Börsipäev 15. aprill

Log in or create an account to leave a comment

-

Nagu eile hilisõhtul kirjutasin, teatas oma tulemused oodatust varem UPS ning numbrid olid väga ilusad, viies aktsiat järelturul ca 4% plussi. Tulemuste poole pealt ootame veel täna pärast turu sulgemist numbreid Advanced Microlt (AMD) ja Google'ilt (GOOG).

Makroandmete poole pealt tulevad täna kell 15.30 esmaste töötu abiraha taotlejate annualiseeritud numbrid (ootus 440 000) ning kestvate töötu abiraha taotlejate annualiseeritud numbrid (ootus 4.58 mln). Kell 16.15 teatatakse märtsikuu tootmismahtude ärakasutamise määr, mis peaks ootuste kohaselt tõusma 72.7% pealt 73.3% peale, ning tööstustoodanug muutus, millelt oodatakse 0.7%list kasvu.

Olympicu poolt eile õhtul teatatud Eestist saadud äritulude valguses saab põnev börsipäev alguse juba kindlasti kohe hommikul. -

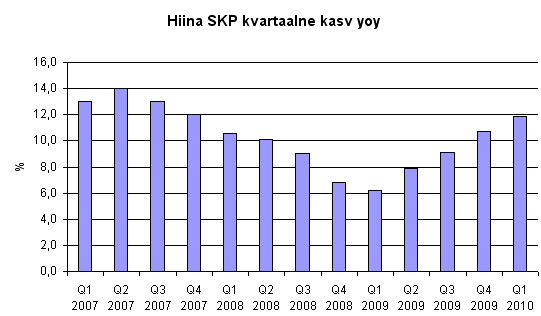

Hiina teatas hommikul, et viimases kvartalis tõusis majandus 11.9% yoy. Number turule suur üllatus ei olnud, kuna see lekkis meediasse juba eile (kirjutasime sellest ka eilses börsipäevas). Hiina majanduskasv näitab hästi, et arenguriikide taastumine kriisist on olnud väga erinev. Nt Ida-Euroopas on hakanud majanduses esimesed paranemismärgid alles ilmuma, kuid Hiina on juba faasis, kus majandust on vaja jahutada:

-

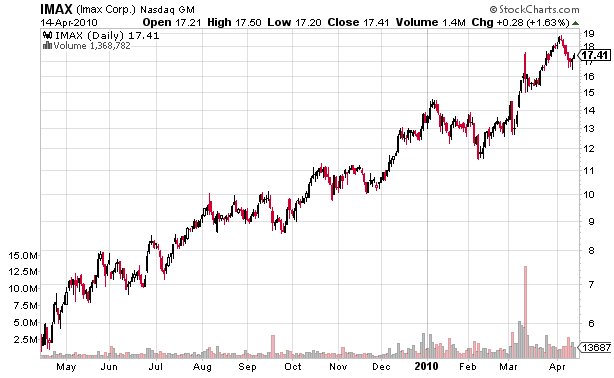

Eile õhtul kiitis Jim Cramer oma 'Mad Money' saates muude ettevõtete seas ka LHV Maailma Pro investeerimisideed IMAX Corporation (IMAX), mida Cramer peab 3D trendide kasvu peale mängimisel heaks valikuks. Videot saab vaadata siit. IMAXist räägitakse video 3 minuti juures.

-

The Economistis pikem lugu, kuidas Bank of America ja Merrill Lynchi ühinemine hakkab ennast ära tasuma:

With the worst of the mortgage losses behind it, BofA can focus on the good things that Merrill has brought: strength in several (relatively) fast-growing businesses and a platform for global expansion. The challenge will be to convince markets that financial conglomerates still make sense. Dick Bove, a veteran bank analyst with Rochdale Securities, thinks the group could fetch $53 per share in a break-up. That is almost three times its current worth. (link).

BofA Merrill Lynch (BAC) on ka meie arvates hea võimalus pikaajaliselt finantssektorisse panustamiseks. BAC teatab 1Q10 tulemused homme.

-

Islandi vulkaanist pärinev tuhk on põhjustamas tõsist kriisiolukorda eelkõige just Skandinaavias, kuna sinna suunas on liikunud põhiline mass. Kauppalehti kohaselt võib homseks olla suletud ka kogu Soome õhuruum, mida Finnair hindab suurte tagajärgedega looduskatastroofiks. Põhja-Soomes jätkub veel suusatamise hooaeg ning kuna inimesed ei pääse tagasi koju ja uusi külastajaid tuleb juurde, on majutuse leidmine muutunud keeruliseks. Finnair kaalub töenäoliselt asendustranspordi pakkumist busside näol neile, kes seda soovivad. Bloombergi uudist olukorrast Euroopa lennuliikluses võib näha siit.

-

Vesi Tallinki veskile,laevad liiguvad ikka edasi ja kes lennukiga ei saa liikuda liigub laevaga

-

Töötu abiraha taotlejate arv tegi USAs eelmisel nädalal üllatuslikult tõusu:

Continuing Claims rises to 4.639 mln from 4.566 mln

Initial Claims 484K vs 440K consensus, prior 460K

-

Tuhapilv on sedapuhku päris massiivsete mõõtmetega ning suletud lennujaamade arv suur. Lennuliinidele - kaasa arvatud üle ookeani lendavatele - toob see kaasa suuri kahjumeid ja seetõttu võib lennuliinide ettevõtete aktsiates täna turu avanedes müügisurvet näha.

-

Londonis kaupleb nt Ryanair -2.3%. Easyjet on langenud aga kõigest -0.4%.

-

Kui USA tööturul tundub olukord taastuvat aeglaselt, siis majandustsüklitest suurest sõltuv tööstussektor peaks järgneva numbri järgi kenasti kasvama:

April NY Empire Manufacturing 31.86 vs 24.00 consensus, prior 22.86

-

Kuidas saab tuhk olla nii ohtlik? Kas paremat tuhaskännerit kui Islandi foorumis ei ole?

-

SAS -4.65%

-

Momentum, vulkaaniline tuhk ummistab väga edukalt lennukimootoreid - täpseid numbreid, palju tuha tihedus peab olema, ei oska sulle öelda. Teiseks on läbi tuhapilve lendamisel kiirusel 800km/h oht, et tuhaosakesed (sisuliselt peenike liiv) kraabivad lennukit nagu liivaprits autot. Värv maha, klaasid läbipaistmatuks ja pagan teab mis kõik veel.

-

Tuhk satub pilvest läbi lennates mootoritesse ning see võib kaasa tuua lennukimootorite läbipõlemise. Iga lennuk, mis on sunnitud aga maa peal viibima, toob lennufirmale kaasa suurt kulu.

-

Bank of America reports March trust data

Co reports March default amount net of recoveries of 12.54% vs 13.51% in February. Co reports March total delinquencies of 7.07% vs 7.35% in February.

BAC teatel vähenes märtsis vs veebruar, kohusetundetult maksmata jäetud kohustuste hulk. Ehk siis positiivsed trendid kohustuste õigeaksel tasumisel jätkuvad. -

ECB's Stark says risks to global inflation outlook tilted to upside - DJ

Inflatsioonirisk on märgatavalt tõusnud. -

-

Ja seal Bloombergi viedost toodi välja, et tuhk on 32000 jala kõrgus ehk lennukite cruising altitude kõrgusel.

-

USA futuurid indikeerivad börsipäeva algust hetkel ca 0.1%-0.2%lise miinusega.

Euroopa turud:

Saksamaa DAX -0.04%

Prantsusmaa CAC 40 +0.14%

Inglismaa FTSE 100 +0.21%

Hispaania IBEX 35 -0.41%

Rootsi OMX 30 -0.45%

Venemaa MICEX -0.13%

Poola WIG -0.43%Aasia turud:

Jaapani Nikkei 225 +0.61%

Hong Kongi Hang Seng +0.16%

Hiina Shanghai A (kodumaine) -0.04%

Hiina Shanghai B (välismaine) +0.04%

Lõuna-Korea Kosdaq -0.21%

Tai Set 50 N/A (börs suletud)

India Sensex 30 -1.03% -

Tööstustoodangu näitaja oodatust nõrgem, tootmismahtude ärakasutamise näitaja samuti oodatust pisut nõrgem.

March Industrial Production +0.1% vs +0.7% consensus, prior +0.3%;

Capacity Utilization 73.2% vs 73.3% consensus, prior 73.0% -

Don't Expect the Spanish Inquisition

By Rev Shark

RealMoney.com Contributor

4/15/2010 8:03 AM EDT

Life is like riding a bicycle. To keep your balance you must keep moving.

-- Albert Einstein

By any measure, the market action on Wednesday was extremely strong. The point gain was sizable, breadth was three-to-one positive, semiconductors led, and we even had a surge in volume.

One of the things that has been missing in this market has been technical follow-through, which is nothing more than a good-sized gain on increased volume. The theory is that the increased volume is an indication that institutional buyers are accumulating and, therefore, there is a higher likelihood of sustained momentum when the big players are active.

Since this rally started back in early February, the only other accumulation day for the Nasdaq was on Mar. 1. Neither the S&P500 nor DJIA have had any accumulation days, as defined by Investor's Business Daily, during this run. For a rally that has been as unrelenting as this one, it is a rather peculiar state of affairs, so it was interesting that we finally had a technically powerful day at such a late point.

The bearish spin on this is likely to be that this is a "blow-off" top. The theory is that the frustrated, underinvested bulls finally capitulated and started buying. They just couldn't take the pain of being left out any longer, so they rushed in. This is the mirror image of the capitulation that takes place after a downtrend, where market players can't stand the pain of losses any longer and they finally throw in the towel.

Theoretically, capitulation is supposed to signal a turning point, but it is rare at bottoms and even more rare at tops. The crash in 1987 is probably the best example of a capitulation low, while the bubble top in 1990 is a pretty good illustration of a capitulation top.

I bring up this up not because I think we have a top, but because it illustrates how bears can always find fault with the market. No matter what the environment might be, there are always compelling and logical bearish arguments, and even strong days like yesterday will be spun as a negative by those who don't trust this market.

The best way to approach this market is the same way I've been suggesting for some time, which is to stick with the trend until there is some clear reason not to. Without a doubt, we are very technically extended and ripe for profit taking, so it is important to keep time frames short and stops fairly tight, but it is a mistake to look for the market to suddenly collapse.

We have a huge number of earnings reports coming up and they won't all be as good as Intel's (INTC) , so we will probably have some bumps in the road, but there is going to be some very strong underlying support, and the dip buyers are likely to be very aggressive on any pullbacks.

The most disturbing thing about the action yesterday was the euphoria expressed by many bulls over this fantastic market. The market beast is often referred to as the Great Humiliator, and he will extract a toll from those who start to take him for granted. Try to keep your emotions on an even keel. It is very important to stay emotionally balanced when others are celebrating. We have our work cut out for us if we want to keep on profiting from this market.

We have some slight softness this morning, but the focus will soon shift to the earnings report from Google (GOOG) , which is out after the close. After the INTC report, expectations have probably ramped up even more and the risk of disappointment is higher.

-----------------------------

Briefing.com'ist:

Ülespoole avanevad:

In reaction to strong earnings/guidance: UPS +5.0% (also upgraded to Overweight from Neutral at Piper Jaffray and upgraded to Outperform from Market Perform at Raymond James), ATVI +3.4%, LSTR +3.2%, YUM +2.0%, SYT +1.9%, JBHT +1.5% (also upgraded to Outperform from Market Perform at FBR Capital).

M&A news: ME +38.6% (Mariner Energy to be acquired by Apache for 0.17043 of a share of Apache common stock and $7.80 in cash for each outstanding share of Mariner's common stock; values ME shares at $26.22/share).

Select oil/gas related names getting boost from ME/APA merger news: WTI +15.3%, PXP +4.5%, MMR +4.0%.

Other news: DVAX +24.1% (chronic kidney disease study confirms HEPLISAV's enhanced seroprotection against HBV infection), IDIX +23.8% (reports positive results with IDX184 from interim analysis of Ph. IIa hepatitis C study), CCRT +16.9% (announces "modified dutch auction" tender offer to purchase up to $100 mln outstanding 3.625% convertible senior notes due 2025 and shares of its common stock), CRDC +16.8% (reports first peer-reviewed publication validating Cardica's C-Port Systems efficacy), ANDS +14.9% (light volume; announces 72% of patients receiving ANA598 in phase II combination study with interferon and Ribavirin achieve undetectable levels of virus at week eight), XOMA +8.1% (receives $1 million milestone payment from Takeda Pharmaceutical), MIPI +7.6% (still checking), ABK +7.5% (continued momentum), IOC +5.8% (signs preliminary works joint venture agreement with Mitsui), MDVN +3.9% (Medivation and Astellas announce Publication in The Lancet of positive efficacy data from Phase 1-2 trial of MDV3100 in advanced prostate cancer patients), BALT +3.9% (Cramer makes positive comments on MadMoney), ERTS +2.3% (up in sympathy with ATVI), FDX +2.1% (trading higher in sympathy with UPS).

Analyst comments: ZION +5.1% (upgraded to Buy at Sun Trust Rbsn Humphrey), AMSC +3.2% (upgraded to Buy at Deutsche Bank), SOLR +1.8% (initiated with a Buy at Wunderlich; tgt $8).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: TITN -10.2% (light volume), MGM -6.2% (announces it proposes to offer up to $ 750 mln in aggregate principal amount of convertible senior notes due 2015 in a private placement), MAC -4.4%, MTXX -1.7% (light volume).

M&A news: APA -3.5% (Mariner Energy to be acquired by Apache for 0.17043 of a share of Apache common stock and $7.80 in cash for each outstanding share of Mariner's common stock; values ME shares at $26.22/share).

Select financial related names showing weakness: NBG -4.0%, ING -2.3%, STD -2.1%, UBS -1.5%, RBS -1.1%.

Select metals/mining stocks trading lower: BBL -1.9%, RTP -1.8% (Rio Tinto bumps up iron ore guidance after strong Q1 - Reuters), GFI -1.5%, BHP -1.5%, MT -1.4%, VALE -1.0% (trading ex dividend), AU -1.0%.

Other news: SNTS -34.3% (confirms District Court ruling in Par litigation), REVU -10.7% (priced 14 mln shares at $3/share), HOTT -9.2% (trading ex dividend), NEP -7.5% (delays form 10-K filing and postpones release date of 2009 financial results), MAC -4.4% (announces 18.5 mln common share offering), NOG -4.1% (announces offering of 5 mln shares of common stock at $15/share), KRC -3.7% (announces commencement of public offering of 5.5 mln shares of common stock), BUD -2.4% (still checking), DAI -2.3% (trading ex dividend), MPW -1.7% (prices 26.0 mln common shares at $9.75/share), SAP -1.3% (still checking for anything specific).

Analyst comments: ARUN -3.1% (downgraded to Market Perform from Outperform at BMO Cap), HPY -1.7% (downgraded to Underperform from Market Perform at Wells Fargo), BWLD -1.4% (downgraded to Neutral from Buy at MKM Partners), NIHD -1.3% (downgraded to Neutral from Buy at Goldman), UNM -1.3% (downgraded to Market Perform from Outperform at Raymond James), GWW -1.0% (downgraded to Hold from Buy at BB&T Capital Mkts). -

Live cam. Island: http://eldgos.mila.is/eyjafjallajokull-fra-valahnjuk/

More live cams. : http://www.volcanolive.com/volcanocams.html -

Google prelim $6.76 vs $6.60 Thomson Reuters consensus; revs $5.06 bln vs $4.95 bln Thomson Reuters consensus

Esimese hooga 2.5% langust ja hetkel püsitakse 1.8% languses.