Börsipäev 12. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Euroopa osas jälgitakse täna pingsalt esimese kvartali SKT numbreid, mida lähitundidel riigiti avaldama hakatakse. Saksamaa QoQ kasvu ei oodata (kl 9.00), Prantsusmaa majandus võis kasvada 0,3% (kl 9.45), Itaalia 0,1% (kl 11.00), Hispaania 0,1% (kl 10.00), Portugal 1,2% ja kogu eurotsoon +0,1% (kl 12.00).

-

Saksamaa Q1 SKT lõi 0.0%list ootust 0.2 protsendipunktiga, millele lisaks revideeriti neljanda kvartali kasvunumbrit 0.0% pealt +0.2%le. Kui Prantsusmaa, Hispaania ja Itaalia numbrid jäävad ootuste lähedaseks, kasvas kogu eurotsooni majandus tõenäoliselt arvatust rohkem.

-

WSJ kirjutab, et USAs on luubi alla võetud Morgan Stanley (MS) CDO tehingud, kus pank soovitas instrumente osta, kuid ise panustas samal ajal nende langusele.

Federal prosecutors are investigating whether Morgan Stanley misled investors about mortgage-derivatives deals it helped design and sometimes bet against, people familiar with the matter say, in a step that intensifies Washington's scrutiny of Wall Street in the wake of the financial crisis. (WSJ)

Aprillis esitas SEC sarnased süüdistused ka Goldman Sachsile (GS), kuid siiani pole GS oma tegevuses probleemi näinud. Panen siia ka GSi aktsia reaktsiooni SECi süüdistuste peale:

-

Täna kell 13.15 esitab Euroopa Komisjon euroaruande, milles hinnatakse, kas Eesti on valmis euroga liituma. Eestit käsitlevat aruannet tutvustab hr Massimo Suardi Euroopa Komisjoni majanduse ja rahanduse peadirektoraadist Komisjoni konvergentsiraportist selgub, kas kriisi tingimustes kulude kärpimisega tõsist vaeva näinud Eesti vastab euro¬tsooni sissepääsureeglitele ehk siis kas me täidame Maastrichti kriteeriume.

-

Eurotsooni SKT kasvas esimeses kvartalis 0.2% vs oodatud 0.1%. Üle mitme kvartali jõudis esimest korda plussi ka Hispaania, Kreeka majandus kahanes kvartaalsel baasil -0.8% ehk samas tempos nagu neljandas kvartaliski.

-

Meeldetuletuseks homse kohta:

13. mai 2010 Balti börsidel kauplemist ei toimu.

Täiendavat infot kauplemispühade veebilehelt http://www.nasdaqomxbaltic.com/et/news/kauplemispuhad -

Taevaminemispüha

Ilma kauplemata paneb OMXT taevasse :) -

Samuti ei toimu kauplemist NASDAQ OMX börsidel Rootsis, Soomes, Norras ja Taanis.

-

Mis päevast te räägite? Kas on raske kirjutada? Ma ei näe kalendrist peale 1.mai sel kuul ühtegi punast päeva.

-

Homsest

-

Stokholmi börs tänaseks suletud (early-close).

-

BIDU aktsia tehti "kauplejatele põnevamaks", splitt 10:1. Seega täna kaupleb $72 juures

-

March Trade Balance -$40.4 bln vs -$40.5 bln, prior revised to -$39.4 bln from -$39.7 bln

-

Turud on olnud täna optimistlikud ning Euroopas ulatuvad plussid isegi kohati üle 2%. USA indeksite futuurid on eelturul ca +0.5% kuni +0.6%.

Euroopa turud:

Saksamaa DAX +1.90%

Pantsusmaa CAC 40 +0.97%

Suurbritannia FTSE100 +0.52%

Hispaania IBEX 35 +0.95%

Rootsi OMX 30 +1.73%

Venemaa MICEX +3.46%

Poola WIG +0.42%Aasia turud:

Jaapani Nikkei 225 -0.16%

Hong Kongi Hang Seng +0.33%

Hiina Shanghai A (kodumaine) +0.32%

Hiina Shanghai B (välismaine) -1.90%

Lõuna-Korea Kosdaq -0.02%

Tai Set 50 +0.27%

India Sensex 30 +0.32% -

Welcome to the Machine

By Rev Shark

RealMoney.com Contributor

5/12/2010 8:33 AM EDT

"As machines become more and more efficient and perfect, so it will become clear that imperfection is the greatness of man."

--Ernst Fischer

Traders who use technical analysis to navigate the market look for certain patterns of price action in stocks and indices. The theory is that certain conditions lead to a predictable set of emotions in market players. To a great degree, technical traders are market psychologists who try to measure the level of greed and fear and how it will impact the market.

It can be quite a difficult task at times simply because human beings are not always very predictable or even rationale. We also have to deal with our own biases and subjectivity, and, of course, surprise news events can shift market psychology in a matter of minutes. Although it is not perfect, technical analysis can provide an excellent framework for traders as they navigate the market.

Unfortunately, there are times when the general ideas behind technical analysis just don't work very well at all. One of the things, which I've discussed extensively for quite a while, is the theory that V-shaped bounces should not be expected.

The theory here is very simple. When market players are caught in a market breakdown they suffer anxiety and will look for opportunities to escape the situation as we bounce so that they can cut their losses. When stocks move back up and a trader is closer to breaking even, that trader is more likely to look for an exit. That is what overhead resistance is all about. It is the inclination of people to try to escape stressful situations with a minimum amount of damage.

For some reason, that basic investor psychology hasn't been very apparent in this market for quite some time. Once we start to bounce, we tend to keep on going and don't struggle much as we move through overhead resistance.

One theory for this is that computerized trading is overriding the normal psychology. Algorithms are written to buy rather than sell at obvious resistance points, causing short squeezes and momentum chases and leading to some big profits for the computerized trading industry. I'm oversimplifying this to a great degree, but with two-thirds of the markets' volume being generated by computers, it isn't hard for them to push us in any direction they want, regardless of overall market psychology.

I believe that is a big part of why I hear so many complaints from traders about how difficult it is to navigate this market. The human emotions that drove us just don't matter much, which gives the action a very random feel. We can always guess what other traders might do, but trying to guess how a computer is programmed is a lot tougher.

With that in mind, we are once again at a familiar juncture. The market has broken down, and we are trying to bounce back. The bulls actually faltered in their drive for another V-shaped move yesterday afternoon, which is a change of pace, so maybe the market finally is undergoing a change in character. The problem is that it has been a losing trade for so long to bet against this market that you have to be hesitant, even when the index charts look as poor as they do now.

Based on standard analysis of the major index charts, there is no good reason to be very bullish here. The gap on Monday morning begs to be filled eventually, and the failure yesterday afternoon shows that resistance levels did matter.

The problem is that we just don't know if the machines are going to overrun this rather clear pattern yet again. The best approach for dealing with that issue is to wait to see what happens and then be quick to react. Another V-shaped bounce would be a bad bet based on standard technical analysis, but if the machines really are in control of this market, then we certainly have to be much more open to the possibility.

Futures were looking weak very early this morning but have gained steam steadily, and we now have a positive open shaping up. Gold continues its rampage higher. Overseas markets are mostly positive, and the worries and concerns about Europe are on the back burner at the moment.

-----------------------------

Briefing.com:

Ülespoole avanevad:

In reaction to strong earnings/guidance: TPI +22.7% (light volume), CWS +17.8% (thinly traded; light volume), SMTX +15.6%, OBCI +12.8%, STV +9.2%, ESIO +7.2%, HPJ +7.1%, ING +5.6%, HMIN +4.2%, CTRP +2.9%, EXEL +2.4% (also upgraded to Overweight from Neutral at Piper Jaffray), ASEI +1.8%.

Select financial related names showing strength: HBAN +3.9%, UBS +2.0%, STD +1.7%, DB +1.6%, HBC +1.4%, GS +1.2%, BBVA +1.2%.

Select metals/mining stocks trading higher: HMY +3.9%, NG +3.1%, GSS +3.1%, HL +2.8%, CDE +2.7%, AUY +2.7%, KGC +2.2%, EGO +2.2% (announced an agreement where it will acquire all the outstanding common shares of Brazauro Resources Corporation; Each Brazauro share will be exchanged for 0.0675 Eldorado shares), SLW +2.1%, GFI +1.8%, GG +1.4%, NEM +1.4%, ABX +1.2%, RTP +1.0%.

Other news: ACHN +19.1% (reported additional preliminary data from its Phase 1b clinical trial of ACH-1625), AEZS +10.4% (FDA approves Investigational New Drug application for doxorubicin targeted conjugate compound, AEZS-108, in bladder cancer), FIS +6.7% (Hearing early strength related to takeover speculation), DHR +3.3% (declared 2-for-1 split of its common stock and authorized 10 mln share repurchase program), DD +0.8% (Cramer makes positive comments on MadMoney).

Analyst comments: PT +6.2% (initiated with an Outperform at Bernstein), BPZ +2.9% (upgraded to Hold from Underperform at Jefferies), PEP +1.5% (added to Conviction Buy List at Goldman), INTC +1.1% (coverage resumed with a Buy at Stifel Nicolaus).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ERTS -5.3%, TAST -4.2%, AONE -3.5%, SPWRA -3.2%, CBEH -3.1%, DIS -3.1%, AEG -1.5%, M -0.8%.

M&A news: AYE -1.8% (FirstEnergy and Allegheny Energy File Merger Application with Federal Energy Regulatory Commission).

Other news: FUQI -5.3% (lfiles to delay its 10-Q), WWE -4.6% (still checking), DFT -4.5% (announces public offering of 11 mln shares of common stock, entered $85 million unsecured revolving credit facility to replace the old secured facility terminated in December 2009), BKD -3.9% (announces sale of 10.0 mln shares of common stock by certain affiliates of Fortress Investment Group LLC; co won't sell any shares in offering and won't receive any proceeds), MS -3.1% (lower on reports of investigation; Morgan Stanley CEO says he has no knowledge of US investigation, according to CNBC), UN -1.3% (trading ex dividend), TRV -1.0% (AIG, Travelers move to dismiss U.S. Medicare reimbursement lawsuit, HB reports ), BXP -0.8% (filed for a $2 bln mixed shelf offering).

Analyst comments: PM -1.1% (removed from Conviction Buy list at Goldman). -

Alaver ütleks, et pole paha tulemus.

Bank of America Corp., JPMorgan Chase & Co. and Goldman Sachs Group Inc., the first, second and fifth-biggest U.S. banks by assets, all said in regulatory filings that they had zero days of trading losses in the first quarter. -

Perfektne tulemus. Business Insideri väga lihtsustatud selgitus (kuid siiski ka üsna oluline point):

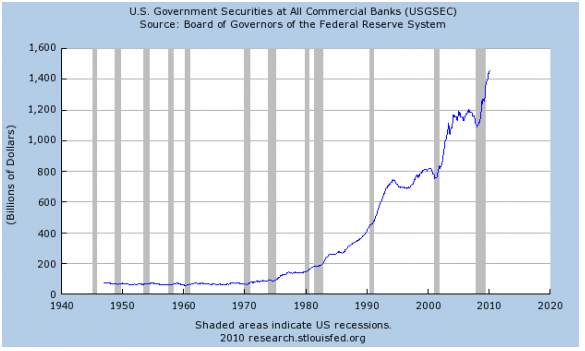

If you don't know how the banks can do this, you haven't been paying any attention. It's the Fed lending these banks money cheap allowing them to lend it back to the government at higher rates? Is that really all the banks are doing with their money? Pretty much yes.

From the St. Louis Fed, here's the total volume of government securities held on bank balance sheets. The number is only going in one direction (link).

-

IBM: New 5-year road map; $20 EPS in 2015 - Collins Stewart

IBM tugevuse taga siis selline uudis. -

Eile mainitud toornafta futuuride contango on rebenenud veelgi suuremaks ja hetkel kalendrispread juuni/juuli juba $4.17

-

Senate votes 90-9 to allow Fed to continue supervising small banks - CNBC

-

$24 bln 10-year Note Auction Results: Yield 3.548% (expected 3.582%); Bid/Cover 2.96x (12-auction avg 2.91x, Prior 3.72x); Indirect Bidders 41.9% (12-auction avg 40.1%, Prior 43.1%)

Taaskord oksjon korraliku nõudlusega, võiks hinnata hindele 4 -

HTC kaebas Apple kohtusse, aktsa tippudest üsna teravalt allapoole müüdud

Apple: HTC Sues Apple for Patent Infringement "HTC Corporation today took legal action against Apple Inc., filing a complaint with the United States International Trade Commission (ITC) to halt the importation and sale of the iPhone, iPad and iPod in the United States. "As the innovator of the original Windows Mobile PocketPC Phone Edition in 2002 and the first Android smartphone in 2008, HTC believes the industry should be driven by healthy competition and innovation that offer consumers the best, most accessible mobile experiences possible," said Jason Mackenzie, vice president of North America, HTC Corporation. "We are taking this action against Apple to protect our intellectual property, our industry partners, and most importantly our customers that use HTC phones." HTC's commitment to innovation has continued for more than a decade as it has focused on building a portfolio of the world's most advanced smartphones that are inspired by consumers and provide them with a variety of choices in software, design, form-factor, price and wireless carrier. Today, consumers in the United States can choose between 12 HTC smartphones with the national wireless carriers. HTC has continuously strived to bring innovative smartphone choices to consumers, like the recently unveiled HTC EVO 4G with Sprint, DROID Incredible by HTC with Verizon Wireless and the HTC HD2 with T-Mobile"....Source: HTC website -

April Treasury Budget -$82.7 bln vs -$52.9 bln consensus, prior -@0.9 bln

-

Source tells CNBC that the SEC could announce a circuit breaker rule later today

-

Deutsche Bank getting hit as story circulates that SEC will probe them on CDO deals

DB kogu päeva tõusu käest andnud, kuid püsib siiski veel kergelt plusspoolel. -

AlariÜ, a kas nad ütlesid ka millepärast või ajasid lihtsalt niisama reklaamijuttu ?

-

Deutsche Bank:

Fox Business Senior Correspondent Gasparino on discussing DB and C being mentioned as targets of SEC CDO probe; notes surprisingly MS not being mentioned

Paistab, et sama teema, mis GS puhul

http://www.foxbusiness.com/story/markets/industries/finance/government-probe-wall-street-sales-widening/ -

Tänased tulemused:

Earnings CalendarToday after the close look for the following companies to report: ANW, ARI, AUTH, CSCO, CLD, CPII, DRYS, JACK, PSSI, SLW, SPTN, STLY, SUPX, URS, and WFMI.

Ja homme enne turgu:

Tomorrow before the open look for the following companies to report: ACXM, ADES, AMSC, ACAT, STST, WEL, CAE, CGA, EJ, ESLT, GIL, KSS, CHUX, PBH, SNE, TK, URBN, VIT, and WEN. -

GIGM on hakanud veidi tugevust näitama ja käive ka täitsa ok. Kas mõneks ajaks põhi tehtud?

-

Kuigi tänase päeva tõusuprotsendid on väga korralikud - indeksid ikkagi ca +1.5% kuni +2.0% tõusus -, ei tohiks pullide rõõmutaevas siiski ainult päikene paista. Tänase päeva käive on võrreldes paari viimastel nädalatel nähtuga üpris lahja ning võib jääda alla isegi 3 kuu keskmisele. Saame näha, kas see 50-päeva libisevate keskmiste juurde liikunud indeksitele probleeme tekitab või mitte, aga väike ohumärk on see positiivse fooni taustal küll.

-

kaua GIGM veel LHV Pro idee on? Niikaua kui plussi jõuab, ükskõik mitme aasta pärast? Või äkki tuleks tunnistada et asi on katki?

-

White Nigga,

Oleme Pro all korduvalt öelnud, et võrreldes idee algse väljakäimisega on ettevõtte juures väga paljud riskid realiseerunud ning põhimõtteliselt tegu ebaõnnestunud ideega. Ettevõtet kattes oleme mitmeid kordi ja väga tugevalt alandanud ka hinnasihti, et toimunud negatiivseid arenguid kajastada. Selleks, et otsustada, mida ideega edasi teha, ootasime ettevõttelt kvartalitulemusi ja rohkem uut infot ettevõtte käekäigu kohta. Täna hommikul tuli GigaMedia (GIGM) 2009. aasta neljanda kvartali ja 2010. aasta 1. kvartali esialgsete tulemustega ning pärast numbrite läbivaatamist saame teha oma otsuse, kuidas ideega edasi minna.