Börsipäev 8. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

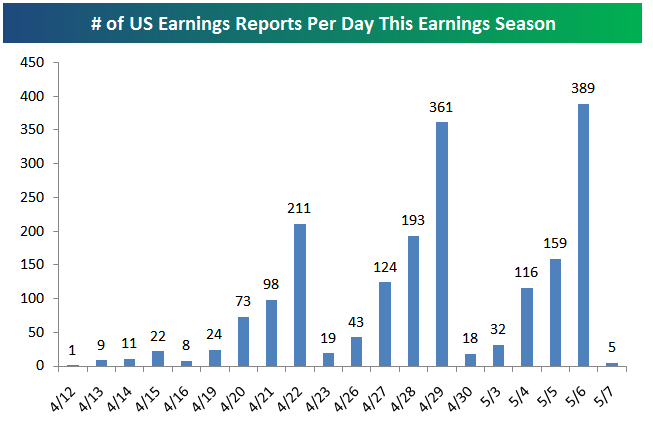

Eile oli USA börsidel näha mõningast kasumivõtmist koos viimaste nädalate suurima käibega. Enne 1Q tulemuste avalikustamist on turg võimsalt üles ostetud ja ettevõtetele pettumusruumi ilmselt jäetud ei ole. Eelmisel aastal oli konsensus EPSi prognoosimisel liiga tagasihoidlik (üsna tavaline kriisist taastumise korral) ja paljud ootavad, et ka sellel aastal jätkavad ettevõtted oodatust paremate tulemuste raporteerimist. Tulemuste hooaja avab järgmisel esmaspäeval Alcoa. Bespoke'ilt ka üks graafik, millal ülejäänud tulemused tulevad:

-

Makro poole pealt teatatakse täna kl 15.30 USA esmaste töötu abiraha taotlejate number (ootus 435K) ja kestvate töötu abiraha taotlejate number (ootus 4630K). Mõlemad numbrid peaks ootuste järgi võrreldes eelmise nädalaga vähenema ja näitama paranemist USA tööturul.

Euroopas on täna Euroopa Keskpanga kohtumine, kus konsensus baasintressimäära tõstmist praeguse 1% juurest ei oota.

-

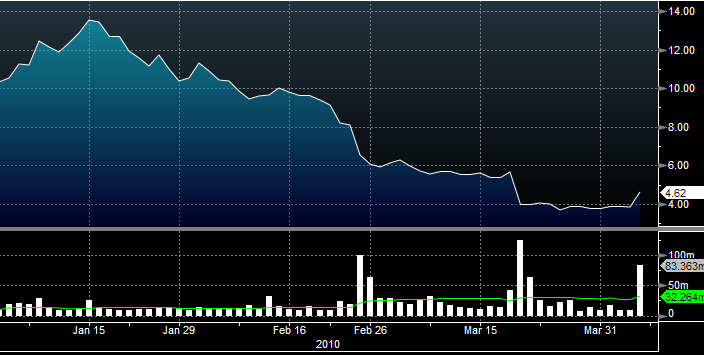

Palmi kehvadest kvartalitulemustest ja hädistest prognoosidest motiveeritud lühikeseks müüjad olid hoolega eile positsioone katmas, kergitades aktsia hinda 20% 4.62 dollarile. Kuigi osad analüüsimajad on väljas koguni 0 dollari suuruse hinnasihiga, tõdetakse et mobiiltelefonitootja võib surmasuust päästa vaid mõni ülevõtja. Eile läksidki liikvele spekulatsioonid, et Hiina arvutitootja Lenovo võiks olla potentsiaalne ostja, kuna tegevjuht rääkis ühes Saksa ajalehes plaanidest võtta mobiilse interneti äri ülesehitamiseks üle ettevõtteid. Kuigi Palmi nimi ei tulnud kordagi jutuks, eeldatakse, et tänu sidemetele operaatoritega võiks Palmi bränd siiski mingit väärtust pakkuda.

-

Euroopa aktsiaturudel on täna korralik kasumite lukustamine ja eurost jätkatakse väljumist. Kreeka valitsuse võlakirjad on kukkunud juba seitse päeva järjest, kuigi riigi rahandusminister kinnitab, et Kreekal ei ole rohkem abi vaja (loe pikemalt siit). Steve Barrow Standard Bankist ütleb tabavalt: “Greece continues to look like a slow-motion train crash”.

-

Üks teema, mis peaks tänasel Euroopa Keskpanga pressikonverentsil kindlasti huvi pakkuma, on detailsem ülevaade laenude tagatisnõuetest. Olgugi, et EKP otsustas kriisi ohjamiseks madalamale asetatud nõudeid mitte enne 2011.a muuta, peaks lisanduv riskipreemiasüsteem laenamise Kreeka pankade jaoks siiski kallimaks muutma. Lähemalt saab sellest lugeda Bloombergi artiklist.

-

Märtsi keskel tõstis Potash Corp(POT) prognoose, mille peale liikus aktsia 127$ peale, tänaseks on langetud 113$-ni. Kas piisav et osta?

-

marti837, panen siia Citi pos. kommentaari sektori kohta enne 1Q10 tulemusi:

We are adjusting 2010-11EPS estimates for our fertilizer companies generally upwards ahead of the 1Q earnings season. Our updated estimates reflect stronger potash volumes, partially offset by weaker margins in phosphates. We have also raised our long term potash price estimate to $400/mt from $370/mt, and our 2010 DAP price to $400/t (see page 2 for full assumptions). Our favorite name in Ag remains AGU; we are Hold rated on POT & MOS. We are also updating our MON estimate to reflect earnings pushed out into fiscal 2H.

-

BofE ja ECB intressimäärasid ei muutnud. Keda Euroopa Keskpanga pressikonverents huvitab, siis seda saab kuulata ca15 minuti pärast siit.

-

Esmaste töötu abiraha taotlejate arv tõusis üllatavalt:

Initial Claims 460K vs 435K consensus, prior revised to 442K from 439K

Continuing Claims falls to 4.550 mln from 4.681 mln

-

Gapping up

In reaction to strong earnings/guidance/SSS: HOTT +16.4% (announces a $1.00 per share special one-time cash dividend and a $0.07 per share regular quarterly dividend), STRM +9.0% (light volume), , WDFC +7.6%, SMSC +6.2%, GPS +4.3%, ARO +4.0% (sees Q1 EPS of ~$0.44 vs $0.41 Thomson Reuters consensus), BBBY +3.4%, MDRX +3.0%, NAV +2.8%, TGT +1.8% (also issues upside Q1 guidance), LTD +1.8%, M +0.8%.M&A news: LCC +20.5% and UAUA +7.4% (United and US Airways Said to Be in Merger Talks - NY Times).

Select airline related stocks trading higher boosted by LCC/UAUA merger news: AMR +3.9%, JBLU +2.6%, LUV +2.3%, RJET +1.6%, DAL +1.3%.

Other news: CIGX +16.9% (pre-market strength attributed to James Altucher's blog on Seeking Alpha; shares trading at $2.84 in pre-market), HUSA +6.8% (addresses stock trading volume and price; "attributable to an internet posting questioning the valuation of the company's holdings"), DM +4.1% (will replace NewMarket in the S&P SmallCap 600 index), HOKU +3.6% (starts polysilicon ramp-up at Pocatello facility), CVBF +3.4% (Cramer makes positive comments on MadMoney), VRTX +2.5% (New England Journal of Medicine publishes PROVE 3 trial showing telaprevir-based regimens significantly increased sustained viral response rates in patients who did not achieve SVR with prior HCV therapy), CYN +1.3% (Cramer makes positive comments on MadMoney), MEE +1.3% (still checking), PANL +0.7% (Awarded SBIR Phase II Contract from the National Science Foundation for Novel Encapsulation Technology for Flexible Electronics)

Analyst comments: SOMX +5.4% (initiated Outperform and $12 tgt at Oppenheimer, initiated with a Buy at Jefferies), ABC +1.6% ( coverage assumed with a Buy from Hold at Citigroup), ATHN +1.5% (coverage assumed with a Hold from Sell at Citigroup).

Gapping down

In reaction to disappointing earnings/guidance/SSS: CML -15.5% (also downgraded to Neutral from Buy at Merriman, downgraded to Market Perform from Outperform at Northland Securities), LYTS -14.3% (light volume), APOG -12.5%, SCSC -9.1%, ANF -4.5%, JCP -4.4%, ZUMZ -3.4% (also downgraded to Neutral from Outperform at Wedbush), ATK -1.9%, AEO -1.6%, COST -1.1% (light volume).Select financial related names showing weakness: NBG -6.2% (Markets dump Greek assets as debt fears grow - Reuters.com), UBS -2.8%, CS -2.7%, LYG -2.6%, STD -2.4%, AIB -2.1%, MI -2.1%, ING -2.0%.

Select metals/mining stocks trading lower: MT -2.5%, AU -2.2%, HMY -2.2%, BBL -1.7%, BHP -1.3%, RTP -1.3%, VALE -1.1%.

Select oil/gas related names showing weakness: SU -1.1%, E -1.1%, RDS.A -0.9%, HAL -0.9%.

Other news: FRX -9.2% (US FDA Panel data do not support approval of Forest, Nycomed lung drug Daxas for COPD maintenance - Reuters; downgraded to Hold from Buy at Lazard, downgraded to Underweight from Neutral at Piper Jaffray), WZE -8.0% (light volume; announced that its audited financial statements contained a going concern qualification), AIXG -4.4% (still checking), DGIT -4.1% (prices 3.175 mln share common stock offering at $31.50/share ), MFA -3.9% (trading ex dividend), VHC -2.3% (report of its independent public accounting firm contains a "going concern" qualification), BEXP -1.6% (prices offering of 14,000,000 shares of common stock at $18 per share), PNW -1.5% (commenced a public offering of 6 mln shares of its common stock), RF -1.0% (Morgan Keegan responds to regulatory actions; intends to defend rigorously against charges).

Analyst comments: KEY -2.0% (downgraded to Underperform from Neutral at Baird), ELX -2.0% (downgraded to Hold from Buy at Canaccord), FDO -2.0% (downgraded to Underweight from Neutral at Piper Jaffray), EBAY -1.8% (downgraded to Hold from Buy at Kaufman), EMC -1.5% (downgraded to Hold from Buy at Canaccord).

-

Rev Shark: Bumpy Road Ahead

04/08/2010 7:45 AMThe bumps in the road just make the ride more fun.

-- J.P. WinklerWith the market finally stumbling a bit and earnings season fast approaching, conditions are ripe for some change in the character of the action. I highly doubt that we are going to suddenly collapse, but I do think there is a good chance that the action will become choppier and that volatility will pick up.

Typically, when the market makes a big run into earnings season, there is a tendency for a "sell the news" reaction to report. Obviously when we have a strong run-up in the market, it is due in part because expectations for good news are increasing. An earnings report that may have been celebrated when a stock was 20% lower may not be so warmly greeted at higher prices.

Another thing that suggests that we may see choppier action going forward is that the mood of the market has been so complacent and sanguine for so long. There has been very little strong emotion, and that has led to this steady upward drift with little volatility. We haven't had any big surge in volume or signs of frenzy to indicate that wild speculation is taking place but there certainly there hasn't been any great worry or concern either.

One thing we know for sure about emotions is that they eventually change. Periods of complacency usually lead to periods of greater worry. Typically some fundamental catalyst is needed to hasten the shift, and earnings season is ideal for that.

The bears need to recognize about this market is that it has been so strong that it is very unlikely to just suddenly fall apart. There is strong underlying support, and spikes to the downside are very likely to attract buyers rather than frighten them away.

Dip-buyers can be a very stubborn group, especially when we have been in an environment where they have not had any good opportunities for months. There are a lot of folks who have been sitting on the sidelines, not so patiently, and they are anxious to buy some of their favorites as they pull back. We can't underestimate the power of this group that has provided tremendous support for this market for over a year now.

Just because we have a little weakness, we should not be looking for the market to collapse; on the other hand, we need to watch for an increase in volatility, especially as earnings reports roll out. The good news is that it will likely make for a more interesting trading environment, but it will require more aggressive management of positions.

We have a little softness again this morning. It is very unusual to see downside follow-through last for long, but overseas markets are almost all in the red and concerns over the financial problems in Greece are bubbling up once again.

Buckle up. The ride is going to get bumpier.

-

Trichet tahab oma sõnadest taganeda?

-

USA indeksite futuurid hetkel indikeerimas avanemist -0.25% madalamal

Euroopa turud:

Saksamaa DAX -1,16%

Prantsusmaa CAC 40 -1,64%

Inglismaa FTSE 100 -1,13%

Hispaania IBEX 35 -1,80%

Rootsi OMX 30 -0,75%

Venemaa MICEX -0,41%

Poola WIG -1,54%Aasia turud:

Jaapani Nikkei 225 -1,10%

Hong Kongi Hang Seng -0,28%

Hiina Shanghai A (kodumaine) -0,94%

Hiina Shanghai B (välismaine) -0,08%

Lõuna-Korea Kosdaq +0,47%

Tai Set 50 -3,95%

India Sensex 30 -1,42% -

Tundubv küll, et tagatisnõuete samaks jätmist ei taheta võrreldes Tricheti varasemate kommentaaridega enam Kreekaga seostada

-

Jaemüük on märtsis olnud väga korralik:

Analysts were expecting retailers to report their strongest monthly sales gains in 16 years. So far, many retailers, including Costco, Limited, and Zumiez have outpaced Wall Street's expectations. (täpsemalt saab erinevate jaemüüjate tulemusi vaadata siit)