Börsipäev 30. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Täna on USAst oodata suuremal hulgal makromajanduslikke teateid, millest enim pälvib tähelepanu Ühendriikide esimese kvartali SKT kasv. Kui neljanda kvartali sisemajanduse kogutoodang jäi pärast kolmandat revideerimist püsima 5.6%le, siis konsensuse arvates jätkas tarbimiskulutuste edasine paranemine ja ettevõtete kapitalikuluste suurenemine majanduse taastumise toetamist esimeses kvartalis, aidates saavutada 3.3%list annualiseeritud kasvu. Ühes SKT numbriga avalikustatakse kell 15.30 veel isiklik tarbimine ja SKT deflaator. Kell 16.45 avaldatakse Chicago PMI ja kell 16.55 Michigani tarbijasentimenti indeks.

-

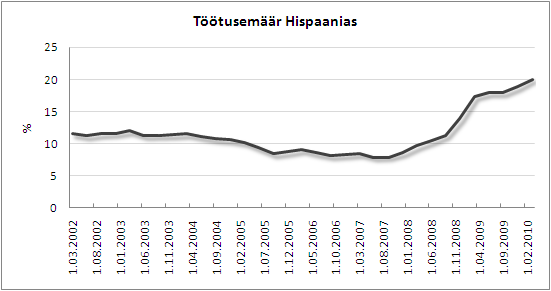

Täna avaldatud andmete kohaselt tõusis Hispaania töötusemäär esimeses kvartalis üle 20% (18.8% neljandas kvartalis), mis tekitab küsimuse, kuidas on võimalik valitsusel üldse vähendada eelarve defitsiiti keskkonnas, kus töötus on kõrgeim alates 1997. aastast, maksutulu kahaneb, kinnisvarasektoris lastakse õhku välja, kindlat sisemist ega ka välist nõudlust pole, mis aitaks majanduskasvu genereerida. S&P langetas mõni päev tagasi Hispaania kreidiidireitingut ja tõenäoliselt on vaid aja küsimus, millal Moody's ja Fitch oma kolme A-d kärpima hakkavad.

-

Hispaania poliitikud ise väidavad, et S&P paisutab Hispaania probleeme üle ja Kreeka on kõiges süüdi. Sellist töötusemäära vaadates tundub, et probleeme ei taheta tunnistada ja see võib kurvalt lõppeda. Lisaks kõrgele töötusemäärale on Hispaania tuntud ka oma finantssektori poolest, kus probleeme edasi lükatakse. Credit Suisse'i kommentaar Hispaania pankade kohta:

We believe the market might be underestimating the risks the financial system faces. Not only do we expect negative loan growth for two years in a row but the housing market appears to be more than 30% overvalued, which might trigger markdowns going forward. In our view, there is a risk reported NPLs might be underestimated to the order of 30–40% and we believe the slowdown in NPL formation is partly related to restructurings. The current level of provisions (2.8% of total loans) covers only 16% of the exposure to developers, which we believe is insufficient going forward as in some cases developer loans exceed 4.5x core capital and depending how the potential losses in the sector evolve over time.

Panen siia ka iShares MSCI Spain (EWP) börsil kaubeldava fondi liikumise, mis on PIGSi probleemide tõttu ca 25% allapoole liikunud:

-

ennist jäi veel mainimata, et töötus alla 25a vanuste hispaanlaste seas küündis esimeses kvartalis juba 41%ni - potentsiaalne sotsiaalsete rahutuste ja kuritegevuse kasvu allkas?

-

Terve Hispaania töötus üle 20%

-

Eile kirjutas MarketWatch meie omast poisist Steve Jürvetsonist ja tema plaanidest investeerida rohelisse tehnoloogiasse: http://www.marketwatch.com/story/venture-capitalist-steve-jurvetson-eyes-green-it-2010-04-29?d=nbit

-

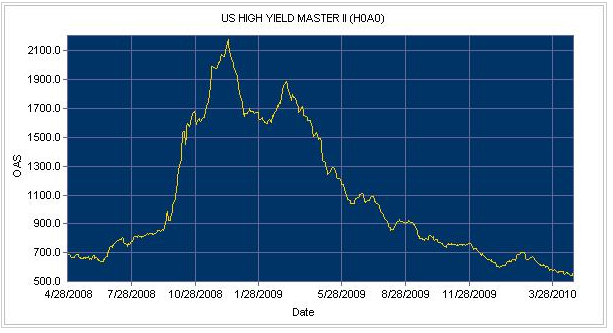

Eile sai börsipäevas mainitud, et spekulatiivsete võlakirjade hinnatase on tagasi 2007.a suve tasemel. Täna on Merrill Lynch High Yield Index ka Pragcapi päeva graafik:

Pullid ütlevad, et see on märk krediiditurgude tugevusest ja finantseerimisvõimaluste paranemisest. Karudele on see märk liigsest riskeerimisest ja sellest, et me kriisist midagi õppinud ei ole. As You Like It...

-

JP Morgan tõstab Dendreoni (DNDN) hinnasihi $46 pealt $66 peale.

-

DNDNi soovituse tõstmisi täna palju, aga JPMil kõige kõrgem hinnasiht:

Dendreon target raised to $62 from $47 at Canaccord

Dendreon target raised to $62 from $38 at Needham

-

Needham tõstab omalt poolt hinnasihi $38 pealt $62le. Seega mõnus võidusõit käimas - võidab see, kes pakub kõige rohkem.

-

FBR Research langetas Transoceani (RIG) ja Halliburtoni (HAL) soovitusi, kuna BP naftaplatvormi kokku kukkumine võib ettevõtetele väga kulukaks minna:

Transocean and Halliburton were cut to market perform from outperfrom by FBR Research, as the broker saying investors will pay a far lower multiple to earnings until the cause of the Deepwater Horizon catastrophe yields a clear picture. It cut Transocean's price target to $87 from $110 and Halliburton's to $35 from $44.

-

USA 1Q10 SKP kasv üsna ootuspärane:

Q1 GDP-advanced +3.2% vs +3.3% consensus, prior +5.6%

Q1 Chain Deflator-advanced +0.9% vs +1.0% consensus, prior +0.5%

Q1 Employment Cost Index +0.6% vs +0.5% consensus, prior +0.4%

-

U.S. federal prosecutors in New York have begun investigating Goldman Sachs Group Inc

, raising the possibility of criminal charges against the company or its employees, a source familiar with the situation said on Thursday.

Goldman said it was not surprised by the news and would cooperate with any information requests.

Shares of the world's most powerful investment bank dropped 3.4 percent to$154.75 in premarket trade.

Reuters -

Gapping down

In reaction to disappointing earnings/guidance: MCBC -26.6%, ATHN -14.9% (also downgraded to Market Perform from Outperform at Leerink Swann), AXL -14.0%, MSTR -12.2% (also downgraded to Market Perform from Outperform at FBR Capital), MFE -11.1% (also downgraded to Market Perform from Outperform at Wells Fargo), MWW -10.0%, SWIR -8.9%, VPRT -8.4%, QLGC -7.3%, BOOM -6.5%, WFR -5.9%, BCS -5.9%, NETL -5.2%, CERS -4.9%, DRIV -4.3%, PDLI -4.3%, TSYS -4.3%, MPWR -3.7%, MXIM -3.6%, SWN -2.2%, IRF -2.0%, BMRN -1.5%, CQB -1.4%, FISV -1.3%.

Other news: RTP -75.4% (trading post split), APPY -10.2% (announces registered direct common stock and warrant offering of $10.0 mln; per share exercise price of the warrants is $4.82), NMM -5.3% (announces public offering of 4,500,000 common units), GS -3.9% (weakness following reports that Federal criminal probe looking into Goldman trading and broker downgrade), FEN -3.7% (announced that it has commenced a public offering of 1,200,000 common shares of beneficial interest), FULT -3.0% (announces $230 Million common stock offering).

Analyst comments: ATPG -3.8% (downgraded to Hold from Buy at Wunderlich), MMR -3.1% (downgraded to Hold from Buy at Wunderlich), OSK -2.8% (downgraded to Underweight from Neutral at JP Morgan), RIG -2.7% (downgraded to Market Perform from Outperform at FBR Capital ), HAL -2.7% (downgraded to Market Perform from Outperform at FBR Capital ), ANDE -1.2% (downgraded to Hold at BB&T Capital), CMCSA -1.0% (downgraded to Hold from Buy at Stifel Nicolaus).

Gapping up

In reaction to strong earnings/guidance: APKT +28.1%, PWER +26.2%, CSTR +24.0% (also Coinstar unit Redbox Signs Agreement with Schnucks to Install DVD Rental Kiosk at all Schnucks Locations), CSUN +12.6%, THOR +10.2%, CLRT +9.5%, PAG +7.7%, SLTC +7.3%, CATM +6.5%, JRCC +5.7%, BEXP +5.7% (also announces three high initial rate Bakken completions and provides operational update ), ACOM +5.5%, AMCC +4.9%, SWKS +4.7%, DHI +4.6%, DLB +4.0%, VSEA +3.6% (also upgraded to Buy from Hold at Deutsche Bank), COHR +3.3%, KTEC +2.3%, KLAC +1.9%, ANH +1.3%, RMD +1.3%, WYNN +1.3%, CTV +1.1%.

Select financial related names showing strength: ING +2.7%, NBG +2.2% (confidence about the potential for a EU/IMF bailout of Greece), BBVA +0.9%.

Select metals/mining stocks trading higher: NEM +3.0%, SLW +1.9%, EGO +1.9%, ABX +1.6%, GFI +1.0%, IAG +1.0%, GDX +1.0%, GG +0.9%.

Select oil/gas related names showing strength: RDS.A +2.3%, BP +1.2%, PBR +1.0%.

Other news: POZN +8.4% (continued strength), DNDN +7.4% (target raised to $66 from $46 at JP Morgan, target raised to $62 from $38 at Needham, target raised to $62 from $47 at Canaccord), CLNE +2.8% (to provide natural gas fueling services to SuperShuttle shared-ride vans operating at U.S. metropolitan airports), SI +2.2% and ABB +1.3% (still checking for anything specific).

Analyst comments: TEF +1.7% (upgraded to Hold from Sell at ING Group), SAP +0.9% (upgraded to Overweight from Neutral at JP Morgan).

-

Rev Shark: What More Can I Say?

04/30/2010 7:59 AMThe world belongs to the enthusiast who keeps cool.

-- William McFeeAs I contemplate the market this morning, I find it striking how content the bulls are and how utterly confounded the bears are. The bulls are enthusiastic but keeping cool as the market steadily moves higher. Even though Goldman Sachs (GS - commentary - Trade Now) is now dealing with criminal charges and the European sovereign debt issues remain unresolved, there doesn't seem to be any worry at all that we'll see much downside in the near term.

There are a few fundamental concerns about the economy, but earnings reports continue to be quite positive, and that's the biggest driving force for the bulls right now. Companies are generally upbeat and there isn't any significantly cutting of forward guidance.

The bears' primary argument against this market is that we have gone too long without much of a rest. We are technically extended and in need of consolidation. The bears also argue that the mood is too complacent and sentiment too positive, but none of that has mattered. The sentiment indicators may be extended, but the market is indifferent to that warning sign right now.

There are reports this morning that mutual fund managers are holding the lowest amount of cash ever and that individual investors are starting to buy stocks more aggressively. Both of these situations are contrary indicators, as they indicate that the cash on the sidelines to drive the market higher is drying up, but it is impossible to use these data to precisely time the market. They are important considerations, but like so many things in the market they don't matter until they do.

As the market continues to trend higher, more and more people focus on trying to call a turning point, which perversely creates pressure for the trend to continue. Each time the top-callers are wrong, they end up covering shorts or adding long exposure ... and up we go again.

Markets like this also put tremendous pressure on pundits to keep talking about turning points. It is much more intellectual and entertaining to write about why the market trend is about to end. There is only so much that can be said about staying with the trend. It is much more dramatic and potentially rewarding to make big predictions and to nail a market turn. Of course, most of the folks who play that game rack up big losses until they finally get it right, but the appeal of doing so will never go away. Someone will eventually get it right but profiting from such calls is more a matter of luck than skill.

We are off to a mildly positive start this morning. The Goldman Sachs news of criminal charges is having little impact and there were plenty of strong earnings reports to bolster the mood. If there is a negative out there, it's that no one seems to be worried about anything. That will eventually matter, but right now it doesn't.

No positions

-

USA futuurid indikeerimas starti eilse sulgumistaseme juurest

Euroopa turud:

Saksamaa DAX -0.06%

Pantsusmaa CAC 40 -0.42%

Suurbritannia FTSE100 -0.63%

Hispaania IBEX 35 +0.43%

Rootsi OMX 30 -0.74%

Venemaa MICEX -0.75%

Poola WIG +0.88%Aasia turud:

Jaapani Nikkei 225 +1.21%

Hong Kongi Hang Seng +1.59%

Hiina Shanghai A (kodumaine) +0.07%

Hiina Shanghai B (välismaine) +0.94%

Lõuna-Korea Kosdaq +0.87%

Tai Set 50 +1.51%

India Sensex 30 +0.32% -

April Chicago PMI 63.8 vs 59.9 consensus, prior 58.8

-

Michigani tarbijasentiment oodatust parem

April University of Michigan Sentiment- final 72.2 vs 71.0 consensus, prior 69.5