or a 10-15 point correction in ISM new orders.”

MSi hinnangul tasub sellel aastal liikumist võrrelda 1994 ja 2004. aastaga:

Allikas Morgan Stanley

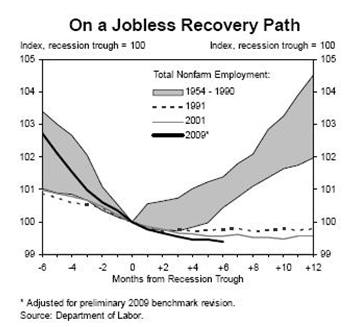

Nagu siin börsipäevas oleme ka korduvalt rõhutanud, siis on viimased majanduslangused taastunud selliselt, kus pikalt pole töökohti suudetud luua, kuigi majandus kasvab. See tekitab pidavalt uue majanduslanguse spekulatsioone, mis muudab turud aeg-ajalt närviliseks.

Allikas: Goldman Sachs

-

February ADP Employment Change -20K vs -20K consensus

January ADP Employment revised to -60K from -22K -

Kui seda tehnilist pilti täiendada UBS-i dg-ga, siis polegi niiväga tehniline :)

-

Panen siia ka Baidu ja Google'i aktsia hindade liikumised:

-

Euroopa turud:

Saksamaa DAX +0.92%

Prantsusmaa CAC 40 +0.82%

Inglismaa FTSE 100 +0.87%

Hispaania IBEX 35 +0.73%

Rootsi OMX 30 +0.53%

Venemaa MICEX +0.66%

Poola WIG +1.49%Aasia turud:

Jaapani Nikkei 225 +0.31%

Hongkongi Hang Seng -0.14%

Hiina Shanghai A (kodumaine) +0.78%

Hiina Shanghai B (välismaine) +0.88%

Lõuna-Korea Kosdaq +0.33%

Tai Set 50 +0.36%

India Sensex 30 +1.36% -

Note Market Direction, but Also Look Further

By Rev Shark

RealMoney.com Contributor

3/3/2010 8:35 AM EST

Eschew the monumental. Shun the epic. All the guys who can paint great big pictures can paint great small ones.

-- Ernest Hemmingway

When I first started trading, I paid little attention to overall market direction. I focused on individual stock-picking and didn't much care what the major indices were doing. Even when the market was moving against me, I could still do quite well if I was in the right stocks.

Over time I came to realize that I could enhance my returns if my level of aggressiveness was correlated with the market trend. Generally about 80% of stocks will move in the same direction of the overall market, so obviously it's going to be tougher to make money if you fight the trend.

The problem is that you miss out on opportunities if you focus too much on overall market direction. There are two issues here. The most dangerous is that if you are wrong about market direction you will have needlessly sold stocks that may have done nothing wrong. If you are too black-and-white about being bearish and bullish based on the overall indices, you are going to find yourself very poorly positioned quite often.

The second problem is that the overall indices often cover up strong themes and sectors that are working well. As Jim Cramer says, there is always a bull market somewhere. At times there may not be much of one, but at other times you can have some great-performing stocks when the indices don't look so great.

I bring this up because it is so easy to be caught up in labels like "bullish" and "bearish." Even if we are quite pessimistic about market direction we can still be holding long positions and vice versa. Good trading isn't just about having one opinion about the overall market; it is about managing a number of individual positions within the context of a shifting environment. You don't want to be blind to overall market direction, because it is going to have a large impact on what your stocks do, but you don't want to be so slavish to it that you are holding nothing when you are negative about the indices.

I take gains into strength, and that helps me navigate the market. I automatically become less bullish the more extended the market becomes. If I keep finding good individual charts I will add them and still have long positions even as I grow more concerned about a shift in market direction.

It is very convenient to use labels like "bullish" and "bearish," but it is a very poor trading methodology. I've been concerned that the market is becoming extended and vulnerable for a reversal soon, but if I just sold everything and started loading up on shorts I would have missed out on the gains in stocks that are acting well. On the other hand, if I keep loading up with no regard for the dangers of a reversal, I'll cost myself a very big chunk of recent profits.

We have a fairly flat open on the way, but we are extended and the risks of a reversal are increasing. I still have some long positions but they are shrinking fast as I lock in gains when I have them.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: AMCF +18.0%, LSCC +11.4%, NPD +9.5% (light volume), MFB +8.9%, ETH +8.9%, HSNI +3.7%, HOV +3.3%, JOYG +3.1%, URS +3.0% (light volume), SCLN +2.9%, GFRE +1.8%, CISG +1.6% ... M&A news: SWWC +50.6% (signs agreement to be acquired by Long-Term Infrastructure Investor Group for $11 per share), NOVL +27.7% (Elliott Offers to Acquire Novell for $5.75 per share in cash, which implies an enterprise value net of cash of $1.0 bln), LOV +10.2% (announces formation of a Special Committee to evaluate acquisition proposal at $3.10/share)... Select financial names showing strength: PUK +4.1%, BCS +3.1%, UBS +1.6%, DB +1.2%... Select metals/mining related names trading higher: GFI +1.9%, RTP +1.7%, AU +1.7%, SLV +1.4%, MT +1.4%, ABX +1.4%, HMY +1.4%, GDX +1.3%, MT +1.3%, SLW +1.0%, GLD +0.5%... Other news: ELN +4.2% (seeing continued strength), RNN +3.4% (submits Zoraxel Phase IIb protocol to FDA), JDSU +2.6% (Cramer makes positive comments on MadMoney), TM +2.1% (following strength in overseas trading), BT +1.6% (still checking), IBKC +0.9% (priced a ~5.19 mln share common stock offering at $57.75/share)... Analyst comments: DAN +5.6% (added to Conviction Buy list at Goldman), CLU +3.7% (initiated with Overweight at JPMorgan), BX +2.8% (upgraded to Outperform at Oppenheimer), AKAM +1.2% (upgraded to Buy at Merriman), UPS +1.0% (initiated with Buy at Goldman), FCX +0.9% (upgraded to Outperform at RBC), LECO +0.9% (upgraded to Outperform at Barrington Research).

Allapoole avanevad:

In reaction to disappointing earnings/guidance/SSS: VISN -26.2% (also Susquehanna downgraded to Negative from Neutral and Piper downgraded to Neutral from Overweight), CT -18.1%, CMED -9.4%, PAY -6.0%, JAKK -5.8%, APSG -4.9%, NKTR -4.9%, BJ -2.9%, COST -2.2%, BIG -1.6%... Other news: MDVN -67.7% amd PFE -0.5% (Medivation and Pfizer announce results from two Phase 3 Studies in Dimebon Alzheimer's Disease clinical development program study, Dimebon does not meet primary and secondary), CPNO -4.9% (announces public offering of 6.3 mln common units), PTNR -4.7% (trading ex dividend), SNV -4.3% (facing informal SEC inquiry: Filing - Reuters), MSSR -4.2% (still checking), IRE -4.2% (still checking), NBG -3.8% (S&P says less pessimistic than markets on Greece - Reuters), CTRP -2.5% (files 6-K announcing secondary offering of 5.7 mln ADS), PNNT -1.7% (prices public offering at $10.00), GENZ -1.4% (Genzyme and PTC Therapeutics announce preliminary results from the Phase 2b clinical trial of Ataluren; primary endpoint of change in 6-minute walk distance did not reach statistical significance within the 48-week duration of the study)... Analyst comments: NFLX -4.3% (downgraded to Underperform at BofA/Merrill, downgraded to Neutral at Susquehanna, downgraded to Hold at Kaufman), CHRW -3.2% (initiated with a Sell at Goldman), ANN -2.5% (downgraded to Hold at Jesup & Lamont based on valuation), CSX -1.4% (initiated with a Sell at Goldman), SPLS -1.1% (downgraded to Neutral at Goldman), BIDU -0.9% (Hearing downgraded to Neutral at UBS). -

Fed's Rosengren says risk low current rates fueling future bubbles - DJ

-

"no s**t, Sherlock" moment of the day?

-

February ISM Services 53.0 vs 51.0 consensus, January 50.5

-

Alari, miks just nüüd peaks BIDU allapoole tulema? Et "tõustud küll" tees või on mingi konkreetne katalüsaator?

-

Tehnilise pildi järgi üleostetud, kui sinna lisada UBS dg peaks põhjust olema aga turg väga roosiline ja see hinda toetamas. Valuatsioon tundub ka ikka väga kõrge, kuid ega rohkem katalüsaatoried kui aprilli tulemused ei paista. Vahepeal toimus GOOG raha voolamine BIDU-sse, millest esimene on hetkel jalad alla saanud.

-

Naftavarude raportis midagi ilusat ei ole:

Dept of Energy reports that crude oil inventories had a build of 4034K (consensus is a build of 1275K); gasoline inventories had a build of 773K (consensus is a build of 300K); distillate inventories had a draw of 843K (consensus is a draw of 1050K).

-

Fed's Lockhart says fully supports message in FOMC statement that rates to stay low for "extended period" - Reuters

-

Obama Administration draft of Volcker Rule language includes ban of proprietary trading for banking firms, according to draft language obtained by Reuters

-

Obama Administration would ban banks from investing in or sponsoring hedge funds, private equity funds, according to draft - Reuters

-

Fed Beige Book says nine of 12 Fed districts say economic activity improved modestly in February - Reuters

-

Fed said consumer spending improved 'slightly' in many districts

-

Take-Two prelim ($0.31) vs ($0.51) First Call consensus; revs $163.2 mln vs $125.27 mln First Call consensus

Take-Two sees FY10 $(0.60)-(0.40) vs ($0.56) First Call consensus; sees revs $725-925 mln vs $843.92 mln First Call consensus