Börsipäev 11. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Siiani uudiste osas üsnagi vaikseks osutunud nädal võiks tänase makro peale veidigi elavamaks muutuda. Kell 15.30 tehakse teatavaks läinud nädala esmase töötuabiraha taotlejate arv, mille suurusjärguks prognoosib konsensus 460 000 (läinud nädalal oli see 469 000) ning kestvate töötuabiraha taotlejate arv, mis peaks jääma 4.55 miljonile (eelmisel nädalal 4.5 miljonit). Samal ajal avaldatakse ka jaanuari kaubandusbilansi näit. Defitsiidi suuruseks oodatakse 41 miljardit dollarit.

-

Vilniuse börs täna ja homme suletud, Leedu taasiseseisvumispäev.

-

Jaapani valitsus revideeris neljanda kvartali QoQ kasvu varasemalt 1.1%-lt 0.9%-le. SKT deflaatorit korrigeeriti -3.0%-lt -2.8%le (Yoy) ning osade analüütikute sõnul tingib jätkuvalt deflatsiooniline keskkond likviidsusprogrammide taastamise keskpanga poolt, mis nõrgendaks jeeni ja mõjuks positiivselt aktsiaturule. Jaapani keskpank avalikustab monetaarpoliitika edasise kursi pärast kahepäevast miitingut, mis algab 16. märtsil.

-

Suhkru hind on käesoleval aastal läbinud märkimisväärse korrektsiooni, kukkudes 30 sendilt 19,7 sendile naela kohta. Kolmekümne aasta kõrgeimale tasemele lennutas suhkru hinna sademetevaene aasta Indias, mis sundis maailma suurimat suhkrutootjat antud toorainet nõudluse rahuldamiseks täiendavalt juurde importima. Kuid tootmistmahtude oodatav suurenemine nii käesoleval kui ka järgmisel põllumajandusaastal (lõppeb 30. septembril) on toonud suhkru hinna 35% madalamale ning ajendanud analüüsimajasid kärpima sektori väljavaadet.

-

Palun lisage kaubeldavate aktsiate nimekirja eile NYSE-l kauplemist alustanud BALT (Baltic Trading Ltd.)

-

Värske IPO-ga tulnud BALT lisatud

-

The unemployment rate in the Silicon Valley was 12.4 percent in January, up from 11.5 percent in December and above the year-ago estimate of 9.2 percent, according to a report Wednesday from the state Employment Development Department.

-

Eile sai börsipäeva foorumisse postitatud lühike kommentaar BlackRocki strateegi Bob Dolli optimistlikust nägemusest. Siin on üks Bloombergi video, kus mees on pandud vastu oluliselt karusema David Rosenbergiga. Mõlemad on endised Merrill Lynchi aegsed kolleegid.

-

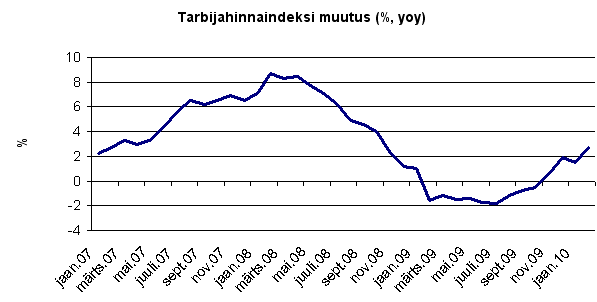

Täna saab palju tähelepanu Hiina hoogustuv inflatsioon, mis oli veebruaris viimase 16. kuu kõrgeim (+2.7% yoy). Kuna Hiina poliitikutel on soov hoida hinnatõus sellel aastal 3% juures, siis on selge, et lääneriikide-toaline ultraliberaalne rahapoliitika Hiinale enam ei sobi ja seda on vaja rangemaks muuta.

-

IMAXi neljanda kvartali kuuesendine aktsiakasum ühtib konsensuse ootusega, raporteeritud 54.2 miljoni dollari suurune käive (97.8% yoy) aga ületab tublisti prognoosi, mis oli 45.3 miljonit USD. Viimase nelja päevaga 23% tõusnud aktsia on eelturul kauplemas 2.3% kõrgemal.

"Our box office momentum has continued with Disney's home run title Alice in Wonderland. With our projected network growth, increased activity on the theatre signings front - including our recently announced joint venture partnership with CJ CGV in South Korea - our high level of business activity and our compelling film slate, we believe 2010 will be a very strong year and that we have laid a solid foundation for our business to build upon over the years to come."

-

Kreeka on sellel nädalal vähem pildis olnud, kuid probleemid reaalmajanduses pole kuhugi kadunud. Deutsche Bank tuletab investoritele meelde, et nad Kreeka poliitkute optimismiga kaasa ei lähe, kuna nende makroprognoosid on selgelt reaalsusest väga kaugel (paraku oodatakse nende prognooside järgi ka eelarvesse laekuvaid tulusid).

Where policymakers see GDP growth of -0.3% in 2010, we believe growth could be closer to -4.0% and the economy could contract by as much as 7.5% in total over 2010 – 2012. Policymakers expect unemployment to rise to just over 10.0%, where we expect an increase to nearly 20.0% before the adjustment is complete.

-

See viimane on hea point, mis mulle endale ka silma jäänud - kärbete/streikide/sentimendi muutustega SKP prognoosimisel Kreekas justkui ei arvestata. Mis omakorda tähendab, et eelarves ka tulude pool liiga optimistlik, mis omakorda tähendab, et eelarve defitsiit tõenäoliselt tulemas suurem kui praegu oodatakse (ceteris paribus). Ja siit võiks omakorda tuletada, et isegi kui Euroopa kevadel bailouti ära teeb, on aasta lõpus jälle koht kukalt kratsida.

-

väga nõus. Mulle tundub ka, et suure vaevaga peatati valitsuse võlakirjade intressimäära tõus, kuid oodata sellel aastal väikest majanduslangust ja järgmisel aastal 1.5% majanduskasvu tähendab, et probleeme reaalmajanduses ei tunnistata (viimstel aastetel küll paanikat rohkem olnud, kuid Eestis näha ilmekalt, milline olukord reaalmajanduses on, kui eelarve vaja enamvähem tasakaalus hoida).

-

Esmase töötuabiraha taotlejate arv enam vähem ootustesse, kuid defitsiit prognoositust väiksem. Futuurides erilist reaktsiooni polnud, SP500 kaupleb -0.3% punases

Weekly Initial Claims 462K vs 460K consensus, prior revised to 468K from 469K

January Trade Balance -$37.3bln vs -$41.0 bln consensus, prior revised to -$39.9bln from -$40.2 bln

Continuing Claims rises to 4.558 mln from 4.521 mln

-

Rev Shark: A Philosophical Challenge

03/11/2010 8:34 AMExcess generally causes reaction, and produces a change in the opposite direction, whether it be in the seasons, or in individuals, or in governments.

-- PlatoPlato would be struggling if he tried to apply his philosophy to this market. So far excess upside has created no reaction in the opposite direction. That is the challenge we face here, and it isn't an easy one.

The great benefit of active trading is that changing market conditions constantly provide us with a good supply of opportunities for potential profits. The excesses always eventually create a reaction, and the ups and downs of the market allow us to buy and sell over and over again. Even if the major indices do little we can still rack up some good profits if there is sufficient volatility in the market.

However, there are times when the market action is so extreme for so long that the number of favorable trading setups becomes quite small as we wait for the reaction in the opposite direction. We are experiencing one of those times now.

With the major indices almost straight up over the past three weeks, plenty of folks are celebrating how wonderful the gains are. If you have been holding anything recently, it has probably gone up.

Big rallies obviously produce big profits, but eventually there comes a point at which it becomes nearly impossible to keep on buying. We all know that the market never moves in one direction forever and that the odds of further upside start to decline the longer we run without a pause.

Big-picture buy-and-hold bulls like to dismiss the whole idea of overbought technical conditions. Their argument is that conditions are obviously very good and there is no reason for the market not to keep running. The fact that the market is up so much and refuses to rest just supports their view that conditions are great.

For the active trader, it isn't as easy. While traders always want to respect the trend above all else, there are times when the risk of buying doesn't justify the potential reward. That is what it means when we say things are extended. We just can't trust that things that are already up huge will continue to move up endlessly.

My style of trading is to try to stick with the prevailing trend as long as possible. Trends almost always last longer than we think they will, which makes it hard not to start looking for turning points. But sticking with the trend doesn't mean being blindly bullish. You have to use a methodology to reap profits into strength, which means you will become less long the higher the market goes. Unfortunately if you take profits into a market that is making a parabolic move it can be quite difficult to keep finding new stocks to buy. That is the position we are in now.

I see little choice here other than to stay very-short-term bullish and to stay extra vigilant for signs of a change in market character. So far other than having this amazingly strong stretch of positive days, there is nothing in the market action that suggests we are about to fall apart. That doesn't make it easy to buy extended charts but it should prevent us from being too bearish.

We have mild action in the early going. The China economic news overnight had little impact, although there did appear to be some signs of inflation. Weekly unemployment claims should give us a little movement but the bulls still have the ball and are running over the skeptics.

-

Gapping down

In reaction to disappointing earnings/guidance: INOD -9.9%, JTX -7.3%, AACC -6.9% (light volume), MW -6.4%, HOTT -3.1%... M&A news: SKIL -4.9% (Board continues to unanimously recommend that SkillSoft shareholders vote in favour of the SSI Investments acquisition; also downgraded at William Blair)... Other news: CSR -10.4% (to sell 20 mln in common stock in a Form S-3), YUII -8.3% (Audit Committee is studying ways to improve internal controls and eliminate the improper payment arrangement), BLT -5.5% (still checking), CNK -3.6% (registers to sell 10 mln shares of common stock for holders), ROVI -2.1% (to offer $400 mln convertible senior notes due 2040), BX -2.0% (trading ex dividend), MO -1.7% (trading ex dividend)... Analyst comments: NPBC -3.7% (Hearing downgraded at Sterne Agee), BUCY -1.6% (downgraded at Broadpoint Amtech), NLY -1.4% (downgraded to Mkt Perform from Outperform at JMP Securities), YHOO -1.1% (downgraded to Hold at Benchmark), BBBY -1.1% (downgraded to Underperform at FBR Capital).Gapping up

In reaction to strong earnings/guidance: SMTX +48.5%, IGOI +15.7%, FCEL +5.1% (also awarded $2.1 mln for fuel cell to be incorporated into Air Products' renewable hydrogen fueling station in California), GYMB +4.3%, SMTC +4.3%, CSUN +3.3% (light volume), CLNE +3.2% (also upgraded to Outperform at Northland Securities), NABI +2.6% ... M&A news: CKR +2.1% (Wendy's Peltz eyes THL Partners' CKE bid - NY Post)... Select financial related names showing strength: IRE +5.9%, AIG +4.4%, SNV +3.5%, AIB +3.2%, KEY +1.9%, PUK +1.5%... Other news: BPAX +28.7% (announces positive leukemia vaccine results), TEAR +24.7% (announced that TLCVision Corporation will be incorporating the TearLab Osmolarity System), FXCB +15.0% (light volume; announces adoption of plan of conversion and reorganization), ES +5.5% (selected to provide waste management systems to new CPR1000 reactors being built as a part of the extensive nuclear new build program in China), ENTG +4.4% (still checking), MDR +3.1% (McDermott pops ~$0.80 as Cramer makes positive comments about the stock), PUDA +3.0% (still checking), DVN +3.0% (Devon Energy announces $7.0 bln of property sales and oil sands joint venture), APWR +1.7% (announced the development and construction of a new production and assembly plant), AGO +1.5% (announces that Dexia SA has priced a secondary public offering of 21,848,934 AGO common shares owned by selling shareholder at $22.66/share), WLT +1.3% (pops ~$1 to $87.90 as Cramer says he likes the stock as the best pure-play on metallurgical coal), GOLD +1.0% (still checking)... Analyst comments: LVLT +9.5% (upgraded to Neutral from Underweight at JP Morgan), AMLN +1.7% (initiated with Buy at Merriman), DPS +1.2% (upgraded to Buy from Neutral at UBS). -

Euroopa turud:

Saksamaa DAX -0,13%

Prantsusmaa CAC 40 -0,50%

Inglismaa FTSE 100 -0,47%

Hispaania IBEX 35 -0,88%

Rootsi OMX 30 -0,50%

Venemaa MICEX +0,13%

Poola WIG -0,12%Aasia turud:

Jaapani Nikkei 225 +0,96%

Hongkongi Hang Seng +0,09%

Hiina Shanghai A (kodumaine) +0,08%

Hiina Shanghai B (välismaine) -1,27%

Lõuna-Korea Kosdaq -0,21%

Tai Set 50 +0,83%

India Sensex 30 +0,41%USA indeksid kauplevad hetkel -0.3% punases

-

USGS reports 7.2 magnitude quake in Libertador O'higgins, Chile region

NOAA says no widespread tsunami threat from Chile quake - DJ -

Citigroup: Dick Bove says that C could double to $8.50-- Bloomberg

-

Alari, mida see viimane lause eesti keeles peaks tähandama?

-

Dick Bove'i arvates võiks Citigroupi (C) aktsia kahekordistuda $8.50ni - Bloomberg.

-

ES saanud korraliku vastupanu 1144.50 tasemel. Viimase 1h jooksul seal kellegi suurem pakk vastas olnud.

-

Fed releases Q4 Flow of Funds: Q4 Household networth est $54.2 trl up $0.7 trl from Q3

Household net worth—the difference between the value of assets and liabilities—was an estimated $54.2 trillion at the end of the fourth quarter, up $0.7 trillion from the third quarter. For 2009 as a whole, household net worth increased $2.8 trillion. -

Mnjah, sain sellest lihtlausest samamoodi aru, aga mis aja jooksul? Kui praegusel hetkel, siis läheb ju näiteks P/E üle 2x kõrgemaks?

-

Dick Bove on olnud finantssektori suhtes kogu aeg väga positiivne ja oli seda ka enne kriisi. Kohati tundub, et mees hõljub veidi pilvedes. C kohta tema arvamust ei jaga.

-

C'lt oleks mõistlikum oodata "rallit" 5.25-5.50 vahele 2010.a. jooksul?

-

$13 bln 30-year Bond Auction: Yield 4.679% (expected 4.702%); Bid/Cover 2.89x (10-auction avg 2.47x, Prior 2.26x); Indirect Bidders 23.9% (10-auction Avg 41.47%, Prior 28.5%)

-

Imax tgt raised to $22 at Brigantine

-

Citigroup Inc

Chief Executive Vikram Pandit told investors on Thursday that he views the troubled bank as "well positioned to return to sustained profitability."

Shares of Citigrouprose nearly 5 percent to hit session high of $4.14 after Pandit's comments -

Taaskord tavapäraseks saanud lugu, kus käive tõmmatakse üles ES ja SPY. NQ, YM ja muud üksikaktsiad tiksuvad vaikselt järgi.

-

Kella 19:00 ajal müüdi päris kenasti, kuid nii kui müük pealt võeti taastus turg mängleva kergusega endistele tasemetele ( ilma käibeta).

-

Ja lükataksegi ilma käibeta turg tippu???

-

vedasin eile kihla, et SPY on 125 enne juunit. lets see