Börsipäev 23. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Sel ajal kui Lõuna-Eestis sajab lörtsi ja lund, peaks Wall Streetil New Yorkis täna paistma päike ja temperatuur tõusma ca +20 kraadini. Majandusraportitest ootame täna kell 15.30 USA märtsikuu kestvuskaupade tellimuste muutust (ootus +0.1% ning ilma liiklusvahenditeta +0.7%) ning kell 17.00 uute eluasemete annualiseeritud müüginumbreid (ootus 330 000).

Tähtsamate indeksite futuurid on hetkel kauplemas eilsete sulgumistasemete lähedal, eilsed olulisemad tulemuste teatajad Amazon.com (AMZN) ja Microsoft (MSFT) vajusid numbrite raporteerimise järel aga ca 3%lisse miinusesse. -

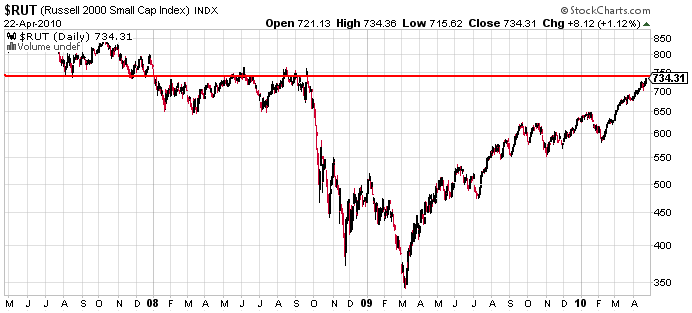

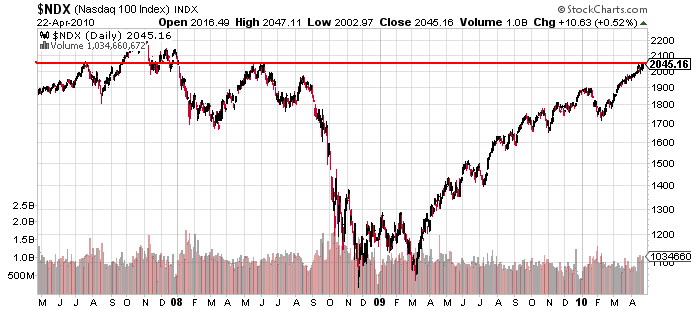

Kui keegi eile tähele ei pannud, siis Nasdaq100 ja Russell2000 indeksid tegid oma uued 52-nädala tipud. Kusjuures Russell 2000 indeksil on 2.3 aasta tippude löömisest puudu vaid ca 4% ning Nasdaq 100 indeksil vaid 0.5% (!). Viimase 9 aasta tippudest on Nasdaq100 indeksil puudu pisut alla 9%.

-

Optimism on kohutavalt suur ning langusesse uskujaid on praeguseks järgi jäänud vaid üksikud. Samas, langus tulebki reeglina alles siis, kui keegi seda enam ei oota. Ülioptimistlikku meelestatust näitab minu arust väga hästi Realmoney.com portaalis eile väljaöeldud lause Timothy Collinsi poolt, kes ütles pärast AMZNi ja MSFTi aktsiate kukkumist, et ostab juba järelturul aktsiaid, et hommikul eelturul ostjatest ette jõuda : )

Realmoney.com: "Timothy Collins - Why Wait Till Morning? The after-hours dip may be gone by morning, so I'm buying some stock now." -

Suurbritannia majandus ei tundu kohe kuidagi jalgu alla saavat. Selle aasta esimeses kvartalis kasvas majandus 0.2% võrreldes 4Q09 kvartaliga, mis oli kehvem analüütikute poolt prognoositud 0.4% kasvust. Võrreldes eelmise aastaga langes SKP -0.3%.

-

Viimase 9 aasta tippudest on Nasdaq100 indeksil puudu pisut alla 9%. Optimism on kohutavalt suur

Aktsiad pidid ju tõusma 12% aastas!!!!??

Midagi siin ei klapi (kes sõi ära minu pudru)? -

Kärmas peaks asja uurima. Tahaks ikkagi teada, miks keegi ei vastuta.

-

: )

-

Euro vastu on lõpuks tekkinud ka mingi ostuhuvi, kuna Kreeka on läinud EU/IMF-i laenuraha järele (mingit kindlat tehingut veel sõlmitud ei ole):

Eventually the die was cast. After a dramatic cabinet meeting today, Greece has recourse to the IMF…

Ultimately the decision taken by Prime Minister Papandreou was a direct appeal to the mechanism of EU assistance and the IMF. We immediately sent a letter which calls for immediate activation of the support mechanism of the Greek economy. (link)

-

Esimese nädala tulemuste tabel hakkab tasapisi lõpule jõudma. Hommikuste teatajate numbrid on nüüdseks tabelisse kantud - link siin.

-

Kellegil IBKR kohta ka arvamus on? Selliste tulemuste peale esmane reaktsioon -3% nagu liiga tagasihoidlik ei tundu?

-

JP76,

Credit Agricole jättis tulemuste järel oma $16lise hinnasihi ja 'underperform' soovituse muutmata. Keefe, Bruyette & Woods jättis samuti alles oma 'underperform' reitingu ja on väljas $15lise hinnasihiga. Väike väljavõte siia ka KBW analüüsi kokkuvõttest:

KBW: "IBKR missed our and consensus estimates by a margin as the structural and cyclical market factors continued to compress revenue. New competition for options market makers, falling volatility and unfavorable FX movement persisted in pressuring top line though it was slightly better than weak 4Q09. We lower estimates and maintain UP given the challenging visibility of earnings through this market cycle." -

RBC on täna väljas note'iga energiasektori teemal. Paneme siia ka ühe lõigu Briefingu vahendusel:

RBC initiated coverage of eleven integrated oil and independent refining companies. The firm believes the two sectors are currently at different points in the investment cycle. They say the integrated oils have received an "excessive downstream penalty" and are poised for an upward move due to rising upstream earnings. Firm says thier Top Pick is Chevron (CVX) and Holly Corporation (HOC). The firm initiates ConocoPhillips (COP) and Frontier Oil (FTO) with Outperforms. They also initiate with Sector Performs: Delek US Holdings (DK), ExxonMobil (XOM), Marathon Oil (MRO), Sunoco (SUN) and Valero Energy (VLO). They initiate Tesoro (TSO) and Western Refining (WNR) with Underperforms. -

Märtsikuu kestvuskaupade tellimuste muutus ilma volatiilsete liiklusvahendite tellimusteta tõuseb oodatust oluliselt enam:

March Durable Orders ex auto +2.8% vs +0.7% consensus, prior revised to +1.7% from +1.4%

March Durable Orders -1.3%% vs +0.1% consensus, prior revised to +1.1% from +0.5% -

USA indeksite futuurid 20 minutit enne börsipäeva algust järgmised: S&P500 indeks +0.2%, Nasdaq100 indeks +0.3% ja nafta -0.6%.

Euroopa turud:

Saksamaa DAX +1.30%

Prantsusmaa CAC 40 +0.46%

Inglismaa FTSE 100 +0.73%

Hispaania IBEX 35 +0.83%

Rootsi OMX 30 +2.02%

Venemaa MICEX +1.24%

Poola WIG +0.70%Aasia turud:

Jaapani Nikkei 225 -0.32%

Hong Kongi Hang Seng -0.98%

Hiina Shanghai A (kodumaine) -0.54%

Hiina Shanghai B (välismaine) +0.22%

Lõuna-Korea Kosdaq +0.01%

Tai Set 50 -1.00%

India Sensex 30 +0.68% -

Avoid Calling Tops

By Rev Shark

RealMoney.com Contributor

4/23/2010 8:40 AM EDT

Such is the state of life that none are happy but by the anticipation of change. The change itself is nothing. When we have made it, the next wish is to change again.

-- Samuel Johnson

Market players are always trying to stay a step ahead of the crowd. To that end, they are constantly trying to anticipate when a trend might shift. The idea of shifting from bull to bear at exactly the right moment is extremely appealing, but it can be an extremely costly quest if you focus on it too intently.

Calling exact market turning points just isn't something that can be readily done, no matter how great your market insight. Many market players like to believe they can time the market with great precision, but if they do actually get it right, it's often luck more than skill.

The current market is a particularly good example of how enticing and frustrating it can be to try to call a market turn. Since this rally began back in early February, we've had a constant barrage of market pundits declaring that the reversal is finally at hand ... but we just keep on running.

Over the past week we've had a little slowing in the upside momentum as the Goldman Sachs (GS) fraud allegations were made and a little "sell the news" reaction to earnings kick in, yet the market has found its footing and soon we were trending up again. All the folks who were hoping that a turn was about to occur found themselves berating the market beast on Thursday after what seems like the millionth dip-buying bounce to a new high.

My solution for dealing with the difficulty of trying to call market turns is to avoid trying to do it. We should stick with the prevailing trend until there is some pretty clear evidence that it is turning. That means suffering some losses when an actual turn does occur, but most people would be better off overall if they did just that. There is a strong tendency to underestimate how long a trend will last, and if we keep trying to call turning points, we will almost always end up on the sidelines way too early.

Like most things in investing, sticking with the trend and trying not to anticipate turning points is more difficult than it sounds. One of the biggest problems is that the longer the market runs in one direction without a correction, the more difficult it becomes to find stocks that are not technically extended. When the market goes straight up for nearly three months, you just aren't going to find a lot of easy entry points if you are a disciplined investor, no matter how bullish you might be.

That's the position many investors find themselves in right now, and it's why we hear so many complaints about this market that the media and permabulls love so much. It isn't that folks are all that bearish, but they're finding it very difficult to navigate a market that only goes in one direction. Many of the bulls scoff at that notion, but if you have a disciplined trading methodology that regularly harvests gains and prevents you from buying overbought stocks, you're probably not fully invested at this point even though the trend is still up.

This morning we have a little weakness as Amazon (AMZN) and Microsoft (MSFT) react negatively to reports that beat analyst estimates. Some folks seem mystified by this, but both stocks have been pricing in better-than-expected numbers as they ran up over the past couple of months. AMZN was up about 25% since March 1, so is it really a big surprise that some folks are locking in gains on the news?

Overall the market indices are indicating a flat open. They were down more last night following the earnings news, but I suspect the dip-buyers are just too impatient to wait for the market to open before they do their thing.

European markets are up despite Greece's indication that it is ready to receive some financial aid. That event has been anticipated, so there is probably a "buy the bad news" reaction occurring. That dollar is up and we'll have to watch that as a potential drag on oil and commodity stocks.

Overall, the bulls remain firmly in control of this market and are causing great pain for those who keep on anticipating a turn. The turn will eventually come and catch many by surprise, but for now we have little choice but to embrace the old maxim that the trend is our friend.

-----------------------------

Briefing.com

Ülespoole avanevad:

In reaction to strong earnings/guidance: MBTF +38.2%, ACTG +22.2%, SYNA +8.5%, EMN +7.3% (also announced that it is reviewing strategic options for performance polymers business), XRX +6.7%, ERIC +5.8%, COF +4.9%, RMTR +4.2%, RMBS +3.7%, LOCM +3.3%, RVBD +2.4%, HITT +2.3%, JCI +2.1%, IGT +2.0%, WDC +2.0% (also upgraded to Outperform from Neutral at Baird), AXP +1.9%.

Select mortgage insurer realted names showing strength: ABK +2.5%, MBI +1.7%, AIG +1.4%.

Other news: AUTH +14.5% (SmartSynch and AuthenTec Partner to Fortify Smart Grid Infrastructure), APPY +9.1% (continued momentum), ONP +7.8% (still checking), PALM +7.4% (Hearing rumor that Lenovo has emerged as the leading candidate makes the rounds), NBG +5.4% (Reports indicate that the plan could lend Greece a total of $55 bln, with $40 bln coming from the EU and the other $15 bln from the IMF), LNG +4.9% (Agrees to Sell Interest in Freeport LNG Development, L.P.), SPF +2.3% (Cramer makes positive comments on MadMoney), CSTR +2.2% (Coinstar unit Redbox announces distribution agreement with Twentieth Century Fox & Universal Studios), AIB +1.2% (still checking).

Analyst comments: MWW +2.8% (upgraded to Market Perform from Underperform at Wells Fargo), STP +2.1% (Oppenheimer upgrades to Perform), YGE +1.7% (Oppenheimer upgrades Yingli Green Energy (YGE 12.58) to Outperform from Perform),

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PXLW -15.5%, CRBC -10.3%, AMSG -9.3% (also downgraded to Hold from Buy at Stifel Nicolaus), BUCY -6.8%, TASR -6.6%, GVA -6.0%, NCR -5.8%, EPAY -5.6%, PMCS -5.0%, AMZN -4.9%, DV -4.9%, IR -4.5%, MSFT -3.8%, WL -3.3%, TRV -3.1%, CAKE -3.1% (also downgraded to Underperform from Market Perform at Raymond James ), MSCC -3.0% (light volume), IBKR -2.2%, BJRI -1.5%.

Select financial related names showing weakness: PUK -3.0%, ING -2.6%, BCS -1.7%, CS -2.3%, DB -2.2%, BBVA -1.3%, STD -1.3%, UBS -1.2%.

Select metals/mining stocks trading lower: BBL -1.5%, BHP -1.3%, SLW -1.2%, IAG -1.2%, MT -1.1%, RTP -1.0%.

Select oil/gas related names showing weakness: RDS.A -1.5%, TOT -1.2%, BP -1.1%.

Other news: ACUR -39.8% (the co and King Pharmaceuticals provide update on FDA Advisory Committee meeting for Acurox; Committees voted that they do not have enough evidence to support the approval of the NDA Acurox), MAIL -8.0% (trading ex dividend), ARMH -3.1% (Hearing weakness attributed to ARMH chief denying co in talks with AAPL), JOYG -2.5% (trading lower in sympathy with BUCY), SHLD -2.2% (light volume; Sears Hldg acquires additional Sears Canada shares and provides financial update), BUD -1.9% (trading ex dividend).

Analyst comments: NOK -2.2% (downgraded to Underperform at Jefferies), BWLD -1.5% (light vol; downgraded to Neutral from Outperform at Cowen), PLD -1.0% (downgraded to Underweight from Neutral at JP Morgan), JNS -1.0% (downgraded to Neutral from Buy at Goldman), VZ -1.0% (downgraded to Neutral from Buy at Goldman), SHW -0.8% (downgraded to Neutral from Overweight at JP Morgan), SY -0.7% (downgraded to Hold at Needham). -

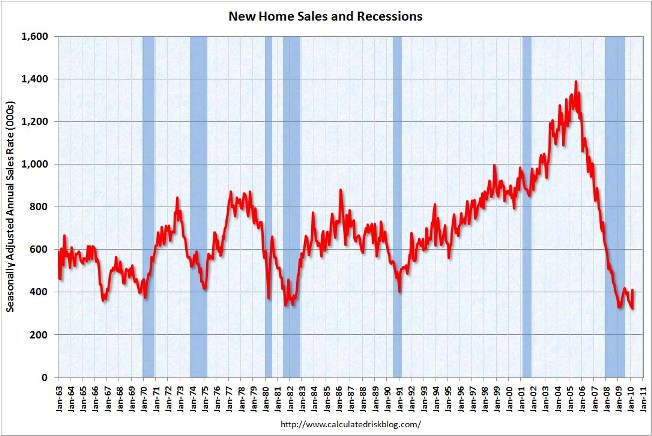

Uute eluasemete müük on oluliselt üle ootuste. Isiklikult kahtlustan, et müüginumbrid tulevad ka järgmisel kuul väga tugevad ning et antud numbri puhul mängib väga olulist ajutist efekti USA kinnisvaraostu stiimul, millest olen kirjutanud nii siinses finantsportaalis kui ka rääkinud seminarides.

Briefing: March New Home Sales 411K vs 330K consensus; M/M change +26.9%

Link mu veebruarikuisele kinnisvarastiimuli loole on siin.

-

Siin ka üks graafik märtsi põrkest via calculated risk

-

Joeli ja Erko kommentaaridele lisaks panen siia lõigu Briefingust:

Economic Data Reviews: New Home Sales Jump Before Tax Credits Deadline

The effects from the upcoming expiration of the first-time and existing homebuyers' tax credits were clearly seen in the new home sales data, which bounced off their historic February lows and increased 26.9% to 411,000. The expectations were for an increase to only 330,000 homes. Sales should continue to be strong for one more month before another pullback following the end of the tax breaks at the end of April. It is interesting that the jump in new home sales was much stronger than the 6.8% increase in existing homes. -

Toon siia nädala insiderite tehingud:

Notable Purchases -- institutional buying in SD, THQI, and WXCO;

Notable Sales -- Harbinger selling shares of NYT, THO and AMTD Directors selling

This week we've seen notable insider buying in the following stocks:

SandRidge Energy (SD) 10% Owner Fairfax Financial Holdings bought 4,530,000 shares at $7.02-7.69 on 4/7-4/19

VMware (VMW) 10% owner EMC, pursuant to stock purchase program, bought 135,000 shares at $55.55-56.70 on 4/16-4/20

THQ (THQI) 10% owner MAK Capital One bought 269,798 shares at $7.59-7.67 on 4/15-4/19

WHX Corp. (WXCO) 10% owner Steel Partners bought 348,874 shares at $4.61-4.95 on 4/15-4/21

Northern Trust (NTRS) Director bought 10,000 shares at $53.98 on 4/22

Spectrum Brands (SPB) 10% owner Harbinger Capital Partners bought 6,500 shares at $29.10-29.50 on 4/19-4/20

Ditech Networks (DITC) 10% owner L. Miller bought 108,962 shares at $1.40 on 4/15

We've seen notable insider selling in the following stocks:

Enbridge Energy Partners (EEP) 10% Owner Caisse Infrastructures Fund sold 3,500,000 shares at $50.00 on 4/15

New York Times (NYT) 10% owner Harbinger Capital Partners sold 3,250,000 shares at $12.30-12.55 on 4/20-4/21

Thor Industries (THO) Director sold 1,000,000 shares at $32.40 on 4/21

TD Ameritrade (AMTD) Director, in accordance with Rule 10b5-1 plan, sold 940,329 shares at $20.50-20.56 on 4/15-4/21

Intercontinental Exchange (ICE) CEO, in accordance with Rule 10b5-1 plan, sold 103,300 shares at $111.06-118.67 on 4/21-4/22

Illinois Tool Works (ITW) Director sold 172,900 shares at $50.32-51.02 on 4/22

Fastenal (FAST) Director sold 150,000 shares at $54.05 on 4/21

Urban Outfitters (URBN) Director sold 200,000 shares at $38.00-38.22 on 4/13

TJX Companies (TJX) CEO sold 75,000 shares at $45.53 on 4/16 -

Turul ühtlane bid all, kuid taaskord huvi pigem futuurides ja indeksites. Üksikaktsiad käituvad juba viimased paar tundi üsna lahjalt.

-

S&P 500 tegi aasta tipuks 1214.98