Börsipäev 5. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Reedene tööjõuraport võeti teatud mööndustega vastu siiski positiivselt. Ühest küljest märkis 162 000 töökoha lisandumine märtsis suurimat kasvu viimase kolme aasta jooksul, millele täiendavalt teatati numbrite positiivsest revideerimisest ka jaanuaris ja veebruaris. Lisaks polnud valitsuse palgatud ajutiste loendajate/rahvaküsitlejate osakaal nõnda suur, nagu kardeti, seega aktiivsemalt on palkama hakanud ka erasektor. Negatiivsest küljest aga püsis ametlik töötusemäär muutumatuna 9.7% peal.

USA futuurid kauplevad hetkel 0.4-0.5% kõrgemal, Euroopa naudib täna puhkepäeva, sealhulgas ei toimu kauplemist ka Baltikumis. -

Kuu esimene nädal, nagu tavaliselt, saab makro osas olema võrdlemisi õhuke. Eelmisel nädalal avaldatud ISM indeks viitas USA tootmissektori tegevuse kasvule kaheksandat kuud järjest ning näitaja paranemist oodatakse täna ka teenindussektoris (kl 17.00). Samaaegselt tehakse teatavaks veel veebruarikuu pending home sales. Suurem tähelepanu koondub siiski töötuabiraha taotluste arvule ning jaemüüjate märtsikuu müügitulemustele nädala teises pooles. Kuigi ametlikult avab tulemuste hooaja Alcoa 12. aprillil, hakatakse esimese kvartali numbrite avaldamisega juba vaikselt pihta ning teiste seas raporteerivad kolmapäeval näiteks Bed Bath & Beyond ning Monsanto

-

Apple'i (AAPL) tahvelarvuti iPad müük algas nädalavahetusel edukalt ja ületas paljude analüütikute prognoose:

The iPad’s initial sales may have reached 700,000 units, Piper Jaffray & Co.’s Gene Munster said in an interview yesterday. The Minneapolis-based analyst had predicted sales of 200,000 to 300,000, while Sanford C. Bernstein & Co.’s Toni Sacconaghi had projected 300,000 to 400,000. (pikemalt loe siit)

-

Esimesel aprillil väljastas FED teate tänasele päevale planeeritud miitingust, mille päevaplaani kuulub arutelu discount rate'i üle. Seega, kui tegemist polnud halva aprillinaljaga, võib USA keskpank tõsta uuesti intressimäära, mida küsitakse finantsinstitutsioonidelt lühiajalise krediidi eest.

-

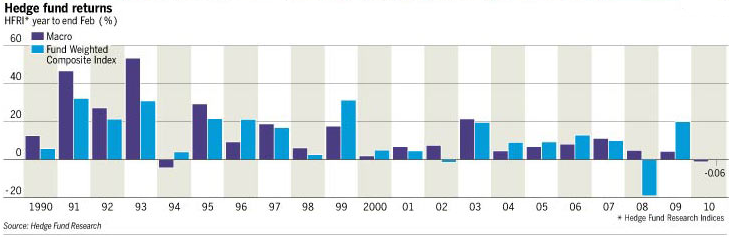

Kuigi palju on räägitud, et macro hedge fondid võimendava Kreeka võlaprobleeme ja euro langust, siis macro hedge fondide tootlused seda ei kinnita. Hedge Fund Researchi andmetel on muutustele intressimäärades, valitsuse võlakirjades, valuutades jne panustavad marco hedge fondid kaotanud siiani sellel aastal -1.25% oma investeeringutelt. Võrdlusena lõpetasid nt globaalsed aktsiaturud esimese kvartali ca7% tõusuga (USA +5.3% ja OMXT koguni +41.4%).

-

FTs ka üks graafik hedge-fondide tootluste kohta:

-

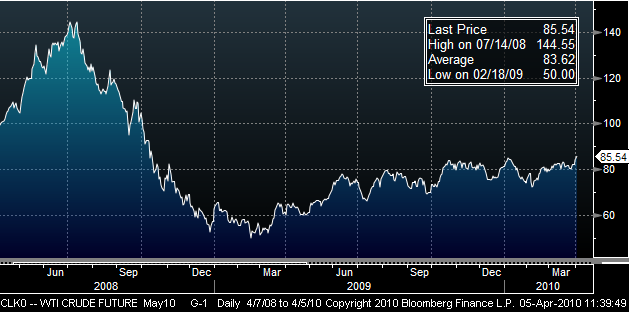

Toornafta kaupleb 17 kuu tippudel, vaatamata sellele, et USA energiaagentuuri raporti kohaselt on sealsed naftavarud kasvanud üheksa nädalat järjest. Stephen Schork tõdeb Bloombergi videointervjuus, et spekulatsiooni toel võib nafta juuni lõpuks jõuda väga tõenäoliselt 110 dollarini, kuid juhib ühtlasi tähelepanu sellele, et USA on siiski suurim per capita nafta tarbija maailmas ning sellise hinna juures peaks bensiini gallon maksma tanklas 3.50 USD - tase, kust tarbija väga meelsasti kütust enam ostma ei kipu.

-

JPMorgan tõstab täna Apple'i hinnasihi 240 dollarilt 305 dollarile, mis on kõrgeim tase suuremate analüüsimajade seas. Ilmselt tuleb teistelgi oma iPadi prognoosid üle vaadata pärast ootusi ületanud esimest nädalavaheust. Credit Suisse näiteks prognoosis oma märtsi analüüsis, et juunis lõppeva kvartali jooksul suudetakse müüa 1.08 miljonit tahvelarvutit.

-

AAPL on huvitav täna selles mõttes, et kõik analüüsimajad taovad trummi ja NotableCallsi guru ennustab "towards 240". Aga samas aktsia ise on premarketil miinuses ja ennustatud ralli ei taha kuidagi materialseeruda.

Kummad võidavad, kas katalüstijärgsed müüjad või headest numbritest eufoorias ostjad? -

Tegelikult NC natuke kahtleb ralli jätkusuutlikkuses:

Notablecalls: So the estimates and price targets keep raising. Deutsche's $325 tgt is now the new Street high, surpassing Credit Suisse's $300 target just 10 days ago.

The stock is likely to trade towards the $240 level this morning.

The est/tgt bumps are feeding the buying frenzy for today but I must ask - is this how good it's going to get in the n-t?

Are there any catalysts left here? Yes, results are scheduled for April 21, but with several firms already calling for a monster quarter and the stock up 30-40 pts since March, is there much upside left there?

Recall, that Apple has tendency to rally ahead of catalysts and sell off after they have materialized.

But these are problems of tomorrow, not today.

vähemalt nii saan mina aru. -

ilmselt päeva sees teeb väga tugeva plussi, millest kaotab poole päeva lõpuks.

Aga raha selle peale ma ei paneks. :) -

Ma arvaks, et 95% NC lugejatest ei huvita absoluutselt, mida see AAPL homme teeb ja samuti ka teda ennast mitte. Küsimus on selles, kas tal on täna hommikul õigus või mitte. Viimasel ajal on ta üsna täppi pannud.

-

Gapping up:

In reaction to strong earnings/guidance: SPPI +4.6%, TLVT +3.4%... M&A news: ARD +8.0% (SandRidge Energy to acquire Arena Resources for $40/share in cash and stock)... Other news: MRNA +17.6% (announces research study with Pfizer), CAMP +16.2% (announces $15.2 million in new contracts for its wireless networks business), ROSG +12.7% (light volume; now processing fine-needle aspirate cell block samples for lung cancer subclassification), RS +5.4% (mentioned positively in Barron's), BEXP +4.0% (announces Sorenson 2-32 #1H produces at a record 24 hour peak for a Williston Basin horizontal Bakken well of 5,133 barrels of oil equivalent), AAPL +0.8% (For iPad, lines but no shortage - WSJ; target raised to $295 from $253 at Kaufman Bros, tgt raised to $305 from $240 at JP Morgan), RBS +0.8% (Wilbur Ross backing Virgin Money in RBS branch bid - Reuters.com)... Analyst comments: MPEL +9.9% (upgraded to Overweight from Neutral at JP Morgan; tgt raised to $7 from $5), EMC +2.3% (upgraded to Overweight from Neutral at Piper Jaffray).

Gapping down:

In reaction to disappointing earnings/guidance: WHI -13.2% (filed to delay its 10-k; anticipate recording a loss before income taxes for the year ended December 31, 2009), TASR -5.7%... M&A news: SD -6.1% (SandRidge Energy to acquire Arena Resources for $40/share in cash and stock)... Other news: RGN -15.3% (announces annual report contained a going concern qualification), ENCO -11.5% (announces delay in filing its annual report on form 10-K for the year ended December 31, 2009), TSO -4.4% (fire occurred at the Tesoro Anacortes refinery; downgraded to Hold from Buy at Deutsche Bank)... Analyst comments: MWW -3.3% (downgraded to Sell from Neutral at Goldman), GNW -1.4% (downgraded to Hold from Buy at Deutsche Bank), YGE -1.3% (downgraded to Neutral from Outperform at Macquarie), AA -0.8% (downgraded to Hold from Buy at JP Morgan).

-

Rev Shark: Slay the Beast With Persistence

04/05/2010 7:44 AMForget about the crowds, the size of the school, their fancy uniforms, and remember what got you here. Focus on the fundamentals that we've gone over time and time again. And most important, don't get caught up thinking about winning or losing this game. If you put your effort and concentration into playing to your potential, to be the best that you can be, I don't care what the scoreboard says at the end of the game. In my book, we're gonna be winners!

-- Gene Hackman as Coach Norman Dale in HoosiersThe Butler vs. Duke battle tonight is the classic story of the underdog doing battle with the established giant. Unless you've been a loyal Duke fan it is hard not to root for the small school with only 4,000 students. Most everyone can relate to being the underdog, and it's especially true when doing battle with the market beast.

The Market Beast is the ultimate giant and has the power to crush anyone who challenges it, no matter how good they might be or hard they may work. The scoreboard is the only thing that ultimately matters in the stock market. If you don't score some gains, there isn't much comfort that you put forth hard work, effort and concentration.

There is only one way to conquer the Market Beast, and that is through persistence. You will have bad luck and good luck, and there will be times when you work hard and do everything that you should be doing but will end up with nothing to show for it. In fact, you may execute perfectly and still have losses to show for it.

The way to win is to keep on going day after day. You have to make sure you protect your capital so you can stay in the game, but otherwise it is just plugging away day after day that ultimately will bring you success.

Even though this market has been going straight up, the current environment has not been an easy one for many traders. We have had extended market conditions for weeks and have barely had any pullbacks allowing for easy entries. What makes it worse is that the uptrend gives many the illusion that the market is much easier than it really is.

We are all Butlers in this battle with the Market Beast, but we all have the capacity to be victorious if we don't give up. It can be easy to be discouraged and to think we'll never really succeed, but the great thing about the market is that there are a new set of opportunities every day and we can always start fresh if we so desire. Just don't ever give up.

We are starting off this morning with the standard Monday market strength that we have seen so many times over the past year. Mondays have by far been the best day of the week for the market, and it is very rare for there to be a reversal once we start off strongly.

The jobs report from Friday is being greeted as positive news and most overseas markets are closed. There is a tendency to give back gains on the jobs report, but this market has been so freakishly persistent it is very tough to even contemplate the downside.

My approach continues to be short-term bullishness while being very vigilant for any signs of a reversal. The market is not making it easy to be aggressively long here because it is so extended, but being bearish has been a far worse posture.

Strap on your trading helmet and adjust your seat belt. We'll just keep doing battle with the Beast -- and ultimately we will win.

-

Makro positiivne. Majandustsüklitest vähem sõltuv teenustesektori ISM tegi märtsis korraliku tõusu:

March ISM Services 55.4 vs 54.0 consensus, prior 53.0

& veebruaris hoogustus kinnisvaramüük:

February Pending Home Sales M/M 8.2% vs 0.0% consensus; Y/Y 17.3%, prior +8.8%

-

Street

sinust on raske aru saada. Kas see sinu seisukoht on puhtalt deitreideri seisukoht või ma ei saa asja mõttest aru? -

Notablecallsi asjad on enamast sama hommiku, heal juhul päeva mänguks mõeldud. Las abesiki harib sind edasi, ma ei viitsi.

-

Kellel huvi, siis NC twittwri RSS FEED

http://twitter.com/statuses/user_timeline/118399469.rss