Börsipäev 21. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Nagu eilse börsipäeva foorumi hilisõhtul sai kirjutatud, suutis Apple ootusi tugevalt ületada nii müügitulude kui ka kasumi osas ning tuleviku osas anti traditsiooniliselt konservatiivsed prognoosid. Järelturul kaubeldi läbi 5.7 miljonit AAPLi aktsiat, järelturu põhi oli ca $244 ning tipp $265. Silma järgi öeldes läks enamus tehinguid läbi ca $255-$258 juures.

Indeksite futuurid tegi Apple'i numbrite teatamise järel hüppe ülespoole ning hetkel on S&P500 indeksi futuurid +0.25% ja Nasdaq100 futuurid +0.65%. -

Kui Apple'i käive oli 13.5 miljardit USD ja EPS 3.33 USD siis kõige lähemale suutis müügitulu pakkuda ametlikest analüütikutest RBC Capitali esindaja, kelle vastavaks ootuseks oli 12.6 mld USD. Aktsiakasumi lähimaks prognoosiks oli aga 2.65 USD (Rodman & Reinshaw). Üldse on analüütikud seni raporteerinud ettevõtete osas väga konservatiivsed olnud. 15% S&P 500-st on nüüdseks avaldanud ning tervelt 84% neist prognoose ületanud.

-

Tulemuste tabel nüüd taas uuendatud - link siin. Täna enne turgu on oodata numbreid näiteks Altrialt, Morgan Stanley'lt, Wells Fargolt jt, järelturul tulevad eBay, Starbucks, Qualcomm jt.

-

http://pragcap.com/do-apples-earnings-even-matter

"The best managements know how the game works and they play the analysts for fools by consistently managing expectations. No one does this better than Apple. Every quarter they beat and every quarter they sandbag earnings. Like clockwork, the analysts peg their estimates near Apple’s “projections”. And Apple blows them out of the water. This quarter should be no different." -

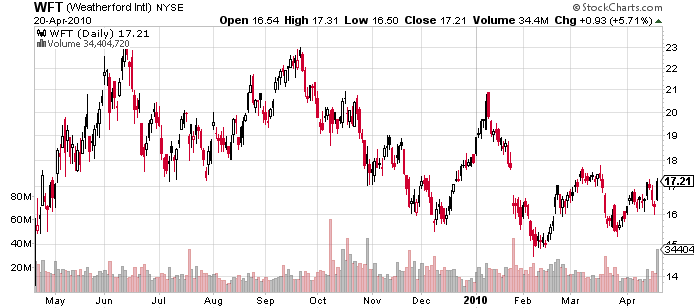

Weatherford (WFT) tuli eile tulemustega, mis konsensusootustele jäid küll pisut alla, kuid mille peale aktsia reageeris siiski tugevalt. Aktsia üks vaieldamatult suuremaid fänne on Morgan Stanley analüüsimaja, kes on WFT valinud üheks oma top pick'iks. Hoolimata nõrgapoolsetest kvartalinumbritest julgeb MS arvata, et hullem on WFT jaoks selja taga ning ees ootamas palju helgem tulevik. Kvartalitulemuste järel kinnitas Morgan Stanley aktsiale antavat overweight soovitust ja $45list hinnasihti, mis on turuhinnast ca 160% kõrgemal! Oleme ka ise LHV Maailma Pro alla otsinud aktsiat, mida osta, et energiasektoris tõusvatest kapitalikulutustest pikaajaliselt kasu lõigata - kandidaate on mitmeid, kuid nende seas kindlasti ka WFT.

-

iPhone'i üllatav menu on andnud Deutsche Bankile põhjuse tõsta Apple'i hinnasihti teist korda sel kuul, mis peale eilseid tulemusi kergitati 350 dollarile, omades seejuures analüüsimajadest kõige positiivsemat nägemust.

While current quarter results were very impressive, we see 3 major product cycles converging in the June Q which should drive continued momentum. The iPad is off to a very strong start with demand characterized as ‘shocking’ and tracking ahead of management expectation (before the 3G & international versions are released). In addition, we expect the iPhone to be refreshed this summer which remains immensely profitable (we est. ~55% GM) and continues to ramp internationally (151 carriers in 88 countries). Finally, we expect the recently refreshed Mac lineup to perform well for the remainder of 2010 and beyond.

-

Venemaa analüüsimaja Otkritie on täna mõlgutamas mõtteid Venemaa finantssektori teemal. Kohalikule analüüsimajale traditsiooniliselt ollakse kohalike ettevõtete osas reeglina positiivselt meelestatud, aga panen lõigu nende tekstist ka siia:

Bank St. Petersburg. The bank trades at 2010E P/BV of 1.5, or at significant discount to Russian an EM peers. It has under-performed the sector over the last 12-months. We set our new target price at $5.37, a 39% upgrade. Our rating remains BUY.

Vozrozhdenie has priced in a lot. The best banking tock in terms of performance over the last 12 months (up 398%), Vozrozhdenie is now relatively expensive (P/BV of 1.7x, but P/E of 41.3x on 2010E), and has become to a degree a victim of its own success, as SME lending will be a late-cycle recovery. We cut our target to $48.9, and cut our rating to HOLD.

Sberbank remains a structural BUY, but lacks near-term catalysts. Trading at 2010E P/BV of 2.4x, Sberbank commands a well-deserved premium, given that we expect net income to more than double in 2010E, and reach a whopping $9.3bn in 2011E. We upgrade our target to $4.14. However, margin erosion will be visible near-term, while other catalysts (DR program) are more likely to happen in 2H10 only. -

Credit Suisse analüütikud on lõpuks loobunud oma "2010 double-dip" teesist ja usuvad, et S&P500 indeks jõuab aastalõpuks 1270 punkti tasemele. Optimismi taga on järgnevad põhjused:

1) We still expect GDP growth to surprise positively (41/2% global GDP growth this year)

2) Corporates are under-invested (if corporate FCF normalises investment could rise by 32%)

3) Aggregate labour income looks set to surprise positively (as corporates have over-shed labour)

4) China should have a soft landing (economic overheating is limited

5) Fiscal/monetary policy is still loose and the impact of a property-price decline looks manageable).

-

Eile kirjutasime siin foorumis Prantsusmaa börsil kauplevast Eurotunneli aktsiast sümboliga GET. Täpselt samasugust börsisümbolit kasutab ka USAs kauplev, kuid totaalselt teises valdkonnas tegutsev Gaylord Entertainment (GET), kes saab täna hommikul Wells Fargolt upgrade'i overweight peale.

Briefing: Gaylord Entertainment (GET 30.95) upgraded to Outperform from Market Perform at Wells Fargo. -

Kui keegi salvestab aktsiaraamatuid ja on olemas umbes kuu vanused andmed, siis palun saatke e-mail.

reneilves

gmail

com -

Eelturul teatatud numbrid nüüd tabelisse kantud (link) - EPSi ametlike ootuste ületamine on lausa epideemiline.

-

S&P500 indeksi futuur eilse sulgumistaseme juures, Nasdaq100 futuur ca +0.5% ja Apple'i aktsia +6%.

Euroopa turud:

Saksamaa DAX -0.31%

Prantsusmaa CAC 40 -0.80%

Inglismaa FTSE 100 -0.94%

Hispaania IBEX 35 -1.71%

Rootsi OMX 30 -0.62%

Venemaa MICEX -0.44%

Poola WIG -0.35%Aasia turud:

Jaapani Nikkei 225 +1.74%

Hong Kongi Hang Seng -0.52%

Hiina Shanghai A (kodumaine) +1.80%

Hiina Shanghai B (välismaine) +2.25%

Lõuna-Korea Kosdaq +1.08%

Tai Set 50 -1.11%

India Sensex 30 +0.07% -

Keep an Open Mind

By Rev Shark

RealMoney.com Contributor

4/21/2010 8:22 AM EDT

By all means let's be open-minded, but not so open-minded that our brains drop out.

-- Richard Dawkins

As was widely anticipated, Apple (AAPL) announced another exceptional earnings report. The company even managed to exceed expectations by enough to drive the stock up $20 or so initially. It has cooled off a little after the initial euphoric response but is still up about $14.

Despite the move in AAPL, early indications are for a flat to slightly negative open. European indices are all in the red as concerns over Portugal are bubbling up and pressuring the financial sector. Asian stocks were mixed as weakness in banks offset the Apple-induced strength in technology.

Weakness in the dollar helped the indices quite a bit yesterday, and we need to watch that closely. It was oil and commodities that led on Tuesday and if technology doesn't perk up more, we are going to need commodities to continue to surge if this market is to work back up to the highs of last week.

The market has done a fine job of shrugging off the weakness created by the Goldman Sachs (GS) news over the last two days, but the main issue now is whether earnings are strong enough to keep pushing us higher. Most of the strong earnings reports on Tuesday -- especially IBM (IBM) -- were sold. It is going to be very interesting to see whether AAPL can gain further momentum after its report. Apple is definitely a unique company that is taking market share from others rather than just profiting from increased technology spending, so it is not necessary a bellwether stock. AAPL can't be treated as a stock that reflects the overall economy. It is a great company that does well regardless of the economy.

After the Goldman hiccup, the market is pretty much back to where it was four days ago; the primary issue for market players is once again whether we will see a "sell the news" response to earnings reports. The trend is still up, but the recovery over the last two days wasn't quite as vigorous as the selling on Friday. It is not a major problem but there are a few chinks in the uptrend.

Of course, the major indices are still technically extended, but strong momentum has consistently rendered that an irrelevancy. Anyone who has tried to short this market based on arguments that it is overbought has suffered badly.

Fighting the trend has not paid off, but that doesn't necessarily mean that it is easy to buy. Few stocks have consolidated, and you have not had many opportunities to buy if you aren't willing to chase strength.

Morgan Stanley (MS) earnings are now out and are quite strong, boosting futures to about even. I'm a bit surprised we aren't seeing a better open given the good earnings. If the bears are going to finally get some "sell the news" action, today is a good setup for it to occur. I still believe the dip-buyers will offer some very strong underlying support, so I'm not bearish but I'm staying flexible and keeping an open mind.

-----------------------------

Briefing.com

Ülespoole avanevad:

In reaction to strong earnings/guidance: DEAR +100.0%, TPX +8.9%, MANH +8.2%, HBAN +8.1% (light volume), ALTR +6.5%, FULT +6.0%, AAPL +5.9%, KEY +4.9%, AME +4.1% (light volume), MS +4.0%, MAA +3.5% (light volume), STX +2.9%, VASC +2.8%, EMC +2.5%, VMW +1.9% (also upgraded to Outperform from Market Perform at JMP Securities), STJ +1.5%, TSS +1.4%, TCK +0.9%, BA +0.7%.

Select semi related names seeing early strength: BRCM +2.4%, MU +2.1%, SMH +0.7%

Select computer storage device related cos ticking higher following: SNDK +2.3%, WDC +1.6%, XRTX +1.0%

M&A news: CYBS +32.5% (CyberSource to be acquired by Visa for $26.00/share or $2 bln).

Other news: BNVI +13.6% (announces patent issuance for Bezielle for metastatic breast cancer), CLRT +10.9% (announces new data indicate effectiveness of Clarient's Pulmotax test for lung cancer), ZLC +8.5% (Hearing strength attributed to plan related to sale of stake in company), ABK +4.2% (still checking), LOGI +2.7% (still checking), SPF +2.1% (announces proposed offering of $200 mln of senior notes due 2018), WDC +1.2% (trading higher in sympathy with STX), AU +1.1% (secures a $1 bln, four-year unsecured revolving credit facility), AA +1.1% (still checking), DNDN +0.7% (Presents Data at American Association for Cancer Research Supporting Mechanism of Action of PROVENGE).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: VITC -30.9% (also downgraded by multiple analysts), TSFG -20.9%, OFG -11.7%, SNV -10.2% (downgraded to Hold from Buy at Soleil; downgraded to Market Perform from Outperform at Raymond James),GILD -6.8% (also downgraded to Neutral from Overweight at Piper Jaffray), JNPR -6.4%, NUVA -5.2%, CREE -4.8%, MCO -3.2%, CHRW -3.2%, CPTS -2.7% (light volume), AAI -2.6%, EW -2.5%, YHOO -2.1%, WFC -2.0%, PLXS -1.7%, UTX -0.6%.

Select financial related names showing weakness: NBG -4.2%, UBS -2.9% (trading ex dividend), ), ING -2.6%, STD -2.3%, RBS -1.5%, LYG -1.4%, AIB -1.4%, BCS -1.2%, HBC -1.1%, CS -1.1%, DB -1.0%.

Select metals/mining stocks trading lower: PAL -4.9% (announces C$75 Million cross-border bought deal financing of units), RTP -2.1%, BBL -1.8%, BHP -1.6% (discloses production report for the nine months ended March 31, 2010; discloses update regarding SEC investigation; not possible at this time to predict the scope or duration of the investigation) MT -1.5%.

Other news: CSIQ -8.6% (expects PV module shipments in the first quarter of 2010 to be approximately 189 MW to 191 MW, with gross margins at 13% to 13.5%; downgraded to Neutral from Outperform at Macquarie), IGTE -7.9% (files for $6.7 mln common stock offering by selling stockholders), IGTE -5.7% (still checking), DRYS -4.5% (Announces $150 Million convertible senior notes offering,announces offering of 10 mln shares of common stock; earlier co announced $150 mln convertible senior notes offering), PAL -3.6% (announces C$75 Million cross-border bought deal financing of units), TWO -2.4% (announces pricing of public offering of 11.5 mln shares of Common Stock at $8.90/share), RIG -0.6% (Reports Fire on Semisubmersible Drilling Rig Deepwater Horizon ; downgraded to Neutral from Outperform at Credit Suisse).

Analyst comments: EDU -1.7% (removed from Conviction Buy list at Goldman), CIEN -1.3% (downgraded to Sell from Hold at Soleil), RF -1.1% (downgraded to Mkt Perform from Outperform at Bernstein), SYT -0.9% (downgraded to Hold from Buy at Citigroup), NAV -0.8% (initiated with a Sell at Morgan Joseph), FRX -0.6% (downgraded to Perform from Outperform at Oppenheimer). -

Dept of Energy reports that crude oil inventories had a build of 1894K (consensus is a draw of 750K); gasoline inventories had a build of 3587K (consensus is a build of 500K); distillate inventories had a build of 2096K (consensus is a build of 1000K). The US refinery utilization rate was 0.34% (consensus is 0.35%).

Toornafta tegi oodatust suuremate varude peale pea dollarilise kukkumise 83.5 dollarile -

Ponzi skeemidest. Kui Madoff suutis luua illusiooni ca $65+ miljardilisest varahaldurist, siis täna on on SEC päevavalgele toonud c $1 miljardilise Ponzi skeemi Miami ärimehe Nevin K. Shapiro poolt. Link süüdistusele on siin (link) ja esimene lõik sellest on järgmine:

The SEC alleges that Nevin K. Shapiro, the founder and president of Capitol Investments USA, Inc., sold investors securities that he claimed would fund Capitol’s grocery diverting business. Shapiro told investors that the securities were risk-free with rates of return as high as 26 percent annually. Instead, Shapiro was actually conducting a Ponzi scheme and illegally using investor money to pay for other unrelated business ventures and fund his own lavish lifestyle. When investors questioned Capitol’s business, Shapiro showed them fabricated invoices and purchase orders for nonexistent sales.

Kui keegi kuuleb 26%lisest riskivabast intressimäärast, siis tänase inflatsioonimäära juures tasuks kahelda sellist juttu rääkiva inimese kaines mõistuses.

-

RUMOR: British Airways 747 diverted after engine shutdown. If true, potentially devastating for Europe air...

http://www.businessinsider.com/rumor-british-airways-747-diverted-after-twin-engine-shutdownnbsp-if-true-potentially-devastating-for-europe-air-2010-4 -

LHV Maailma Pro investeerimisidee Imax Corporation (IMAX) teatab oma kvartalitulemused järgmisel nädalal 29. aprillil. Ettevõte on järjepanu raporteerinud geograafilistest laienemistest ning täna tuleb teade Hiina-tehingust, mis on saatnud aktsia eilsele 6%lisele tõusule täna veel üle 6% plussi ja kaupleb juba $20 piirimail. Link Hiinas sõlmitud lepingu pressiteatele on siin.

-

Müük on päris hoogsaks läinud, VIX +6%. Tehnoloogia veel peab,VXN -1%.

-

Qualcomm prelim $0.59 vs $0.57 Thomson Reuters consensus; revs $2.66 bln vs $2.63 bln Thomson Reuters consensus

Qualcomm sees Q3 $0.51-0.55 vs $0.55 Thomson Reuters consensus; sees revs $2.5-2.7 bln vs $2.66 bln Thomson Reuters consensus -

Päev lõpuks siiski indeksid flat ja Russell 2000 -> RUT poolt jällegi uued tipud.

-

Netflix prelim $0.59 vs $0.54 Thomson Reuters consensus; revs $493.7 mln vs $493.07 mln Thomson Reuters consensus

-

Starbucks prelim $0.29 vs $0.25 Thomson Reuters consensus; revs $2.5 bln vs $2.41 bln Thomson Reuters consensus

SBUX ~+2%

QCOM ja NFLX mõlemad tulemuste peale ~7% punases. -

Joel, Weatherford oli hea vihje, mis tekitas huvi asja ise edasi uurida. Loodaks ka Pro alla paar sõna, näiteks Morgan Stanley analüüsi kohta väikese ülevaate.