Börsipäev 19. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Kui eelmise nädala esimeses pooles aitasid ettevõtete korralikud tulemused juhtida investorite tähelepanu eemale negatiivsematest makroindikaatoritest ja FED-i pessimistlikumast majajandusprognoosist, siis reedel avaldatud Michigani tarbijasentimenti näitaja ning mitte kõige julgustavamad tulemused BAC-lt, GE-lt ja C-lt vedasid turud -2,5% kuni -3,1% madalamale. Kuigi ettevõtted teenivad mullusest paremaid kasumeid, siis vähemalt reedesed raporteerijad näitasid, et müügitulu poolt on jätkuvalt keeruline kasvatada.

Pärast reedest langust USA börsidel on sentiment täna hommikul negatiivne ka Aasias, kuigi mitte nii tugevalt. Hongkong -1%, Austraalia -1,3%, Hiina +1,2%. USA futuurid on hetkel kauplemas 0,23% kuni 0,28% plussis. -

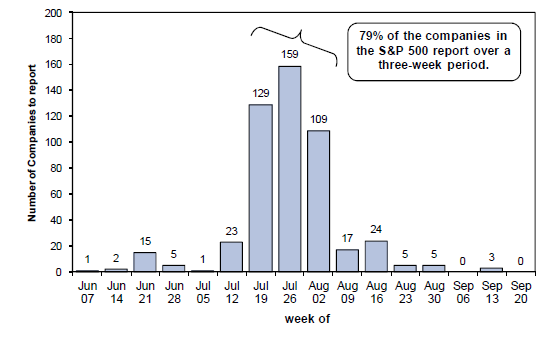

Kui eelmisel nädalal avalikustas oma majandustulemused 23 S&P 500 ettevõtet, siis allolevalt Goldmani graafikult on näha, et tõsine tulemuste sadu hakkab pihta sellest nädalast, mil oma teise kvartali numbrid teevad teatavaks mitmed blue chipid nagu näiteks IBM (täna peale turgu), Pepsi, Apple, Coca-Cola, American Express, Amazon, McDonalds.

-

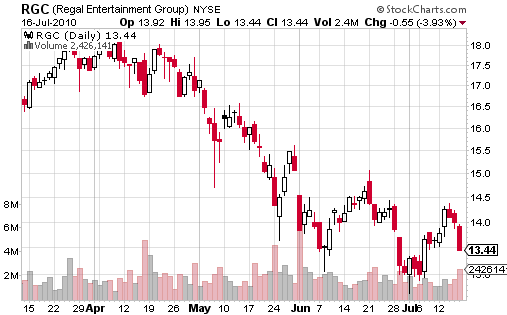

Kinotandril on viimasel ajal huvitavaid muutusi olnud. Regal Entertainmenti (RGC) ja Imax Corporationi (IMAX) aktsiad on olnud viimasel ajal surve all. Üheks põhjuseks kindlasti konkurendi RealD (RLD) IPO, milles osalemiseks investorid tõenäoliselt oma positsioone IMAXis ja RGCs vähendasid.

Samas lisab aga positiivsust see, et RLD börsiletulek oli üle ootuste edukas, mis näitab investorite usku kinomaailma ja eelkõige 3D filmide jätkusuutlikkuse vastu tervikuna. Kui IPO hinnavahemikuks oodati ca $13-$15 aktsiast, siis müügihinnaks kujunes $16 ning reedel, mil oli RLD esimene kauplemispäev, alustasid aktsiad kauplemist kogunisti $19.5 peal. Kuigi reede oli tervikuna USA aktsiaturgudel väga nõrk ja indeksid tegid läbi ca 2.5%lise languse, siis RLD suutis ikkagi sulguda $19.5 peal. Seega RLD näol tegu väga olulise börsiettevõttega 3D filmitrendide populaarsuse jälgimisel.

-

Vaatamata sellele, et Moody's langetas Iirimaa reitingut ning Ungaril ei ole enam juurdepääsu IMFi ülejäänud laenuosadele, on euro teinud päeva keskel tugeva spike'i ning kaupleb taas 1.30 lähedal. Üks võimalik põhjus, mis võis eurot toetada:

Via IBTimesFX: Traders said semi-official demand was helping to push the rate back above $1.2900, while a large buy order from the Middle East, executed through a major U.S. bank in London, had helped euro/dollar to a session high of $1.2991.

-

Fitch raises Estonia sovereign rating one notch to "A" from "A-"; Outlook Stable

-

Praegusel ajal, kui inimesed on jagunenud kahte leeri, kus ühed usuvad kaksikpõhja ja teised turgude taastumist, on Seeking Alpha toonud välja neli väga usaldusväärset indikaatorit, mis on ajaloos suutnud turgude nõrkusi järjekindlalt ennustada. Seejuures on huvitav asjaolu, et kõik neli indikaatorit on hetkel muutumas negatiivseks. Huvi tekitamiseks on lisatud lühike kiitus artiklis räägitavate indikaatorite kohta.

Going back even further in time also produces similar results, so the predictive merit of these indicators has been exceptional. Additionally, it is just as important to note that this group does not have a history of misfiring. In fact, over the past 40 years, none of these four recession predictors have generated even one false signal. Not one.

-

This time is different :)

-

Täna pärast turu sulgemist tuleb oma kvartalitulemustega ka Tupperware (TUP). Tegu on ettevõttega, mis on järjekindlalt suutnud analüütikute ootusi korralikult lüüa ning viimase 8 kvartali jooksul ses osas ühtegi vääratust pole. 2009. aasta aprillist saati on välja antud 11 tulevikuprognoosi, millest 7 on ootusi ületanud, 4 ootustele vastanud ja 0 ootustele alla jäänud. Headele numbritele on aktsia reeglina ka ilusasti reageerinud, mistõttu tasuks Tupperwarel täna silma peal hoida.

-

USA indeksite futuurid alustavad päeva ca 0.3% kõrgemal.

Euroopa turud:

Saksamaa DAX +0.52%

Pantsusmaa CAC 40 +0.65%

Suurbritannia FTSE100 +0.58%

Hispaania IBEX 35 +1.19%

Rootsi OMX 30 +0.76%

Venemaa MICEX +0.91%

Poola WIG -0.13%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng -0.79%

Hiina Shanghai A (kodumaine) +2.11%

Hiina Shanghai B (välismaine) +1.73%

Lõuna-Korea Kosdaq -0.08%

Tai Set 50 +0.30%

India Sensex 30 -0.15% -

Murky Waters

By Rev Shark

RealMoney.com Contributor

7/19/2010 8:43 AM EDT

The basic thing is that everyone wants happiness; no one wants suffering. And happiness mainly comes from our own attitude, rather than from external factors. If your own mental attitude is correct, even if you remain in a hostile atmosphere, you feel happy.

-- Tenzin Gyatso, 14th Dalai Lama

One of the most remarkable things about the rally that began in March 2009 and lasted through April 2010 was how the mood of the market was so disconnected from the economy on Main Street. Despite persistent high unemployment, weak real estate and a slow economic recovery, the market often acted like we had a booming economy.

The primary explanation for this disconnect was that the liquidity created by bailouts and stimulus programs was being parked in the stock market rather than flowing into the Main Street economy. The trillions received by banks was being parked in the stock market (often in the form of computerized trading) rather than being lent to business, and that is why we rallied far more and far longer than most anyone thought we would.

Now here we are, nearly three months into a persistent downtrend. and the mood on Main Street -- which was never great -- is slipping once again. But this time the market isn't ignoring it like it did during 2009. This time the gloomy consumer is mattering, and we no longer seem to have all that cash sloshing around looking for someplace to go.

That is what the recent downtrend is all about. Our job is to navigate this poor action and wait for signs that improvement is on the way. There is nothing happening yet to indicate that we have hit bottom, so we have to continue to proceed with caution.

The best chance of a market turn at this point is going to be from some solid earnings reports and upbeat guidance. So far the market has been in a "sell the news" mood as reports have rolled out. Google (GOOG) was hit hard on its report, the banks performed poorly on OK numbers and even a stellar report from Intel (INTC) couldn't keep the stock up for long.

This week we have a slew of reports, with Texas Instruments (TXN) and IBM (IBM) reporting tonight and the very important Apple (AAPL) report tomorrow night. There are hundreds of other reports as well, but we need the mood to shift for this market to regain its footing. Once a "sell the news" pattern is started it will often persist throughout earnings season. We need to be very aware of that for the next two weeks.

Probably the biggest positive we have right now is that the mood is so negative that a lot of folks have probably already sold -- and that means we have priced in some bad news. One of the most remarkable things about sentiment lately has been how it declined even while the market was bouncing a week or so ago. The mood is poor, and that can be a positive if it is extreme enough.

Technically the charts of the major indices look quite poor. We are in danger of seeing our fourth failed bounce since the top in April, and we are very clearly in a downtrend. The obvious key support levels are the lows around 1010 to 1020. We are still a long way from there, but the selling on Friday was intense enough to undermine the rally attempt we had been enjoying since the first of July. There was no buying interest at all and poor consumer sentiment seemed to have spooked the market.

So the big question this week is whether earnings can turn this thing around. So far the earnings action has not been very encouraging, but with the mood negative, that will make it easier to have some positive surprises.

While we might talk about what will turn this market up, the most important thing we can do at this point is be respectful of the fact that we are in a downtrend. This is not the time to start anticipating a market bottom. The market needs to prove itself and the bears have the benefit of the doubt.

We are starting off the week with a little traditional Monday morning strength. Banks and miners bounced in Europe but Asia played catchup to the downside.

-----------------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance: HAL +2.4%.

M&A news: CYPB +51.2% (Ramius offers to acquire Cypress Bioscience for $4.00/share in cash), TKS +33.9% (confirms that it has received an approach about a possible offer for the Company).

Select metals/mining stocks trading higher: MT +3.2%, RTP +2.1%, BBL +1.2%, BHP +1.0%, HMY +1.0%.

Other news: KWK +5.6% (is trading over following article that suggested Reliance Industries is in talks to buy the company), MOT +5.1% and NOK +1.8% (Nokia Siemans confirms it will acquire certain wireless network infrastructure assets of Motorola for USD 1.2 billion), NBG +4.8% (still checking), CLF +3.1% (light volume; announced that it has taken up approximately 195.5 million common shares of Spider Resources), BA +1.8% (Boeing and Dubai-based Emirates Airlines announces an order for 30 Boeing 777-300ERs; Commercial Airplanes CEO sees mkt for airplanes rebounding), ERIC +1.6% (still checking), PPG +0.9% (Cramer makes positive comments on MadMoney).

Analyst comments: ATHR +2.2% (upgraded to Outperform from Mkt Perform at FBR Capital), YHOO +1.2% (upgraded to Buy from Hold at ThinkEquity).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PETS -14.0%, PHG -2.3%, DAL -1.5%.

Other news: BIDU -4.3% (Auriga says it expect beat & raise quarter, but positives mostly in the stock; also hearing that co accused of promoting unlicensed drugs), BP -2.4% (discloses update; well integrity test on the MC252 exploratory well continues), AMR -1.7% (ticking lower following DAL results).

Analyst comments: PRGO -1.7% (downgraded to Sell from Neutral at Goldman), BAC -0.8% (removed from Conviction Buy List at Goldman). -

Tesla (TSLA) on nüüd viimastel päevadel taas momentumit kogunud ning 7. juulil tehtud põhjast $15 pealt on nüüdseks jõutud $22 peale. Aktsia on tõusnud järjest viimased 5 päeva, kaasaarvatud reedel, mil turud olid muidu väga nõrgad.

-

Põhjuseks võib olla Toyota katseauto, mis väidetavalt Tesla tehnoloogial, ringi sõitmas juba nähtud.

-

Seeing moderate market reaction to BBerg report that Germany's Hypo Real Estate may have failed the Stress Test

-

Lehman Brothers vist kukuks kah testist läbi

-

ScalpTrader: Pärast esmast pullback, turu hakanud firma siin ... kui SÜNDMUS märgib Hypo juba riigistatud, mistõttu võib pidada mitte-sündmus ... märgiksin, et lisaks Euroopa stresstesti tulemusi oodata hiljem sel nädalal

-

BP follow up -- AP reports White House spokesman says BP's ruptured oil well is leaking at the top

-

Today after the close look for the following companies to report: ATHR, BRO, CCK, ELS, IBM, ICUI, IEX, LDSH, LNCR, NE, PKG, RLRN, RLI, STLD, TXN, TUP, and ZION. Tomorrow before the open look for the following companies to report: AOS, ASTE, BK, BIIB, CRUS, FRX, GS, HOG, ITW, JNJ, LAB, MI, VIVO, MUSA, MTG, MICC, NEOG, OMC, BTU, PEP, PII, WNI, STT, AMTD, TXI, UNG, WFT, and WHR.

-

BP says scientists conclude seabed seepage unrelated to well, naturally occuring, according to CNBC

-

IBM prelim $2.61 vs $2.58 Thomson Reuters consensus; revs $23.7 bln vs $24.17 bln Thomson Reuters consensus

IBM sees FY10 EPS of at least $11.25 vs. at least $11.20 previously and the $11.27 consensus

TUP Tupperware misses by $0.04, misses on revs; guides Q3 EPS below consensus; guides FY10 EPS below consensus

NE Noble Corp misses by $0.18, misses on revs

TXN Texas Instruments prelim $0.62 vs $0.62 Thomson Reuters consensus and $0.60-0.64 guidance; revs $3.5 bln vs $3.52 bln consensus and $3.45-3.59 bln guid

TXN Texas Instruments sees Q3 $0.64-0.74 vs $0.64 Thomson Reuters consensus; sees revs $3.55-3.85 bln vs $3.59 bln Thomson Reuters consensus

Kõik tulemustejärgselt korralikus 3-5% languses. Erandiks TUP, kes hetkel juba ~9% käest andnud. -

Amazon.com reports Kindle unit sales accelerated each month in Q2; the new $189 price resulted in tipping point for growth

-

Steel Dynamics (STLD) prelim $0.22 vs $0.25 Thomson Reuters consensus; revs $1.6 bln vs $1.64 bln Thomson Reuters consensus

Ja samuti -6%