Börsipäev 28. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

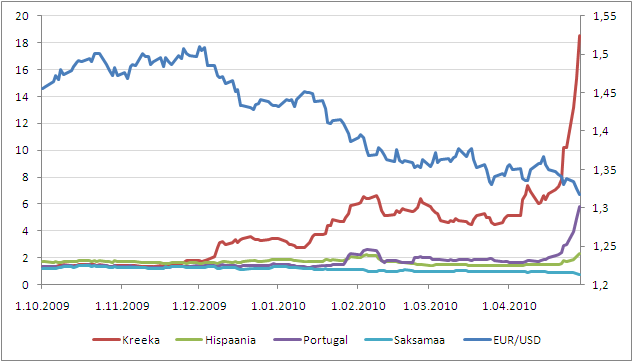

Eile õhtul tõi aktsiaturgudele närvilisust Kreeka krediidireitingu langetamine BB+ peale S&P poolt. BB+ langeb nn “rämpsstaatus” kategooriasse, mida pole euro ajaloo jooksul ükski liikmesriik veel saanud. Lisaks hoiatas S&P, et Kreeka võlakirjade hoidjad võivad oma algsest investeeringust tagasi saada kõigest 30%. Kartus, et Kreeka valitsuse võlga hakakse restruktureerima ja probleemid levivad Lõuna-Euroopasse edasi, on finantsturud taas närviliseks muutunud:

- Kreekas on aktsiatega kauplemine peatatud ja 2. aastase valitsuse võlakirja tulusus on hetkel tõusnud 17.8% peale.

- Hispaania ja Portugali aktsiaturud tegid eile rohkem kui 4% kukkumise ja hetkel alustatakse kauplemist ka miinuspoolel.

- VIX, mis mõõdab “hirmu” USA turgudel, tõusis +30%. Tegu suurima tõusuga alates 2008. aasta oktoobrist.

-

Tulemuste tabel samuti nüüd uuendatud ning reaktsiooni veerg jääb üsna punaseks pärast eilset laiapõhjalist sell-offi. Link tulemustele

-

FT sõnul on Kreekal ilmselt võimalus IMFi käest veel 10 miljardit eurot saada:

Senior bankers and officials in Washington and Athens told the Financial Times that the IMF was in talks to increase its aid contribution by €10bn. The fund could make that sum available under a planned three-year loan, according to an Athens-based analyst familiar with the talks. (link)

Siiani on EL ja IMF lubanud Kreekale 45 miljardit eurot laenuraha, kuid analüütikute hinnangul peaks summa vähemal 2x suurem olema, et Kreeka päästmine edukas oleks.

-

Kreeka üritab spekuleerijaid peatada ja keelas kaheks kuuks Ateena börsil lühikeseks müügi. USAs on Kreeka saagale panustamiseks kasutatud palju National Bank of Greece (NBG) aktsiat, mis on oktoobri tippudest ca 70% allapoole kukkunud.

NBG

-

FOMC liige Hoenig on juba pikemat aega üritanud tõstatada FEDi vabaturukomitee kohtumiste ajal diskussiooni "extende period" eemaldamise osas, soovides seda siduda statement'i rohkem majandusliku pildi, kui kalendriga, ent siiani on FOMC jätkanud oma harjumuspärase sõnumiga turgude toetamist. Tõenäoliselt selgub hilisemast protokollist, et Hoenig jääb eriarvamusele ka tänaõhtusel otsusel, sest vaevalt et FED tahab hakata oma seiskukohta muutma võttes arvesse praegusi sündmusi globaalsetel finantsturgudel. Kui aga nii ikkagi juhtuks, riskikartlikkus turgudel ilmselt suureneks. FOMC otsus täna õhtul kell 21.15

-

Kreeka 2a võlakirja yield jõudnud nüüdseks üle 18% ja Portugali oma pea 6% ehk juba kõrgemal võrreldes Kreekale antava laenu intressiga (Saksamaa ekvivalentse instrumendi intress alla 0.8%). Eur/Usd kauplemas 1a põhjadel @ 1.317

-

18% ? Kallima otsa krediidkaardi intress juba ...

Kogu see PIGSi teema lõhnab ikka väga hapuks mineku järgi. -

Nagu S&P prognoosis, siis ilmselt on selle intressi taga hirm, et väljas olevast võlast kirjutatakse mingi % võla ümberstruktrueerimise käigus maha. Ma küll ei suuda aru saada, kuidas üks riik endale seda lubada saab ja pärast rahvusvahelisel areenil veel kellelegi silma vaadata, aga noh, eks seda varemgi tehtud.

-

Gapping up

In reaction to strong earnings/guidance: DSCO +15.4% (also provides update on Surfaxin; says progress on addressing sole remaining issue to gain potential FDA approval in 2011 of Surfaxin), ISSI +11.9%, OC +9.1%, MPEL +5.9%, BIN +4.7%, SIMG +4.7%, GT +4.3%, RFMD +3.1%, GLW +2.9%, RDS.A +2.5%, TMO +2.5% (light volume), BRCM +2.4%, KTCC +2.3%, LIFE +1.7%, DOW +1.4%, AFL +1.1%, DWA +1.0%.Select financial related names rebounding: NBG +7.7%, AIG +2.4%, KEY +1.5%, C +1.4%, GS +1.0%.

Select casino names trading higher: WYNN +2.2%, MGM +2.1%, LVS +2.0%.

Other news: SURG +56.8% (Synergetics USA enters into a settlement and license agreement with Alcon), CIIC +22.1% (still checking), CSII +10.5% (receives unconditional FDA approval for ORBIT II coronary clinical trial), MRNA +8.1% (Announces Combinations of UsiRNAs in Proprietary DiLA2 Delivery Technology Show Improved Efficacy in Bladder Cancer Model ), AVII +7.7% (secures increased funding of approx $4.0 mln), CTAS +6.2% (light volume; announced the appointment of Joe Scaminace to its board of directors. Scaminace is the Chairman, President and CEO of the OM Group), DVAX +1.3% (Dynavax Technologies Two Phase 3 HEPLISAV Trials Cleared by DSMB to Continue Immunizations), SYT +1.3% (entered into a long-term multi-crop partnership with Embrapa).

Analyst comments: SQNM +4.6% (upgraded to Buy from Neutral at Global Hunter), TLAB +3.1% (upgraded to Overweight from Neutral at JP Morgan), BRCD +2.2% (upgraded to Outperform from Sector Perform at RBC Capital), NVAX +1.9% (initiated with a Buy at Lazard), , ACE +0.6% (upgraded to Buy from Hold at Citigroup).

Gapping down

In reaction to disappointing earnings/guidance: BWLD -20.0% (also downgraded to Perform from Outperform at Oppenheimer), HTCH -19.6%, JST -14.0%, AMAG -13.0%, CCUR -10.1%, RHI -10.0% (also downgraded to Neutral at Robert W. Baird), CNXT -8.9%, PMTC -6.5%, MTW -6.5%, WBSN -6.2%, S -5.9%, SMCI -5.2%, FLEX -4.9%, AMKR -4.8%, JBLU -4.1%, AOL -3.1%, PNRA -3.0%, FPFC -2.8%, SAP -1.8%, RCL -1.0%.Select financial related names showing weakness: AIB -5.9%, STD -1.7% (trading ex dividend), IRE -1.0%.

Other news: MTA -11.8% (trading ex dividend), TTM -3.8% (still checking), WPPGY -3.5% (still checking for anything specific), CCL -2.4% (down in sympathy with RCL), PNC -2.2% (Treasury Department announces public offering of warrants to purchase common stock of PNC), VOD -1.5% (still checking), WY -1.4% (trading ex dividend; also downgraded to Underperform from Neutral at Credit Suisse), AINV -1.2% (prices public offering of common stock at $12.40).

Analyst comments: F -1.4% (downgraded to Underperform from Neutral at Credit Suisse), DELL -1.4% (downgraded to Neutral from Buy at UBS), MOT -1.2% (downgraded to Sector Perform from Outperform at RBC Capital).

-

Rev Shark: Assessing the Character

04/28/2010 7:44 AMContinuity gives us roots; change gives us branches, letting us stretch and grow and reach new heights.

-- Pauline R. KezerOn Tuesday the market suffered its worst bout of selling since the current rally began back in early February. Volume was heavy and breadth poor, and the action had all the attributes of a technical distribution.

Unfortunately for the bears, a strong market can handle a few distribution days. It takes more than just one or two to cause a change in trend, and typically markets that have been strong don't just hit highs one day and completely fall apart the next. It usually takes some time for the dip-buyers to temper their activities and for the bears to gain more confidence, but we must make note of this action because if it develops further, it will signal a change in the market character.

We have seen a few selling squalls like this before that proved to be nothing but a temporary hiccup that was forgotten a few days later. This market has come roaring back every time we have had any sort of dip or pullback. The bears start saying that it is different this time and we really are seeing a top, but then before you know it we are trending up once again and sentiment has that complacent, positive feel to it once again.

The good thing about this pullback from a technical standpoint is that it provides some pretty clear technical levels. We now have a range in the S&P 500 with 1219 as the recent high and 1181 as the recent low. Those are going to be the levels everyone is watching now, and we should see action pick up as we approach either one.

I've been playing the recent rally for quite a while with very-short-term longs and tight stops. That puts me quickly in cash on a day like yesterday and affords me a good amount of flexibility in looking for the next opportunity.

The main thing I'm watching for now is failed bounces. If the market is really undergoing a change in character, then the bounces are not going to have as much vigor and will fizzle out before the indices are back at highs.

As for specific stocks, so many are still so extended that they aren't offering good entry points yet. They need to come back to support and churn a bit before they turn up in order to create more inviting entry points.

If nothing else, the good news is we finally have seen a pretty good market shake. It is possible we'll go right back to acting like we have over the last couple months, but there's also a good likelihood that conditions might change and we'll see a different market character.

We have a decent bounce this morning as overseas markets bounced and the irritating Goldman (GS - commentary - Trade Now) congressional hearings came to an end. I think that bashing of Goldman affected the mood yesterday and contributed to the weakness, but Europe is the big issue, and that will remain the focus today. Buckle up. It should be an interesting day.

No positions.

-

Euroopa turud ja USA futuurid on teinud pärast ennelõunast põhja muljetavaldava taastumise. Euroopa sisuliselt nullis (hommikul üle -2% punases) ja USA indeksid alustamas päeva 0.5% kõrgemal

Euroopa turud:

Saksamaa DAX -0.15%

Pantsusmaa CAC 40 -0.03%

Suurbritannia FTSE100 +0.61%

Hispaania IBEX 35 -0.12%

Rootsi OMX 30 +1.47%

Venemaa MICEX -1.14%

Poola WIG -1.12%Aasia turud:

Jaapani Nikkei 225 -2.57%

Hong Kongi Hang Seng -1.47%

Hiina Shanghai A (kodumaine) -0.26%

Hiina Shanghai B (välismaine) -1.31%

Lõuna-Korea Kosdaq -0.27%

Tai Set 50 -1.85%

India Sensex 30 -1.76% -

Toornafta ja destillaatide varu oodatust suurem, kuid kütuse oma hoopis vähenes. Nafta hind hüppas korraks plussi, ent nüüd tagasi -0.3% punases @ 82.1

DoE Inventory Data: Dept of Energy reports that crude oil inventories had a build of 1963K (consensus is a build of 1000K); gasoline inventories had a draw of 1240K (consensus is a build of 900K); distillate inventories had a build of 2937K (consensus is a build of 1500K). The US refinery utilization rate was 3.02% (consensus is 0.00%).

-

Google'i (GOOG) 1Q10 tulemused ei olnud kindlasti halvad, kuid kuna ootused olid liiga kõrged, siis järgnes tulemustele korralik müügisurve. Täna läheneb GOOG veebruari põhjadele 520 dollari juures:

-

Võrdluseks Google'ile panen siia ka Baidu (BIDU) aktsia hinna graafiku. Baidu, kelle otsingumootor domineerib maailma suurima kasutajate arvuga Hiina internetiturgu, teatab oma tulemused täna õhtul. BIDU aktsia hind on viimase kvartaliga teinud võimsa ralli ja eksimisruumi tulemustele jäetud ei ole:

-

Spain Downgraded at S&P To 'AA' On Protracted Economic Adjustment And Risks To Budgetary Position; Outlook Negative

Turule taas veidi müüki. -

Börsid homme - kas langus jätkub? Kas tõesti on selle tänase üleüldise kukkumise taga pisike Kreeka?

-

Eks seda kasumivõttu on juba üsna kaua edasi lükatud ja hirm oli täiesti kadunud, siit peaks USA indeksid kergelt madalamale tulema. Pikemate investeeringute tegemisel saab tõenäoliselt parema sisenemiskoha.

Shanghai on ~ nädal juba punast kündnud ja Euroopa turge vaevavad Kreeka, Hispaania ja Portugali probleemid.

USA on seni väga tugev olnud ja tavapäraseks saanud ostupress pole kuhugi kadunud. Mõned investorid lihtsalt riske vähendamas ja kasumit lukku löömas. -

$42 bln 5-year Note Auction: Yield 2.540% (2.532% expected); Bid/Cover 2.75x (Prior 2.55x, 10-auction avg 2.55x); Indirect Bidders 48.9% (Prior 39.7%, 10-auction avg 49.3%)

Võlakirjaoksjon keskpärane. -

As expected, no change in FOMC's fed funds target rate of 0.00-0.25%; says rates to stay exceptionally low for extended period

Intressimäärad muutmata ja jutt sama, mis viimasel ajal domineerinud. -

Tulemustesadu jätkub:

Today after the close, of the many companies scheduled to report, some of the bigger names include: BIDU, ALL, ESRX, FSLR, GMCR, IRBT, RYL, RNOW, SFLY, SKX, VRSN, and V. Tomorrow before the open, of the many companies scheduled to report, some of the bigger names include: AKNS, MT, BDX, BMY, BKC, CELG, CME, CL, COP, XOM, MOT, OMX, OXY, ZEUS, POT, PG, HOT, TWC, VIA.B, and WM. -

H-P to buy Palm for $1.2 bln

-

HPQ valmis maksma $5.70 aktsia eest, aktsia uudise peale kauplemas järelturul $5.90 tasemest kõrgemal.

-

Baidult väga korralikud tulemused. Kauplemine hetkel peatatud, kuna tehakse split:

Baidu.com prelim $2.02 vs $1.50 Thomson Reuters consensus

Baidu.com non-GAAP EPS $2.10 vs $1.50 Thomson Reuters consensus; revs $189.6 mln vs $180.11 mln Thomson Reuters consensus

Baidu.com sees Q2 revs $268.1-274.0 mln vs $240.07 mln Thomson Reuters consensus

Baidu.com announces ADS to share ratio of ten ADSs for one share -

BIDU $700 sõideti läbi ja püsitakse kõrgemal.