Börsipäev 21. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Tulemustetabel nüüd taaskord uuendatud. Link siin.

Olulisi makroandmeid USAst täna tulemas ei ole ning seetõttu rõhk jätkuvalt tulemustel, kus iga päev on mitmeid suuri nimesid oma numbreid avalikustamas.

-

Kui tund tagasi olid USA futuurid veel -0,2% punases siis praeguseks liigutakse juba nulli lähedal. Euroopa futuurid indikeerivad samuti tugevat sessiooni algust: DAX on hetkel +0,9% ja CAC40 +1,2%

-

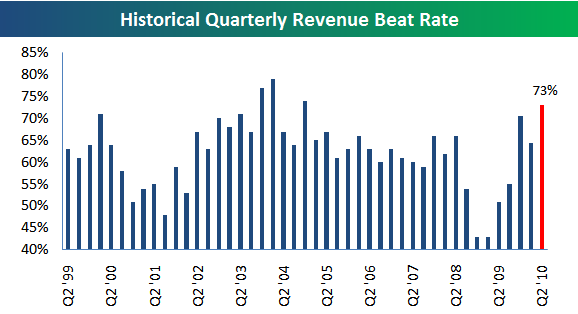

Tulemuste hooaeg on tõelise hoo sisse saanud. Siiamaani on mitmed ettevõtted suutnud kasumiootusi (bottom line) ületada. Kuid mitmete analüütikute sõnul on negatiivne märk see, et ettevõtete käibenumbrid (top line) on jäänud alla ootuste. Bespoke toob välja, et see on siiski ekslik arusaam, sest siiamaani raporteerinud ettevõtetest 73% on näidanud prognoositust suuremat käivet. Alates 1999. aastast on keskmiselt 62% ettevõtetest müügitulu ootusi ületanud, seega hetkel ei tohiks veel muretsemiseks põhjust olla.

-

Inglismaa keskpank otsustas jätta intressimäärad muutmata 0,5% peale nagu turgudel oodatigi. Hääled jagunesid 7-1 vastu; ainsaks intressimäära tõstimise pooldajaks oli Andrew Sentence, kes hääletas intressimäära tõstmise poolt ka eelmisel kuul. GBP/USD kukkus uudise peale üle 40 baaspunkti.

Samas anti teada, et majanduskasvu väljavaated on nõrgenenud. -

JPM on Apple'i hinnasihi tõstnud $390 pealt $400 peale. Kuna Apple'i (AAPL) aktsia moodustab ca 19% QQQQst, siis on ka eelturul ca 3.5% plussis kauplev AAPL aidanud kuubikutel võrreldes muu turuga rohkem tõusta. QQQQ hetkel +0.65% ja SPY +0.35%.

-

USA MBA kodulaenu taotluste arv juulis kasvas vastu ootusi 7,6%. Oodati 2,9% langust. Dollar on euro vastu tugevnenud täna 0,75%; hetkel kaupleb EUR/USD 1,2793 juures.

-

Reuters kirjutab täna, et finantssüsteemi turgutamise programm TARP (Troubled Asset Relief Program) on läinud maksumaksjale maksma juba $3,7 triljonit. Suurem enamus arvest on tulnud valitsuse toetustest kinnisvarasektorisse.

Kinnisvarasektori toetuseks paigutatud summad on viimase aastaga paisutanud TARPi kulusid $700 miljardi võrra. Enamus rahast läheb riiklikult-toetatud ettevõtete Fannie Mae ja Freddie Mac'i kapitaliseerituse suurendamiseks ja kodulaenude garantiideks. Laenugarantiid suurendasid kulusid ainuksi 2010. aasta esimeses pooles $512,4 miljardi võrra.

Kuigi pangad maksid eelmisel aastal programmi raames saadud rahadest tagasi umbes $300 miljardit, on uued väljamakstud toetused olnud tagasimaksetest suuremad, kasvatades seega maksumaksjale esitatavat arvet.

-

Selle raha eest saaks palju sõdu korraldada :)

Iraagi + Afganistaani sõda kokku on maksma läinud ca 1 triljon USD

http://costofwar.com/ -

Portugal korraldas täna €1,25 miljardi eest 12-kuuliste võlakirjade oksjoni, mida võib lugeda erinevalt teisipäevasest Hispaania, Kreeka ja Iirimaa oksjonitest ebaõnnestunuks.

Võlakirja keskmine tulusus oli 2,452%, mis on enam kui kaks korda suurem aprillis korraldatud oksjoni 1,043% tulususest. Nõudluse-pakkumise suhe kukkus aprilli 2,8 pealt 1,3 peale.

Euro on olnud terve päeva müügisurve all: EUR/USD saavutas mitme päeva põhjaks 1,2792, hetkel kaupleb paar 1,2815 juures.

-

Euroopa turud:

Saksamaa DAX +1.33%

Pantsusmaa CAC 40 +1.85%

Suurbritannia FTSE100 +1.95%

Hispaania IBEX 35 +0.76%

Rootsi OMX 30 +2.24%

Venemaa MICEX +2.00%

Poola WIG +1.58%Aasia turud:

Jaapani Nikkei 225 -0.23%

Hong Kongi Hang Seng +1.10%

Hiina Shanghai A (kodumaine) +0.26%

Hiina Shanghai B (välismaine) +0.06%

Lõuna-Korea Kosdaq -0.60%

Tai Set 50 +0.66%

India Sensex 30 +0.55% -

Looking for a Break

By Rev Shark

RealMoney.com Contributor

7/21/2010 8:50 AM EDT

Unhappiness is best defined as the difference between our talents and our expectations.

-- Edward de Bono

Apple (AAPL) came through with another solid earnings report last night, beating the whisper number expectations sufficiently to gap the stock up about $10. Shares traded down into the $257 area last night but were back up near $262 in premarket trading.

The key to the market action today will be how well Apple holds on to its gains. For now, the market is happy that the company surpassed expectations, but that can change as the news is digested.

So far, I don't see much analyst action but no one is complaining much. We need to see now if profit-taking kicks in during the day. If the stock gives back a sizable chunk of the $10 gain, the selling is very likely to spread to the broader market. The bulls need it to hold as that will reassure market players that there is no need to play the "sell the news" game.

Overall, earnings reports continue to be quite solid, but there aren't a lot of huge gaps. There have been some disappointments as well ,such as Yahoo! (YHOO) , Gilead (GILD) and Seagate Technology (STX) . Tonight, Baidu (BIDU) , F5 Networks (FFIV) , Intuitive Surgical ( ISRG) , Netflix (NFLX) and Qualcomm (QCOM) are scheduled to report, so there will continue to be plenty of market catalysts.

Navigating through earnings season is always a tricky business. It isn't just about the numbers -- expectations and the general mood also have to be taken into account. Tuesday morning the market looked very bleak, as nearly every earnings report was being sold -- even those that looked pretty good. Luckily, the bulls found their footing after the gap down open and walked us back up. By the end of the day, the gloomy mood had been overcome and things were feeling upbeat once again. Of course, Apple helped with yet another of its very positive earnings reports.

Technically, the bounce put the market in good shape to attack the 50-day simple moving average of the S&P 500 at 1088. But after that, the big hurdle is 1100, which is where it was turned back last week.

The key to today's action will be whether or not the market can continue to shrug off the "sell the earnings news" inclination as it did yesterday. Apple is obviously going to be the main event for the week in that regard. However, reports from other companies such as Coca-Cola (KO) , EMC (EMC) and Stanley Black & Decker (SWK) will give us some good insight as well.

Keep in mind that the downtrend since the April high is still in place. Until that changes, the best approach with long plays is to use a short-term strategy and set tight stops. Great chart setups on the long side are sparse right now, but they are developing as the S&P 500 churns in the 1050 to 1100 level. That is the range we need to keep an eye on. A break one way or the other should attract some momentum money.

-----------------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance: CYT +12.2%, TXT +9.5%, IDSA +7.6%, URI +7.3%, APH +4.8% (light volume), FCX +4.7%, AAPL +4.0%, WFC +3.6%, VMW +3.6%, ETH +3.4%, MANH +3.3%, MS +3.1%, TPX +2.4%, USB +2.1%, NTRS +1.4% (light volume), KO +1.3%, BSX +1.3%.

Select financial related names ticking higher following a few earnings releases in the sector: C +2.0%, ZION +1.9% (upgraded to Hold from Sell at Citigroup), ING +1.5%, BBT +1.5%, FITB +1.4%, PNC +1.3%, HBAN +1.2%, BCS +1.2%, BAC +1.1%, HIG +1.1%, COF +1.0%, CS +0.9%, JPM +0.9%.

Select metals/mining stocks trading higher: CLF +2.8%, SCCO +1.9%, BBL +1.5%, RTP +1.4%, AA +1.4%, GOLD +1.2%, VALE +1.1%, BHP +1.0%, NEM +0.5%. Select oil/gas related names showing strength: .

Other news: AVII +5.4% (up to $291 mln U.S. Government contract for advanced development of therapeutic candidates for Ebola and Marburg hemorrhagic fever viruses), BP +4.7% (Apache to acquire BP Assets in Permian Basin, Canada and Egypt For $7 bln), RYAAY +2.2% (traded higher overseas following ernings), ARMH +1.9% (traded higher overseas).

Analyst comments: FRO +2.6% (upgraded to Overweight from Underweight at JP Morgan), NLY +0.7% (upgraded to Outperform at FBR Capital), GS +0.5% (upgraded to Outperform from Market Perform at Keefe Bruyette).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PNFP -9.9%, DGX -6.9%, YHOO -5.9% (also downgraded to Hold from Buy at Citigroup), TDW -5.2%, SYK -3.5%, GILD -3.0% (also downgraded to Sector Perform from Outperform at RBC Capital; downgraded to Hold from Buy at Citigroup), STX -2.9% (also downgraded to Hold at Brean Murray), JNPR -2.6% (also said intends to file shelf registration statement for up to $1.5 bln of securities), MDRX -1.7%, FIS -1.4% (light volume), APA -1.3% (also Apache to acquire BP Assets for $7 bln; to offer 21 mln shares of common stock and $1.1 bln of mandatory convertible preferred stock).

Select medical device related names showing weakness following SYK earnings: SNN -4.5% ZMH -2.1%.

Other news: GNK -4.7% (announces concurrent offerings of $100 mln convertible senior notes and 2.82 mln shares of common stock), PEB -3.6% (announced the commencement of a public offering of 17 mln common shares of beneficial interest), LH -2.3% (trading lower in sympathy with DGX), STD -2.0% (still checking for anything specific), SAP -1.4% (obtained approval from the European Commission for the acquisition of Sybase yesterday afternoon), AZN -1.2% (still checking).

Analyst comments: MAS -4.0% (light volume; downgraded to Neutral from Buy at Goldman , SFL -3.0% (downgraded to Underweight from Neutral at JP Morgan). -

Russia Today uudis:

Russia’s banks are trying to somehow limit new deposits by clients in the short term, as they face up to excess liquidity and a lack of quality borrowers.

-

Fed Chairman Bernanke says the Fed is prepared to take more plolicy actions as needed

Fed Chairman Bernanke' says economic outlook remains unusually uncertain -

10-yr yield falls below 2.90%, a move below 2.879% will result in the lowest yield since April 2009

-

Fed Chairman Ben Bernanke Testimony- Says GSE debt is not 'technically or legally' backed by the Fed but that there is a general understanding in the markets that it is

Says has been earning high returns on its holdings so far.

Fed Chairman Ben Bernanke Testimony- Believes the Fed still has options available for stimulating the economy but that it is not the conventional instruments

Futuurid juba 1.5% kukkunud. -

Today after the close of the many companies scheduled to report, some of the bigger names include: DOX, AMLN, BIDU, EBAY, FFIV, ISRG, NFLX, NTGR, QCOM, SBUX, WDC, and XLNX. Tomorrow before the open, of the many companies scheduled to report, some of the bigger names include: MMM, AKNS, BBT, CAT, LLY, EXC, FITB, FLIR, KEY, MBFI, NUE, PENN, RS, PCP, SWY, STI, TZOO, TEL, UTEK, UPS, USAK, and ZMH.

-

Qualcomm prelim $0.57 vs $0.54 Thomson Reuters consensus; revs $2.71 bln vs $2.63 bln Thomson Reuters consensus.

Qualcomm sees Q4 $0.55-0.59 vs $0.57 Thomson Reuters consensus; sees revs $2.67-2.93 mln vs $2.77 bln Thomson Reuters consensus.