Börsipäev 16. märts

Kommentaari jätmiseks loo konto või logi sisse

-

USA turult on täna tulemas hulgaliselt makroandmeid. Kell 14.30 teatatakse veebruarikuus väljastatud ehituslubade aastane tempo - ootuseks on ca 601 000, mis oleks väiksem, kui jaanuaris nähtud 622 000. Samuti teatatakse alustatud ehituste number, kust oodatakse ca 570 000list näitu, mis oleks väiksem kui jaanuaris nähtud 591 000.

Eesti aja järgi kell 20.15 teatatakse Föderaalreservi intressimäära otsus. Intressimääradelt muutust ei oodata ning samuti ei oodata ka intressimäära otsusega kaasnevas raportis sõnastuse olulist muutust ehk lause 'intressimäärad jäävad ebaharilikult madalale tasemele pikaks ajaks', peaks jätkuvalt raportisse sisse jääma. -

Eile teatas kivisöe kaevandaja Consol Energy (CNX), et ostab $3.48 miljardi eest Dominionilt (D) maagaasi varad Marcelluse regioonis. Tehinguga saab CNX enda valdusesse täiendavad ca 1 tcf tõestatud ja ca 20 tcf tõestamata varusid.

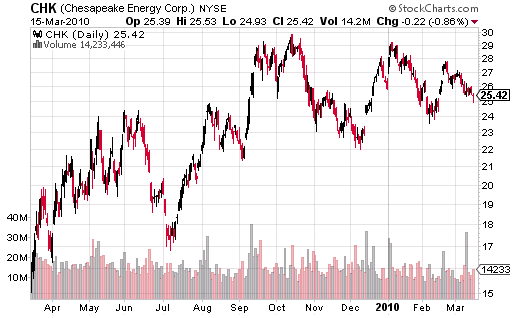

Chesapeake Energy (CHK) tõestatud reservid on hetkel ca 15 tcf ja tõestamata reservid ca 65 tcf. Juhtkonna prognooside kohaselt jõuavad need 2012. aastaks vastavalt ca 20 ja 120 peale. Kuigi eile õhtul langetas Morgan Stanley analüüsimaja oma soovituse Chesapeake'i aktsiale 'overweight' pealt 'neutraalsele', öeldes, et lähitulevikus ei nähta ettevõtte-spetsiifilisi uudiseid, mis võiksid aidata aktsial edasi tõusta, näitab Consol Energy poolne maagaasi varade ostmine minu arust siiski seda, et pikaajaliselt on üha enam ja enam energia-ettevõtteid panustamas maagaasi laiemale kasutusvõtu peale ning seetõttu väärib kindlasti hoida portfellis ka Chesapeake Energy (CHK) aktsiaid.

Oma $35'list hinnasihti ja ostusoovitust CHK aktsiatele kinnitas eile Oppenheimer. Street high'ga on väljas Suntrust Robinson analüüsimaja $50lise sihiga, madalaim numbriline hinnasiht on Credit Suisse'il, kes näeb õiglase hinnana $26.

-

Makroandmed ehitusturult oodatuga võrreldes pisut paremad:

February Housing Starts 575K vs 570K consensus; M/M change -5.9%

February Building Permits 612K vs 601K consensus; M/M change -1.6% -

Euroopa turud:

Saksamaa DAX +0.75%

Prantsusmaa CAC 40 +0.84%

Inglismaa FTSE 100 +0.26%

Hispaania IBEX 35 +0.18%

Rootsi OMX 30 +0.05%

Venemaa MICEX +0.84%

Poola WIG +0.96%Aasia turud:

Jaapani Nikkei 225 -0.28%

Hongkongi Hang Seng -0.27%

Hiina Shanghai A (kodumaine) +0.53%

Hiina Shanghai B (välismaine) +0.86%

Lõuna-Korea Kosdaq +0.60%

Tai Set 50 +2.52%

India Sensex 30 +1.27% -

We're on Fed Time

By Rev Shark

RealMoney.com Contributor

3/16/2010 8:49 AM EDT

Inflation is one form of taxation that can be imposed without legislation.

-- Milton Friedman

On Monday the market paused a little in its relentless uptrend, but the selling was so mild it hardly qualified as profit-taking. In the morning it looked like the selling was going to pick up, but the dip-buyers moved in after the lunch hour and helped to produce a finish near the highs of the day. The bulls remain firmly in control.

Today the primary focus will be on the FOMC interest rate decision. No one is expecting a change in rates, but market players will be scrutinizing the accompanying policy statement for any hints about how long we can expect rates to stay at extremely low levels. The biggest obstacle this market faces will be inflationary pressures created by the flood of cheap funds. The only way the Fed has of battling that is higher interest rates, and that is never market-friendly. We don't have any obvious inflationary pressures at the moment, but the market will be keenly focused on any signs that prices are rising.

Even though the market has this potential worry about inflation, it is very unlikely that there will be anything surprising in the FOMC policy statement today. The key language in the last report was, "With substantial resource slack continuing to restrain cost pressures and with longer-term inflation expectations stable, inflation is likely to be subdued for some time." There hasn't been any indication from Fed members that this view of inflation has changed in the last month.

Overall the market has tended to perform very well on FOMC announcement days over the past year. The old adage about not fighting the Fed has applied -- we have generally had positive reactions to the news. The market usually drifts up into the news, and during the past year we have only had aggressive selling on the announcement once.

According to Sentimentrader.com, there have been five times in the past 15 years when the S&P 500 closed at a new one-year high prior to a FOMC policy decision. Three times the market was within days of an intermediate-term correction. So the news has been a catalyst for a turning point when we are at highs. The market is still quite technically extended, so we need to keep that in mind in the next few days.

The current technical condition of the market presents a challenging trading environment. There is no question we have a strong uptrend in place, but we have had so little rest recently that it is extremely difficult to be very aggressive with new buying. On the other hand, shorting has been suicide. There is just no notable or sustained weakness, and even when we do have a little selling (like yesterday morning) it doesn't last long enough to allow any shorting.

So here we are with the uptrend showing few signs of weakness and a recent tendency to drift up in front of the FOMC news. There is little choice but to remain bullish but keep a very-short-term time frame and stay very vigilant. It hasn't paid to be bearish in front of the Fed, but quite often a strong response to the news is reversed in the next couple days.

We have a slightly positive open shaping up. There is some economic news that may give us a jiggle but primarily we just have to wait for the FOMC announcement before we can do much.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ATHN +6.6%, SDTH +2.9%, MCHP +2.7%, DB +1.4% (confirms 2009 net income of $6.9 bln - AP)... Select financial related names showing strength: CS +1.6%, BCS +1.6%, UBS +1.3%... Select metals/mining names trading higher: HL +1.5%, ABX +1.3%, AUY +1.2%, MT +1.0% (plans reinforcing bar joint venture in Iraq)... Other news: ICGN +74.1% (reports positive results for ICA-105665 in patients with photosensitive epilepsy), BLTI +35.1% (announces FDA 510(K) clearance of iLase personal laser for dental market), CGEN +9.5% (announces discovery platform to predict cell penetrating peptides for drug delivery), DVAX +7.5% (anticipates earlier BLA submission for HEPLISAV), DNN +4.9% (reports Phoenix high-grade uranium deposit continues to encounter 'significant results' ), PDC +4.5% (CFO bought 42,275 shares at $7.29; CEO bought 56,300 shares at $7.32), LTD +3.8% (announces $1 per share special dividend and $200 million share repurchase program), USEG +2.5% (announces initial production rate on Bakken Wells), BEXP +2.2% (announces signing of purchase and sale agreement to acquire over 10,000 Net Acres in its rough rider project area), IUSA +2.1% (SEC investigation of Infogroup is concluded), PCX +1.9% (sells metallurgical coal to Asian destinations of ~1.5 mln tons), GLW +1.8% (comments on demand for LCD TVs), AIG +1.7% (closes secondary public offering of shares in Transatlantic Holdings), NAV +1.1% (receives $178 mln contract to retrofit 1,222 MRAPs with DXM independent suspension), RDS.A +1.1% (to increase production), OFG +1.0% (priced a 7.6 mln share common stock offering at $11.40/share), MRX +1.0% (Cramer makes positive comments on MadMoney)... Analyst comments: MPEL +4.7% (upgraded to Outperform from Neutral at Credit Suisse), SONC +3.0% (upgraded to Overweight at Piper), SBUX +2.4% (upgraded to Buy at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SQNM -17.5%, ADY -14.0%, EONC -12.7% (light volume), UWBK -10.5% (also downgraded to Neutral from Buy at Sterne Agee), CFSG -6.7%, GSI -6.4%, MOV -6.4%, MDVN -1.6% (also target lowered to $13 from $25 at RBC Capital), DSW -2.9%... Other news: LXRX -8.5% (prices an ~87.71 mln share common stock offering at $1.15/share), GLP -5.0% (announces public offering of 3.4 mln common units), NVAX -4.3% (filed for a $150 mln mixed shelf offering), FPO -3.8% (announces public offering of 5 mln common shares), FNSR -3.4% (files S-3ASR for mixed shelf of indeterminate amount; files for 7.2 mln share common stock offering), BXS -2.3% (revises previously reported financial results), SNIC -0.9% (light volume; files $166.5 mln mixed shelf offering in an S-3)... Analyst comments: WYN -3.0% (downgraded to Neutral at Goldman), EAT -2.8% (downgraded to Underweight at Piper), PSEC -1.9% (downgraded to Neutral at Macquarie), CAKE -1.5% (downgraded to Underweight at Piper), KMB -1.2% (added to Conviction Sell List at Goldman), SFL -1.1% (downgraded to Neutral at JPMorgan), TEVA -1.1% (removed from their Conviction Buy List at Goldman), GT -0.9% (initiated with Underweight at Morgan Stanley), UNH -0.9% (removed from their Conviction Buy List at Goldman). -

"February Housing Starts 575K"

"February Building Permits 612K"

Joel, kas tegemist on aastaste või kuiste numbritega ning mis on nende taga? -

Ouna Ants, USA statistikaametitele kohaselt on avaldatav info sesoonsusega läbi korrigeeritud ja annualiseeritud. Ehk siis 'February Building Permits' tähendab, et kui võtta aluseks veebruaris nähtud aktiivsus väljastatud eluasemete ehituslubade kohta ja korrigeerida see ajaloolise sesoonsusega läbi, oleks aastane ehituslubade võtmise tempo ca 612 000. Samamoodi siis 'Housing Starts' ehk alustatud eluasemete ehituse number - veebruaris nähtud tempo, mis on sesoonsusega läbi korrigeeritud ja annualiseeritud ehk siis pikendatud aasta peale.

-

http://www.investopedia.com/university/releases/housingstarts.asp

-

Joel, tänan! Osade näitajate saamiseks tuleb kuu tulemus "sesoonsusega läbi korrigeerida ja annualiseerida" ning lisada vajadusel Tambovi konstant! Kahtlemata huvitav lähenemine! Kahtlen, kas leidub keegi, kes julgeks mõelda, kui usaldusväärne selline laialtkasutatav näitaja tegelikult on.

-

As expected, FOMC leaves fed funds target rate unchanged at 0.00-0.25%; says rates to stay exceptionally low for extended period.

Fed says economic activity has continued to strengthen. -

Kokkuvõte Föderaalreservi raportist:

Information received since the FOMC met in January suggests that economic activity has continued to strengthen and that the labor market is stabilizing. Household spending is expanding at a moderate rate but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly. However, investment in nonresidential structures is declining, housing starts have been flat at a depressed level, and employers remain reluctant to add to payrolls. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve has been purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of agency debt; those purchases are nearing completion, and the remaining transactions will be executed by the end of this month. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability. In light of improved functioning of financial markets, the Federal Reserve has been closing the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities and on March 31 for loans backed by all other types of collateral. Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to the buildup of financial imbalances and increase risks to longer-run macroeconomic and financial stability. -

Intel: Source tells CNBC that the co will not be offering a mid-qtr update

-

regular sell the news ?

-

ee, matu, mida sa öelda tahtsid?