Börsipäev 18. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Eilne börsipäev, mis meenutas sõitu Ameerika mägedel, on nüüdseks selja taga. Päeva kesekel nähtud aktsiaturu suuna ümberpöördumine ja päeva lõpus nähtud ostusurve võiksid vargsi justkui vihjata, et praegustelt tasemetelt on ülespoole liikumiseks suuremad šansid, kui allapoole liikumiseks. Hommikusel eelturul on futuurid igaljuhul eilsete sulgumistasemete juures.

Eesti aja järgi kell 15.30 on tulemas ka makroraporteid. Nimelt teatatakse siis USAs aprillikuus nähtud sesoonsusega korrigeeritud elamuehituse aastane tempo (ootus ca 655 000) ning väljastatud ehituslubade arv (ootus 680 000). On selge, et mida suuremad näitajad need on, seda parem aktsiaturgudele. Samuti teatatakse veel aprillikuu tootjahinnaindeksi muutus (ootus +0.1% ning tuumikosa ootus samuti +0.1%).

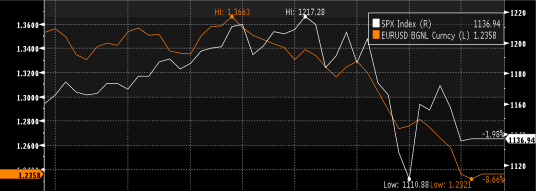

Kuna euro liikumine dollari vastu on viimasel ajal olnud väga sarnane aktsiaturgude liikumisega, tuleks kindlasti euro kursil silma peal hoida. -

Panen siia ka kaks graafikut EURUSDi liikumise kohta võrreldes S&P500 indeksiga. EURUSD on neil tähistatud oranži joonega ning S&P500 indeks valge joonega.

Esimene on viimase 2 kuu kohta:

Teine on viimase 2 aasta kohta:

-

Panen siia lühikese väljavõtte ühest artiklist (link), mis käsitleb Mehhiko lahel toimunud BP naftaplatvormiga seotud reostust. Kui ainult seadusi järgida, siis teoreetiliselt ei peakski BP maksma rohkem kui naeruväärsed $75 miljonit. See tähendaks tulevikus muidugi seda, et USA ametnikud ei annaks BPle tõenäoliselt mitte ühegi uue naftaplatvormi püstipanemiseks enam luba. Seega seni kuni potential future revenue loss USAst on suurem kui nõutav kahjutasu, tasub koristustööde eest maksta... Aga naljakad seadused ikka USAs.

BP faced additional pressure from the Obama administration over the weekend. The White House asked for assurances from the company that it wouldn't try to take advantage of an existing law that would limit its liability to just $75 million. BP responded on Sunday by saying that its intention all along has been to ignore the cap and pay whatever it takes. /-/There have been plenty of estimates for the spill's ultimate cost to BP, running as high as $16 billion.

-

Suurbritannias tõusis tarbijahinnaindeks aprillis +3.7% yoy. Kehva majanduskasvu arvestades tundub väga korralik inflatsioon... huvitav milline on number siis, kui majandus täisvõimsusel hoo sisse saab?

-

Eile hilisõhtul teatas Icahn, et on ostnud 1. kvartali jooksul 2.1 miljonit Chesapeake Energy (CHK) aktsiat, mis on ca 0.3% ettevõtte aktsiakapitalist. Tundub, et aktsia madal hind ja pikaajaline potentsiaal hakkab huvi pakkuma juba aktiivsetele väärtusinvestoritele.

-

Housing Starts 672K vs oodatud 655K

Building Permits 606K vs oodatud 680K

PPI -0.1% vs oodatud +0.1%

Core PPI +0.2% vs oodatud +0.1% -

Euroopa on olnud täna korralikult roheline ning ka USA futuurid enne turu avanemist korralikult plussis. S&P500 ja Nasdaq100 indeksi futuurid hetkel ca +0.8%. Nafta on tõusus ca 3% jagu ning euro on dollari vastu tugevnenud 0.3%.

Euroopa turud:

Saksamaa DAX +1.47%

Pantsusmaa CAC 40 +2.13%

Suurbritannia FTSE100 +1.04%

Hispaania IBEX 35 +3.63%

Rootsi OMX 30 +0.98%

Venemaa MICEX +0.18%

Poola WIG +0.63%Aasia turud:

Jaapani Nikkei 225 +0.07%

Hong Kongi Hang Seng +1.17%

Hiina Shanghai A (kodumaine) +1.37%

Hiina Shanghai B (välismaine) +0.19%

Lõuna-Korea Kosdaq -1.12%

Tai Set 50 +0.89%

India Sensex 30 +0.24% -

The Test Is On

By Rev Shark

RealMoney.com Contributor

5/18/2010 8:33 AM EDT

Forget past mistakes. Forget failures. Forget about everything except what you're going to do now -- and do it.

-- William Durant

Early indications are that we are going to build on yesterday's afternoon bounce. Although breadth was quite negative, the major indices came back from midday weakness and produced a solid finish. We have upside follow-through this morning, and the million-dollar question now is whether this is the start of another "V"-shaped bounce.

As a downtrend develops, we usually have a series of failed bounces. At first traders are anxious to buy the dips because the strategy pays off well when we are trending higher. That has been especially true in this market, where the dip-buyers not only see some quick bounces but huge moves straight back up.

Developing downtrend cause the most pain when the dip-buyers are caught in failed bounces. They think this is just another run-of-the-mill pullback and then just pile in aggressively, but when the bounce fizzles, they rush for the exits -- and that causes the selling pressure as a downtrend develops.

What has been tricky about the "V"-shaped bounces in this market is that they start off looking like very weak oversold bounces and then they keep on running. Yesterday was a good example. We dipped intraday and came back to close slightly in the green, which is a good sign, but volume was nothing special and breadth was quite poor. It looks like nothing more than a market that was stretched a bit too much to the downside putting together a little relief bounce.

We have some follow-through this morning and I know the bulls are going to be excited about this being the start of another move straight back up. That certainly is possible given the recent history of this market, but we have some major overhead resistance levels to hurdle along the way.

The number on key technical level for the S&P 500 is 1175, which is the 50-day simple moving average and also where the bounce last week was halted. We need a 40-point move before it becomes an issue, but that is the level that the sellers and shorts will be focused on. We have had a tendency to cut through that overhead without much trouble for a very long time, but last week it mattered, and we certainly have to stay cognizant of the key resistance point.

The more immediate level to watch will be 1150, which was the high we hit back in January before we rolled over. The market didn't have any trouble with that level on the way up in March, so I'm not sure it will be significant.

So the bounce is on, and we have some room to the upside before we have to deal with any serious technically overhead. Can the bulls pull off another "V"-shaped move? Or will this turn out to be a failed bounce attempt that cements the fact that we are in a downtrend?

I'm giving the bulls some room to run and have covered all my shorts. I'm joining them with some long plays like Vivus (VVUS) and will be looking for some other trades, but I'm not going to worry about the idea of a "V"-shaped bounce until we move closer to 1175.

-----------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance: SPRD +16.0% (also target raised to $12.50 at Auriga U.S.A), LGL +9.8% (thinly traded), LLEN +9.5% (light volume), DKS +4.5% (light volume), SINA +3.3%.

Select financial related names showing strength: BBVA +3.9%, ING +3.1%, STD +3.1%, C +2.1%, LYG +1.8%, DB +1.7%, AIB +1.6%, BAC +1.2%, BCS +1.1%, AIG +1.0%.

Select metals/mining stocks trading higher: VALE +2.1%, RTP +1.5%, BBL +1.2%, MT +1.2%.

Select oil/gas related names showing strength: MRO +2.8%, REP +2.1%, CHK +1.9% (Icahn discloses new 2.1 mln share stake), APC +1.7%, RIG +1.6%, PBR +1.5%, SLB +1.3%, TOT +1.2%, E +1.2%, .

Other news: NTWK +12.3% (founders acquire over 1 million shares of stock), NEXM +10.0% (announced the FDA has granted the Co an Investigational New Drug application number for its NexACT-based alprostadil treatment for Raynaud's syndrome, ahead of a pre-IND meeting in mid-July 2010), LDK +4.7% (Hearing strength attributed to tier 1 upgrade), MGM +4.7% (Paulson discloses stakes in after hours filing), ALTH +4.5% (Allos Therapeutics' pralatrexate granted FDA orphan drug designation for the treatment of bladder cancer), IRM +4.3% (Berkshire discloses stake increased to 7.8 mln from 7.0 mln), MOT +1.6% (Icahn discloses increased stake), BDX +1.5% (Berkshire discloses stake increased to 7.1 mln shares from 1.5 mln), BMO +0.8% (Cramer makes positive comments on MadMoney).

Analyst comments: BZH +4.6% (upgraded to Buy from Hold at Citigroup), BEE +3.9% (upgraded to Outperform from Market Perform at Keefe, Bruyette), DV +1.2% (upgraded to Overweight from Neutral at JP Morgan), AAPL +0.7% (initiated with a Buy at Sterne Agee).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: QADI -12.3%, CNAM -12.1%, APPA -9.0%, ABK -8.9%, NPD -7.6%, IFLG -3.8% (also pulling back from yesterday's 4+ point surge higher), VOD -2.3%, TJX -2.1%.

M&A news: FIS -5.2% (announces discussions have ceased regarding a potential leveraged buyout of FIS).

Select European drug names showing weakness: AZN -1.3%, GSK -1.3%, SHPGY -1.2%.

Select gold/silver related names pulling back: NGD -2.4%, GRS -1.6%, HMY -1.6%, AU -1.6%, GOLD -1.4%, GFI -1.4%, AUY -1.4%, GDX -1.3%, EGO -1.0%.

Other news: NBS -13.2% (provides update on its pharmaceutical subsidiary Suzhou Erye ), RSO -5.5% (announces common stock follow-on offering of $80 mln), HAUP -4.3% (continuing to pull back from last week's surge higher), ANW -3.0% (files for mixed securities shelf offering, also announced its shareholder, Leveret International, is offering 4 mln shares of common stock in a public offering), UNH -1.0% (Berkshire discloses stake of 1.1 mln liquidated). -

Eesti on eurojutuga marketwatch.com esilehele jõudnud. Link siin.

-

Saksamaa keelustamas naked-lühikeseks müüki finantssektoris:

Germany's financial regulator, BaFin, has said it is banning until March 31, 2011 the naked short selling of euro-denominated bonds, as well as the naked short-selling of credit default swaps (CDS) of euro-area government bonds.

In addition, BaFin said it is banning naked short selling in the following major German banks and insurers: Aareal Bank, Allianz, Commerzbank, Deutsche Bank, Deutsche Boerse, Deutsche Postbank, Generali Deutschland Holding, Hannover Rueckversicherung, MLP and Muenchener Rueckversicherung. -

Täna peale turu sulgemist avaldab tulemused HPQ, EPS-i ootused $1.05 peal. Tehnoloogia on viimasel ajal väga nõrk olnud ning HPQ positiivse üllatuse puhul võib sektor tuge saada.

Today after the close APP, ADI, and HPQ are scheduled to report.

Tomorrow before the open look for the following companies to report: ABMD, BJ, BRC, CHS, CTRN, DE, DHT, EV, GSOL, HRL, RL, TGT, and YTEC. -

HPQ Reports second quarter 2010 results. Q2 non-GAAP earnings per share $1.09 Q2 GAAP earnings per share $0.91. Sees FY 2010 GAAP earnings per share $3.76 to $3.81 Q2 revenue rose 13 percent to $30.8 billion. Sees Q3 2010 non-GAAP earnings per share $1.05 to $1.07. Sees Q3 2010 GAAP earnings per share $0.87 to $0.89. Sees FY 2010 revenue up about 8 to 9 percent. Sees Q3 2010 revenue about $29.7 billion to $30 billion * Says raises full-year outlook * Q2 earnings per share view $1.05, revenue view $29,815.33 million -- Thomson

-

Eespool ei mainitud, et USA-s oli täna jälle tõsine langus NDX -1,44%

Euroopas oli roheline, aga USA-ga ikka kehvad lood.

Head Kreeka uudised ei suutnud USA-d tõsta.

Nafta voolab endiselt merre ... ja kirstud kodumaale ...

Millal algab tõus? Tundub, et jama kestab veel kaua. -

Tomorrow before the open look for the following companies to report: ABMD, BJ, BRC, CHS, CTRN, DE, ...

Kõik mainit firmad sügavas miinuses ... kaugemale ei viitsinud vaadata.