Börsipäev 18. august

Kommentaari jätmiseks loo konto või logi sisse

-

Makroandmete avaldamise osas on täna võrdlemisi vaikne päev. Hommikul avaldati Jaapani juunikuu juhtiv indeks, mille tulemus oli 99,0 punkti ja mis on ühtlasi 0,4 punkti kõrgem kui maikuu näit. Enamus juhtiva indeksi komponentide näitudest olid tugevad, mis viitab sellele, et hoolimata esmaspäeval avaldatud kehvadest SKT tulemustest ja Hiina möödumisest Jaapanist kui maailma suuruselt teisest majandusest, näevad Jaapanlased lähimat kuut kuni üheksat kuud suhteliselt optimistlikes toonides.

Kell 11.30 avaldatakse Inglismaa keskpanga augustikuu kohtumise protokollid, millest ilmneb muuhulgas ka monetaarpoliitika komitee häälte jagunemised potentsiaalse uue stiimulprogrammi osas. Võttes arvesse, et inflatsioonimäära väljavaated on natuke alanenud, siis võib tõenäoliselt leiduda komitees pooldajaid uuele majanduse ergutusprogrammile.

Kell 12.00 ilmuvad eurotsooni juunikuu ehitusmahtude andmed ja kell 14.00 ilmub USA MBA hüpoteeklaenude taotlused.

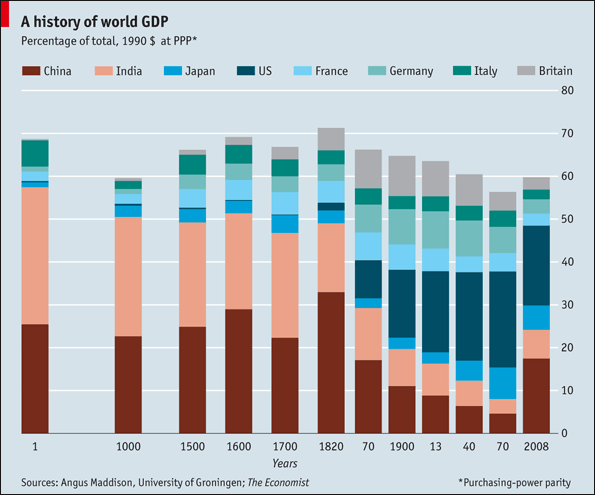

Eile ilmus Economist'is seoses Hiina möödumisega Jaapani majandusest histogramm pealkirjaga A History of World GDP, milles kasutati aasta alguses lahkunud majandusteadlase Angus Maddisoni kogutud andmeid. Jooniselt on näha, et Hiina ja India olid maailma suurimad majandused peaagu kogu viimased 2000 aastat:

-

BHP Goes Hostile With POT

http://online.wsj.com/article/SB10001424052748703649004575436701778489536.html?ru=MKTW&mod=MKTW

sisuliselt tähendab see seda, et BHP paneb oma ostuorderi 130 $ peale ja that´s it, paremat pakkumist siit ei tule. -

Täna kütab jätkuvalt kirgi BHP Billitoni (BHP) ülevõtmispakkumine Potash Corpile (POT).

Eile esitatud $130 aktsia kohta pakkumine lükati tagasi, kuid täna kinnitati avalduses Austraalia börsile, et hind jääb samaks Finantsportaalid on tembeldanud selle vaenulikuks ülevõtmispakkumiseks!?

BHP enda arvamuse kohaselt peaks 32% preemia üle viimase 30 päeva keskmise hinna olema POT aktsiaonäridele atraktiivne.

BHP-d on nõustamas JPMorgan, Potashi poolel on BofA Merrill Lynch, Goldman Sachs ja RBC Capital Markets. -

Pole ime kui ka VALE ja RTP oma pakkumistega tulevad. 20% turust on ikka magus tükk.

-

Eurotsooni juunikuu ehitusmahud tulid tugevad: 2,7% (MoM) (eelmisel kuul -0,7%) ja 3,1% (YoY) (eelmise kuu näit -6,2%). Euro on viimase kahe tunniga teinud kogu hommikuse kaotuse tagasi ja kaupleb hetkel $1,2887 juures.

-

matu, juba eile sa teadsid midagi, millest teised aru ei saanud. nad on jätkuvalt bidiga üle pakkumishinna. mine ta see neetud preemia bidil maha :)

-

Morgan Stanley (MS) kergitas Potashi (POT) hinnasihi $132 -> $160

Deutsche Bank (DB) ja Credit Suisse (CS) kergitasi hinnasihi $150-ni.

Goldman (GS) lõpetas katmise, viimane siht oli 10 augustist $113.99

Viimane nõustab ühtlasi BHP-d -

NFLXi shortijatele

Netflix downgraded to Underperform from Outperform at Morgan Keegan - Morgan Keegan downgraded Netflix based on the be

(theflyonthewall.com 08.18 07:52:52)

Netflix downgraded to Underperform from Outperform at Morgan Keegan - Morgan

Keegan downgraded Netflix based on the belief that the Epix content deal now

represents a baseline for future content negotiations and has limited the

company's ability to take on such deals without impacting margins. Target

$100. -

Jaemüüja Target (TGT) tuli oma kvartalitulemustega analüütikute ootustesse, teenides 92 senti aktsia kohta. Elmise aasta samal perioodil teeniti 79 senti. Aktsia kaupleb uudise peale 3.2% miinuses.

-

Trina Solar (TSL) on täna saanud korraliku upgrade'i Barclay'lt, kes tõstab soovituse 'osta' peale ja hinnasihi $21 pealt $30 peale.

-

Euroopa turud:

Saksamaa DAX +0.12%

Pantsusmaa CAC 40 +0.09%

Suurbritannia FTSE100 -0,42%

Hispaania IBEX 35 +0.05%

Rootsi OMX 30 +0,21%

Venemaa MICEX -0,36%

Poola WIG -0.03%Aasia turud:

Jaapani Nikkei 225 +0.86%

Hong Kongi Hang Seng -0.54%

Hiina Shanghai A (kodumaine) -0.21%

Hiina Shanghai B (välismaine) -0.22%

Lõuna-Korea Kosdaq +0.14%

Tai Set 50 +1.78%

India Sensex 30 +1.15% -

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance: CRDC +45.2% (also Cardica and Intuitive Surgical enter into license agreement), STV +9.7%, KTCC +7.0%, CNTF +5.3%, CHS +2.3% (light volume), ADI +2.0%, LFT +1.7%.

M&A news: PTEC +24.2% (Announces Agreement to Be Acquired by Marlin Equity Partners for $3.85/share), POT +1.8% (BHP issues press release on POT offer; plans to formally commence its Offer by way of newspaper advertisement on August 20).

Other news: HEB +25.0% (awarded $188 million judgment against JCI), BQI +17.6% (announces review of strategic alternatives), JAZZ +7.3% (trading higher in premarket on reports that the FDA issued staff review of fibromyalgia drug), FRG +4.9% (reports exploration and development activities update; intersected significant intervals of high-grade oxide gold), BSDM +4.4% (that the U.S. Food and Drug Administration granted the coa510(k) clearance to market its MicroThermX Microwave Ablation System), MVIS +3.9% (Microvision secures $60 million committed equity financing facility, also registers to sell 17,771,901 shares of common stock for shareholders), SOL +2.3% (hearing attributed to tier 1 firm upgrade), +1.1% (to pay down more than $1 bln of debt), MHS +0.9% (Cramer said he thinks the stock has bottomed here - CNBC).

Analyst comments: WFT +2.0% (upgraded to Outperform from Market Perform at Bernstein).

Allapoole avanevad:

Gapping downIn reaction to disappointing earnings/guidance: CTRN -13.8% (light volume), BJ -4.1%, GU -3.4%, TGT -2.9%, DE -1.5%, .

M&A news: BHP -0.8% (BHP issues press release on POT offer; plans to formally commence its Offer by way of newspaper advertisement on August 20). Select machinery names ticking lower following DE results: CNH -4.3%, AGCO -4.0%.

Other news: XOMA -12.5% (announces 1-for-15 reverse split; receives $4 million for sale of royalty interest in CIMZIA), UTA -7.3% (discloses Yizhao Zhang resigned as Chief Financial Officer), PNNT -4.4% (announces public offering of 4 mln shares), LOCM -3.3% (still checking), ETP -2.7% (announces offering of 8 mln common units representing limited partner interest), EXAS -2.0% (files $150 mln mixed securities shelf offering), ZION -2.0% (announces entry into new equity distribution agreements), STO -1.3% (still checking).

Analyst comments: CRXL -1.7% (light volume, downgraded to Neutral from Buy at UBS), NFLX -1.3% (downgraded to Underperform from Outperform at Morgan Keegan).

-

CDC Software closes two seven digit deals in Q3; reports increasing sales visibility

Co announes two seven digit deals in Q3. Total Contract Backlog increase ~ 40% as of July 31, 2010, compared to June 30, 2009. -

Target (TGT) räägib jaemüügisektorit ja turgu tervikuna ülespoole.

-

Ken Shreve RealMoney'st kommenteerib täna ka Trina Solarit, kelle Barclay upgrade'i siin hommikul ära märkisin:

Ken Shreve: "Trina Solar (TSL) is trading well ahead of its earnings report on Aug. 24. It's one of many potential upside breakouts that could take shape if the general market can hold itself together. Trina has made a nice move with the broad market since early July, and it's moving higher again today on news of a supply deal with U.S. solar firm SunEdison.

Big top-line growth is expected when Trina reports next Tuesday. It's expected to earn 49 cents a share, a 36% increase from a year ago with sales up 123% to $334.8 million.

Technicals look good, too. It's been consolidating gains for 3 1/2 weeks, holding above its 50-day moving average and not far from its prior high of $24.45.

Shares were recently trading around $23.35, up 4.1%" -

(RIG) Transocean: Moody's downgraded earlier the ratings for Transocean to Baa3 with a negative outlook

-

GM files for IPO in S-1

GM files for common stock offering by selling stockholders, including the United States Department of the Treasury. Co also files for offering of Series B preferred stock -

Miks turg siin lõpus nii palju kukub?

-

momentum:

Sa küsid seda küsimust mitmes kord .

Ehk on sul positsioon vale :) -

Fitch: Largest US banks could lose up to $42B