Börsipäev 10. märts

Kommentaari jätmiseks loo konto või logi sisse

-

SEC says no truth to rumor that it is considering short sale curbs on companies in which US government has stake - Reuters

-

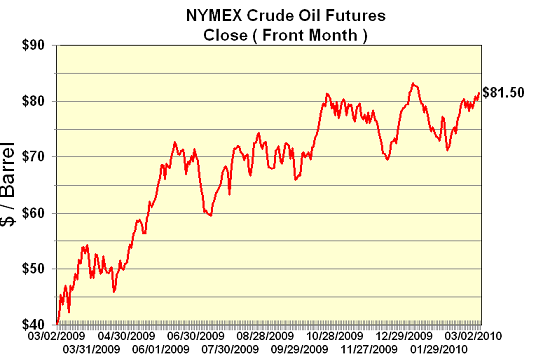

Täna USAst olulisi makrouudiseid tulemas ei ole (kl 17:00 avaldatakse jaanuarikuu hulgimüüjate laovarud, kus konsensus ootab varude 0.2% suurenemist). Toorainesektoris tasub silm peal hoida naftavarude raportil, mis avaldatakse kl 17:30. Nafta hind on üsna lähedal jaanuarikuu tippudele ja selle ületamiseks on ilmselt vajalikud nõudluse paranemismärgid (graafiku link siin).

-

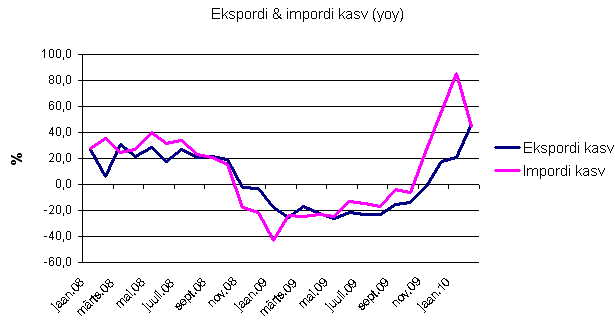

Aasias sai enim tähelepanu uudis, et Hiina eksport kasvas veebruaris 46% yoy. Ekspordi tugev kasv on üks eeldus, mida Hiina poliitikud soovivad enne intressimäärade tõstmist ja jüaani kallinemist näha. Kuna eksport on viimased kolm kuud korralikult tõusnud (eelmise aasta baas on ka madal), siis võib üha kindlam olla, et Hiina jätkab oma stiimulite vähendamist.

-

Sellel nädalal on analüütikud Morgan Stanleyist ja HSBCst tõstnud China Southern Airlines'i (ZNH) soovitust, kuna lennufirma teatas, et kogub uute aktsiate väljastamisega kapitali ja soovib oma võlakoormust vähendada (mitmed riigiettevõtted on kinnitanud, et ostavad uusi aktsiaid). Eile hüppas lennufirma aktsia koguni 17% kõrgemale. ZNH aktsiat oleme positiivselt kommenteerinud pikemalt ka Pro all, kui aktsia hind oli 16 dollarit (paraku hindasime oktoobris riske natuke liiga kõrgeks ostusoovituse jaoks). Täna kaupleb aktsia 20.7 dollari juures & siit tundub ZNH valuatsioon juba üsna krõbe (meie hinnasiht jäi 19 dollari juurde):

-

Euroopast segane makro:

UK jaanuari tööstustoodang langes 0.4% vs oodatud +0.3% MoM

UK jaanuari YoY languseks tuli 1.5% vs -0.8%

IT tööstustoodang näitas jaanuaris seevastu korralikku kasvu +2.6% vs +0.7%

FR tööstustoodang samuti tõusus +1.6% vs +0.1%

Saksamaa eksport kukkus jaanuaris 6.3% vs +0.5% MoM -

Tänane Gartmani letter on toonud välja huvitava graafiku EUR/USD kursi ja futuuripositsioonide vahel. Oktoobris mitme aasta kõrgeima taseme saavutanud pikkade positsioonide osakaal on viimaste kuudega teinud kiire kannapöörde ning ülemvõimu näitavad nüüd lühikesed positsioonid. Ajalooliselt on selline ühe sentimenti domineerimine toonud mingil hetkel kaasa ägeda suunamuutuse, kuid vaadates tagasi sügisesse, mil net long positsioonid vähenema hakkasid aga euro veel mitu kuud tugevnes, võib samasugune viivitus aset leida ka praegu. Hetkel ei taha aga lühikeste positsioonide jätkuv kasvamine anda isegi lootust näha lähinädalatel euro tugevnemist.

-

Väga bullish sõnavõtt maailma ühe suurima varahaldaja, BlackRocki strateegilt Bob Dollilt:

"In our view, March 2009 marked the primary low for this bear market. We are a year past that now and, barring a significant double dip in the economy, the odds point to 2010 as a positive year for equities and other risk assets. Some argue that the recovery process is artificial, mainly reflecting the impact of government intervention, and that the economy’s day of reckoning will come as stimulus is withdrawn. Skepticism about the durability of a recovery is common following recessions, especially after a severe one, but recent history suggests that the world economy almost always adapts and returns to growth. Minus any significant negative external shocks, we believe this recovery should follow suit.”

Ka tööturgu näeb ta roosamate prillide tagant võrreldes üldise konsensusega. Teine kvartal võiks tema sõnul tuua USAs juba 300 000 uut töökohta.

-

Baidu.com target raised to $630 at Citigroup (542.65)

Citigroup raises their BIDU tgt to $630 from $550 saying search engines are a key beneficiary of eCommerce growth, and as the dominant leader, Baidu is the best listed proxy to China's strong eCommerce momentum. Firm says even as large, well-funded online B2C/C2C platforms continue to spend to build brand and traffic, traditional retailers moving online to set up their own B2C transaction sites provide further significant growth potential. Their raise their tgt based on 40x '11 P/E, as they view robust eCommerce growth, plus Phoenix Nest improving its monetization capabilities, as supporting Baidu's healthy medium-term growth outlook.

-

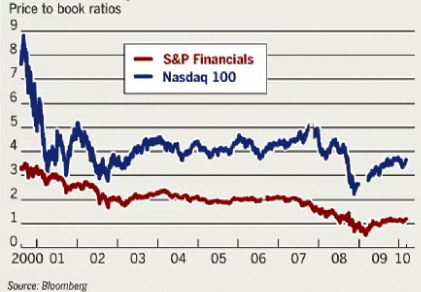

Kui eile möödus eelmise aasta märtsi põhjadest aasta, siis täna möödub dot.com mulli lõhkemisest kümme aastat. Siin on välja toodud Nasdaqi viimase kümendi P/B suhtarv, mis näitab hästi, kuidas tehnoloogiamulli ajal reaalsustaju kaotati:

Allikas: FT

-

Gapping down

In reaction to disappointing earnings/guidance: GU -15.5%, AVAV -6.9%, EQT -6.3%, NAV -5.6%, JMBA -5.4%, SAM -4.4%, PSS -4.1% (also downgraded to Hold at Soleil and downgraded to Neutral at MKM Partners), SONC -2.6%, PLCE -2.3%, ELMG -2.3% (light volume), JCG -1.6% (also Citigroup downgrades to Hold from Buy)... M&A news: ABT -0.5% (light volume; Abbott to acquire Facet for $27/cash; transaction does not impact Abbott's previously issued ongoing earnings-per-share guidance for 2010)... Other news: BTI -3.8% (trading ex dividend), AGO -3.7% (Commences Secondary Public Offering on Behalf of Dexia SA), MITI -3.5% (announces 10 mln share proposed public offering of common stock), EQY -2.9% (announces offering of 4.2 million shares of common stock), SOLR -2.1% (announces pricing of secondary offering of 25 million shares of common stock at $4.85/share by a selling stockholder), GSK -1.1% (still checking)... Analyst comments: BCS -1.8% (downgraded to Mkt Perform at FBR Capital), NLY -1.1% (downgraded to Neutral at JPMorgan).

Gapping up

In reaction to strong earnings/guidance: PESI +13.0%, APT +12.4%, CHOP +10.0%, EXLS +9.3% (also JP Morgan upgraded to Neutral from Underweight), AEO +5.8%, ALOG +5.0% (light volume), HBAN +4.6%, HRBN +2.6% (light volume), AONE +1.5% (also signs battery system development agreement with Navistar)... M&A news: FACT +66.3% (Abbott to acquire Facet for $27/cash), TRA +1.5% (Terra Industries to deem CF's bid superior to Yara deal - CNBC)... Select financial related names showing strength: AIB +4.2%, NBG +4.2%, IRE +3.7%, AIG +2.5% (ILFC debt offering draws strong demand - WSJ), C +2.1% (Citigroup preferred offering to be ~$2 bln - CNBC), RBS +1.4%, BAC +1.2%... Other news: ITMN +68.9% (confirms that FDA advisory committee recommends approval of InterMune's Esbriet (pirfenidone) for idiopathic pulmonary fibrosis; upgraded to Buy at ThinkEquity), OCLS +60.2% (Receives First FDA Clearance for Microcyn-Based HydroGel for Dermatology Market with Claims Including Reduction of Itch and Pain Relief), AMCF +11.2% (successfully achieved breakthrough in research on the company's proprietary pour point depressant LDY-103), AEO +9.3% (announces plans to close its MARTIN+OSA concept), AGN +3.4% (FDA confirms approval of Botox to treat spasticity in flexor muscles of the elbow, wrist and fingers), MU +2.2% (still checking), SKT +1.4% (CEO appears on CNBC with Cramer)... Analyst comments: VNDA +5.3% (initiated with a Buy at Hapoalim), BUCY +3.2% (Goldman adds to their Conviction Buy list), RDN +1.3% (upgraded to Neutral from Underweight at Piper Jaffray), ADI +1.2% (upgraded to Outperform from Market Perform at Bernstein), BIDU +1.1% (target raised to $630 from $550 at Citigroup).

-

Rev Shark: Don't Jump the Gun on the End of the Trend

03/10/2010 8:48 AMWhat would you do if you were stuck in one place and every day was exactly the same, and nothing that you did mattered?

-- Bill Murray as "Phil Connors" in the movie Groundhog DayWhen the market does the same thing about 20 days in a row, there isn't much new that can be said about it. We are still technically extended, we still have strong upside momentum and with each new day of upside it becomes increasingly difficult to find good trading setups.

The market is always a balancing act, but when we have a trend like we have had lately it becomes more and more difficult to navigate. Trading is all about determining each day whether the current trend will continue or whether it will reverse. It is always one or the other, and the longer a trend goes without a rest the higher the odds are that a reversal will occur.

The problem with this market is that logic, probabilities and technical readings have not mattered. There are all sorts of reasons we shouldn't keep doing the same thing day after day, but if you have done anything other than look for more upside you have been wrong.

My general approach to the market is to always expect trends to continue longer than you think they will, but that doesn't mean you should stay equally bullish the whole way. As stocks become more extended, the prudent thing to do is to lock in some gains; if you can't find new stocks to buy, then you shouldn't be buying. That isn't disrespect of the trend, it is just a logical way to deal with a trend as it becomes increasingly stretched.

The best way to approach an environment like this is to stick with the trend but to keep shortening your time frames and keeping stops tight. You want to make sure that you minimize the amount of damage that is done to the long positions you are holding when the inevitable reversal does come.

The easiest way to get in trouble in this sort of market is to keep anticipating a major reversal. You could have made the exact same argument for a reversal a week ago that you can make today. The only difference is that you would be sitting on bigger losses if you acted too early. There just is no way to know when this trend will finally come to an end.

If you can find some good longs to buy, don't hesitate to jump in and ride them but be ready to move if this upward trend finally starts to roll over. Although the buy-and-hold bulls are giddy with delight over this action, is not easy to trade at all. Don't be swayed by those who want to tell you how dumb you are for not being more aggressively long. You have to stay focused on what is in front of you today and forget about yesterday.

It's slow in the early going this morning but we have some slight positive action. The news wires are fairly quiet. The economic news from China was red-hot and we have Citigroup (C - commentary - Trade Now) gapping up this morning on a preferred stock offering that is reported as being multiple times oversubscribed.

No positions.

-

Euroopa turud:

Saksamaa DAX +0,14%

Prantsusmaa CAC 40 +0,23%

Inglismaa FTSE 100 +0,03%

Hispaania IBEX 35 +0,21%

Rootsi OMX 30 +0,33%

Venemaa MICEX -1,05%

Poola WIG +0,88%Aasia turud:

Jaapani Nikkei 225 -0,04%

Hongkongi Hang Seng +0,0%

Hiina Shanghai A (kodumaine) -0,66%

Hiina Shanghai B (välismaine) -0,87%

Lõuna-Korea Kosdaq +0,11%

Tai Set 50 +0,31%

India Sensex 30 +0,27%USA indeksid on esimestel minutitel kauplemas 0.2% plussis

-

Google CEO Sees Conclusion to China Talks Soon

http://online.wsj.com/article/SB10001424052748703701004575113550674654886.html?ru=yahoo&mod=yahoo_hs