Börsipäev 26. märts

Kommentaari jätmiseks loo konto või logi sisse

-

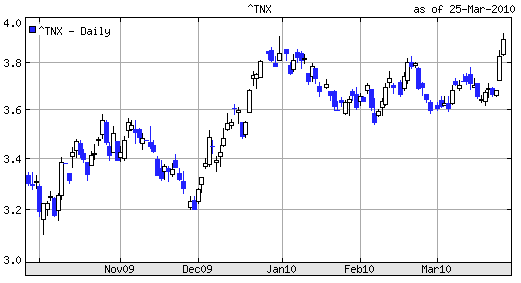

Eile panin siia graafiku USA 10-aastasest võlakirja tulususest. Teen seda ka täna, kuna tulususmäär tõusis eile juba 3.9%ni. Mida kõrgemale tõuseb võlakirjade tulususmäär, seda suuremaks konkurendiks saab see olema aktsiaturgudele. Kes tahab mängida tulususmäärade jätkuvale tõusule, siis neil on võimalik osta kas TBFi (1-kordne võimendus) või TBT'd (2-kordne võimendus).

Makroandmete poole pealt täna väga olulisi uudiseid oodata ei ole. Kell 14.30 teatatakse 2009. aasta 4. kvartali SKP kolmandat korda ülevaadatud number, mis peaks ootuste kohaselt jääma 5.9% peale, ning SKP deflaator, mis peaks ootuste kohaselt jääma 0.4% peale. Kell 15.55 teatatakse Michigani sentimendihinnang märtsikuu kohta ning sealt oodatakse 73 punktilist näitu.

Varastel hommikutundidel on S&P500 ja Nasdaq100 indeksi futuurid ca +0.2%.

Kõigile LHV foorumikülastajatele siinkohal aga palve minu poolt. Oma magistritöö raames palun abi ca 10 minutilise aktsiaturgude teemalise küsitluse täitmisel. Tõsi, tavaliselt pooldame selliste küsitluste panemist 'vaba teema' alla, kuid kuna töö teema on seotud otseselt investeerimise ja aktsiaturgudega, kasutan moderaatori õigusi ning levitan oma küsitlust kuni märtsikuu lõpuni ka siinses börsipäeva foorumis. Link küsitlusele on siin. Palun kõigil, kel vähegi võimalik, selle täitmiseks 10 minutit eraldada. Suured tänud kõigile vastajatele!

-

'Eesti euroliitumise 'tracker'i' foorumis on see juba kirjutatud, aga kuna number avaldati täna, siis panen selle ka siia. Eesti 2009. aasta riigieelarve defitsiidiks tuli siis kokku 1.7%. Link ka Bloombergi loole.

-

Eile õhtul teatas Oracle (ORCL) oma fiskaalaasta 3. kvartali (lõppeb veebruariga) tulemused, mis laias laastus vastasid turu ootustele.

Briefing: Reports Q3 (Feb) earnings of $0.38 per share, excluding non-recurring items, in-line with the First Call consensus of $0.38; revenues rose 17.4% year/year to $6.4 bln vs the $6.35 bln consensus. ORCL reports Q3 operating margins of 45% vs Street est of 44%. ORCL reports Q3 operating margins of 45% vs Street est of 44%.

Ka tuleviku prognoosid vastasid ootustele:

Briefing: Oracle on call guides Q4 in-line; EPS of $0.52-0.56 vs $0.53 First Call consensus; rev growth of 36-41% which equates to ~$9.36-9.7 bln year/year vs $9.55 bln First Call consensus (26.04 +0.28) -Update

Kuna aga aktsia on juba korralikult rallinud, siis eile vajuti järelturul inline tulemuste peale pisut miinusesse.

-

Euro on täna korralikku rallit tegemas ning +0.85%lise tõusuga liikunud tasemele €1=$1.34.

-

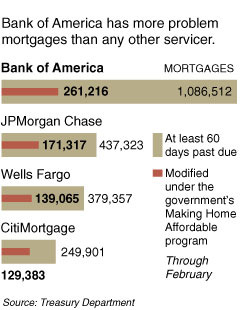

Obama teatab täna, milliseid uusi meetmeid kavatseb valitsus rakendada selleks, et aidata inimestel vältida oma kodu sündmüüki panemist. Eelkõige pööratakse tähelepanu nendele, kes on töötud ja kelle laenu suurus ületab tagatiseks oleva maja maksumust. Viimaste osakaal moodustab tänasel päeval juba viiendiku (11 miljonit majapidamist) kõigist, kellel on hüpoteeklaen võetud. Osade allikate kohaselt võib üheks elemendiks olla nõudmine, et laenuandjad langetavad väljastatud krediidi väärtust ning teiseks elemendiks töötute puhul maksegraafiku leevendamine. Mõni päev tagas teatas näiteks Bank of America oma vatutulekust, mis töötab järgmiselt:

Obama teatab täna, milliseid uusi meetmeid kavatseb valitsus rakendada selleks, et aidata inimestel vältida oma kodu sündmüüki panemist. Eelkõige pööratakse tähelepanu nendele, kes on töötud ja kelle laenu suurus ületab tagatiseks oleva maja maksumust. Viimaste osakaal moodustab tänasel päeval juba viiendiku (11 miljonit majapidamist) kõigist, kellel on hüpoteeklaen võetud. Osade allikate kohaselt võib üheks elemendiks olla nõudmine, et laenuandjad langetavad väljastatud krediidi väärtust ning teiseks elemendiks töötute puhul maksegraafiku leevendamine. Mõni päev tagas teatas näiteks Bank of America oma vatutulekust, mis töötab järgmiselt: A borrower might owe, say, $250,000 on a house whose value has fallen to $200,000. Fifty thousand dollars of that balance would be moved into a special interest-free account.

As long as the owner continued to make payments on the $200,000, $10,000 in the special account would be forgiven each year until either the balance was zero or the housing market had recovered and the borrower once again had positive equity.

“Modifications are better than foreclosure,” Jack Schakett, a Bank of America executive, said in a media briefing. “The time has come to test this kind of program.”

-

USA neljanda kvartali SKT revideeriti kolmandal vaatlusel 5.9%lt 5.6%le. Teine vaatlus tõi veebruari lõpus mäletatavasti revideerimise 5.7%-lt 5.9%-le.

-

Goldman Sachs tgt cut to $210 from $225 at Bernstein- Reuters

-

Euroopa turud:

Saksamaa DAX -0.19%

Prantsusmaa CAC 40 -0.22%

Inglismaa FTSE 100 -0.29%

Hispaania IBEX 35 -0.01%

Rootsi OMX 30 -0.89%

Venemaa MICEX +0.51%

Poola WIG -0.05%Aasia turud:

Jaapani Nikkei 225 +1.55%

Hong Kongi Hang Seng +1.32%

Hiina Shanghai A (kodumaine) +1.35%

Hiina Shanghai B (välismaine) +0.69%

Lõuna-Korea Kosdaq +0.85%

Tai Set 50 -0.91%

India Sensex 30 +0.49% -

Don't Count Out the Bulls Just Yet

By Rev Shark

RealMoney.com Contributor

3/26/2010 8:28 AM EDT

Simple solutions seldom are. It takes a very unusual mind to undertake analysis of the obvious.

-- Alfred North Whitehead

The market action on Thursday was classic topping action, but we shouldn't assume that the market is now going to suddenly fall apart.

For a while yesterday it looked like we were going to continue to blast higher and never turn back. The news from Best Buy (BBY) was quite good, the dollar was weakening again, big-cap technology names like Apple (AAPL) and Priceline (PCLN) were leading and breadth was superb. The fact that we were grossly overbought continued to be nothing more than some quaint technical problem that hasn't mattered for weeks.

But news of a possible Greece bailout deal turned the euro down and the dollar up, and we reversed hard. Continued weakness in the bond market also gave the bears some ammunition in the form of higher rates. But even though the reversal was quite dramatic, the major indices finished the day close to the flat.

It was refreshing to see some volatility from a trading standpoint, but does the intraday reversal mean that this market is now on the fast track back down? The bulls still have a number of things working in their favor. First is that we only have a few more days left in the first quarter, and there will be pressure to preserve profits or add a few more points of performance. Typically the end-of-the-quarter pressure will end a day or two before the start of a new quarter, but it should help some of the institutional favorites like AAPL and PCLN for the next few days.

The other big positive the bulls have at this point is that the recent momentum has been so strong and so consistent that it is unlikely to just suddenly end. When a market moves like this one has, it creates a lot of underinvested bulls who have been unable to buy a pullback. We have had almost no dips to entice those who don't like to chase strength, and there have been no recent failures of the dip-buying approach. There is still a strong underlying bid, and that is going to prevent any sort of sudden collapse.

The bottom line is that we shouldn't look for the very stunning recent rally to suddenly die. If a top is forming, it is going to be a process that will take a little time. Even if we do see a quick resumption of the uptrend, I'm hopeful we'll have more interesting volatility that will allow some of the very extended stocks to consolidate and develop better entry points.

This morning the dollar is weak again as the Greek drama continues. AAPL has a big upgrade and market players seem to have already forgotten yesterday's intraday reversal. It is going to be tricky, so buckle on the old trading helmet, adjust your goggles and let's go to work.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CPWM +18.4%, SMOD +15.2% (also assumed with a Buy at Needham), KHD +10.0%, MNTX +7.9%, FINL +6.7%, WTSLA +4.7%, TIBX +3.7% (acquires Netrics; financial details of the transaction were not disclosed), EAT +3.6%, SI +1.2% (Siemens sees Q2 operating profit up year-on-year, CFO says - Reuters.com)... Select financial stocks showing strength: NBG +4.9% (Eurozone agrees on bailout plan for Greece - AP), STD +2.6%, UBS +2.5%, BCS +2.1%, ING +1.9%, RBS +1.9%, BBVA +1.8%, C +1.6%, BAC +1.6%, HBC +1.1%, ... Select metals/mining names trading higher: MT +2.8%, RTP +2.3%, BBL +2.2%, SLW +2.2%, BHP +1.6%... Select oil/gas related names showing strength: TOT +1.4%, SLB +1.3%, STO +1.2%, OXY +1.0%... Other news: RSH +8.2% (exploring sale and share buyback options - NY Post), MGM +6.1% (still checking), CTIC +6.0% (held conference call to provide an update on the co, including a discussion of pixantrone), RYAAY +5.3% (traded higher overseas), VTIV +5.0% (inVentiv Health is quietly seeking a buyer; calls upon Goldman for help - NY Post), FHN +4.2% (Cramer makes positive comments on MadMoney), NETL +1.1% (prices 5,890,838 common share offering at $28.85/share)... Analyst comments: PGR +6.5% (upgraded to Neutral from Underweight at JP Morgan, upgraded to Outperform at FBR Capital), THQI +3.9% (upgraded to Outperform at Cowen), PALM +3.8% (upgraded to Mkt Perform at BMO), TSL +2.8% (upgraded at Credit Suisse), CAKE +2.8% (upgraded to Buy at Janney), SNV +2.6% (upgraded to Hold at Wunderlich), RIMM +2.5% (upgraded to Overweight at JPMorgan), NOK +2.4% (upgraded to Overweight at JPMorgan), COH +2.1% (upgraded to Overweight from Neutral at JP Morgan), AAPL +1.5% (ests and target raised to $300 at Credit Suisse as qtr running well ahead of expectations).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: APP -11.5%, BSQR -7.7% (light volume), SNX -4.9%, ORCL -1.0%... Other news: ORCT -14.2% (still checking), SOMX -7.5% (prices 6.0 mln common shares at $8.25/share), PVG -6.1% (Penn Va GP Hldgs' Penn Virginia Resource LP Corp announces secondary public offering of 10 mln common units), LXP -5.1% (announces offering of seven mln common shares), VITC -3.0% (Cramer makes negative comments on MadMoney), MFG -1.7% (trading ex dividend), CNX -0.9% (prices 38.5 mln common shares at $42.50/share)... Analyst comments: LULU -1.8% (downgraded to Neutral from Buy at BofA/Merrill), BKE -1.7% (downgraded to Underweight at JPMorgan), STX -1.6% (downgraded to Market Perform from Outperform at BMO Capital), SNCR -1.4% (downgraded to Neutral at Baird), LPL -1.2% (downgraded to Neutral at UBS). -

Täna mitu huvitavat ja pullidele kindlasti meeldivat upgrade'i.

1) JPMorgan tõstab Nokia (NOK) soovituse Overweight peale.

2) JPMorgan tõstab Research in Motioni (RIMM) Overweight peale.

3) Credit Suisse tõstab Apple'i (AAPL) hinnasihi $300 peale. -

Greenspan on Bloomberg TV says rising Treasury yields "canary in the mine"

-

March University of Michigan Sentiment- Final 73.6 vs 73.0 consensus, prior 72.5

-

Fed's Plosser open to selling MBS before raising rates - WSJ

-

Juncker says no similarity between situation in Greece and countries like Portugal, Spain - Reuters

-

Heh, kas 8 minutit helikopteriga või 2 tundi autoga - tegu siis New Yorki siseste transpordivõimalustega. Kõik sõltub muidugi hinnast, aga nii suurte ajavahede puhul võib tõesti panna mõtlema. Link Bloombergi videole siin.

-

Fed's Bullard says latest weakness in U.S. housing data makes him nervous about asset sales as an early exit tool - Reuters

-

Kas seda ühte uudiserida on pidevalt raske raske tõlkida või ei viitsita lihtsalt?

-

Üritame olulisemad silma jäävad uudised võimalikult kiiresti ka foorumi üles panna ja kahjuks neid tõlkida ei ole aega.

-

S&PBulletin says Greece ratings unchanged on potential EMU/IMF support

S&P poolt siis Kreeka reiting välisabi najal muutmata. -

Eelnevalt liikusid turul ka kuulujutud Põhja Korea ja Lõuna Korea vahelistest pingetest:

No sign of North Korean military in area where South Korean ship was sinking, Yonhap quotes presidential official - Reuters