Börsipäev 14. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

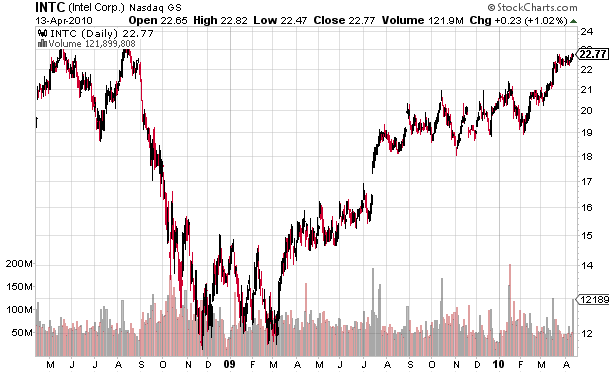

Eile õhtul pärast kauplemise sulgemist teatas oma ülivõimsad tulemused Intel (INTC). Ettevõte raporteeris EPSi $0.43 vs oodatud $0.38 ning müügitulusid $10.3 miljardit vs oodatud $9.8 miljardit. Kui eilse päevaga kerkis Inteli aktsia 1%, siis järelturul liikus nende numbrite peale Intel veel 4% kõrgemale, jõudes oma viimase 2 aasta tippude juurde.

Panen siia ka Jim Crameri kommentaar Intelile tulemustele: Intel (INTC) could be a game-changer. The strength in the quarter, plus the lack of inventory, will make people realize that this cycle -- born of new servers, strong PC demand and mobile computing -- is still in its infancy, not on its last legs. That matters, because Intel is trading at just 12x earnings, a sign that people expect earnings to be cut severely.

Näiteks Deutsche Bank tõstis kvartalitulemuste peale oma hinnasihi $25 pealt $27 peale.

-

Makroandmete poole pealt ootame täna kell 15.30 USA märtsikuise tarbijahinnaindeksi muutuse avaldamist (ootus 0.1%) ja märtsikuise jaemüügistatistika avaldamist (ootus +1.2%, ilma transpordivahenditeta +0.5%).

Eelturg on USAs igaljuhul optimistlik. S&P500 indeksi futuurid on kerkinud ca +0.3% ja Nasdaq100 futuurid +0.45%. -

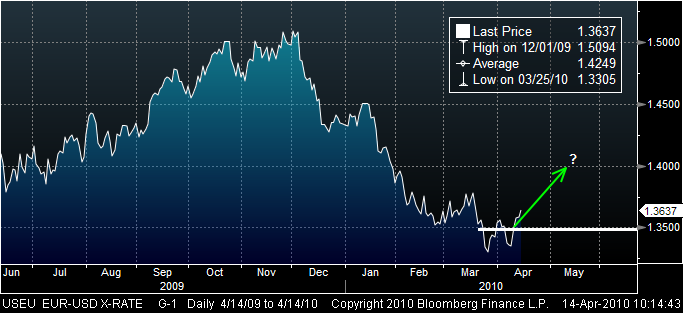

Pärast seda kui Goldman Sachs ühe kuu jooksul EUR long ja seejärel EUR short ideest välja stopiti on oma õnne proovimas Citi, kes pakub puhtalt tehnilise pildi põhjal, et momentumit jahtides võiks eur/usd jõuda 1.40 juurde. Stop seatakse 1.349 peale ehk tase, mille peal kaubeldi vahetult enne nädalavahetusel avalikustatud Kreeka abipaketti.

-

Morgan Stanley on Inteli tulemusi kommenteerides jäänud siiski kindlaks oma 'equal-weight' soovitusele, kartes, et tsüklilises nõudluses võib ees olla tipp. Samas, ega selles kindlad ei olda ning analüüsi lugedes jääb pigem mulje analüütikutest, kes vesise suuga eest ära tõusnud aktsiahinda nüüd kõrvalt jälgivad. Tahaksid justkui tõsta 'ostusoovituse' peale, aga aduvad samas, et turul öeldaks sellepeale, et 'MS is late to the party' ning seetõttu kinnitataksegi oma neutraalset soovitust :D

Väike väljavõte nende analüüsist, kus tuuakse ilusate numbrite kõrval välja ka varude väga väike kvartaalne kasv (mis näitab, et nõudlus oli korralik - mis toodeti, see ka ära müüdi):

The company’s inventories increased by only $50m, lower than the previous quarter build of $450m and expectations for a $300m build this quarter. Finally, the company maintained that channel inventories are healthy and that they were seeing signs of the corporate buyer.

-

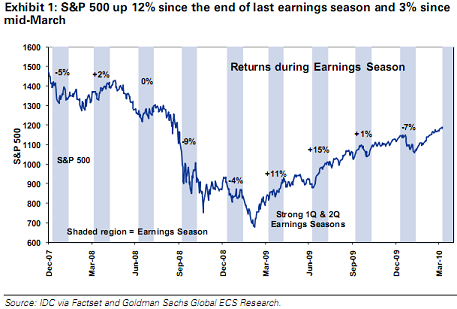

Kui JPM on vist ainuke, kes vaatamata aktsiaturgude tõusule oma jätkuvalt bullish nägemusele kindlaks jääb siis mitmed teised analüüsimajad pelgavad, et mõned päevad tagasi alanud tulemustehoojast võib kujuneda sell the news sündmus. Teiste seas arvab seda ka Goldman Sachs. Allolevalt graafikult on võimalik näha, et kui märtsi põhjadele järgnenud kaks tulemustehooaega kergitasid S&500 indeksit vastavalt 11% ja 15%, siis kahel järgneval kvartalil teadsid investorid tugevat kasumit juba oodata ning on tegelenud front runninguga. Kuna Q1 tulemustele eelnenud tõus oli suurim alates 2009.a märtsist, arvab Goldman, et head tulemused on juba hindadesse sisse arvestatud.

-

FT Lex vahendab üht Citi küsitlust, kust näha, et enamus investoreid ootavad tänaste tasemete juurest jätkuvalt vähemalt 20% S&P ettevõtete kasumite tõusu:

A similar survey of 100 institutional investors by Citigroup found a consensus expectation that the S&P 500 will gain some 11 per cent for the year, implying more gains ahead, with a sharp upside move seen as a greater risk than a sharp move down. In Citi’s poll, more than 60 per cent expect earnings growth of more than 20 per cent this year (link).

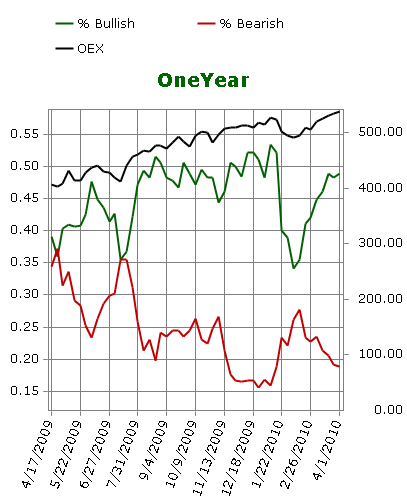

Seda, et turgudel on lühiajaliselt meeleolu väga optimistlik näitab nt put/call ratio, kust on näha, et investorite huvi langusele panustavate optsioonide vastu suhtes tõusule panustavate optsioonidega on hetkel börsiralli käigus madalaim. Samuti kinnitab optimismi nt bullish/bearish investorite osakaal, mida saab jälgida siit:

-

Finantssektoris alustas JPMorgan Chase (JPM) tulemustehooaega oodatust parema kasumi ja tuludega:

Reports Q1 (Mar) earnings of $0.74 per share, $0.10 better than the Thomson Reuters consensus of $0.64; revenues rose 4.6% year/year to $28.17 bln vs the $26.47 bln consensus. Noninterest revenue was $14.4 bln, up by $2.9 bln. The increase was driven by higher principal transactions revenue, including higher trading revenue and higher private equity gains (compared with losses in the prior year), partially offset by lower MSR risk management results. Net interest income was $13.8 bln, down by $1.7 bln, or 11%, largely driven by lower loan balances. Partially offsetting these declines were wider loan spreads and higher investment portfolio net interest income. The provision for credit losses was $7.0 bln, down by $3.1 bln, or 30%, from the prior-year managed provision.

JPMi aktsia on eelturul tulemuste peale +3.3% kõrgemale liikunud ja kogu finantssektori protsendi võrra ülespoole lükanud.

-

March Retail Sales +1.6% vs +1.2% consensus, prior revised to +0.5% from +0.3%

March Retail Sales ex-auto and gas +0.7% vs +0.6% consensus, prior revised to +1.1% from +0.9%

March CPI m/m +0.1% vs +0.1% consensus

March Core CPI m/m 0.0% vs +0.1% consensus

Kokkuvõttes tähendab siis eelnev, et inflatsioon on oodatust pisut väiksem ning tarbimine oodatust oluliselt suurem. Positiivsed numbrid turule. -

Homme saab alguse ka tulemuste hooaeg Baltikumis, kui Tallink avaldab oma kvartalitulemused. Kirjutasime LHV ootustest lähemalt Balti Pro all. Link prognoosidele

-

USA turud teevad eelturul igaljuhul võimast rallit ning on liikunud uutele 1.5 aasta tippudele. S&P500 indeks on kerkinud üle 1200 punkti piiri ning kaupleb võrreldes eilsega 0.4% kõrgemal, Nasdaq100 indeks on kerkinud 0.6% ning nafta 1%.

Euroopa turud:

Saksamaa DAX +0.75%

Prantsusmaa CAC 40 +0.93%

Inglismaa FTSE 100 +0.85%

Hispaania IBEX 35 +0.78%

Rootsi OMX 30 +0.50%

Venemaa MICEX +1.65%

Poola WIG +0.36%Aasia turud:

Jaapani Nikkei 225 +0.39%

Hong Kongi Hang Seng +0.08%

Hiina Shanghai A (kodumaine) +0.16%

Hiina Shanghai B (välismaine) +0.19%

Lõuna-Korea Kosdaq +0.62%

Tai Set 50 N/A (börs suletud)

India Sensex 30 N/A (börs suletud) -

Apple (AAPL) target raised to $300 at Caris & Company -> Caris tõstab targetit $300-ni ehk siis konsensuse ülemisse äärde.

-

Beware of Intel Euphoria

By Rev Shark

RealMoney.com Contributor

4/14/2010 8:29 AM EDT

Celebrate what you want to see more of.

-- Thomas J. Peters

The Intel (INTC) earnings report last night came in nicely ahead of analyst expectations. The stock is off to a strong start this morning and is taking the broader market along with it. Sentiment is downright euphoric and this already extended market looks ready to become even more extended.

But we have had this situation before and Intel has seldom proved to be a lasting positive catalyst, even when it does issue a superb earnings report. According to Sentimentrader.com, there have been six times since 1997 when Intel was at a new annual higher prior to earnings. If you bought the open the next day and held for three days, you lost money every time, with an average loss of 2.7%. Overall, if you had bought Intel after earnings even when it wasn't at a new high and held for three days, you had a loss 15 out of 22 times.

The point here is obvious: Intel does not tend to follow through on good earnings news. We saw a good example of this in January following the fourth quarter. I recall writing about the euphoric mood and the feeling that it was going to be up, up and away, and it turned out to be a short-term top.

Of course, this time may be different. Intel may indeed light a fire under this already hot market and keep this trend running steadily higher. The extended technical conditions of the indices, the very positive mood, the history of Intel's action following earnings and the pressure to take gains on some good news are the right conditions for the bears to finally see some topping action, but this market has confounded them for way too long already.

The game plan here isn't to be wildly bearish, but to be a bit careful about being sucked in to the celebratory mood. I certainly don't want to fight the trend, but I want to watch very closely for signs of a reversal. Intel's history of poor performance is not unknown and there will be some who are inclined to sell into the strength. Should that selling take hold, we want to be ready to move quickly to do some repositioning.

If nothing else, we should have more interesting action now rather than this slow drift upward. Try to stay open minded and don't be too quick to think that Intel is going to keep driving this market straight up. On the other hand, it is foolish to look for a sudden collapse in this market and you have to have great respect for the dip buyers, who are going to give us some major underlying support.

-----------------------------

Briefingust:

Ülespoole avanevad:

In reaction to strong earnings/guidance: KLIC +17.3% (also target raised to $10 at Oppenheimer following positive pre-announcement), INTC +4.6%, JPM +3.1%, LLTC +2.9%, CSX +1.3%.

Select financial related names showing strength boosted by JPM earnings: AIB +6.1% (upgraded to Buy from Neutral at Goldman), RF +3.1%, HBAN +3.0%, IRE +2.5%, C +2.4% (enters agreement to sell its fund of hedge funds, hedge fund seeding and hedge fund advisory businesses to SkyBridge Capital), WFC +2.3%, BCS +1.7%, MS +1.5%, LYG +1.5%, XLF +1.4%, GS +1.3% (initiated with a Buy at Nomura), BBT +1.1%, RBS +1.1%.

Select mortgage insurer names showing continued strength: ABK +11.1%, FNM +5.9%, PMI +3.8%, MBI +2.4%, AIG +1.6%.

Select metals/mining stocks trading higher: AU +2.1%, MT +1.9%, RTP +1.6%, BBL +1.6%, BHP +1.2%.

Select semi/tech related names showing strength boosted by INTC/LLTC results: SMH +3.5%, NVDA +3.2%, AMD +2.9%, TXN +2.4%, NSM +2.3%, BRCM +2.1%, ATML +2.0%, ONNN +1.8%, SNDK +1.8%, MU +1.8%, ADI +1.7%, DELL +1.5%, HPQ +0.9%, AAPL +0.6%.

Select oil/gas related names trading higher: RDS.A +1.6%, BP +1.5%, SLB +1.4%, TOT +1.3%.

Other news: AEN +82.9% (announces positive results of Part 1 of CopperProof-2 study in Alzheimer's disease and mild congenitive impairment), BLTI +42.6% (light volume; announced that it was awarded a new patent for technology that is utilized in the groundbreaking ezlase and iLase diode lasers), CRXX +27.8% (discovers novel multi-target mechanism for the treatment of hematologic malignancies), AVAV +8.3% (mentioned positively in Barron's), HOTT +6.1% (Cramer makes positive comments on MadMoney), SIRI +4.2% (adds 171,441 net subscribers in 1Q), DRYS +1.7% (still checking for anything specific), SAP +1.5% (still checking), TEVA +0.7% (POZEN enters into settlement agreement with Teva regarding Paragraph IV patent litigation).

Analyst comments: YGE +4.6% (initiated with a Buy at Auriga), TLAB +4.6% (upgraded to Buy from Neutral at UBS), VVUS +1.6% (initiated with a Buy at Needham), SOLF +1.5% (initiated with a Buy at Auriga), CREE +1.2% (upgraded to Buy at Morgan Joseph), ERIC +0.7% (upgraded to Buy from Neutral at Credit Suisse), MCD +0.7% (upgraded to Buy from Neutral at Janney Mntgmy Scott).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: HCSG -8.0%, ABCB -5.2% (light volume; also filed for $12 mln common stock offering in addition to $60 mln proposed maximum aggregate offering price already registered), GWW -3.4%, CJR -2.8% (light volume), ASML -1.6%.

Other news: RPC -18.8% (announced the second closing of a 12% Convertible Promissory Note and Warrant financing), BMR -3.1% (announces public offering of 9,000,000 shares of common stock), NBG -3.7% (German threatens legal challenge over Greek aid - Reuters.com), CKSW -3.3% (files for a 15 mln ordinary share shelf offering), EXAS -1.9% (prices its 4.2 mln share common stock offering at $4.50/share).

Analyst comments: MIPI -6.4% (downgraded to Market Perform from Outperform at Wells Fargo), MOS -2.1% (downgraded to Neutral from Buy at Goldman), POT -1.9% (downgraded to Neutral from Buy at Goldman), DNDN -1.3% (downgraded to Hold from Buy at Citigroup). -

Alari kommentaarile täienduseks, et Apple (AAPL) on Carise top pick.

-

Hiina majandus täistuuridel. Q1 2010 kasv vs Q1 2009 on Reutersi allikate sõnul peaaegu 12%, oluliselt üle ootuste. Ametlikud numbrid tulevad homme.

Reuters.com reports China's economy grew about 11.9% in the first quarter from a year earlier, topping expectations and expanding at the fastest annual pace in nearly three years, according to two market sources. -

Goldman Sachsi conviction ostusoovitus väetisetootjale Potash Corp (POT) ei osutunud kõige paremaks ja ettevõte langetab POTi soovituse "neturaalse" peale. Pikemalt saab lugeda siit.

-

Miku hommikusele kommentaarile täienduseks JPMi oodatust paremate numbrite teemal, tahaks siinkohal öelda, et tõenäoliselt on oodatust suuremad kasumid pangandussektoris toomas kaasa ka rohkem tellimusi Fundtechi (FNDT) laadsetele ettevõtetele, kes finantssektori jaoks erinevaid IT-lahendusi välja töötavad. Fundtech (FNDT) on LHV Maailma Pro investeerimisidee.

-

Kodanikud väljaspool USA peavad ootama arvatust ühe kuu võrra kauem, et endale iPadi osta, kuna Apple on tänase teate kohaselt lükanud rahvusvahelise tarne mai lõppu. Põhjuseks ootamatult suur nõudlus Ühendriikides. Aktsia kaupleb eelturul 1.3% plussis (245.6 USD).

-

China hikes fuel and diesel prices by 4-5% - JLM Pacific Epoch

Hiina tõstab bensiini ja diisli hinda alates 14. aprill, toornafta futuuridele pole uudis mõju avaldanud. Nafta kauplemas hetkel +0.8% kõrgemal $84.75 tasemel. -

Finance.yahoo.com leht, mida kasutavad paljud tasuta reaalajas hinnainfo saamiseks, ei kuva täna millegipärast hindu. Alternatiivina saab kasutada google.com/finance lehte. Näiteks link Apple'i hinnainfole läbi google'i lehe on siin.

-

Palm (PALM): Harbinger discloses 9.48% stake in 13G filing

Harbinger on ostnud 9.48% Palmi aktsiatest. -

Uskumatu, C ja BAC alustavad päeva jälle nii tugevalt.

-

Citigroup sells hedge fund businesses to SkyBridge:

http://www.marketwatch.com/story/citi-sells-hedge-fund-businesses-to-skybridge-2010-04-14 -

Fed's Fisher says biggest banks need to be broken up - DJ

Fisher arvab, et suured pangad tuleks laiali lüüa. -

UPS teatas oma tulemused oodatust paremad ning numbrid on muljetavaldavad. EPSi ootustest näidatakse 15+% suuremat kasumit ning koos sellega liigutatakse oluliselt ülespoole ka terve aasta kasumiprognoose. Aktsia liikus järelturul ca 4% plussi.

Väike kommentaar siia ka läbi Briefingu:

UPS sees adjusted Q1 EPS of $0.71 vs $0.58 Thomson Reuters consensus. As a result of the Q1 upside, co raises FY10 EPS guidance to $3.05-3.30 vs $2.95 Thomson Reuters consensus, up from prior guidance of $2.70-3.05. The results were powered by a significant acceleration in the international package and supply chain businesses and improved operating margins across all three segments. Consolidated revenue for the period grew 7% (consensus is for rev growth of +6%), driven by increases of 18% in International Package and 14% in Supply Chain and Freight. International daily volumes grew significantly with export up more than 9% and non-U.S. domestic up over 24%. U.S. Domestic daily volume increased less than 1%, the first year-over-year growth in more than two years. "We expected the first quarter to be the most challenging of 2010 as the economic recovery gathered steam through the year... As it turned out, revenue was stronger than we expected due to international volume gains, increased yields in the U.S. and growth in Forwarding and Logistics. Also, the operating leverage in our streamlined network provided higher margins than anticipated."