Börsipäev 17. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia turud on täna rõõmsasti rohelised tänu keskpankadele, kes lubavad jätkata majanduse turgutamist madalate intressimääradega ning täiendavate likviidsusprogrammidega. Eilsele Föderaalreservi statement'ile lisaks otsustas Jaapani rahapoliitika koordineerija täna lõppenud kohtumisel, et kahekordistab finantsasutustele suunatud kolmekuuliste laenude mahtu 20 triljoni jeenini ehk 222 miljardi dollarini. Nikkei oli enne uudist 0.7% plussis, kerkides aga päeva lõpuks veel 0.6 protsendipunkti.

Makro kohalt jääb laud USA-s täna tagasihoidlikuks, kui peamist tähelepanu pälvivad tootjahinnaindeksi avaldamine kell 14.30 ning naftavarude raport kell 16.30. -

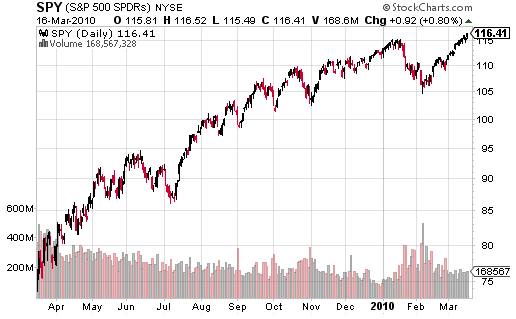

S&P500 indeksi liikumist jälgiv SPY on nüüdseks tõusnud 13 päeva järjest. Tegu on väga pika järjestikuse tõususeeriaga. Viimase kahe aasta pikimad järjestikused tõususeeriad on olnud 8-päevane tõususeeria 2009. aasta novembris, 7-päevane tõususeeria 2009. aasta juulis, 6-päevane tõususeeria 2010. aasta jaanuaris, 2009. aasta detsembris ja 2009. aasta oktoobris.

-

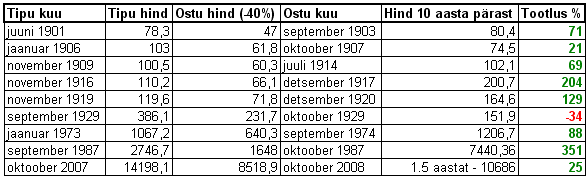

2009. aasta 17. märtsi hommikul ehk täpselt 1 aasta tagasi kirjutasin LHV Finantsportaalis loo pealkirjaga: "Jah, rasketel aegadel tasub investeerida" - link siin. Loos olin ma ära toonud, kuidas oleks läinud investori käekäik, kes oleks ajaloos alati ostnud Dow Jonesi tööstusindeksit pärast selle 40%list tipust kukkumist ja milline oleks tootlus olnud 10 aasta pärast. Panen selle tabeli uuesti siia ning viimasesse ritta saab siis praegu kirjutada 1.5 aasta tulemuse, mis on 25% - pole paha. Samuti tuleks meelde jätta, et siia lisandub veel dividenditootlus.

-

Panen siia ka eileõhtuse kommentaari Jim Cramerilt, mis mulle endale meeldib:

Cramer: "Oil's looking locked at this $80 level give or take, and the stocks are locked with it.

I am amazed that oil's just hung. It doesn't matter whether employment's looking up or down or the consumer is strong or weak -- it's pretty amazing that it could have so little volatility.

/-/

I think that almost all of the oils are buys. A severe collapse in crude would likely only be caused by a severe economic slowdown, and judging by what the Fed said today, I just don't think that's in the cards. " -

kas keegi seletaks mis toimub gaasiga. UNG-i investeerimise eest hoiatati paar kolm kuud tagasi ja nüüd see saatus on ka käes. portfellis on sees 13ga nii et päris paha. kas on lootust, et taastub?

R -

Me oleme taas pildis ning "tublide" poolel... Barclay's arvab nii...

Baltics: Sell Estonia, Latvia 5y CDS

Estonia's path towards euro adoption and the improving economic outlook have been reflected in spread performance over the past quarter, driven by Estonia's strong debt and fiscal position. Since at current market levels there is still a c.40-50bp spread pick-up over Slovenia and Slovakia in 5y CDS, we see room for Estonia's spreads to tighten further (to a target of 60bp) and recommend selling 5y CDS protection. We also recommend going outright long Latvia credit, switching from our long Latvia credit/short Lithuania credit CDS pair trade. Given the signs of economic stabilisation across the region and that Latvia's financial vulnerabilities seem increasingly manageable on the back of the IMF loan disbursements, we view current spread levels as attractive for an outright long position. We prefer selling CDS over buying Latvian bonds given the substantial positive basis and would set a target of 300bp -

ÄP võiks teha nüüd tõlkeuudise, et Barclais soovitab Eestis ja Lätis müüa :-)

-

Zara, Bershka, Bull & Bear ning paljude teiste brändide omanik Inditex teatas hommikul, et neljanda kvartali puhaskasum kasvas 18% 483 miljoni euroni, lüües Bloombergi küsitletud analüütikute ootust, milleks oli 429.8 miljonit eurot. Eelmise aasta käive kasvas 6.5% 11.08 miljardi euroni, mis ühtis analüütikute ootustega. Inditexi aktsia kaupleb uudise peale ca 3% kõrgemal.

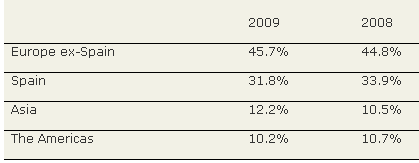

Hispaania päritolu rõivafirma strateegiaks on viimastel aastatel olnud oma tulude osakaalu agressiivne laiendamine väljaspool kodumaad, kus müüginumbrid on kaks aastat järjest languses olnud. Eelmise aastal avati kokku 343 uut poodi, millest 98% asus rahvusvahelisel turul. Kui USA konkurent GAP sulgeb rohkem poode, kui neid avab, siis Inditex vastupidiselt hoopis suurendab oma kaupluste arvu, plaanides tänavu avada 365-425 poodi. Üle 40% sellest leiab aset Aasias, kus tänavu sisenetakse esimest korda ka India turule.

Müügitulude jaotus

-

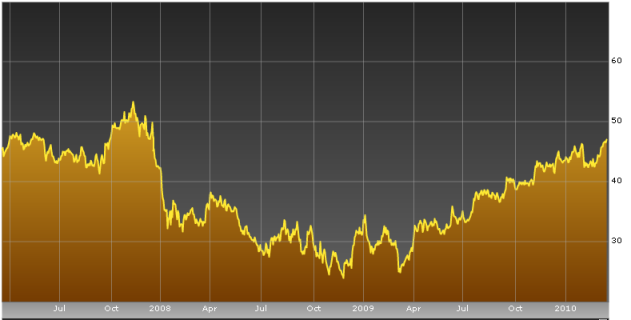

Alates 2009. aasta märtsist on maagaasi maailmaturu hind püsinud põhimõtteliselt muutumatuna. Nii nagu 2009. aasta märtsi alguses maksis gaas ca $4.3 mmbtu eest, on hind sama ka täna.

Maagaasi lühiajalisest tõusust kasu lõikav, kuid pikaajaliste liikumiste korral contango efekti (järgmise kuu lepingute hinnad on kallimad kui käimasoleva kuu lepingud, mistõttu iga kuu ostetatakse kallima hinnaga lepingud sisse ning maailmaturu hinna samaks jäädes või kukkudes liigub UNG allapoole) tõttu tugevalt kannatav UNG on selle ajaga liikunud ca $17 pealt tänaseks ca $7.9 peale ehk ca -55%.

rainerb, UNGi taastumise lootus iseenesest on alati olemas, kuid antud juhul peab aduma, et aeg töötab selle vastu. Selleks, et UNG jõuaks tagasi ca 13ni, peaks maagaasi maailmaturuhind läbi tegema ca 70%lise ralli. See aga tähendaks maagaasi hinnatõusu tänase $4.3 pealt ca $7.3 peale... Kui nüüd naftahinnad peaksid $80 barrelist piirist ülespoole rühkima hakkama, siis peaks see aitama ka maagaasi hindu tõsta, kuid niivõrd suurt rallit maagaasiturult oleks praegu kindlasti väga raske oodata isegi siis, kui nafta peaks jõudma $100ni barrelist. Pikaajalise maagaasihinna tõusu peale mängimiseks tasuks osta maagaasisektoris tegutsevate ettevõtete aktsiaid - meie valikuks on Chesapeake Energy (CHK).

-

rainerb

Umbes kuu tagasi oli Välisilmas juttu USA-s juurutatud uuest gaasi maapõuest saamise viisist - nö kivimitest gaasi välja pressimisest (veega). Juba praegu tuleb selliselt saadavat gaasi turule. Räägiti ka ülejäägi tankeritega Euroopasse transportimisest ja selle tagajärgedest Vene monopolile. Niisiis - otsi vastust oma küsimusele ka selle kivi alt. -

kas UNGd saab shortida ka?

-

jah saab

-

Meeldetuletuseks:

Andres Mäe: energiaturgu muutev kildagaas:

http://www.e24.ee/?id=224227

"USAs märkimisväärse kiirusega kasutusele võetud kildagaas pole mingi uhiuus teadussaavutus, kirjutab välispoliitika instituudi teadur Andres Mäe. Uued on aga puurimiseks kasutatavad tehnoloogiad. Kildagaasi kasutuselevõtt võimaldab maailma gaasituru ümber jagada." -

Kas UNG shortimine pikaajaliselt ei ole siis justkui sampo rahaveski - et aga jahvatab. Mis selle trade miinus võiks olla?

-

February PPI Y/Y +4.4% vs +4.9% consensus, prior +4.6%

February Core PPI M/M +0.1% vs +0.1% consensus, prior +0.3%

February PPI M/M -0.6% vs -0.2% consensus, prior +1.4%

February Core PPI Y/Y +1.0% vs +1.0% consensus, prior +1.0% -

myygiguru, kui alusvara peaks siiski läbi tegema tugeva lühiajalise ralli, eeldab see, et lühikeseks müüjal oleks roppu moodi kannatust, närve ja marginit, et oma positsiooni ikka alles hoida ja vältida sundlikvideerimist. (Teoorias võib samuti ühel hetkel ära kaduda olukord, kus tulevaste lepingute hinnad on kallimad kui front month omad)

-

Aasiast ja Euroopast vaatavad pea eranditult vastu vaid rohelised numbrid. USA tähtsamate indeksite futuurid on ca 0.1% kuni 0.3% plusspoolel. Nafta on tõusnud 1.2% ning barrel maksab hetkel $82.65.

Euroopa turud:

Saksamaa DAX +0.78%

Prantsusmaa CAC 40 +0.50%

Inglismaa FTSE 100 +0.45%

Hispaania IBEX 35 +0.92%

Rootsi OMX 30 +0.65%

Venemaa MICEX +1.23%

Poola WIG +1.10%Aasia turud:

Jaapani Nikkei 225 +1.17%

Hong Kongi Hang Seng +1.72%

Hiina Shanghai A (kodumaine) +1.93%

Hiina Shanghai B (välismaine) +1.70%

Lõuna-Korea Kosdaq +0.40%

Tai Set 50 +1.81%

India Sensex 30 +0.61% -

Just Ignore the Buy-and-Hold 'Geniuses'

By Rev Shark

RealMoney.com Contributor

3/17/2010 8:45 AM EDT

Change alone is unchanging.

-- Heraclitus

Once again the market is set for a positive open. We have been on a truly remarkable run for a month now and there is no indication that it is about to end. The most surprising aspect about this action isn't the amount of the gains -- which are large but not unusual -- but the consistency of the action. We seem to go up a little more every day without pause. The lack of consolidation and pullbacks is truly unusual.

Of course, when the market acts this way, the usual buy-and-hold, bull-market geniuses pop up and tell us how stupid it is to pay attention to volume, technical patterns, sentiment or anything else that may tend to make us cautious. The market is just going straight up, so if you aren't 100% bullish and onboard you are a fool. We always hear these arguments about the uselessness of anything other than fundamental analysis at market extremes. There is a grain of truth to it because market timing can never be too precise.

The simple and frustrating truth about this market is that anyone using a disciplined trading approach is very likely to be underperforming. If you take gains in a systematic way and avoid chasing extended charts, then you will be holding fairly high levels of cash. That doesn't mean that you are wrong and need to change your style; it means that the market is acting in an unusual manner, which it will do on a fairly regular basis.

Generally, disciplined trading will produce outsized gains, but there are times -- like now -- when it won't. That doesn't mean you should suddenly declare charts and volume and other tools useless. It means you need to stay tough and keep on plugging along.

Disciplined trading usually works well because it deals with a market that is constantly changing. We are in an environment now that has been unchanging for quite a while, and that is why I've been sounding a bit frustrated. Discipline has not been a very helpful attribute in a market that does the same thing every day for so long.

There continue to be lots of reasons to look for this market to rest, but this straight-up action has created a big crowd of underinvested bulls who are champing at the bit to buy a dip. That may keep pullbacks shallow, but sooner or later we are going to consolidate and work off these extreme technical conditions.

Don't spend a lot of time worrying about the bull-market geniuses whose advice is to always stay long. They are having some fun making it sound like disciplined trading is just plain stupid, but I guarantee you that over the long run, good traders will always outperform those who think those charts are a waste of time.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: FMCN +7.8%, AGM +6.6%, KONG +5.0%, CLD +3.3%, FXEN +3.2% (light volume), LSI +3.1% (light volume), CIT +2.5% (All equity of predecessor CIT was eliminated and the fair value of new common equity was determined to be $41.99 per share), RUE +2.3% ... M&A news: PLCM +10.1% (Apax eyes Polycom as shares surge - FT.com)... Select financial names showing strength: AIB +8.0%, IRE +5.3%, SNV +2.8%, ING +2.2%, AIG +1.8% (ILFC announces proposed offering of senior notes due September 2015), CS +1.7%, NBG +1.1%, HBC +1.0%... Select metals/mining names trading higher: RTP +2.3%, BBL +1.9%, GFI +1.8%, GOLD +1.3%, MT +1.2%... Select casino related names showing strength: MGM +2.6% (closes $845 mln senior secured notes offering; the notes were issued at par with a four-year no call feature), LVS +2.0%, MPEL +1.4%, WYNN +1.2%... Other news: QUOT +58.8% (very thinly traded and very light volume), MDCO +13.2% (announces decision in PTO and FDA litigation), AKNS +11.5% (to provide installation services for Lowe's), FSII +6.8% (receives ORION single wafer cleaning system order from major semiconductor manufacturer for development of FEOL cleaning processes), SI +3.0% (to cut 1,000 jobs, restructure IT unit - AFP), SCCO +3.0% (mentioned positively by Cramer on MadMoney), FCX +2.9% (still checking)... Analyst comments: NGAS +13.3% (upgraded to Buy at Wunderlich), NOK +3.0% (hearing strength attributed to ests raised at tier 1 firm), ADSK +2.0% (added to Conviction Buy List at Goldman), ANN +1.9% (upgraded to Neutral from Underperform at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: FUQI -30.7% (also files to delay 10-K; downgraded to Neutral at Merriman and downgraded to Perform at Oppenheimer), MIPI -22.2%, UVE -7.2% (also trading ex dividend), CSKI -6.7%, CIGX -5.5%, EVEP -3.5%, EGY -2.3%, EM -2.0%, AIR -1.9%, DFS -1.5%, MEE -1.4% (also announces definitive agreement to acquire Cumberland Resources)... Other news: WRLS -18.6% (expects to sell between 24,000 and 28,000 Telguard units for the current quarter ended March 31, 2010), OXPS -10.7% (reports retail darts of 28,000, 8% lower than Feb 2009), VPFG -8.1% (files for 23 mln share common stock offering at $10.00 per share in connection with the conversion of ViewPoint MHC from the mutual holding company), CYTK -7.6% (announces that James Sabry, who has been serving as Chairman of the Board of Directors, is resigning), FTBK -5.7% (revises results to reflect additional loan loss provisions, valuation adjustments and OTTI impairments; FDIC sees bank as "critically undercapitalized"), BCH -5.5% (trading ex dividend), HRP -4.9% (announces proposed public offering of 20 mln common shares), TOO -4.3% (announces pricing of 4.4 mln common unit follow-on offering at $19.48 per unit), VGR -2.6% (trading ex dividend), FPO -1.7% (announces the pricing of its underwritten registered public offering of 5.5 mln common shares of beneficial interest at a public offering price of $14.50/share), LAZ -1.6% (Estate of Bruce Wasserstein and related trusts to sell 7,869,311 shares of common stock in a secondary offering)... Analyst comments: ERIC -2.7% (downgraded to Underperform from Neutral at BofA/Merrill ), CTXS -2.5% (downgraded to Neutral from Buy at Goldman), SHPGY -1.8% (downgraded to Sell from Buy at Citigroup), ALU -1.4% (downgraded to Neutral from Buy at Goldman), GNW -1.3% (downgraded to Neutral from Buy at BofA/Merrill), TSCO -1.2% (downgraded to Underperform at FBR Capital), CVLT -1.1% (Goldman removes from their Conviction Buy list), ECA -0.8% (downgraded to Neutral from Outperform at Macquarie). -

GM CFO: Sees Reasonable Chance of Being Profitable This Year; Plans a GM IPO, but No Timetable

-

Dept of Energy reports that crude oil inventories had a build of 1012K (consensus is a build of 1150K); gasoline inventories had a draw of 1710K (consensus is a draw of 1250K); distillate inventories had a draw of 1491K (consensus is a draw of 1350K).

-

Senate passes $17.6 bln job-creation bill, sends to Obama to sign into law - Reuters

-

http://www.superpoop.com/121608/money-truck.jpg

-

Turg korraliku ralli teinud enne Volcner-i ja Bernanke sõnavõttu finantskomitee ees.

-

Turule veidi müüki tulnud. AAPL punases, finants samuti surve all (GS, MS).

-

Turg käitub VÄGA raskelt, sellist asja pole tükk aega olnud. Väga suurelt mängitakse positsioone sektorite ja aktsiate vahel ümber jne, sealjuures tundub, et ostmisega kiiret ei ole, küll aga tahab keegi kindlasti välja saada ja suurelt.

Segane jutt ja ainult kõhutundel põhinev, aga pakuks, et mingi nädala lõpuks on SPY siit mingi 1..2 punkti allpool. -

Citigroup equity strategists lower financial sector rating to Neutral from Overweight - DJ

-

see Citi downgrade oli umbes 1,5 tundi tagasi

-

Floor Talk: Market dip coincides with chatter that sellside shop out with call downgrading global Financials, citing magnitude of market recovery from the lows -- unable to confirm

Kergelt hiljem ka downgrade ja turg hakkas allapoole tiksuma. -

abesiki Re: Börsipäev 17. märts 17/03/10 21:40

see Citi downgrade oli umbes 1,5 tundi tagasi

ehk et pole enam nagu aktuaalne? -

Enne jäi silma ka selline uudis:

Toll Brothers has purchased ~3,000 home sites in the last 4 months