Börsipäev 12. august

Kommentaari jätmiseks loo konto või logi sisse

-

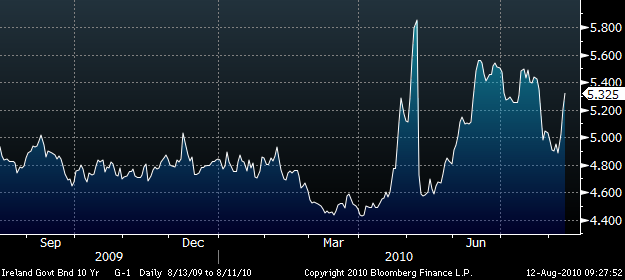

Vaatamata sellele, et eilne makro ning FOMC statement teisipäeval USA majanduse kahjuks rääkisid, eelistati valuutaturul kaitset otsida dollarist kui globaalsest reservvaluutast, mis aitas viimasel sooritada euro suhtes suurima päevasisese tugevnemise pea kahe aasta jooksul. Euro puhul rikkus sentimenti uudis, et mõned Iiri pangad, mis iseenesest läbisid küll stressitesti, kuid vajavad siiski riigipoolset kapitalisüsti. Kuigi võlaprobleemid Euroopas pole kuhugi kadunud, on need möödunud kuude jooksul kaugemale tagaplaanile jäänud ning lasknud investorite riskiisul kasvada, ent sellised uudised toovad maksejõulisuse küsimused jälle päevavalgele. Tugeva spike'i tegi Iiri valitsuse 10.a võlakirja yield (allolev graafik), kuid ka Portugali ja Hispaania puhul on viimaste päevade jooksul intressid pisut kerkinud.

-

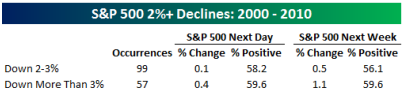

Bespoke Invest on välja toonud S&P 500 tootluse pärast suuri langusi ning on täheldanud, et tugevatele languspäevadele on tavaliselt järgnenud lühiajaline taastumine. Seda on näha ka USA futuuridelt, kus S&P 500 on täna eelturul suurest miinusest välja tulnud ja juba plussi jõudnud. Lühiajaliselt võib indeksitel olla ajalooliselt põhjust kosuda, kuid pikemas perspektiivis sisendab paari nädala taguste põhjade läbimine kindlasti nõrkust.

-

Ma vaatan aga, et futid on järelturul teinud -10 punkti pärast USA turu sulgemist. Praegune +0,7 % futuuril peaks olema siiski sama mis eile turu sulgemise ajal. ES@1086 kanti.

-

Võtsin eelturu liikumise finviz.com lehelt, tundub, et nende cut-off time toimub pärast järelturgu, mistõttu näitab ta tänast tõusu ja eilset langust suuremana kui tegelikult. Parandasin eelmise postituse ära. Hetkel on S&P futuur 1086 punkti ehk 0.1% kõrgemal. Aitäh märkuse eest!

-

Cisco (CSCO) sai oma eile õhtul teatatud tulemuste järel järelturul korralikult peksa ja tõmbas korraks ka terve turu endaga alla. Väike kokkuvõte analüüsimajade reaktsioonist:

Deutsche Bank alandas hinnasihi $32 pealt $28le ning ütles, et juhtkond on ilmselt lihtsalt konservatiivne (DB: We believe they guided conservatively to account for uncertain macro conditions and spending sentiment. Several of Cisco's products are solidly aligned with secular growth themes, meriting our continued Buy rating).

Morgan Stanley kinnitab oma neutraalset hoiakut ning võrreldes DB'ga ollakse palju konservatiivsemad. Baasstsenaariumi hinnasihi langetasid nad $28 pealt $24 peale.

Goldman Sachs oli sarnaselt MSile tagumas vastu rinda ja ütlemas, et neutraalne hoiak, mida nad on seni hoidnud, on olnud õige. GS jättis oma $25lise sihi muutmata. GS: "Cisco’s comments on “mixed signals” from customers and “unusual uncertainty” are consistent with our view that the cyclical uplift in CommTech has played out, and that secular trends will drive performance from here"

Soovitust langetasid CSCO aktsiale paar väiksemat analüüsimaja nagu Oppenheimer ja BMO Capital. -

Eurotsooni juunikuu tööstustoodang: -0,1% vs oodatud 0,6% (MoM) ja 8,2% vs oodatud 9,3% (YoY). EUR/USD on viimase tunni jooksul kukkunud 0,65% ja kaupleb hetkel 1,2842 juures.

-

7. augustiga lõppenud (töö)nädala esmaste töötu abiraha taotlejate sesoonsusega läbikorrigeeritud annualiseeritud näitaja tuli täna 484K vs oodatud 465K. Eelmise nädala oma langetati 479K pealt 482K peale. Kestvate abiraha taotlejate arv oli 4452K vs oodatud 4535K.

-

Täna on uudiseid USA põllumajandusministeeriumilt (USDA) põllumeestele.

ELi nisusaagi väljavaadet on võrreldes juuliga vähendatud 3%, Ukraina oma 15%, Kazakhstani oma 18%, Venemaa oma 15%... -

Gapping down

In reaction to disappointing earnings/guidance: ICOP -12.2%, ANW -10.9% (also downgraded to Equal-Weight from Overweight at boutique firm), CSCO -7.5% (also downgraded to Market Perform from Outperform at BMO Capital, downgraded to Perform from Outperform at Oppenheimer), EL -7.2%, TK -5.6% (light volume), SLE -5.0% (light volume), AEG -4.5% (light volume), NLST -4.3%, SOMX -3.7%, PRGO -3.4%, GIVN -2.2%, CAGC -1.9%.Select financial related names showing wqeakness: BCS -4.4%, NBG -4.3%, IRE -3.2%, ING -2.7%, AIB -2.7%, DB -2.7%, LYG -1.8%, BBVA -1.8%, WFC -1.8%, MS -1.6%, STD -1.4%, HBAN -1.4%, HBC -1.3%.

Select metals/mining related stocks trading lower: MT -3.4%, CLF -2.6%, BBL -1.8%, RTP -1.5%, HMY -1.5%, VALE -1.2%, BHP -1.6%, GFI -1.1%.

Select oil/gas related names showing weakness: APC -2.5%, RIG -2.4%, WFT -2.4%, BEXP -2.2%, EP -2.0%, BP -2.0%, CHK -2.0%, SD -1.7%, TOT -1.7%.

Select semiconductors trading lower following BMO downgrade: XLNX -3.7% and ALTR -3.6% (downgraded to Underperform from Market Perform at BMO Capital ), MRVL -3.4%, BRCM -2.5%, INTC -1.0%, ARMH -1.1% and TXN -1.6% (downgraded to Market Perform from Outperform at BMO Capital)... other semis trading lower include: STM -3.1%, ONNN -2.9%, ASML -2.9%, AMAT -1.5%, KLAC -1.0%

Other news: WTU -7.9% (trading ex dividend), MMLP -4.1% (announces commencement of public offering of 1 mln shares), AEIS -3.5% (announces resignation of Chief Financial Officer Lawrence Firestone), BIDU -2.6% and GOOG -1.0% (lower on reports that China Mobile Xinhua are partnering to launch search engine), BCS -2.2% (still checking).

Analyst comments: BRY -5.5% (downgraded to Sell from Neutral at Goldman), JDSU -4.0% (downgraded to Hold at Auriga U.S.A), CIEN -3.2% (downgraded to Hold at Auriga U.S.A), FNSR -2.6% (downgraded to Hold at Auriga U.S.A), NTAP -2.6% (downgraded to Neutral from Buy at Merriman), K -1.8% (downgraded to Neutral from Outperform at Credit Suisse), FLEX -1.8% (downgraded to Sell at Ticonderoga), CME -1.3% (downgraded to Neutral from Buy at Goldman- also removed from Conviction Buy list ), ARO -1.0% (downgraded to Neutral from Buy at Sterne Agee ),

Gapping up

In reaction to strong earnings/guidance: INTT +6.7%, YONG +4.4% (light volume), SLW +1.3%, AAP +1.1%.Other news: VHC +10.7% (files new lawsuit against multiple companies), NVAX +6.0% (reports positive results from pre-clinical safety study of respiratory syncytial virus vaccine candidate; showed the vaccine to be safe and well-tolerated at all doses tested), AVGO +4.8% (announces withdrawal of secondary offering of 24.84 mln shares), BUD +3.7% (ABV reported results), AIXG +2.2% (discloses substantial multiple order for additional MOCVD tools), CHL +1.9% (ticking higher on reports that the co and Xinhua are partnering to launch search engine), GSK +1.8% (Ezogabine, an investigational anti-epileptic drug, receives positive vote from FDA Advisory Committee), AUY +1.3% (still checking), AEM +1.0% (Cramer makes positive comments on MadMoney).

Analyst comments: EBAY +2.6% (upgraded to Buy from Hold at Citigroup).

-

Rev Shark: Pay the Premium

08/12/2010 7:48 AM"The way to be safe is never to feel secure."

-- Unknown

On Wednesday, we had the worst market action since the breakdown in late June. We stopped short of breaking support at 1,089, which is the 200-day simple moving average of the S&P 500, but a surprisingly downbeat Cisco (CSCO - commentary - Trade Now) earnings report is helping to exert pressure once again this morning. It isn't nearly as bad as it was in late trading yesterday, but we are still looking at a negative open and a break of a key support level

The primary question for us to contemplate is if this selling was just an ugly little hiccup or if the market is rolling over and likely to test the lows we hit back at beginning of July. There certainly seems to have been a big jump in worry and concern following the FOMC policy decision on Tuesday afternoon.

The market had been holding up well as it anticipated a friendly Fed, but it turned into a sell-the-news event. Market players were suddenly not feeling so good about the fact that the Fed felt that the economy was weak enough to justify extending its policy of quantitative easing. While easy money is generally a major positive for the market, it is tough to be overly optimistic about the printing of more money when the trillions that have already been thrown at this economy aren't having a more positive impact.

So what do we do at his point? Do we just shrug off yesterday's action and look for a quick recovery? The selling didn't have the feel of just some aggressive profit-taking. It felt like a change of character was taking place and that there was some real worry about the economy slipping and unemployment failing to improve.

The bulls are quick to point out that the doom and gloom is now way too much, especially since second-quarter earnings reports were so good. They don't see the negativity as being justified and believe that the market is just overacting. Maybe so, but that isn't what the technical action is hinting at.

When the market acts like it did yesterday, I feel we have no choice but to be more cautious. Selling down weak positions, tightening stops and raising cash is nothing more than a form of insurance. If the market recovers quickly and you have to repurchase some long positions at a higher price, that's the equivalent of paying an insurance premium. Having a higher level of cash protects you, but if it proves to be a false alarm and the market quickly turns back up, then you will have to pay a little price for being safe.

I'm fascinated by how quick some market players are to jump in and buy weakness when we have the sort of breakdown like we did yesterday. During the past year, we have had some very quick and easy V-shaped bounces after a breakdown, but that is not the normal psychology that prevails when there is a spike down. Typically, there are trapped longs, who are anxious to escape into any bounce, and that makes it much tougher to quickly recover.

I wouldn't be at all surprised to see some green on the screens as we enjoy an oversold bounce, but I wouldn't bet that yesterday's selling will be overcome and forgotten easily. If we move back over the 1,115 resistance on the S&P 500, I'll feel much better.

My approach right now is to take out some insurance against further downside by going heavily into cash. If the insurance proves unnecessary I'll pay my premium and pay up for some stocks, but the action yesterday certain suggests that a high level of caution is warranted.

At the time of publication, Rev Shark had no positions in the stocks mentioned.

-

Euroopa turud:

Saksamaa DAX -0,65%

Pantsusmaa CAC 40 -1,03%

Suurbritannia FTSE100 -0,44%

Hispaania IBEX 35 -0,84%

Rootsi OMX 30 -1,30%

Venemaa MICEX -0,86%

Poola WIG -0,10%Aasia turud:

Jaapani Nikkei 225 -0,86%

Hong Kongi Hang Seng -0,89%

Hiina Shanghai A (kodumaine) -1,23%

Hiina Shanghai B (välismaine) -1,36%

Lõuna-Korea Kosdaq -0,88%

Tai Set 50 suletud

India Sensex 30 +0,02% -

Netflix displays opening relative strength as it lifts modestly above yesterday's all-time intraday high of $128.42

Väga raju, uueks tipuks $129.74 -

Eile veel: AlariÜ: $125 kandist lühike positsioon ei ole kõige kehvem mõte, kuid peab arvestama, et NFLX aktsia on väga terav liikuja.

kaunis... -

To:ymeramees

Eilne post:

Netflix: $1 bln EPIX deal signals higher cost structure - Wedbush

Wedbush notes that yesterday, NFLX announced a 5-year $1 billion streaming agreement with EPIX. EPIX is a JV among Viacom (parent of Paramount Pictures), Lionsgate and MGM. The EPIX deal appears to them to be a replacement for the Starz deal, which will expire within the next two years. The EPIX deal provides high quality streaming content, but in their view, not enough and at too high a price.

AlariÜ: $125 kandist lühike positsioon ei ole kõige kehvem mõte, kuid peab arvestama, et NFLX aktsia on väga terav liikuja.

Tänases valguses, kas pole mitte terav liikuja?

Tundub siiski ülereageerimisena ning mõne aja möödudes võik näha kauplemas vahemikus $100-110. -

Diil on numbritesse sisse löödud, räägitakse. Aga tänase liikumise taga: http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aXiflFvkVqfs

head level watchi -

Iga HYPE saab ükskord läbi:D

-

Jup, need BIDU shordikoha otsingud sul olid samuti kaunid :)

-

Seal kus sõnad, seal teod, ja sai ka kirjutatud, et tehing läks aiataha:D

-

Ja nisu hind on USDA prognoosimuudatuste peale täna ca 4% tõusus.

-

HPQ langus tundub juba kerge ülereageeringuna. Hetkel jäi $40.20 kandis pidama, juhul kui turg vajub, siis tõenäoliselt üritatakse ka $40-st allpool käia. Järgmine nädal 19. aug avaldatakse kvartalitulemused. Siinkohal peaks olema ootused juba väga madalale toodud ja sept. strike 40 ostuoptsioon tundub $1.60-1.70 päris ahvatlev. Kui $40 tase püsima jääb, siis tundub hea risk revardiga.

-

$NFLX = $34 dollars a share in 11 days....

-

NFLX-le sai ostetud sept. strike 115 put @ 2.85 ja nõrkuse ilmingutel müün tõenäoliselt katteks stike100-105 put-i.

-

$16 bln 30-year Bond Auction Results: Yield 3.954% (expected 3.946%); Bid/Cover: 2.77x (Prior 2.89x, 12-auction avg 2.63x); Indirect Bidders: 46.0% (Prior 37.4%, 12-auction avg 37.5%)

-

At the open Arena Pharma (ARNA) shares traded higher following a rumor Pfizer (PFE) could be interested in the co. ARNA calls are seeing interest following the chatter. ARNA Aug 8 calls are seeing interest following takeover chatter (volume: 3800, open int: 8410, implied vol: ~99%, prev day implied vol: 89%)

-

Today after the close look for the following companies to report: ALIM, ADSK, BYI, EPAY, DV, DNEX, FTK, GEO, MDSO, JWN, NVDA, RRGB, SHOR, and SPRD. Tomorrow before the open look for the following companies to report: ADES, CPC, CTFO, and JCP.