Börsipäev 4. august

Kommentaari jätmiseks loo konto või logi sisse

-

Oodatust kesisem kinnisvarastistika, tehaste tellimuste maht ning tarbijate kulutused olid eile negatiivse sentimenti kujundajaks USA turgudel ning põhjustamas müügisurvet ka täna hommikul Aasias, kus Nikkei on eksportijate eestvedamisel lõpetanud sessiooni üle 2% punases. Mujal jäi langus väiksemaks.

Ettevõtete majandustulemuste avaldamine jätkub, kuid fookus on tagasi nihkumas makronäitajatele, millest otsitakse vihjeid, kui tõsiseks võiks teiseks poolaastaks oodatav majandusaktiivuse jahtumine kujuneda. Täna avaldatakse mitmel pool Euroopas PMI indekseid, sealhulgas leiavad lõpliku kinnituse ka eurotsooni PMI näidud (kl 11.00). Lisaks teatatakse 16 riigi jaemüügistatistika (kl 12.00). USA-s jälgitakse reedese tööjõuraporti eel tänast ADP numbrit ning ISM teenuste indeksit, mis konsenuse arvates näitab langust 53.8 punktilt 53.0 punktile.

-

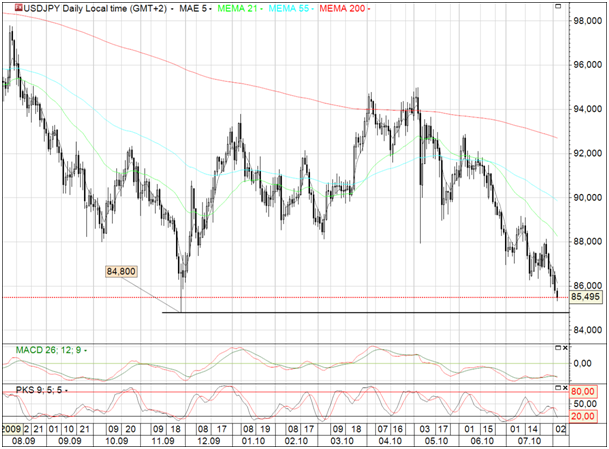

Jaapani jeen on teinud viimase kolme kuu jooksul väga võimsa ralli, tugevnedes USA dollari vastu ~9,5%. Tundub, et paar hakkab testima eelmise aasta novembris tehtud põhjasid 84,800 juures. Varem on USD/JPY olnud seal tasemel 1995. aasta juulis. Täna kukkus USD/JPY 85,310 tasemeni.

-

Euroopa juulikuu PMI teenindussektori indeksid vastasid enamjaolt ootustele: Itaalia indeks 49,9 vs oodatud 51,4 (eelmine kuu 51,5); Prantsusmaa indeks 61,1 vs oodatud 61,3 (eelmine kuu samuti 61,3); Saksamaa indeks 56,5 vs oodatud 57,3 (eelmine kuu 57,3); eurotsooni indeks 55,8 vs oodatud 56,0 (eelmine kuu samuti 56,0). Eurotsooni PMI liitindeks tuli ootuste kohaselt 56,7, mis oli ka juuni näiduks.

EUR/USD on täna langenud 0,3% ja hetkel kaupleb paar allpool 1,3200 taset. -

Eurotsooni juunikuu jaemüügi tulemused: 0,0% vs oodatud 0,0% (MoM) ja 0,4% vs oodatud 0,1% (YoY).

-

Viimaste uudiste põhjal tundub, et teravilja jääb napiks. Kas keegi teab näiteks teravilja indeksiaktsiat soovitada?

-

VIimaste uudiste põhjal tundub, et oled hiljaks jäänud. Nisu futuur http://www.finviz.com/futures_charts.ashx?t=ZW

GRU vist on üks lähedasemaid "The investment seeks to replicate, net of expenses, the MLCX Grains Total Return Index. The index is designed reflect the performance of a fully collateralized investment in the four exchange-traded futures contracts on four physical commodities: corn, soybeans, soy meal and wheat." -

ADM peaks selles olukorras kasu lõikama.

-

JJG: "The investment seeks results that correspond generally to the price and yield performance, before fees and expenses, of the Dow Jones-UBS Grains Total Return Sub-Index. The note is designed to reflect the performance of grains. The index is composed of three futures contracts, corn, soybeans and wheat.

-

Bloomberg vahendab, et Jaapani 10-aastaste võlakirjade tulusus langes esimest korda pärast 2003. aasta augustit alla 1% kui jeen on USA dollari vastu teinud 8 kuu tipu.

Jaapani majandusolukorra halvenedes ja jeeni tugevnedes pakuvad analüütikud, et Jaapani keskpank on sunnitud rakendama edasisi kvantitatiivseid lõdvendamisi läbi võlakirjade ostmise. Keskpank ostab igakuiselt ¥1,8 triljoni (ehk $21 miljardi) eest valitsuse võlakirjasid. Pärast seda, kui eelmise aasta detsembris tugevnes jeen dollari vastu 14 aasta tippu (84,83 jeeni dollari eest), teatas keskpank plaanist pakkuda ¥10 triljoni eest kolmekuulisi laene 0,1% intressimääraga. Hiljem tõsteti summa ¥20 triljoni peale. Analüütikute hinnangul võib 10-aastaste võlakirjade tulusus langeda septembris 0,8 protsendini. 10-aastaste võlakirjade tulusus langes rekordmadala 0,43% peale 11. juunil 2003.

-

Kui konkreetselt nisust rääkida, siis USA turul puhast ETF-i ei leidu, vaid hinnaliikumisele õnnestuks panustada läbi indeksaktsiate, milles nisu moodustab vaid teatud osakaalu. Üks enimkaubeldud on DBA aga seal on nisu osakaaluks ca 13%. Suurima nisu osakaaluga ETF peaks olema USA turul GRU, kus see küündib ligi 50%ni, ent seal tasub juba jälgida spreadi. Londoni börsilt leiab juba puhtalt nisule suunatud indeksaktsiaid (WEAT ja LWEA - võimendusega), kuid seal kauplemine kallim. Üsna asjalik ja arvestatava käibega tundub olevat ka Saksamaal kaubeldav OD7S.

-

Euroopas kauplevad ETFS Corn ja ETFS Wheat - suurim käive on Londonis ja hind seal USDis, aga ka Pariisis või Milaanos kaupleb piisava käibega ja hind EURis

-

Samas tasuks vist entusiaste veidikene hoiatada. Panustada hetkel nisu edasisele hinnatõusule seepärast et venemaal on vilets saak tulemas on umbes sama kui enne talve naftas pikaks võtta teadmisega, et talvel on külm. Et sellise teadmistepagasi baasilt raha teenida peaksid kõik ülejäänud turuosalised täielikud moronid olema...

-

Cynic, hea, et sa seda ikka härrastele meelde tuletasid :)

Teiseks - kui te nyyd nisu ostate, siis olete halvad inimesed, spekulandid ja rahvavaenlased, kes tegelevad strateegiliselt ja globaalselt olulisesse toormehinda spekulatiivse 6hu pumpamisega! Viimane on aga suur sigadus ning tuleks ära keelata. Osalejad tuleks muidugi vastutusele v6tta - saata vähemalt Siberisse ja kogu vara konfiskeerida! :-D -

ADP teeb reedesele juulikuu tööjõuraportile positiivse sissejuhatuse ja näitab, et USA erasektoris loodi eelmisel kuul töökohti juurde:

July ADP Employment Change 42K vs 25K Briefing.com consensus

June ADP Employment revised higher to 19K from 13K

-

Gapping down

In reaction to disappointing guidance: SMCI -9.0% (also downgraded to Neutral from Buy at Merriman), TORM -8.5%, AIB -5.6%, MNDO -5.5% (light volume), WFMI -5.3%, LEAP -4.8% (also announced Cricket Communications enters Into wholesale agreement With Sprint, downgraded to Neutral at Suntrust), PBI -4.7%, SAM -4.4%, SONS -4.4% (light volume), TRLG -4.3%, TIE -4.1%, WMS -3.6%, PEET -2.5%, SHPGY -2.0%, HTZ -1.1%.Select financial related names showing weakness: IRE -5.1%, DB -1.7%, NBG -1.3%, BBVA -1.2%, BCS -0.8%.

Other news: PCS -3.4% (trading lower in sympathy with LEAP), LAZ -2.8% (Shareholders to Sell 7,397,837 shares of Common Stock in a Secondary Offering), CTIC -2.4% (files for Special Protocol Assessment for Pixantrone in Relapsed or Refractory Aggressive B-Cell Non-Hodgkin's lymphoma), XEL -1.8% (priced a public offering of 19 mln shares of its common stock at $21.50 per share), DTG -1.5% (light volume; issued update on Avis Budget proposal; says does not have sufficient information to see if deal can be consumated on a timely basis), BP -1.2% (reports MC252 well reaches static condition; well monitoring underway).

Analyst comments: BKC -1.0% (downgraded to Neutral from Outperform at RW Baird), PH -0.9% (downgraded to Market Perform from Outperform at Wells Fargo), AEP -0.7% (downgraded to Neutral from Buy at Goldman).

Gapping up

In reaction to strong earnings/guidance: PCLN +16.7% (also upgraded to Buy from Hold at Stifel Nicolaus), IOSP +15.1%, SLTM +8.4%, FRPT +7.0%, ZGEN +6.7%(light volume), STEC +4.2%, ERTS +4.1%, SIRI +4.0%, ARNA +3.6%, BEXP +3.6%(also announces ~52,800 net acre expansion in its Williston Basin Acreage Position, initial Montana Bakken results and North Dakota Bakken completions), SGY +3.0%, AGU +2.9%, QUIK +2.3%(light volume), BBOX +2.2%, GRMN +2.2%, LYG +2.2%, TWX +2.0%, CBS +1.8%, APC +1.6% (also reaffirms comments on liability).M&A news: XJT +102.1%(SkyWest makes proposal to acquire ExpressJet Holdings for $6.75/share in cash, ~$133 mln total).

Select gold/silver related names trading higher: NG +2.4%, ABX +1.8%, KGC +1.8%, AUY +1.6%, EGO +1.3%, AU +1.2%, SLW +1.1%, GDX +1.0%, GFI +0.9%.

Other news: BKS +25.8% (to evaluate strategic alternatives, believes stock is significantly undervalued), ISIS +23.8%(Genzyme and Isis report results of two Phase 3 Trials of Mipomersen), DEPO +16.6%(confirms Pfizer will not file infringement suit), FTLK +10.5% (postpones public offering of ordinary shares), XOMA +10.7% (XOMA 052 designated orphan drug by FDA for treatment of Behcet's Disease), EXPE +5.0%(trading higher following PCLN results), MOT +3.1% and VZ +0.7% (Motorola, VZ teaming up for 'TV Tablet' - CNBC), APKT +2.5% (announces China Mobile Deploys Acme Packet for China's Largest IMS Network), EROC +1.3% and SWKS +1.0% (Cramer makes positive comments on MadMoney), MDCO +1.3% (confirms favorable decision in PTO suit).

Analyst comments: SOLF +4.1% (upgraded to Buy from Hold at Jefferies), SQNM +1.4% (upgraded to Buy from Hold at Soleil).

-

Rev Shark: Bulls Betting on Fed Action

08/04/2010 7:52 AMWhen you or I write a check there must be sufficient funds in out account to cover the check, but when the Federal Reserve writes a check, there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.

--"Putting it Simply," Boston Federal Reserve BankThe indices have made a nice move since the low in July but they are running into some resistance now as earnings season winds down and negative seasonality kicks in. The focus going forward will be mainly on economic data and the bulls may find themselves in the perverse position of rooting for more weak data.

The biggest potential positive for this market will be another round of quantitative easing by the Federal Reserve. A flood of cheap money is what drove the market straight up off the lows in March 2009 and the bulls are licking their chops as they contemplate another round.

The chatter is growing over the possibility that the Fed will make a move on this front as early as its meeting next week. An article in Tuesday's Wall Street Journal noted that that it looks as though the Fed is testing the water and that there is an increased focus on the problem of deflation in various statements by Fed members. However, the best hints that something is brewing is that the yield on the two-year Treasury Bill is at 0.52%, which is a record low. In addition, the yen is trading at a 15-year low against the dollar and the euro continues to rally sharply.

The low yields, the weak dollar and the worse-than-expected economic data all support the idea that the dollar is going to become cheaper as the Fed rolls out some sort of "QEII" program. If it does, the market is very likely to see a positive response, as cheap money has few places to go other than into equities.

That is the bullish scenario and it is keeping bids under the market. However, it is no sure thing. Several Fed members are concerned that more cheap money will create asset bubbles and eventually lead to inflation down the road if it is not unwound in a timely manner. The Fed is going to move carefully, so we could easily end up with a light version of QE as the Fed develops some sort of compromise position.

There is an old market saying: You shouldn't fight the Fed. This is probably as good of an example as you'll find. If QEII is implemented, this market is very likely to see some pretty good upside. It is no sure thing what sort of program would be implemented and it not going to be anywhere close to the scale we saw with the first QE program. Still, after the past year, we should all be very aware of how much of a positive factor it can be when the Fed introduces more cheap money.

The market has some quiet action this morning. Europe has minor losses across the board and Asia was mixed, but priceline.com (PCLN - commentary - Trade Now) posted a great earnings report last evening, which is helping some of the momentum names. Technically, the S&P500 is struggling at key resistance around the highs it hit in June. There is economic data coming up, but what we have to keep in mind is that bad news may be good news for the bulls as it will further the case for QEII.

No positions.

-

USA futuurid pöörasid pärast ADP-d plussi ning indikeerivad hetkel avanemist 0,2% kuni 0,3% kõrgemal.

Euroopa turud:

Saksamaa DAX +0,28%

Pantsusmaa CAC 40 +0,02%

Suurbritannia FTSE100 -0,56%

Hispaania IBEX 35 -0,28%

Rootsi OMX 30 -0,34%

Venemaa MICEX +0,48%

Poola WIG +0,15%Aasia turud:

Jaapani Nikkei 225 -2,11%

Hong Kongi Hang Seng +0,43%

Hiina Shanghai A (kodumaine) +0,44%

Hiina Shanghai B (välismaine) +0,32%

Lõuna-Korea Kosdaq -0,49%

Tai Set 50 +0,23%

India Sensex 30 +0,57% -

Solarfun (SOLF) tegi eile heade tulemuste peale võimsa ralli, kuna ettevõte on üks vähestest Hiina ADRidest, kes suutis nii kasumi, tulude, kui ka prognoosidega analüütikute ootusi ületada. Pärast eilset rallit on aktsia konkurentidest jätkuvalt märgatavalt soodsam ja täna annab Jefferies SOLFile ostusoovituse ja tõstab hinnasihi $8 pealt $14 peale, kuna:

1) new 49.99% owner significantly improves the board composition and the potential capitalization of SOLF by initially contributing $78 mln to SOLF, 2) the cost structure has been significantly improved resulting in substantially raised estimates, 3) firm speculates the new board will likely approve capacity expansion in coming months, and it raises ests in 2011 to reflect this growth.

Aktsia on hetkel alustamas kauplemist +3% @11.20.